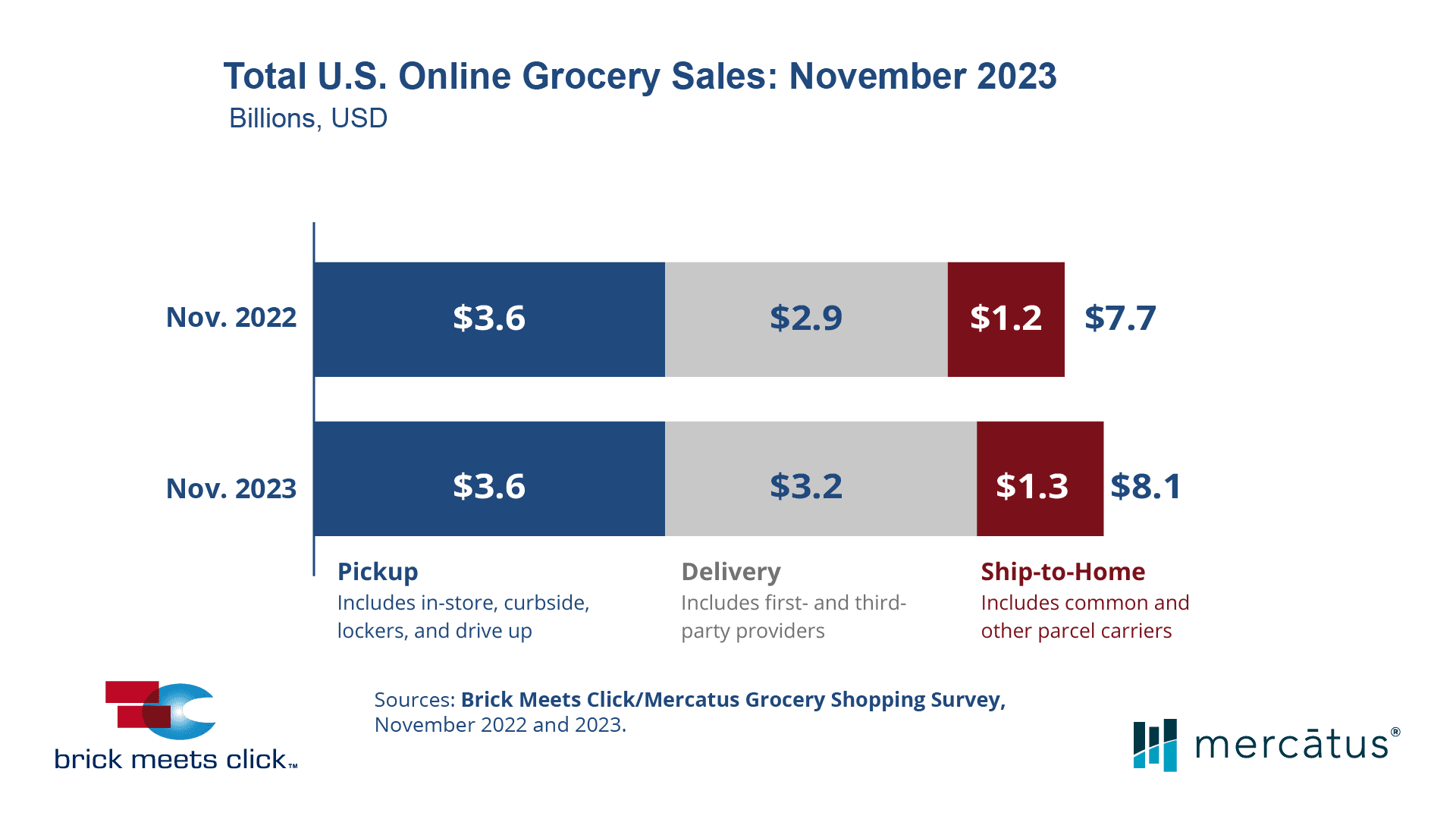

Barrington, Ill. – December 14, 2023 – The U.S. online grocery market posted $8.1 billion in total monthly sales for November, up 5.2% compared to last year’s $7.7 billion, according to the monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded November 29-30, 2023.

While all three eGrocery receiving methods contributed to the year-over-year sales growth, Delivery reported the largest gain driven by a significant jump in its monthly users versus the prior year. Also during November, Mass retailers surpassed Supermarkets to become the primary retail format that most households relied on for their grocery purchases during the month, whether online or in-store.

The headwinds that Supermarkets face in their online business parallel many of the competitive forces also challenging their overall business today. For November, the research showed that 42% of U.S. households used a Mass retailer for most of their in-store or online grocery purchases during the month, finishing 390 basis points (bps) higher than Supermarkets for the same period.

This is a reversal since May 2023, when 42% of households reported using Supermarkets as their primary store compared to 39% for Mass.

“The current economic realities and omnichannel strategies are aiding Mass retailers in attracting more customers today,” said David Bishop, partner at Brick Meets Click. “The price advantage that a Mass rival, such as Walmart, enjoys is motivating cash-strapped households to shift where they shop, and Mass customer engagement strategies are making it easier for those customers to shop the way they want.”

The latest research also documented that households who shopped for groceries primarily at Walmart during November were also more likely to shop online for groceries – and to do this online shopping at Walmart.com – compared to households who shopped primarily at a Supermarket.

Focusing on the results of each eGrocery receiving method, Delivery’s 8.6% year-over-year sales growth was primarily driven by strong gains in its monthly active user (MAU) base which helped grow order volume by 7.5% despite an increase of just 1.0% in average order value (AOV). As a result, Delivery accounted for nearly 33% of all eGrocery sales in November 2023, up 250 bps versus last year.

Walmart’s continued expansion of first-party delivery service plus an increase in membership and subscription offers by national grocers and third-party providers likely contributed to Delivery’s performance in November and its market share growth in all but the smallest of trade areas.

In contrast, Pickup sales grew only 1.6% during November compared to a year ago boosted by AOV growth of 11.8%. This was tempered by a modest decline in its MAU base and lower order frequency which together pulled order volume down 9.2% versus last year. Pickup’s penetration among all age groups declined in the month versus 2022 although the reasons for the broad decline are unclear. These performance trends caused Pickup to cede 350 bps of share compared to a year ago; however, Pickup remains the sales share leader, accounting for 38% of eGrocery sales in November.

Ship-to-Home sales climbed 7.6% driven by solid MAU growth in Amazon’s pure-play services. Despite a softened order frequency rate, this MAU growth led to a nearly 3% increase in overall order volume, and a 4.5% increase in AOV contributed to the balance of the sales gains in November. Ship-to-Home ended the month with 29% of eGrocery sales, up 110 bps compared to 2022.

In comparing the performance of Mass versus Supermarket, trends were mixed. Mass continued to see strong growth in its MAU base, which expanded by 14% in November, while the Supermarket MAU base contracted by 14% compared to last year. Both reported lower order frequency among their MAU bases, with Supermarket and Mass each declining around 5%. For AOVs, Mass posted a 9.0% increase across its Delivery and Pickup services while Supermarket finished up 5.6% across its Delivery and Pickup services versus the prior year.

The continued elevated levels of cross-shopping between Mass and Grocery (combined Supermarkets plus Hard Discount) highlight the challenges facing both customers and retailers. In November, the percentage of households who bought groceries online from both Grocery and Mass during the month rose 300 basis points compared to last year, resulting in 33% of Grocery’s MAU base also shopping for groceries online with a Mass shopping service.

While the composite repeat intent rate for Pickup and Delivery in November improved 140 bps versus 2022 to 63.6%, Mass recorded its largest advantage over Grocery as rates diverged between the two formats. Mass ended with a nearly 19-point lead over Grocery in November as its repeat intent rate improved by 630 bps while Grocery’s declined by 690 bps.

“Considering the challenges regional grocers face today in acquiring and retaining customers, it’s worth recalling the phrase ‘A bird in the hand is worth two in the bush,'” said Sylvain Perrier, president and CEO, Mercatus. “This adage underscores the importance of paying closer attention to current customers’ expectations for online services and then delivering the kind of experience they want. While easier said than done, it requires a clear strategy and plan to execute!”

Online sales across all formats accounted for 11.7% of total weekly grocery spending during the last week of November, increasing 160 bps versus last year. The combined contribution of Pickup and Delivery, since most conventional supermarkets don’t offer Ship-to-Home, also grew 130 bps to finish the month at 9.8%.

Check out the Brick Meets Click eGrocery Dashboard for November 2023 or visit the Monthly eMarket/eShopper page for additional insights and information about the full report.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on November 29-30, 2023, with 1,814 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

• Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

• Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

• Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2023 – Oct. 30-31 (n=1,790); Sept. 28-29 (n=1,754); Aug. 30-31 (n=1,704); July 29-30 (n=1,795); June 29-30 (n=1,769); May 30-31 (n=1,792); Apr. 28-29 (n=1,746); Mar. 30-31 (n=1,742); Feb. 26-27 (n=1,745); Jan. 30-31 (n=1,735); in 2022 – Dec. 28-29 (n=1,715), Nov. 29-30 (n=1,749), Oct. 28-29 (n=1,732), Sept. 29-30 (n=1,752), Aug. 29-30 (n=1,743), July 29-30 (n=1,690), June 29-30 (n=1,743), May 28-29 (n=1,802), Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s, Kowalski’s Markets, Buehler’s Fresh Foods, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com