Overall repeat intent rate is steady year-over-year but still trails pre-COVID levels by 10+ points.

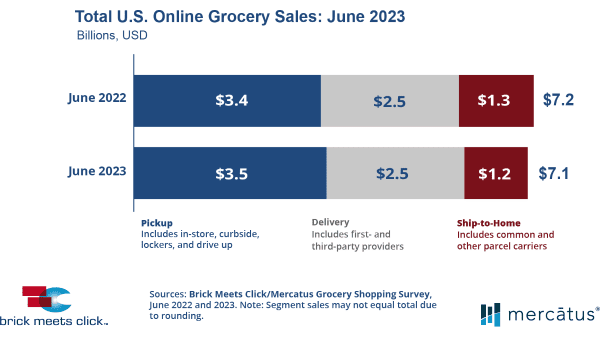

Barrington, Ill. – July 17, 2023 – The U.S. online grocery market finished June with $7.1 billion in total sales, down 1.2% compared to last year’s $7.2 billion, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey fielded June 29-30, 2023.

Although more households bought groceries online in June than last year, these users completed fewer orders during the month and average order values (AOV) had mixed results across the segments.

The number of monthly active users (MAUs) buying groceries online expanded by slightly more than 1% in June and the overall average order value (AOV) rose 3% versus a year ago, however, neither of these gains was great enough to offset the more than 5% drop in the average number of orders completed during the month.

In addition, a greater number of MAUs, nearly 70%, chose to use just one of the three fulfillment methods to receive their online grocery orders, up over 200 basis points (bps) compared to the prior year. Pickup’s penetration rose 140 bps to 56% while Ship-to-Home’s fell 390 bps to 41%, and Delivery dipped 250 bps to 39%.

Looking deeper into each segment’s performance reveals some interesting trends:

• Pickup, much like last month, continued to buck the downward trend experienced by the other two segments. In June, Pickup sales grew 3.2% versus a year ago and accounted for nearly 49% of all eGrocery sales, up 200 bps from last year. Sales climbed largely due to an MAU base that expanded almost 4% during the month although its AOV slipped 40 bps on a year-over-year basis.

• Delivery dipped for the second straight month. The segment’s sales declined 2.5% compared to June last year, causing its sales share to fall by 50 bps to just under 35%. A 5% contraction in MAUs during the month drove most of the sales decline as Delivery’s AOV increased by more than 7% versus last year.

• Ship-to-Home continues to face headwinds as US households continue to shift how they receive online grocery purchases. The segment experienced a 9.7% drop in sales compared to June last year, capturing just under 17% of all eGrocery purchases during the month, a drop of 150 bps versus a year ago. Lower spending per order was also a factor as its AOV fell 1% on a year-over-year basis.

The overall repeat intent rate was flat at 63% versus a year ago, ending the three-month slide reported from March through May of 2023. The current overall rate still lags pre-COVID intent rates by more than 10 percentage points, illustrating the challenge that grocers face relative to retaining customers. The reward for keeping a customer engaged remains clear as the AOV for customers who used the same Grocery or Mass service four or more times in the last three months was 57% higher than the AOV for the service’s first-time customer in June.

“To elevate customer engagement, regional grocers need to improve the perceived value associated with the online shopping experience,” advised Sylvain Perrier, president and CEO, Mercatus. “To achieve this, grocers can focus their efforts on areas like leveraging personalized recommendation algorithms to provide more relevant product suggestions based on individual preferences and past purchases, optimizing the platform’s usability to reduce points of friction, and offering personalized discounts, digital coupons, and loyalty rewards.”

Online’s share of total grocery spending declined in June, dropping 230 basis points to 11.9% versus last year.

Excluding Ship-to-Home, since most conventional supermarkets don’t offer it, the adjusted contribution from Pickup and Delivery finished at 10.0%, down 160 basis points compared to a year ago, due to Delivery’s weaker performance for the month.

For the first six months of 2023, total eGrocery sales were down 1.8% versus the same period in 2022. Pickup sales were up 1.3%, Delivery sales were down 2.0%, and Ship-to-Home sales fell 9.0%. As a result, eGrocery’s year-to-date contribution to total grocery sales fell 100 bps to 12.3% compared to 2022. Throughout the first half of the year, Pickup continued to win the largest share of sales, gaining 140 bps over the 2022 period and capturing 47.1% of total eGrocery sales. Meanwhile, Delivery’s share remained essentially unchanged at 35.9%, and Ship-to-Home ceded 130 bps of share, dropping to 16.9% this year.

“Our 5-year forecast anticipated that 2023 would be a challenging year for eGrocery so these results generally align with our expectations,” said David Bishop, partner at Brick Meets Click. “So, while Ship-to-Home declines and Delivery has mixed results, Pickup’s stronger performance isn’t surprising as it is becoming more widely available and helps customers who want to shop online save money, which is certainly helpful in the current market.”

Check out the Brick Meets Click eGrocery Dashboard for June 2023 or visit the eMarket/eShopper page for additional insights and information about the full report.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on June 29-30, 2023, with 1,769 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

• Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

• Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

• Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2023 – May 30-31 (n=1,792); Apr. 28-29 (n=1,746); Mar. 30-31 (n=1,742); Feb. 26-27 (n=1,745); Jan. 30-31 (n=1,735); in 2022 – Dec. 28-29 (n=1,715), Nov. 29-30 (n=1,749), Oct. 28-29 (n=1,732), Sept. 29-30 (n=1,752), Aug. 29-30 (n=1,743), July 29-30 (n=1,690), June 29-30 (n=1,743), May 28-29 (n=1,802), Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s, Kowalski’s Markets, Buehler’s Fresh Foods, WinCo Foods, Smart & Final, Stater Bros. Markets, Southeastern Grocers’ Fresco y Más, Harveys Supermarket and Winn-Dixie grocery stores among others.