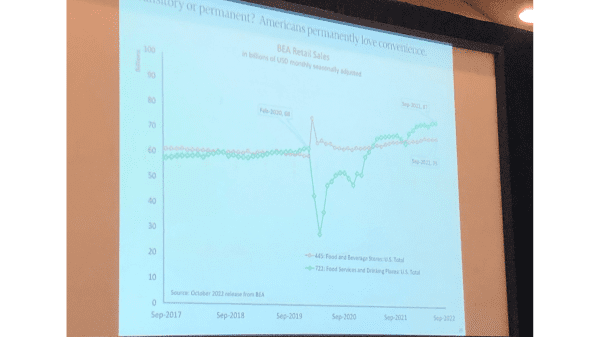

This chart shows the strength of foodservice sales since the pandemic.

TUBAC, AZ – A classic definition of being in a recession is negative GDP growth for two consecutive quarters.

By that measurement, we’re in one, but Michael Swanson, chief agricultural economist for Wells Fargo, told attendees of the Fresh Produce Association of the Americas BB #:144354 annual conference November 3, that there’s more good economic news than bad.

All the other classic signs of a recession are not there, he said. For instance, consumer income and spending keep rising; production and job growth are still on the rise; company payroll and spending are rising.

And most importantly for the produce industry, food spending vs. GDP growth is stable, Swanson said.

Even if some of those factors turn negative, the food industry should escape harm, he said.

“If we have a recession in 2023, we will not see people spend less money on food,” Swanson said. “The bad news is that when the economy booms again, people won’t spend more on food.”

Another sign of economic strength is that restaurant sales are growing faster than retail. Swanson said consumers love the convenience of foodservice and continue to be willing to pay for it.

And this growth is happening despite the restaurant industry continuing to be harmed by labor issues, as he noted the industry segment has about 560,000 fewer workers than just before the pandemic began in early 2020.

Food inflation catches the ire of consumers, Swanson said, but no where in the economic data does is show that consumers are buying less food.

“The consumer doesn’t like food inflation, but will they buy less? I don’t think so.”

TUBAC, AZ – A classic definition of being in a recession is negative GDP growth for two consecutive quarters.

By that measurement, we’re in one, but Michael Swanson, chief agricultural economist for Wells Fargo, told attendees of the Fresh Produce Association of the Americas BB #:144354 annual conference November 3, that there’s more good economic news than bad.

All the other classic signs of a recession are not there, he said. For instance, consumer income and spending keep rising; production and job growth are still on the rise; company payroll and spending are rising.

And most importantly for the produce industry, food spending vs. GDP growth is stable, Swanson said.

Even if some of those factors turn negative, the food industry should escape harm, he said.

“If we have a recession in 2023, we will not see people spend less money on food,” Swanson said. “The bad news is that when the economy booms again, people won’t spend more on food.”

Another sign of economic strength is that restaurant sales are growing faster than retail. Swanson said consumers love the convenience of foodservice and continue to be willing to pay for it.

And this growth is happening despite the restaurant industry continuing to be harmed by labor issues, as he noted the industry segment has about 560,000 fewer workers than just before the pandemic began in early 2020.

Food inflation catches the ire of consumers, Swanson said, but no where in the economic data does is show that consumers are buying less food.

“The consumer doesn’t like food inflation, but will they buy less? I don’t think so.”

Greg Johnson is Director of Media Development for Blue Book Services