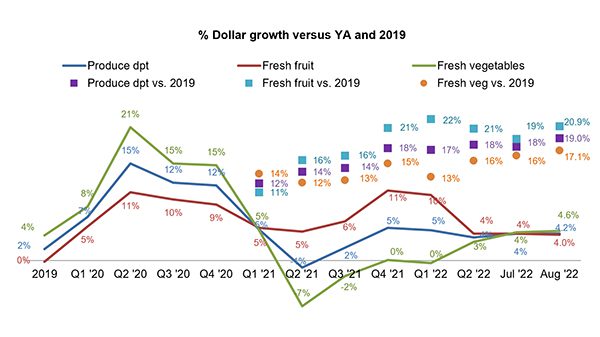

August 2022 dollar sales were up +25.7% versus August 2019 — the pre-pandemic normal. Perishables, including produce, seafood, meat, bakery and deli, had average dollar performance, but center-store item sales increased a little over 10%.

We all know prices are a lot higher than they were before the pandemic, but sometimes it takes a deep dive into the numbers to get the true scope of it.

I dug through the monthly sales analysis from Anne-Marie Roerink of 210 Analytics on behalf of the International Fresh Produce Association and pulled out a few numbers I think paint a picture for what we’re going to see going into the fall.

Surprising no one, 94% of consumers are concerned about food inflation – rightfully so. Unit sales dropped below 2019 levels for all areas of the store, according to the report. Prices increased more than 27% versus 2019.

But this is food we’re talking about and for now, consumers are eating the higher costs. Units were down only -1.3 percent, which Roerink indicates demand is staying strong at retail.

We all have to eat, right?

However, high prices are pushing consumers to explore different shopping behaviors; 78 percent said they’re changing their shopping choices to find lower prices.

The most popular changes are:

- looking for deals more often (50%),

- cutting back on non-essentials (41%),

- looking for coupons (31%),

- buying store brand (31%)

Now is the time for retailers to highlight value whenever they can. Despite high gas prices, consumers are willing to go somewhere else for a better deal.

“Traditional grocery has been losing share whereas value formats, including supercenters and club, have been gaining ground in fresh produce in recent months,” says IRI’s Jonna Parker.

Not surprisingly, most of the Top 10 fruits and vegetables saw dollar gains in August, but only one – cucumbers in vegetables and peaches in fruit – saw volume gains. Some of this is due to supply side issues, but a lot of it can be attributed to higher prices.

“This is a stark illustration of the difficult marketplace,” said IFPA’s Joe Watson, in the report.

Keep your eyes open next week from the Southeast Produce Council’s Southern Exposure as Roerink presents fresh research into consumer spending in “What’s New from the Consumer View.” I’ll have coverage from that research, and a chat with Anne-Marie about what we can expect going into the fall and winter months.

We all know prices are a lot higher than they were before the pandemic, but sometimes it takes a deep dive into the numbers to get the true scope of it.

I dug through the monthly sales analysis from Anne-Marie Roerink of 210 Analytics on behalf of the International Fresh Produce Association and pulled out a few numbers I think paint a picture for what we’re going to see going into the fall.

Surprising no one, 94% of consumers are concerned about food inflation – rightfully so. Unit sales dropped below 2019 levels for all areas of the store, according to the report. Prices increased more than 27% versus 2019.

But this is food we’re talking about and for now, consumers are eating the higher costs. Units were down only -1.3 percent, which Roerink indicates demand is staying strong at retail.

We all have to eat, right?

However, high prices are pushing consumers to explore different shopping behaviors; 78 percent said they’re changing their shopping choices to find lower prices.

The most popular changes are:

- looking for deals more often (50%),

- cutting back on non-essentials (41%),

- looking for coupons (31%),

- buying store brand (31%)

Now is the time for retailers to highlight value whenever they can. Despite high gas prices, consumers are willing to go somewhere else for a better deal.

“Traditional grocery has been losing share whereas value formats, including supercenters and club, have been gaining ground in fresh produce in recent months,” says IRI’s Jonna Parker.

Not surprisingly, most of the Top 10 fruits and vegetables saw dollar gains in August, but only one – cucumbers in vegetables and peaches in fruit – saw volume gains. Some of this is due to supply side issues, but a lot of it can be attributed to higher prices.

“This is a stark illustration of the difficult marketplace,” said IFPA’s Joe Watson, in the report.

Keep your eyes open next week from the Southeast Produce Council’s Southern Exposure as Roerink presents fresh research into consumer spending in “What’s New from the Consumer View.” I’ll have coverage from that research, and a chat with Anne-Marie about what we can expect going into the fall and winter months.

Pamela Riemenschneider is the Retail Editor for Blue Book Services.