High FOB prices, coupled with high freight rates, is a puzzling circumstance.

Overall market prices are slightly down, and we anticipate they will fall further. However, buyers incur the full cost of the supply chain, including delivered freight, and not just the FOB price.

Sadly, there is very little hope for less exorbitant freight rates as truck drivers are in exceedingly short supply and consequently command a premium.

Due to Covid-related absenteeism in warehouses and stores, sky-high freight costs, and snow/ice conditions, being “out of stock” is not uncommon.

So much so, retailers are weighing the choice to go empty rather than fill shelves at any cost. Increasing farming, packing, and distribution costs will force retailers to further raise prices on consumers. Whether or not the rate of inflation is transitory, higher food prices are here for the long-term.

ProduceIQ Index: $1.11/pound, -4.3 percent over prior week

Week #3, ending January 21st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Avocados are wildly expensive! Ranging from $54 to $62, the bigger Hass sizes (32 to 48 count) are nearly worth their weight in gold. In perspective, prices for this week #3 are a whopping +40 percent higher than the previous record holder.

Adding insult to injury, the Super Bowl is looming ominously on the avo buyer’s horizon. Markets are forecasted to increase further as demand is typically driven higher in the weeks before and after the game.

Trader Joe’s launched a promotional campaign for ‘teeny tiny’ Hass Avocados. The ad celebrates small avocados as just the perfect single serving size. As a practical matter, produce insiders highly appreciate a creative push to increase consumer demand for small-sized fruit and their timing couldn’t be better.

Currently, an 84-count size (small fruit) costs $30 less per case than a 40-count size. Selling the ‘whole crop’ is getting easier with a strong push for off-grades and off-sizes, often bundled in convenient consumer packaging.

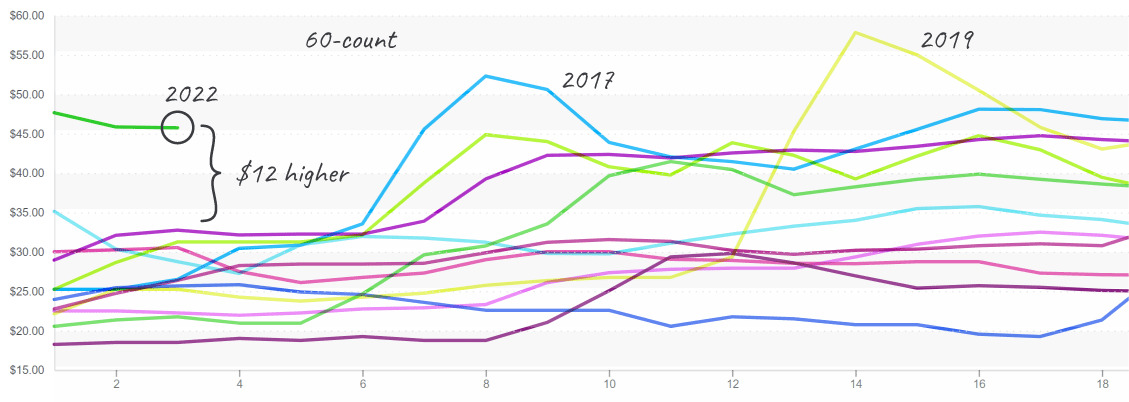

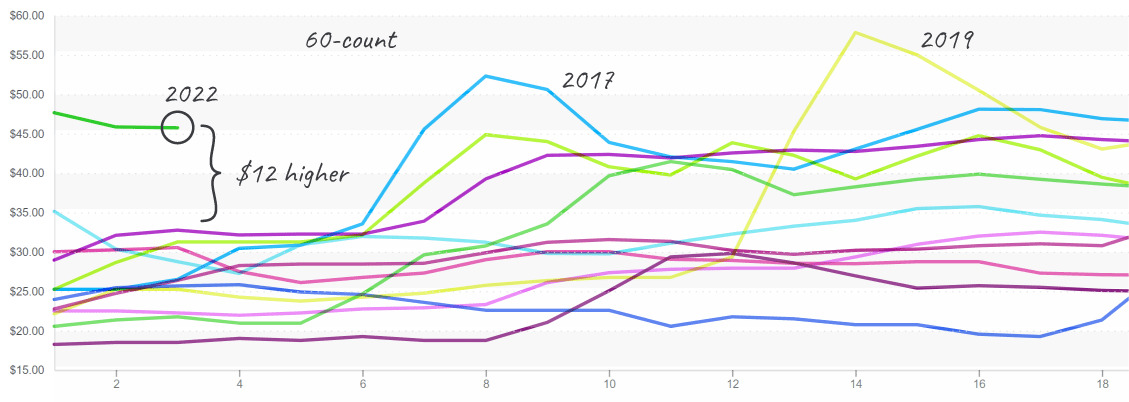

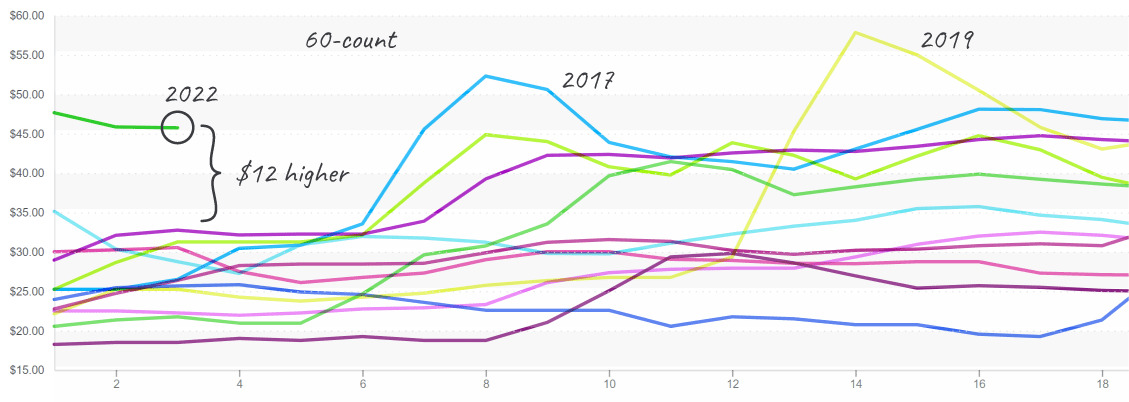

Avocados, 60-count, are $45/case which is $12 higher than in any prior year for week #3.

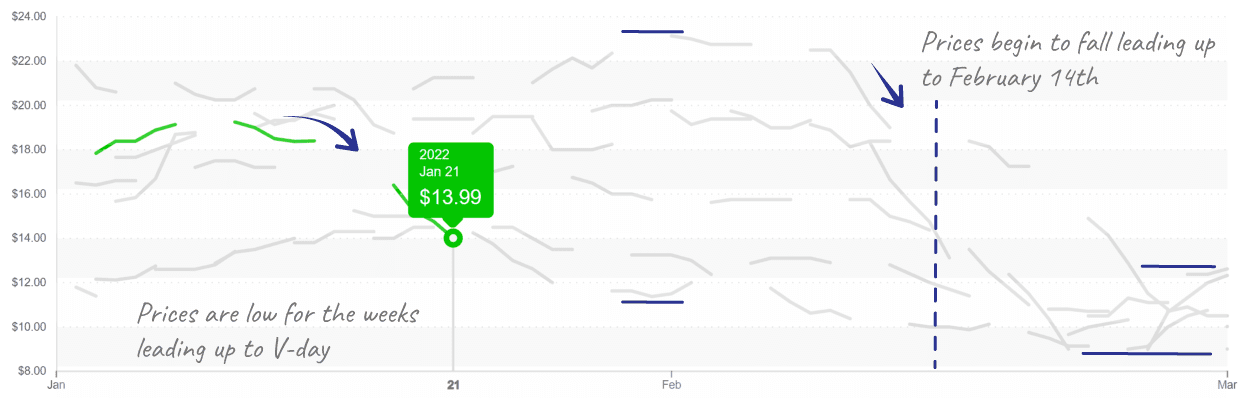

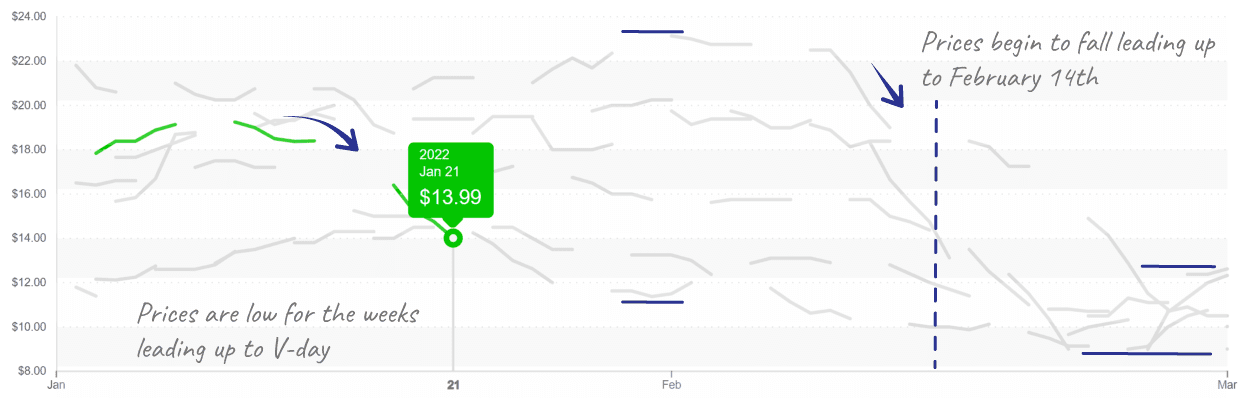

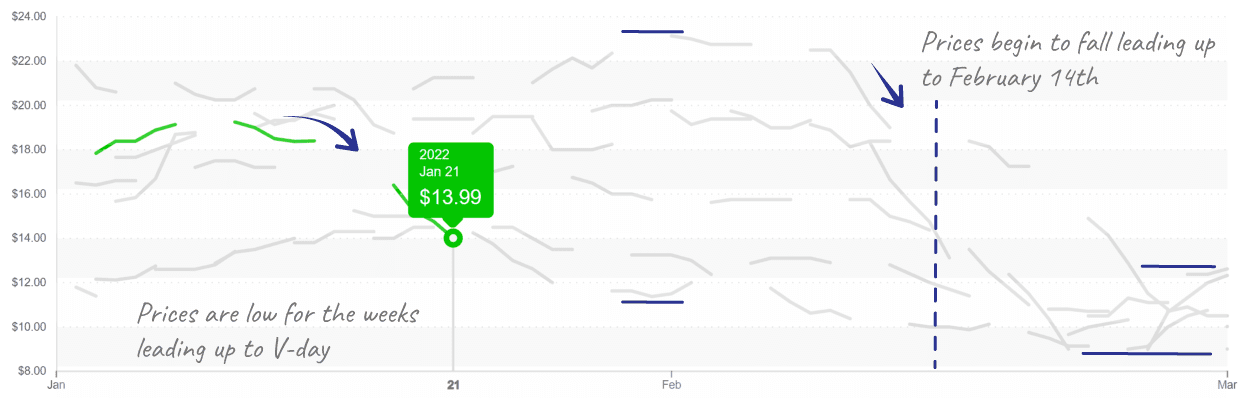

On the flip side, strawberry markets are becoming more promotable by the day. Prices are falling thanks to favorable weather in all three major growing regions (California, Mexico, and Florida) and slightly lower demand. Price momentum may pick up again as Valentine’s Day approaches; however, markets, especially in the East, are typically flooded with product throughout February.

Low strawberry prices are particularly disconcerting in light of UC-ANR and UC Davis’ report on 2021 Strawberry production costs. Overall expenses are up +40 percent over the past five years, and growing costs alone approximate $30,000 per acre. With harvesting, strawberry costs can exceed $95,000 per acre. Wow! Strawberry farmers are taking on a tremendous amount of risk every season.

Strawberry prices are descending and seek to stabilize as pull before Valentine’s Day begins.

Blueberries are struggling to find steady supply. Chilean and Peruvian growers, domestic market’s primary suppliers this time of year, are losing product due to shipping delays. Supply is especially lean as blueberry growing regions are also in transition. As a result, expect markets to remain unsettled for at least two more weeks.

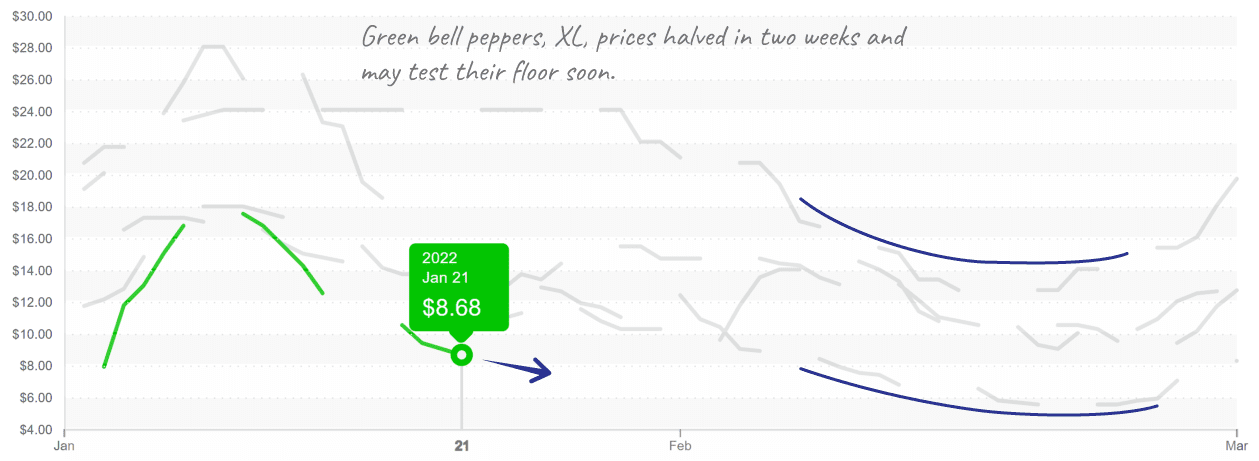

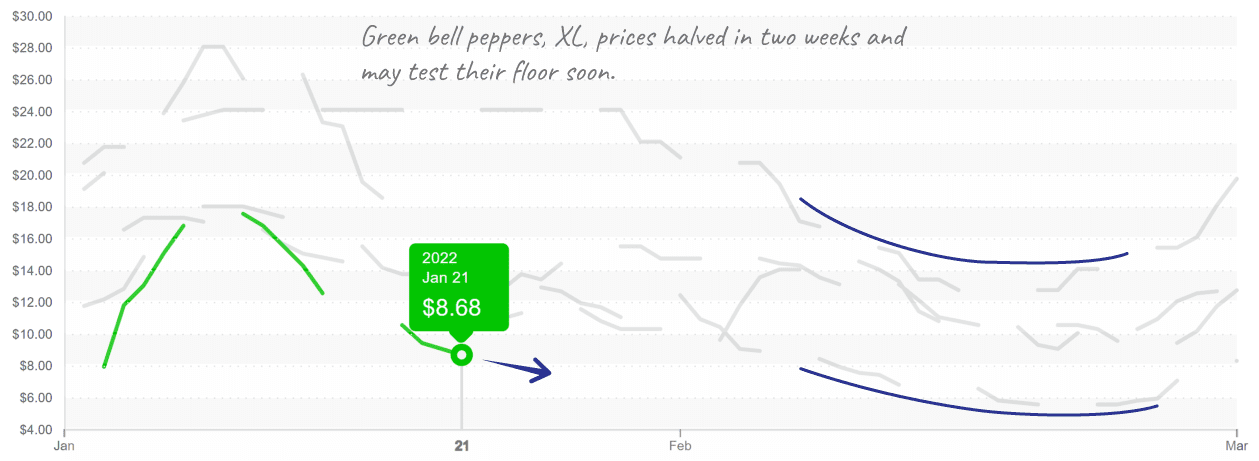

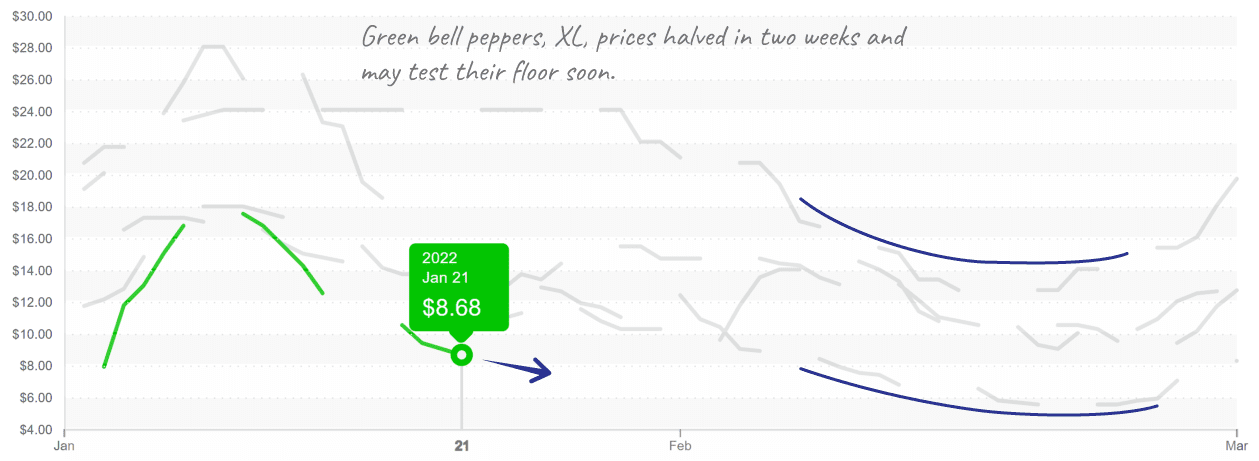

Bell pepper prices are plummeting due to strong yields on both green and colored bells. Florida supply is moderately strong, though a frost warning is in effect for Immokalee, a prominent pepper growing region. On the other hand, Mexican supply is increasing in response to a bout of warmer weather. Prices are on the lower end of historical precedent, and the brief lull in demand isn’t helping what may quickly become a supply-exceeds-demand situation.

Bell Pepper are promotable and in need of support from buyers during this mid-winter season.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

High FOB prices, coupled with high freight rates, is a puzzling circumstance.

Overall market prices are slightly down, and we anticipate they will fall further. However, buyers incur the full cost of the supply chain, including delivered freight, and not just the FOB price.

Sadly, there is very little hope for less exorbitant freight rates as truck drivers are in exceedingly short supply and consequently command a premium.

Due to Covid-related absenteeism in warehouses and stores, sky-high freight costs, and snow/ice conditions, being “out of stock” is not uncommon.

So much so, retailers are weighing the choice to go empty rather than fill shelves at any cost. Increasing farming, packing, and distribution costs will force retailers to further raise prices on consumers. Whether or not the rate of inflation is transitory, higher food prices are here for the long-term.

ProduceIQ Index: $1.11/pound, -4.3 percent over prior week

Week #3, ending January 21st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Avocados are wildly expensive! Ranging from $54 to $62, the bigger Hass sizes (32 to 48 count) are nearly worth their weight in gold. In perspective, prices for this week #3 are a whopping +40 percent higher than the previous record holder.

Adding insult to injury, the Super Bowl is looming ominously on the avo buyer’s horizon. Markets are forecasted to increase further as demand is typically driven higher in the weeks before and after the game.

Trader Joe’s launched a promotional campaign for ‘teeny tiny’ Hass Avocados. The ad celebrates small avocados as just the perfect single serving size. As a practical matter, produce insiders highly appreciate a creative push to increase consumer demand for small-sized fruit and their timing couldn’t be better.

Currently, an 84-count size (small fruit) costs $30 less per case than a 40-count size. Selling the ‘whole crop’ is getting easier with a strong push for off-grades and off-sizes, often bundled in convenient consumer packaging.

Avocados, 60-count, are $45/case which is $12 higher than in any prior year for week #3.

On the flip side, strawberry markets are becoming more promotable by the day. Prices are falling thanks to favorable weather in all three major growing regions (California, Mexico, and Florida) and slightly lower demand. Price momentum may pick up again as Valentine’s Day approaches; however, markets, especially in the East, are typically flooded with product throughout February.

Low strawberry prices are particularly disconcerting in light of UC-ANR and UC Davis’ report on 2021 Strawberry production costs. Overall expenses are up +40 percent over the past five years, and growing costs alone approximate $30,000 per acre. With harvesting, strawberry costs can exceed $95,000 per acre. Wow! Strawberry farmers are taking on a tremendous amount of risk every season.

Strawberry prices are descending and seek to stabilize as pull before Valentine’s Day begins.

Blueberries are struggling to find steady supply. Chilean and Peruvian growers, domestic market’s primary suppliers this time of year, are losing product due to shipping delays. Supply is especially lean as blueberry growing regions are also in transition. As a result, expect markets to remain unsettled for at least two more weeks.

Bell pepper prices are plummeting due to strong yields on both green and colored bells. Florida supply is moderately strong, though a frost warning is in effect for Immokalee, a prominent pepper growing region. On the other hand, Mexican supply is increasing in response to a bout of warmer weather. Prices are on the lower end of historical precedent, and the brief lull in demand isn’t helping what may quickly become a supply-exceeds-demand situation.

Bell Pepper are promotable and in need of support from buyers during this mid-winter season.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.