The supply and demand scale may have just tipped against growers and shippers.

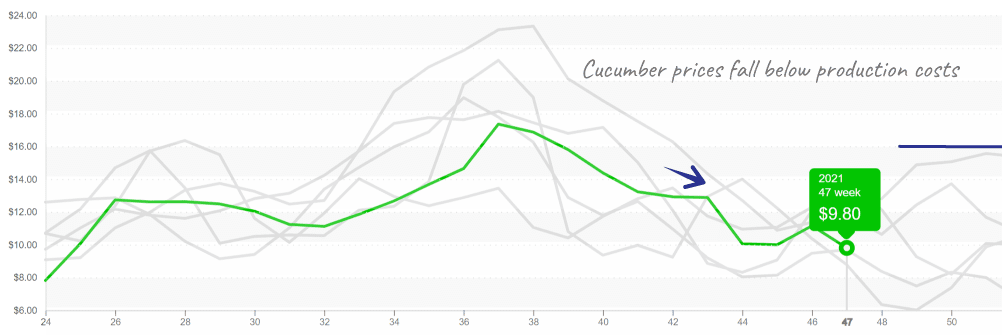

After an expensive fall season, fresh produce prices are pausing, and a few are taking a dive. The Dry Veg category is leading the plunge with a -16 percent decline over the previous week.

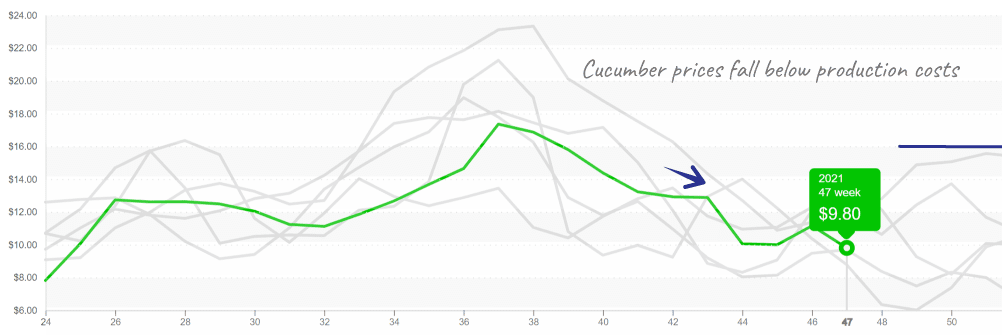

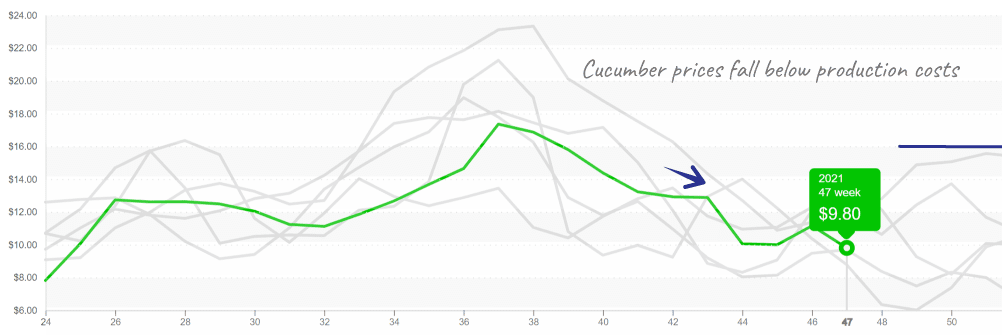

The category, comprised of bell peppers, cucumbers, squash, beans and sweet corn, is susceptible to rapid price declines due to the commodities’ short shelf life and little control over harvest timing.

When demand suddenly drops, growers cannot cost-effectively slow down supply; the fruit still needs to be picked and rushed through the supply chain. When market prices inevitably fall below variable costs (e.g., pick and pack), growers are left with few choices outside of letting harvestable fruit go to waste.

Walking past quality fruit or dropping it on the ground, the dreaded price control tactic, seems to happen with squash at some point each year when market prices crash.

In similar markets, cucumbers are graded tightly, allowing the ‘super select’ size to get packed while the larger sizes, and less perfect fruit, meet the fate of the cull line. The grower’s goal is to avoid additional losses and quickly slow down supply, incurring the opportunity costs, and allowing market prices to rebound.

Post-Thanksgiving’s price decline is somewhat predictable. The price decrease occurs due to the reduction in retail demand.

After all, why go to the grocer when you have a fridge full of leftovers? In addition, the increased crossings through Nogales at this time of year exacerbates the impact of changing market dynamics.

ProduceIQ Index: $1.01/pound, -1.0 percent over prior week

Week #47, ending November 26th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Momentum impacts market prices, and buyers will use this opportunity to keep prices down longer if possible. Grower/Shippers will fight to get prices up again as retailers inevitably need to recharge their shelves.

Cucumbers unable to break the downward price trend will need to wait another week.

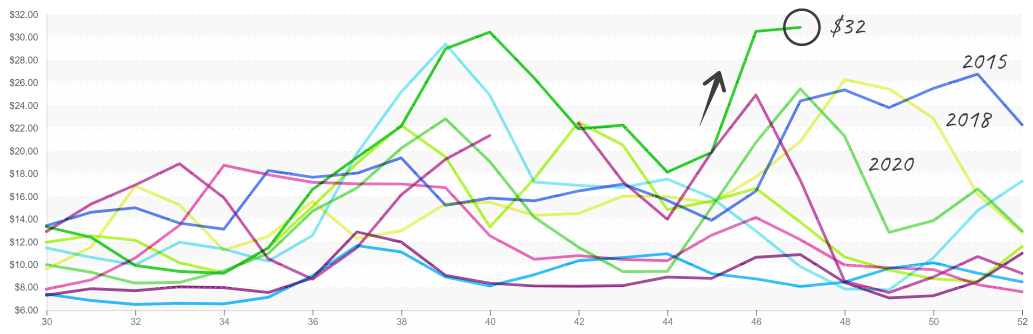

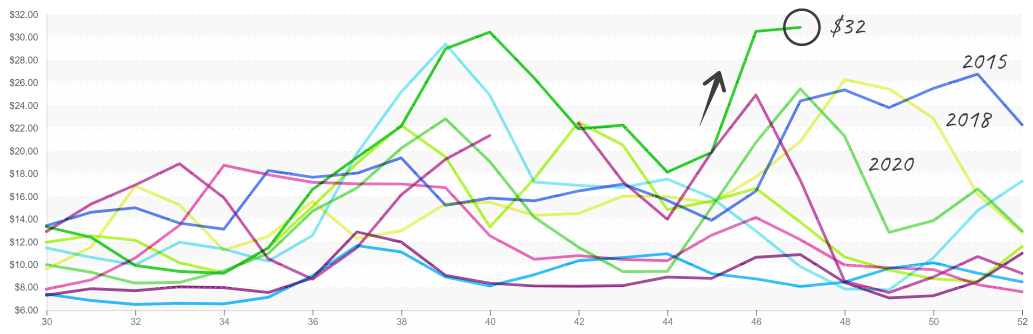

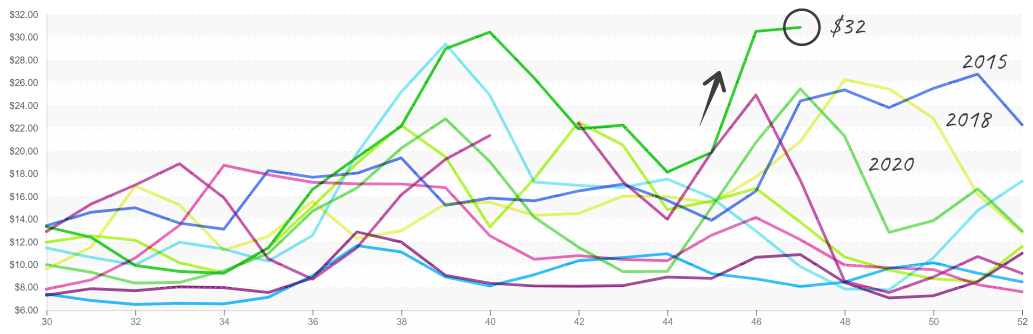

However, not all commodities follow the post-holiday protocol. At $31, broccoli prices are defying gravity. Limited supply out of California and Mexico is stretching the patience of buyers. Price instability may persist through to January.

At record highs, Broccoli is a full $6 above any prior year for this week 47.

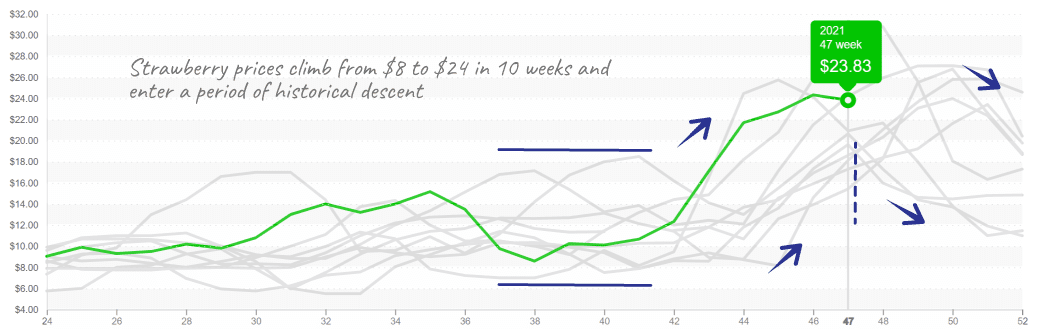

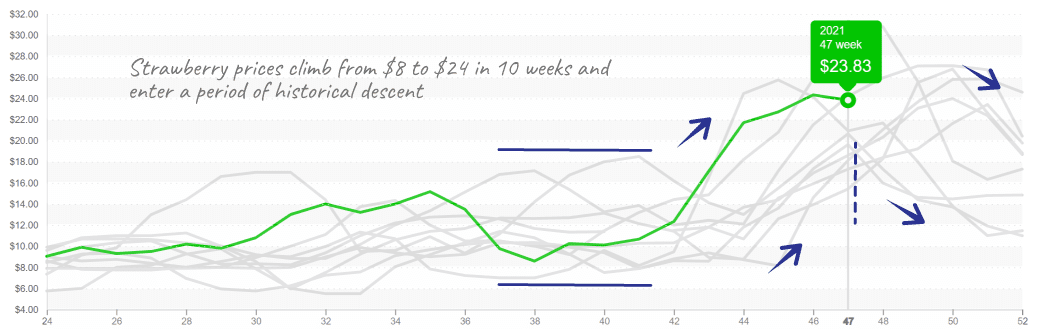

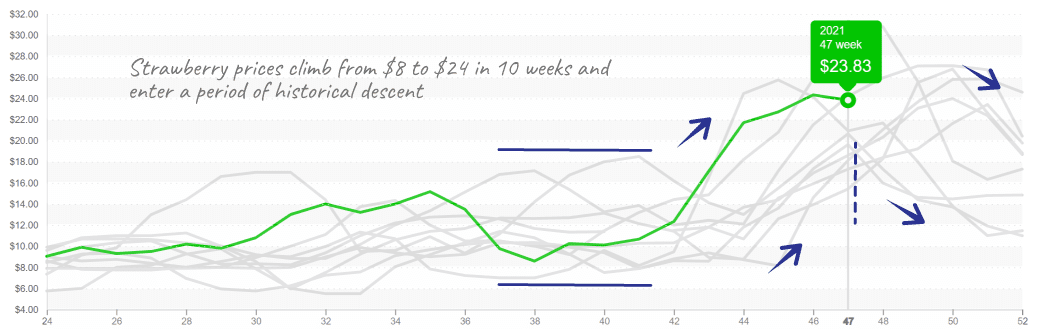

Strawberry prices are also in the upper range of historical precedent. However, prices are down -2 percent over the previous week thanks to the post-holiday decline in demand. Still, supply is tight. Rain in California, short-shelf life and a slow Mexican supply may keep prices elevated for a while longer.

Strawberry prices plateau near historic highs; historical price patterns indicate a pending descent.

Mexican lime supply is on track with industry projections. Lime prices are down -7 percent over the previous week. Few crossings and labor shortages pushed lime prices upwards in early November.

Prices are still at a ten-year high, but a combination between a sharp decline in demand (Thanksgiving snooze) and a slight increase in volume may put lime prices on a downward trend.

As markets lurch slightly downward in response to the Thanksgiving lull, even the commodities most stretched by weak supply and heavy demand are seeing slight decreases for this 7 to 14-day pause.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

The supply and demand scale may have just tipped against growers and shippers.

After an expensive fall season, fresh produce prices are pausing, and a few are taking a dive. The Dry Veg category is leading the plunge with a -16 percent decline over the previous week.

The category, comprised of bell peppers, cucumbers, squash, beans and sweet corn, is susceptible to rapid price declines due to the commodities’ short shelf life and little control over harvest timing.

When demand suddenly drops, growers cannot cost-effectively slow down supply; the fruit still needs to be picked and rushed through the supply chain. When market prices inevitably fall below variable costs (e.g., pick and pack), growers are left with few choices outside of letting harvestable fruit go to waste.

Walking past quality fruit or dropping it on the ground, the dreaded price control tactic, seems to happen with squash at some point each year when market prices crash.

In similar markets, cucumbers are graded tightly, allowing the ‘super select’ size to get packed while the larger sizes, and less perfect fruit, meet the fate of the cull line. The grower’s goal is to avoid additional losses and quickly slow down supply, incurring the opportunity costs, and allowing market prices to rebound.

Post-Thanksgiving’s price decline is somewhat predictable. The price decrease occurs due to the reduction in retail demand.

After all, why go to the grocer when you have a fridge full of leftovers? In addition, the increased crossings through Nogales at this time of year exacerbates the impact of changing market dynamics.

ProduceIQ Index: $1.01/pound, -1.0 percent over prior week

Week #47, ending November 26th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Momentum impacts market prices, and buyers will use this opportunity to keep prices down longer if possible. Grower/Shippers will fight to get prices up again as retailers inevitably need to recharge their shelves.

Cucumbers unable to break the downward price trend will need to wait another week.

However, not all commodities follow the post-holiday protocol. At $31, broccoli prices are defying gravity. Limited supply out of California and Mexico is stretching the patience of buyers. Price instability may persist through to January.

At record highs, Broccoli is a full $6 above any prior year for this week 47.

Strawberry prices are also in the upper range of historical precedent. However, prices are down -2 percent over the previous week thanks to the post-holiday decline in demand. Still, supply is tight. Rain in California, short-shelf life and a slow Mexican supply may keep prices elevated for a while longer.

Strawberry prices plateau near historic highs; historical price patterns indicate a pending descent.

Mexican lime supply is on track with industry projections. Lime prices are down -7 percent over the previous week. Few crossings and labor shortages pushed lime prices upwards in early November.

Prices are still at a ten-year high, but a combination between a sharp decline in demand (Thanksgiving snooze) and a slight increase in volume may put lime prices on a downward trend.

As markets lurch slightly downward in response to the Thanksgiving lull, even the commodities most stretched by weak supply and heavy demand are seeing slight decreases for this 7 to 14-day pause.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.