Hurricane Pamela made landfall as a Category 1 on October 13th, near Mazatlán in the Mexican state of Sinaloa. Mazatlán is 130 miles south of Culiacán, the leading producer of peppers, tomatoes, and cucumbers. Mazatlán received 70 mph winds, and heavy rainfall was widespread. Pamela’s winds were even felt in Texas

Although Mexico’s dry Western region needs rain, growers are wary of damage typically caused by a violent storm like Pamela.

However, in the fall, the mature crops close to harvest are located much further north in the state of Sonora. The wet weather in Mexico has been Eastern, impacting the crops crossing into Texas. Much of Mexico is in a long-term drought, with a few areas that have the opposite problem.

Sonora is just beginning to harvest Chili pepper, which will cross Nogales. Squash had already started, though Nogales won’t have full coolers for several weeks.

Chili pepper is a labor-intensive crop requiring significant hand harvesting. Given widespread labor shortages and other cost increases, don’t anticipate low prices.

Jalapeño prices are trending downwards from historical highs near $23.

ProduceIQ Index: $1.02/pound, -4.7 percent over prior week

Week #41, ending October 15th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Tomato prices are up again over the previous week. On the domestic side, Quincy, FL is filling the eastern gap. Unfortunately for tomato buyers, it’s been reported Quincy acreage planted is noticeably less than in years previous.

Dwindling tomato supplies in the East leaves markets dependent on Mexico to meet the volume demanded. Expect prices to stay elevated as fall transition and inclement weather strain supply.

Sky-high blueberry prices are blowing off some steam after Peruvian blueberries finally gain entry to U.S. markets. Prices are down -19 percent over the previous week. Quality is good, but supply chain issues (e.g., port delays) remain unresolved in some parts of the country and may leave markets in flux.

Like blueberries, supply of raspberries is steadily improving. However, prices are down over the previous week. Continued downward momentum will depend on potential damage from Hurricane Pamela.

Sweet corn markets are tight. In Georgia, inclement weather and poor yields are driving up prices. Expect prices to remain elevated until production in the San Joaquin and Coachella valley pick up.

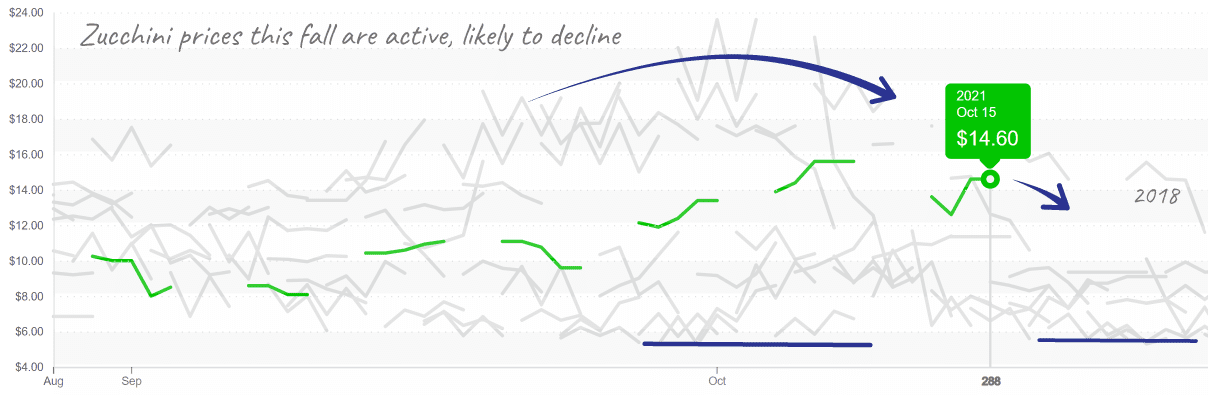

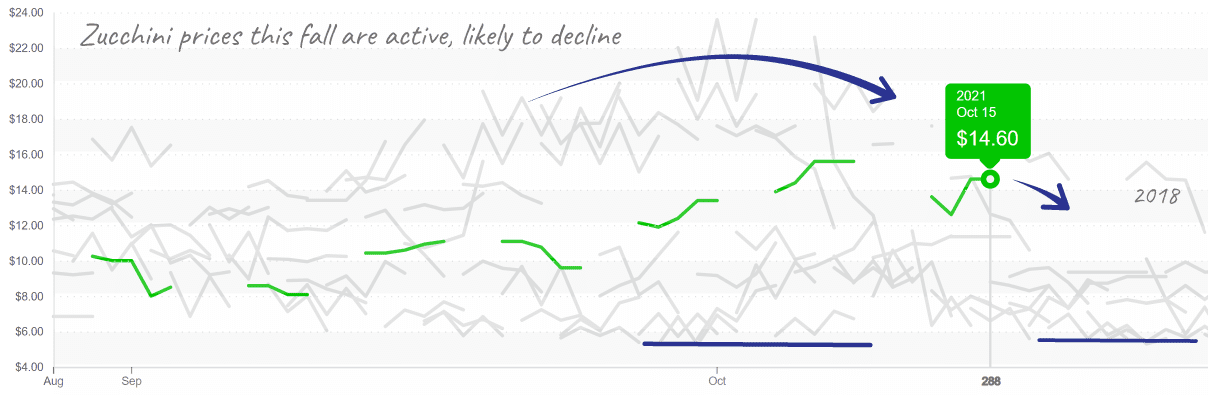

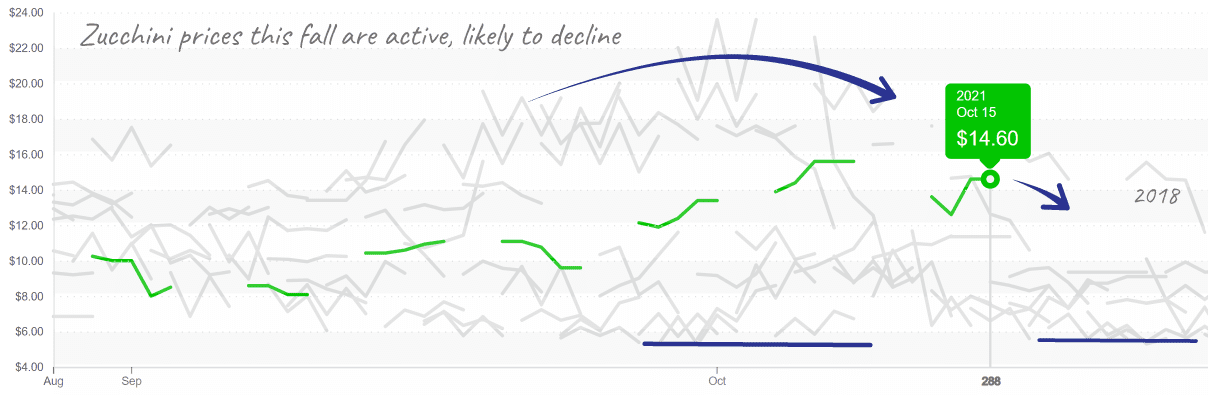

Squash has a divergent market in the East (Georgia) versus the West (Nogales). Overall prices are falling on low demand and increasing supply. Nogales zucchini prices are under $7, whereas South Georgia reports around $13.

Nogales doesn’t yet have the full mix of produce items to justify sending a truck the extra distance to the East. High freight rates generally cause lower Western FOB prices, increasing the spread to the East in FOB prices.

Zucchini squash in the East (South Georgia shown above) holds prices significantly higher than in Nogales

Plentiful Mexican supply is slashing Asparagus prices, -34 percent over the previous week. Prices should continue their descent back towards the realm of historical norms as Mexican volumes increase.

Iceberg is over $27 on supply in transition. Huron, CA is expected to begin production next week, though Yuma, AZ, the largest domestic producer, won’t be ready until mid-November. Declining California yields coupled with heavy rain in Mexico are expected to keep prices elevated. Iceberg quality is fair-to-poor with sizing issues, mildew, and cracking.

A second heat wave and heavy rain in Mexico is exhausting tired broccoli markets. Market prices are falling after peaking yet remain above $25. However, prices are uncertain as quality is “meh,” and disease and insect problems challenge a meager supply.

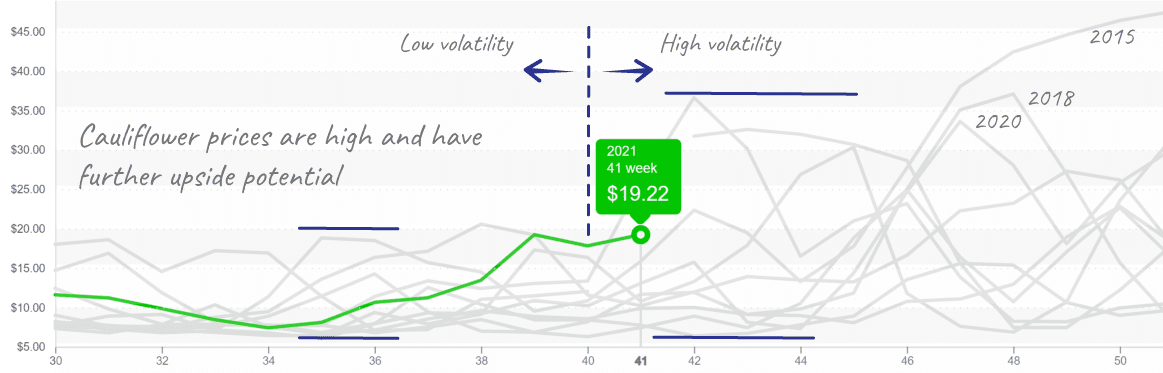

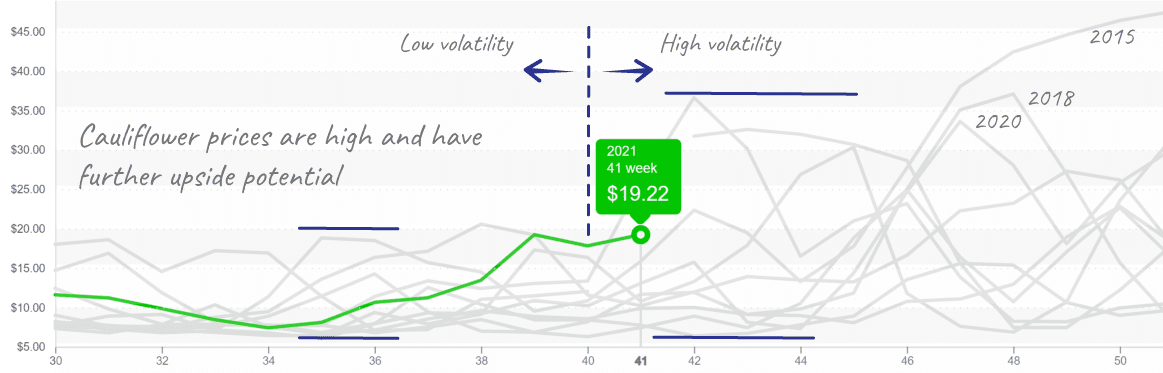

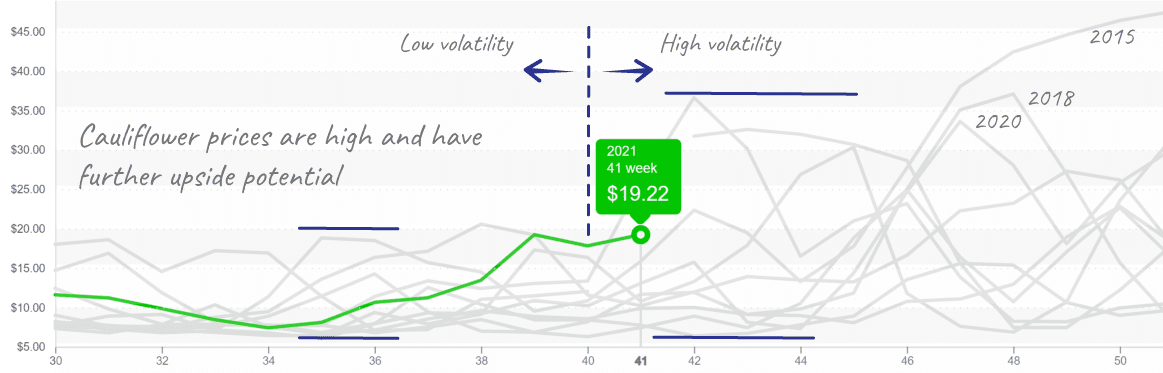

Declining yields force Cauliflower markets up again this week. Still, supply will remain slim until Arizona picks up.

Cauliflower enters a historically volatile period; expect prices to remain active.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Hurricane Pamela made landfall as a Category 1 on October 13th, near Mazatlán in the Mexican state of Sinaloa. Mazatlán is 130 miles south of Culiacán, the leading producer of peppers, tomatoes, and cucumbers. Mazatlán received 70 mph winds, and heavy rainfall was widespread. Pamela’s winds were even felt in Texas

Although Mexico’s dry Western region needs rain, growers are wary of damage typically caused by a violent storm like Pamela.

However, in the fall, the mature crops close to harvest are located much further north in the state of Sonora. The wet weather in Mexico has been Eastern, impacting the crops crossing into Texas. Much of Mexico is in a long-term drought, with a few areas that have the opposite problem.

Sonora is just beginning to harvest Chili pepper, which will cross Nogales. Squash had already started, though Nogales won’t have full coolers for several weeks.

Chili pepper is a labor-intensive crop requiring significant hand harvesting. Given widespread labor shortages and other cost increases, don’t anticipate low prices.

Jalapeño prices are trending downwards from historical highs near $23.

ProduceIQ Index: $1.02/pound, -4.7 percent over prior week

Week #41, ending October 15th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Tomato prices are up again over the previous week. On the domestic side, Quincy, FL is filling the eastern gap. Unfortunately for tomato buyers, it’s been reported Quincy acreage planted is noticeably less than in years previous.

Dwindling tomato supplies in the East leaves markets dependent on Mexico to meet the volume demanded. Expect prices to stay elevated as fall transition and inclement weather strain supply.

Sky-high blueberry prices are blowing off some steam after Peruvian blueberries finally gain entry to U.S. markets. Prices are down -19 percent over the previous week. Quality is good, but supply chain issues (e.g., port delays) remain unresolved in some parts of the country and may leave markets in flux.

Like blueberries, supply of raspberries is steadily improving. However, prices are down over the previous week. Continued downward momentum will depend on potential damage from Hurricane Pamela.

Sweet corn markets are tight. In Georgia, inclement weather and poor yields are driving up prices. Expect prices to remain elevated until production in the San Joaquin and Coachella valley pick up.

Squash has a divergent market in the East (Georgia) versus the West (Nogales). Overall prices are falling on low demand and increasing supply. Nogales zucchini prices are under $7, whereas South Georgia reports around $13.

Nogales doesn’t yet have the full mix of produce items to justify sending a truck the extra distance to the East. High freight rates generally cause lower Western FOB prices, increasing the spread to the East in FOB prices.

Zucchini squash in the East (South Georgia shown above) holds prices significantly higher than in Nogales

Plentiful Mexican supply is slashing Asparagus prices, -34 percent over the previous week. Prices should continue their descent back towards the realm of historical norms as Mexican volumes increase.

Iceberg is over $27 on supply in transition. Huron, CA is expected to begin production next week, though Yuma, AZ, the largest domestic producer, won’t be ready until mid-November. Declining California yields coupled with heavy rain in Mexico are expected to keep prices elevated. Iceberg quality is fair-to-poor with sizing issues, mildew, and cracking.

A second heat wave and heavy rain in Mexico is exhausting tired broccoli markets. Market prices are falling after peaking yet remain above $25. However, prices are uncertain as quality is “meh,” and disease and insect problems challenge a meager supply.

Declining yields force Cauliflower markets up again this week. Still, supply will remain slim until Arizona picks up.

Cauliflower enters a historically volatile period; expect prices to remain active.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.