Between severe drought in the West and a rainy summer in the East, tomato supply can’t catch a break.

Across varietals, prices remain elevated with little hope for relief. Onlookers wonder, is it an abnormal year or a new reality for tomato markets?

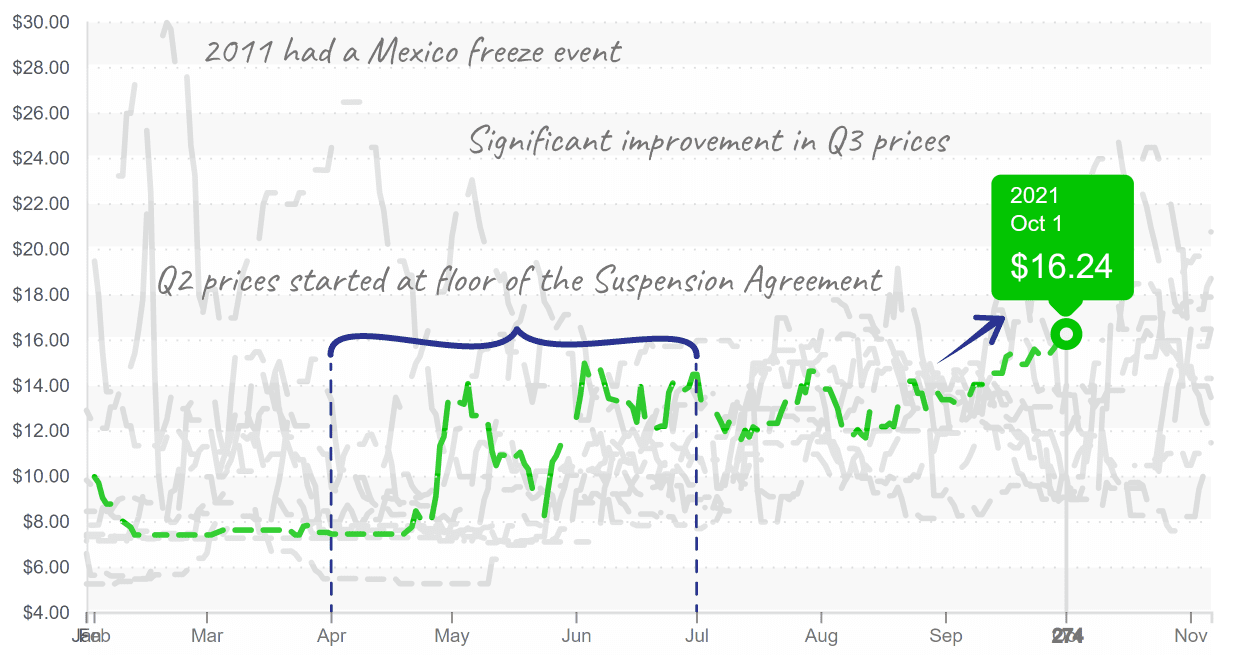

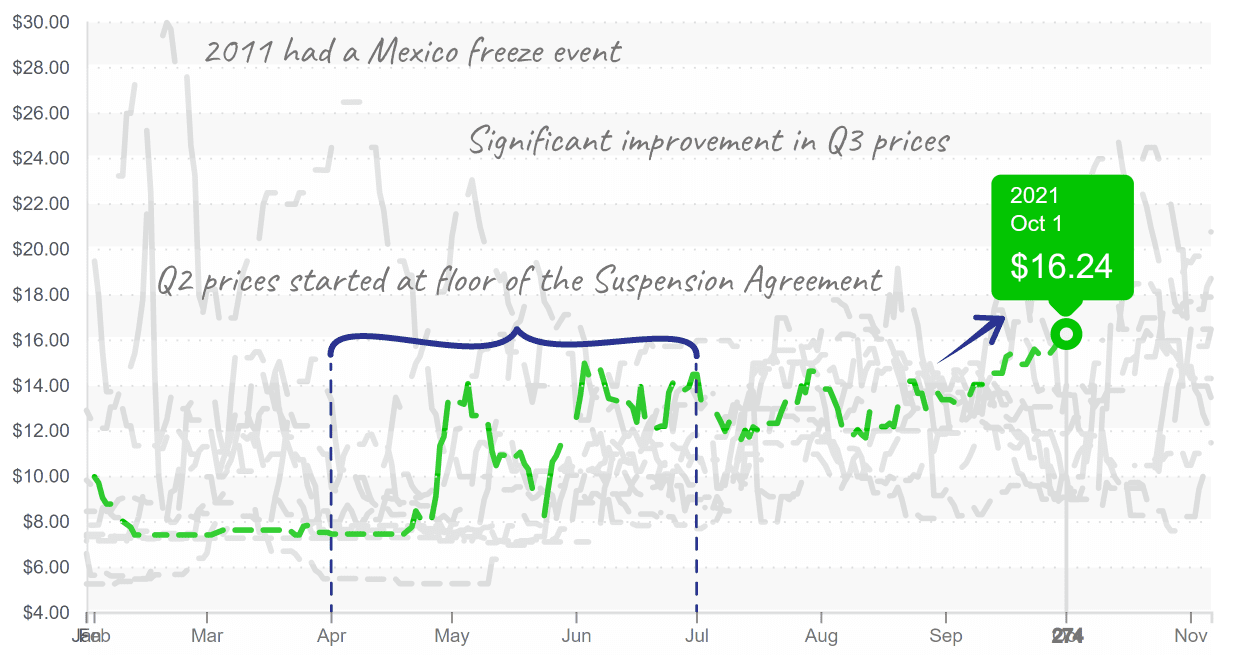

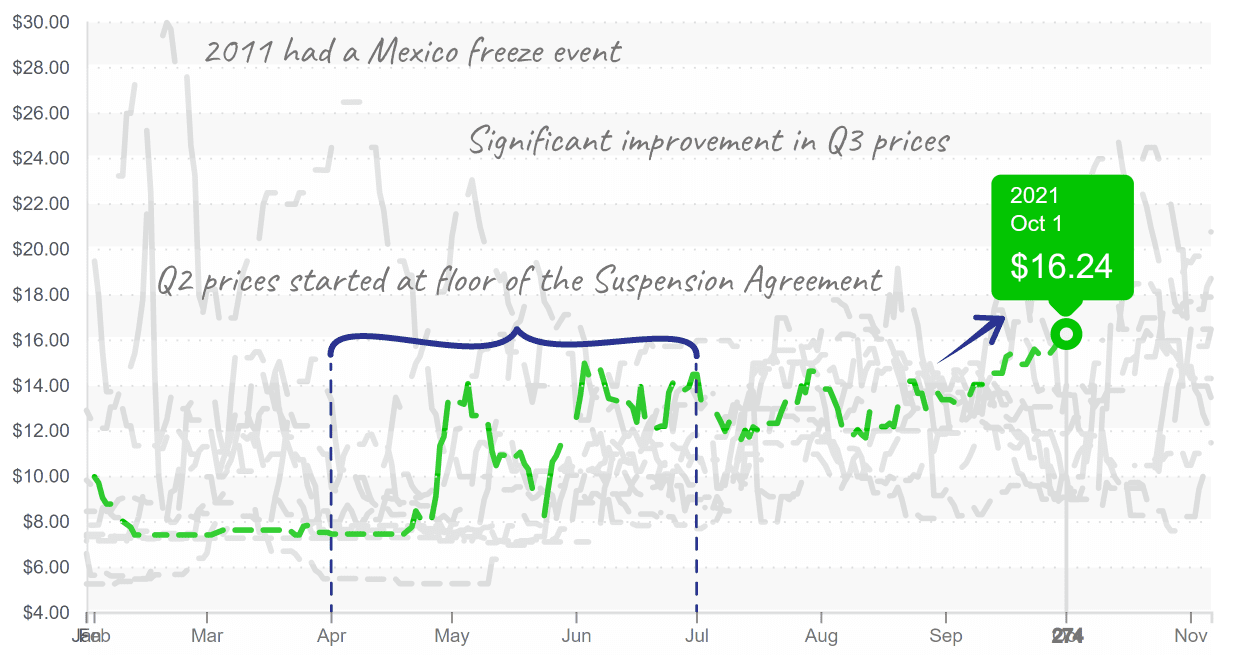

It hasn’t always been this way. Supply began the year strong, causing true market prices to remain below the minimum prices of the suspension agreement from February through April.

One new grower recently reported the pain felt from these early markets. According to their quarterly report for 2nd quarter ending June 30, AppHarvest lost an incredible $32 million.

However, most expenditures were indirect sales, general and administrative expenses rather than direct costs of growing tomatoes.

Like the scarecrow from the Land of Oz, with plenty of courage (and cash-on-hand), they’re pressing onward to see the wizard. Management’s parallel quest for “bran-new brains” is in the form of additional facilities, increased marketing, and product innovation with their recent acquisition of Root AI Inc’s technologies. We’re hoping the best for future crops.

Vine-ripe 2-layer tomatoes are priced for grower profits at $16/case.

ProduceIQ Index: $1.16/pound, +2.7 percent over prior week

Week #39, ending October 1st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

After Mexico, California is the second-largest supplier of tomatoes to domestic markets. However, due to worsening drought conditions, California growers face a difficult decision.

Should they use the little water they have for tomatoes or cut acreage and focus on higher value and less thirsty crops?

As seen in current USDA data, some growers have already made their choice and are cutting tomato acreage, leaving a supply deficit in their wake, especially on the lower-value processor side.

On top of supply shortage issues, current tomato markets have the added pressure of the fall transition. Eastern markets are moving out of Tennessee and into Georgia and Florida, and California growers only have a little over a month left of season.

Watch out for continued price increases on all varieties until late October brings an increase in tomato supply.

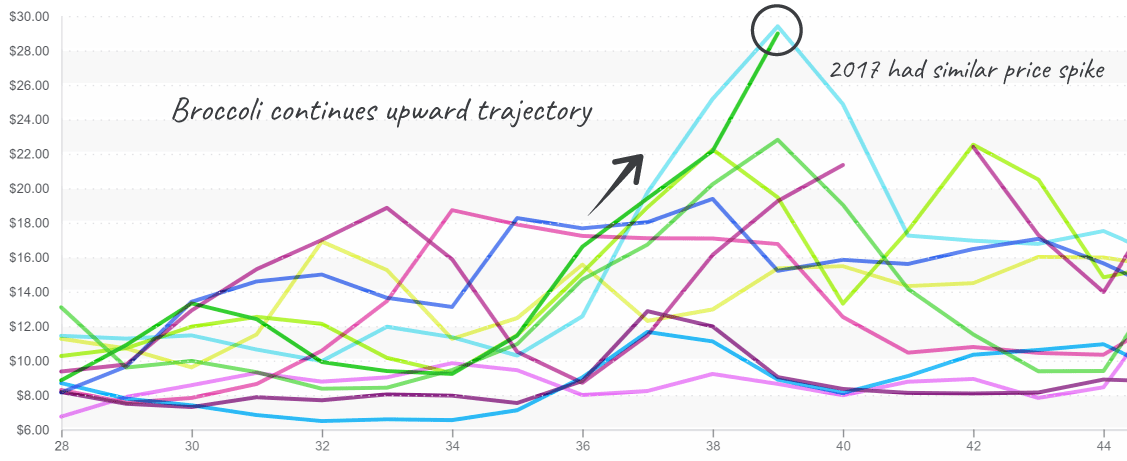

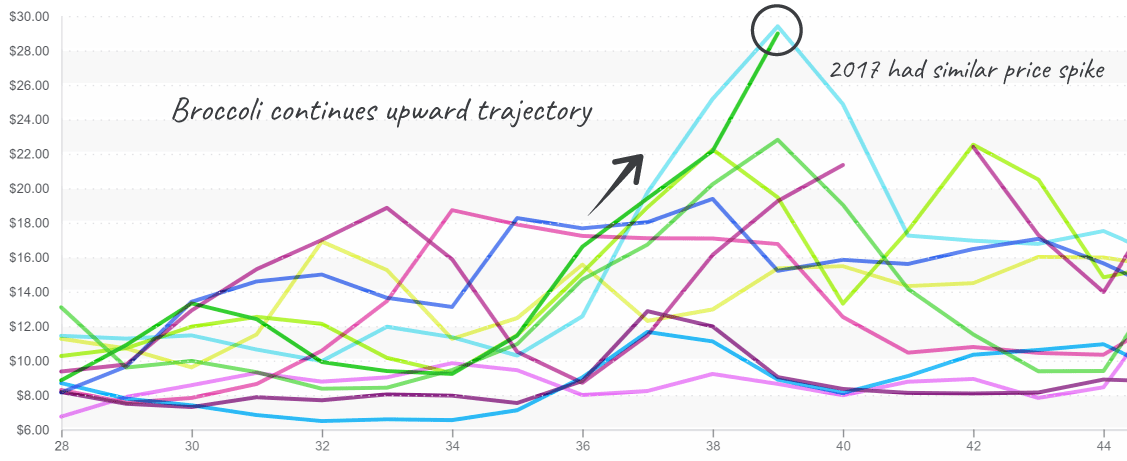

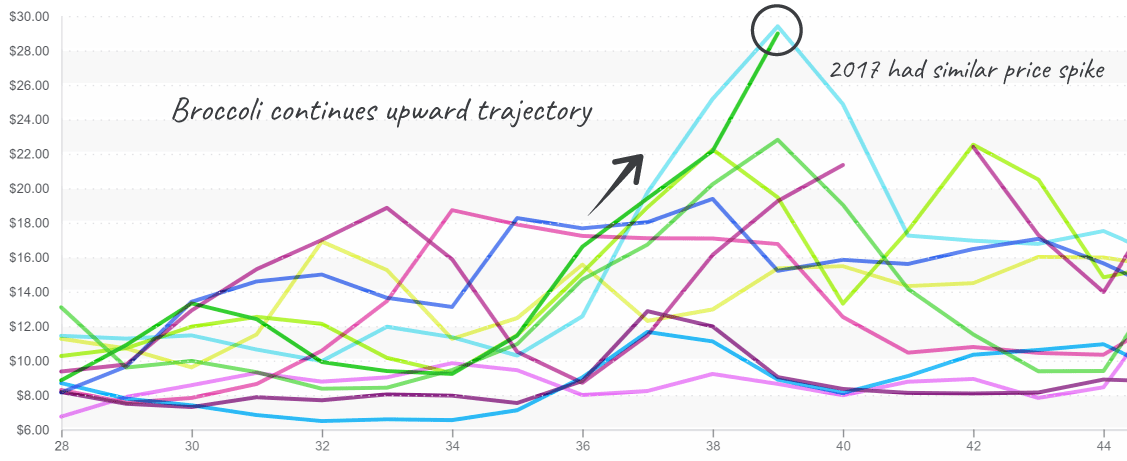

To the moon! Transition and heat thrust broccoli and cauliflower prices upwards for the 5th straight week. Exceeding $30/case, broccoli prices flirt with 2017’s ten-year high. Cauliflower, at $19/case, edges out week #39’s previous record holder, 2014.

Expect prices on both commodities to stay elevated as California’s production struggles to meet demand due to reduced yields or quality issues, and Mexican supply remains weak.

Broccoli, 20lb carton, rises from $10 to $30 in 5 weeks.

It seems ports of entry are not immune to labor shortage issues either, as evidenced by extraordinarily high blueberry prices. Expect markets to remain tight until the Mexican crop picks up in volume or Peruvian crop gets a break at the port.

Orange prices are trending higher again this week. Prices are only up slightly over the previous week but remain towards the upper quartile of historical data. Mandarin’s supply is low due to delays at the ports of entry.

California’s Valencia supply is struggling due to excessive heat, gas times (ripening), and dehydration throughout growing regions. Consider substituting your vitamin C fix for bell peppers or sweet potatoes when able.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Between severe drought in the West and a rainy summer in the East, tomato supply can’t catch a break.

Across varietals, prices remain elevated with little hope for relief. Onlookers wonder, is it an abnormal year or a new reality for tomato markets?

It hasn’t always been this way. Supply began the year strong, causing true market prices to remain below the minimum prices of the suspension agreement from February through April.

One new grower recently reported the pain felt from these early markets. According to their quarterly report for 2nd quarter ending June 30, AppHarvest lost an incredible $32 million.

However, most expenditures were indirect sales, general and administrative expenses rather than direct costs of growing tomatoes.

Like the scarecrow from the Land of Oz, with plenty of courage (and cash-on-hand), they’re pressing onward to see the wizard. Management’s parallel quest for “bran-new brains” is in the form of additional facilities, increased marketing, and product innovation with their recent acquisition of Root AI Inc’s technologies. We’re hoping the best for future crops.

Vine-ripe 2-layer tomatoes are priced for grower profits at $16/case.

ProduceIQ Index: $1.16/pound, +2.7 percent over prior week

Week #39, ending October 1st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

After Mexico, California is the second-largest supplier of tomatoes to domestic markets. However, due to worsening drought conditions, California growers face a difficult decision.

Should they use the little water they have for tomatoes or cut acreage and focus on higher value and less thirsty crops?

As seen in current USDA data, some growers have already made their choice and are cutting tomato acreage, leaving a supply deficit in their wake, especially on the lower-value processor side.

On top of supply shortage issues, current tomato markets have the added pressure of the fall transition. Eastern markets are moving out of Tennessee and into Georgia and Florida, and California growers only have a little over a month left of season.

Watch out for continued price increases on all varieties until late October brings an increase in tomato supply.

To the moon! Transition and heat thrust broccoli and cauliflower prices upwards for the 5th straight week. Exceeding $30/case, broccoli prices flirt with 2017’s ten-year high. Cauliflower, at $19/case, edges out week #39’s previous record holder, 2014.

Expect prices on both commodities to stay elevated as California’s production struggles to meet demand due to reduced yields or quality issues, and Mexican supply remains weak.

Broccoli, 20lb carton, rises from $10 to $30 in 5 weeks.

It seems ports of entry are not immune to labor shortage issues either, as evidenced by extraordinarily high blueberry prices. Expect markets to remain tight until the Mexican crop picks up in volume or Peruvian crop gets a break at the port.

Orange prices are trending higher again this week. Prices are only up slightly over the previous week but remain towards the upper quartile of historical data. Mandarin’s supply is low due to delays at the ports of entry.

California’s Valencia supply is struggling due to excessive heat, gas times (ripening), and dehydration throughout growing regions. Consider substituting your vitamin C fix for bell peppers or sweet potatoes when able.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.