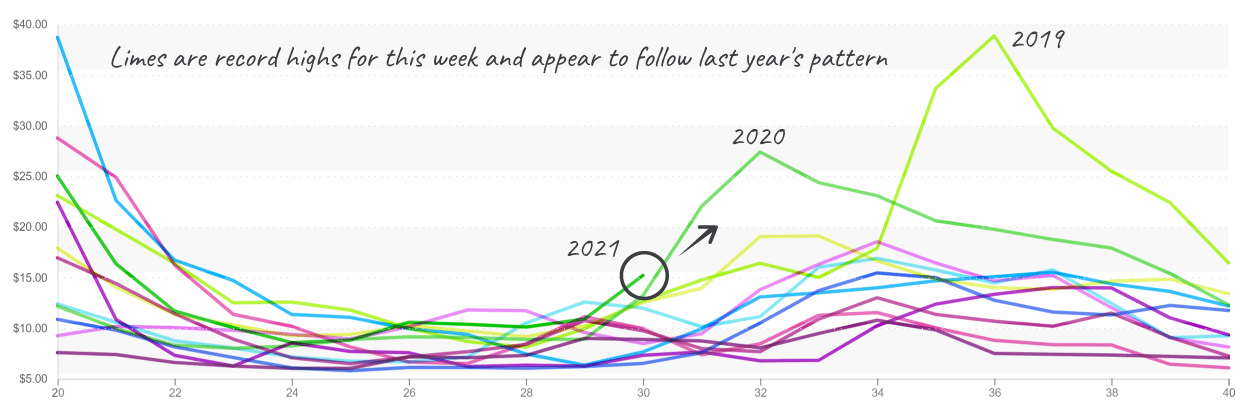

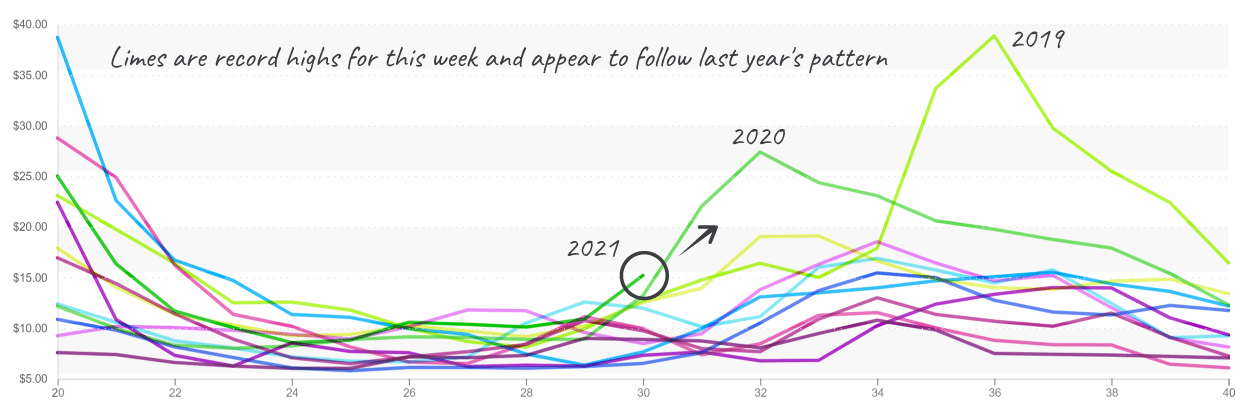

Gold medal Olympians Katie Ledecky and Caeleb Dressel aren’t the only ones getting soaked this week; record rain in Mexico is challenging lime growers.

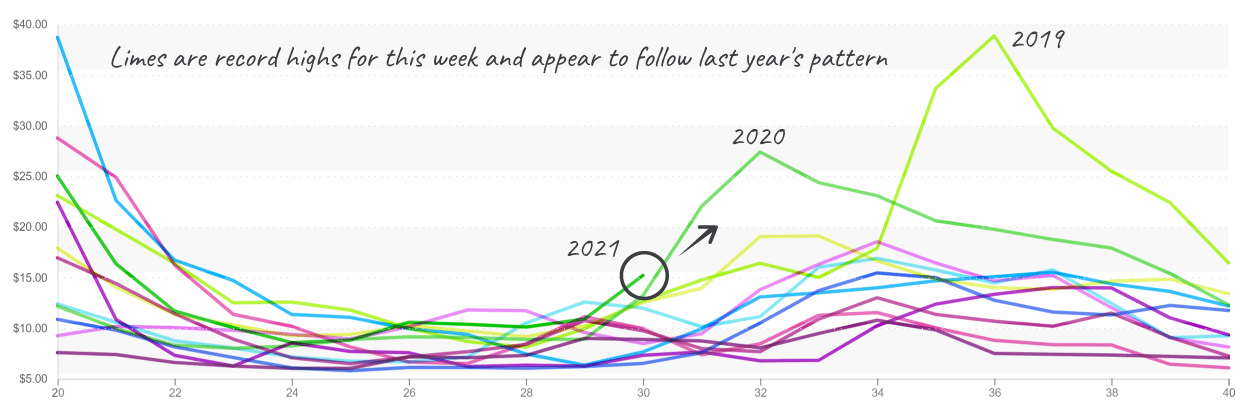

Limes reach a ten-year weekly high, $15.20 for 40-pound cartons. Unfortunately for buyers and growers, record rain throughout the month of June is putting a damper on the beginning of peak season in Veracruz.

Peak ripening season runs from August through December. Markets will remain tight and high for a few weeks. Aesthetically, product may be a little off with light scarring and discoloration.

Limes enter the next transition with supply challenges and higher prices.

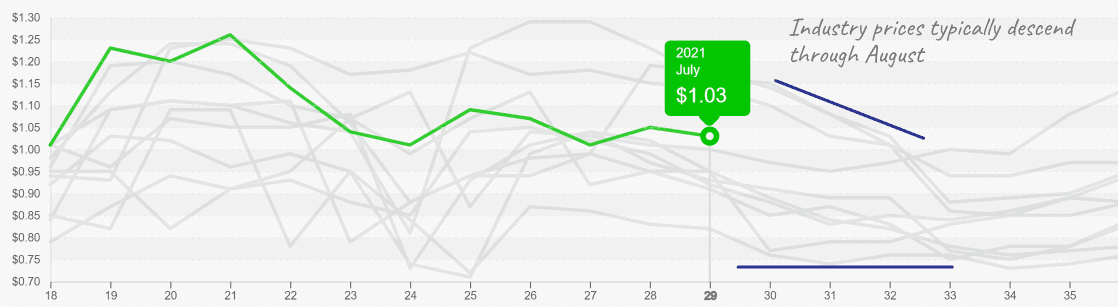

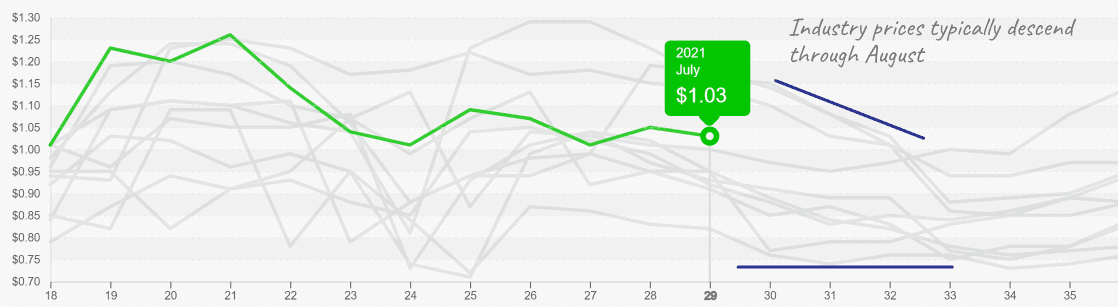

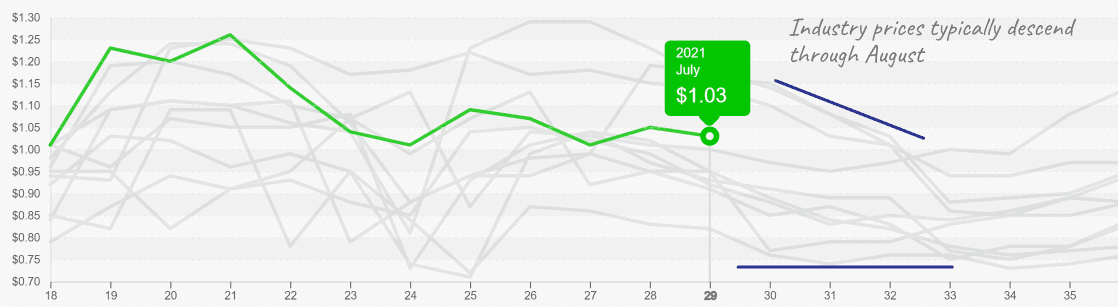

Overall, the produce industry is entering a challenging time of year – mid-summer – for produce prices. It’s normal for prices to broadly decline over the next 4 to 6 weeks as locally grown produce reduces the concentration of suppliers.

This year, prices are above a 10-year average, yet below 2016, 2019 and 2020.

ProduceIQ Index: $1.03 /pound, flat over prior week

Week #30, ending July 30th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Prices holding, yet August and September have historically declining prices as supply is fragmented with locally grown produce.

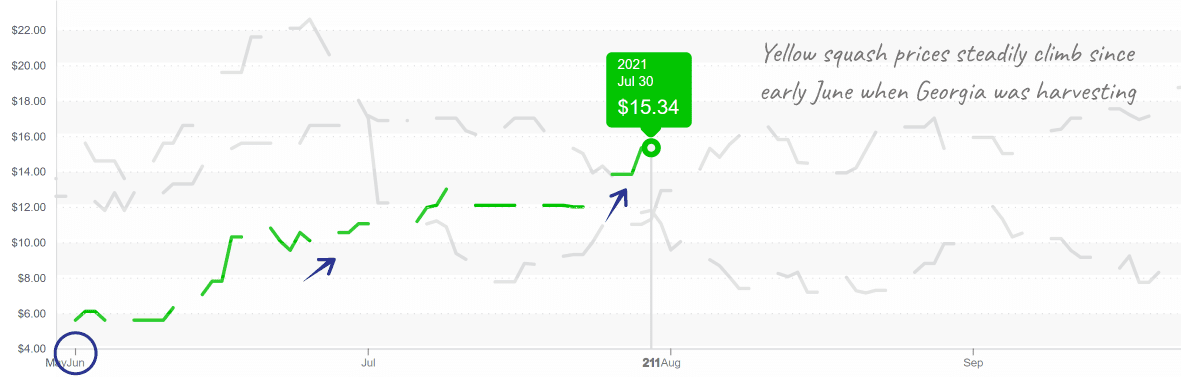

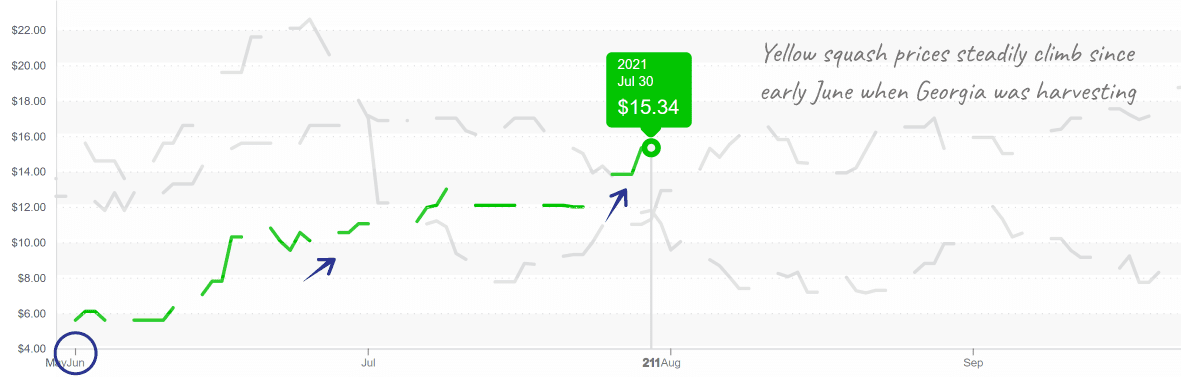

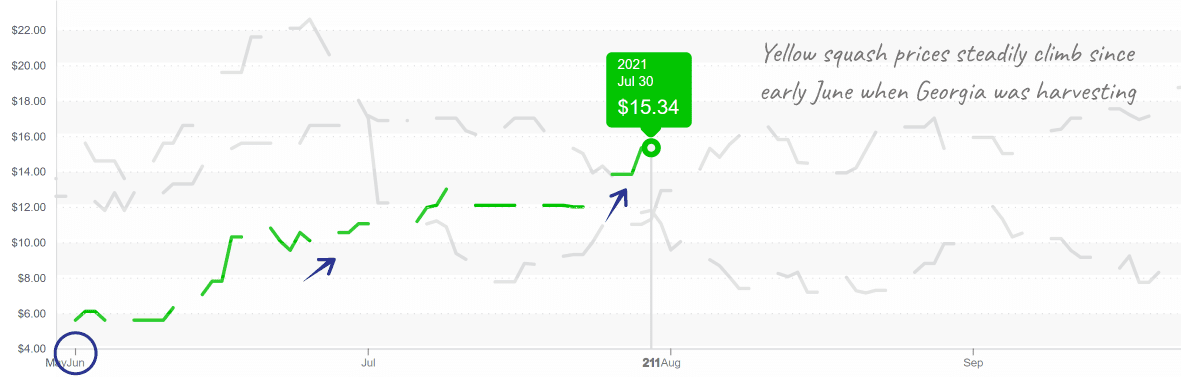

Rain in the East is keeping yellow squash yields low and prices high. USDA data has prices at a five-year high.

The recent heat wave might be doing markets a favor by bringing western markets online quicker. Some regions are experiencing smaller item sizes and yellow squash is generally challenged with heat and rain.

Squash growing regions are diverse in the summer and quality varies with local growers.

Although Californian Squash growers may be helped by the heat wave, tomato crops are withering under the record temps. Product from the East Coast should provide some relief to elevated markets in a few weeks. Beefsteak, Medley, and Campari tomatoes are extremely tight.

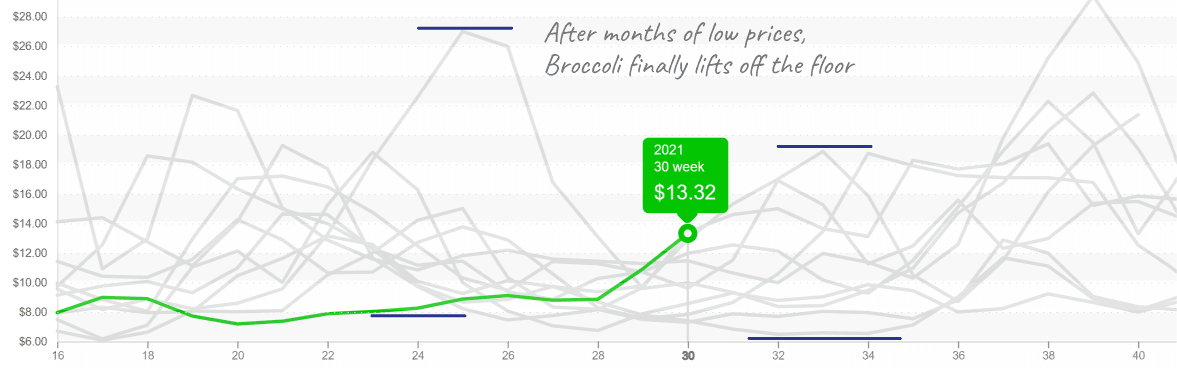

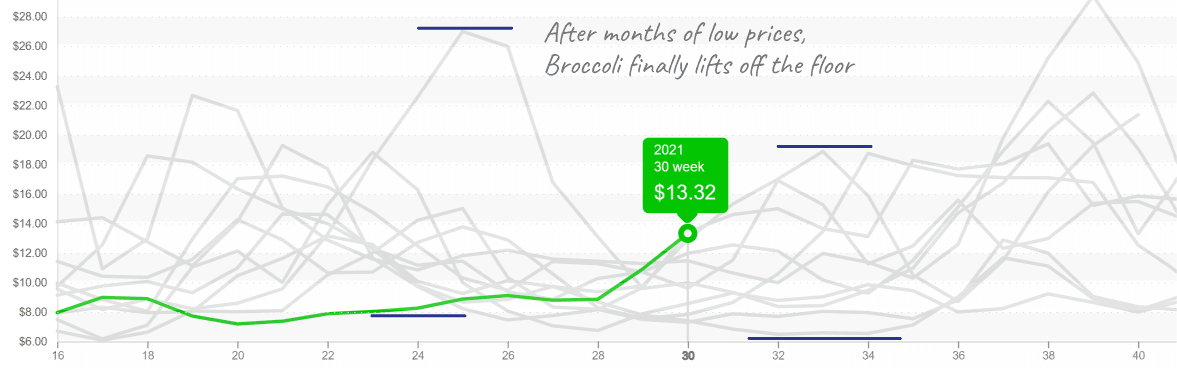

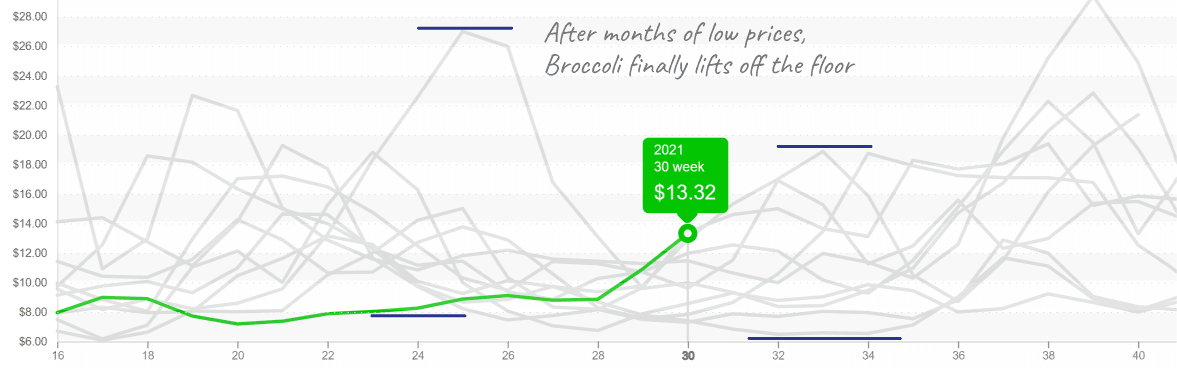

Strong demand is pushing up broccoli markets on struggling supply. Markets are up +22 percent over the previous week. Growers in California and Mexico are battling the elements. Expect relief as temps cool and new growing regions come online.

Broccoli enters a season of variable pricing and inconsistent supply.

Bell Peppers are at an eight-year-low. Prices fell for the third-week in a row following increasing volume coming out of the East. Quality is good and plentiful, especially on green peppers. Expect prices to continue to increase as production ramps up throughout August.

Strong demand for lettuce and leaf on weak supply is pushing prices upwards for the second week in a row. Volume is down on iceberg and romaine following reports of soil diseases and quality issues due to heat-related damage. Expect prices to increase throughout the beginning of August.

Despite being in peak domestic harvesting season, mixed berry prices across the board are on the higher end of the historical spectrum. Heat is damaging the fragile crops and creating challenging harvesting conditions for growers.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Gold medal Olympians Katie Ledecky and Caeleb Dressel aren’t the only ones getting soaked this week; record rain in Mexico is challenging lime growers.

Limes reach a ten-year weekly high, $15.20 for 40-pound cartons. Unfortunately for buyers and growers, record rain throughout the month of June is putting a damper on the beginning of peak season in Veracruz.

Peak ripening season runs from August through December. Markets will remain tight and high for a few weeks. Aesthetically, product may be a little off with light scarring and discoloration.

Limes enter the next transition with supply challenges and higher prices.

Overall, the produce industry is entering a challenging time of year – mid-summer – for produce prices. It’s normal for prices to broadly decline over the next 4 to 6 weeks as locally grown produce reduces the concentration of suppliers.

This year, prices are above a 10-year average, yet below 2016, 2019 and 2020.

ProduceIQ Index: $1.03 /pound, flat over prior week

Week #30, ending July 30th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Prices holding, yet August and September have historically declining prices as supply is fragmented with locally grown produce.

Rain in the East is keeping yellow squash yields low and prices high. USDA data has prices at a five-year high.

The recent heat wave might be doing markets a favor by bringing western markets online quicker. Some regions are experiencing smaller item sizes and yellow squash is generally challenged with heat and rain.

Squash growing regions are diverse in the summer and quality varies with local growers.

Although Californian Squash growers may be helped by the heat wave, tomato crops are withering under the record temps. Product from the East Coast should provide some relief to elevated markets in a few weeks. Beefsteak, Medley, and Campari tomatoes are extremely tight.

Strong demand is pushing up broccoli markets on struggling supply. Markets are up +22 percent over the previous week. Growers in California and Mexico are battling the elements. Expect relief as temps cool and new growing regions come online.

Broccoli enters a season of variable pricing and inconsistent supply.

Bell Peppers are at an eight-year-low. Prices fell for the third-week in a row following increasing volume coming out of the East. Quality is good and plentiful, especially on green peppers. Expect prices to continue to increase as production ramps up throughout August.

Strong demand for lettuce and leaf on weak supply is pushing prices upwards for the second week in a row. Volume is down on iceberg and romaine following reports of soil diseases and quality issues due to heat-related damage. Expect prices to increase throughout the beginning of August.

Despite being in peak domestic harvesting season, mixed berry prices across the board are on the higher end of the historical spectrum. Heat is damaging the fragile crops and creating challenging harvesting conditions for growers.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.