Market direction is uncertain. Will demand exceed supply when both are falling?

The market weighs the decline in demand against the challenged supply. While Western crops endure hot temps, Eastern crops are transitioning out of Georgia and are on storm watch next week.

Tropical storm Elsa is making a path for Florida as it heads North toward warm gulf waters. Simultaneously, vegetable harvesting is moving northward from Georgia and spreading out to North Carolina, Tennessee and New Jersey.

Elsa will be a storm to watch as the early path forecasts it moving towards inland growing regions. Dissipating hurricanes can reduce yields and disrupt vegetable harvesting, particularly cucumbers which are vulnerable to wind and rain.

Eastern growers hope that earlier predictions for a mild hurricane season hold true. Despite a promising shift to a neutral ENSO status, Elsa has become the earliest letter “e” storm, surpassing last year’s previous record by 5 days.

In an average hurricane season, the Atlantic’s fifth storm of the season does not occur until August 31st. Unusually early storms can be an omen of a more active hurricane season ahead.

ProduceIQ Index: $1.07/pound, -1.8 percent over prior week

Week #26 ending July 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

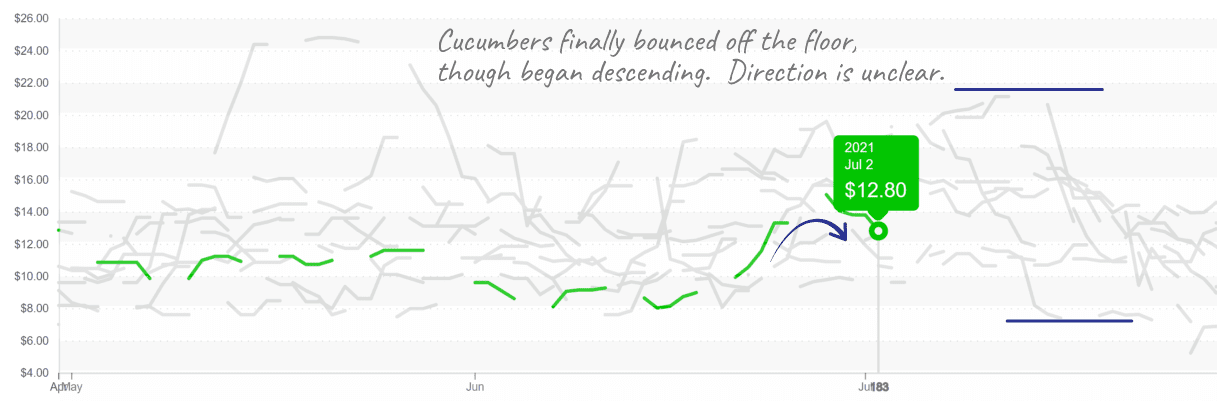

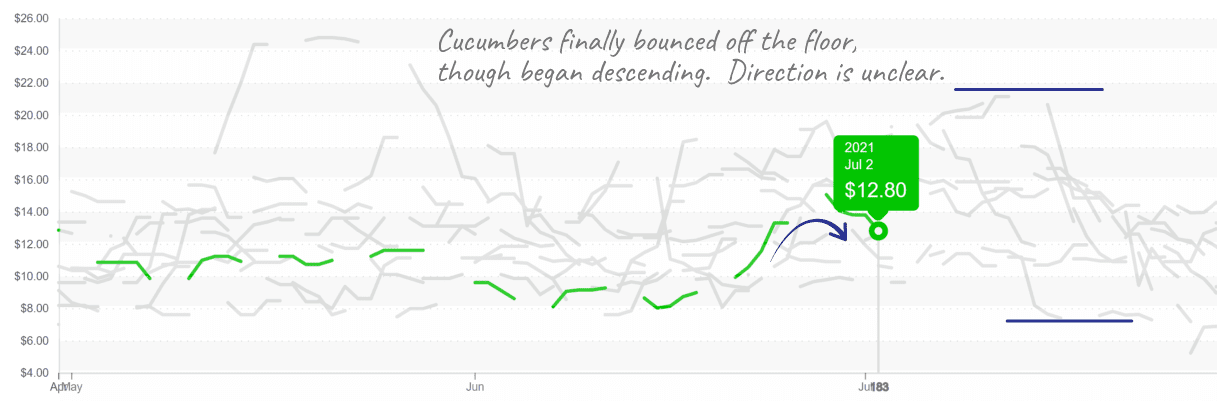

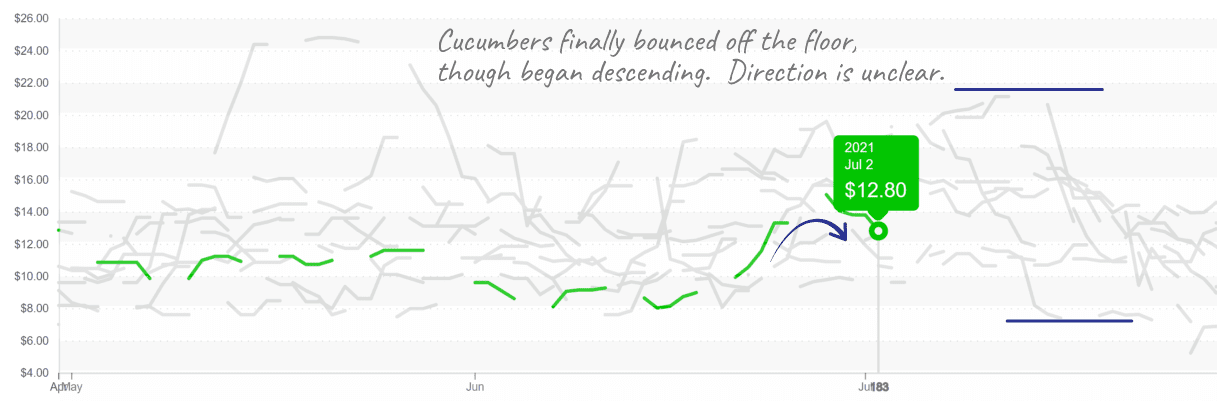

Cucumber prices are finally off the floor in response to a temporary supply gap. Western growers are in between production, and North Carolina fields are just beginning to harvest. Prices remain uncertain as demand for cucumbers tapers off after the Fourth of July holiday.

After a disappointing winter, cucumber had an opportunity at break-even pricing.

Strong holiday demand for watermelon pulled prices slightly upward. Although watermelon markets are up over the previous week, plentiful supply is keeping prices towards the lower range of historical precedent. In the last ten years, only 2019 fell below this week’s prices of $0.17 per pound.

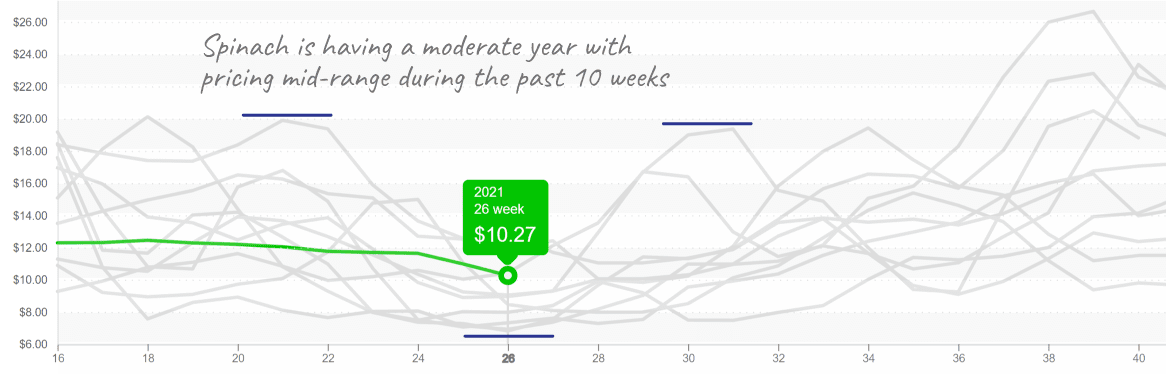

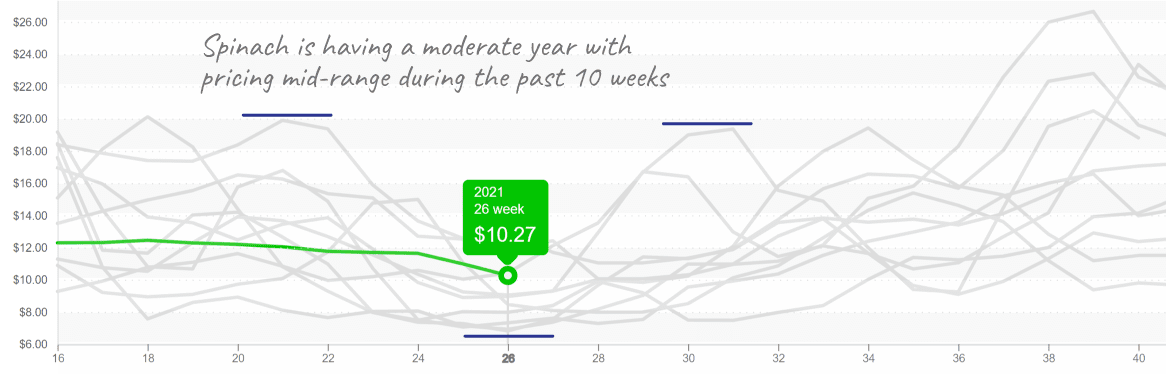

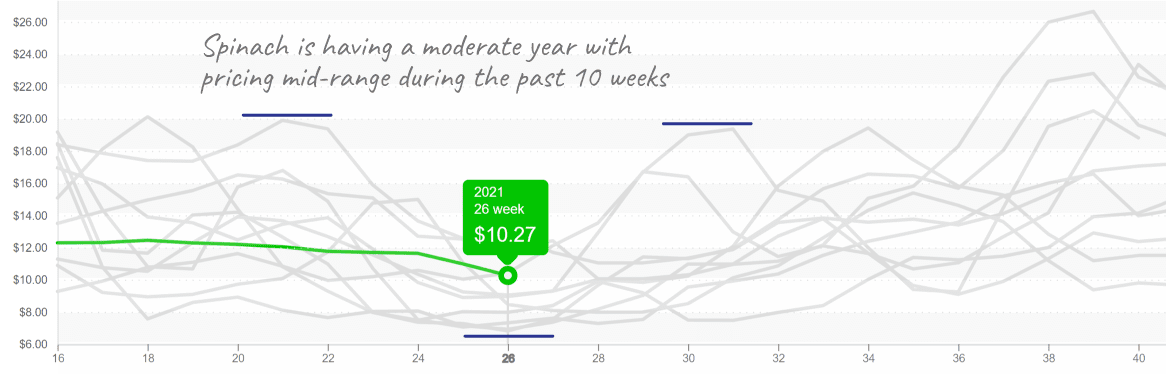

After a few weeks of gains from the price floor, iceberg and romaine prices dip, -8 percent over the previous week. Spinach is also down. Prices need continued improvement for growers to recover this year. Quality is improving gradually, and growers are still reporting challenges from heat, wind and insects. Markets remain in flux depending on post-holiday demand.

Spinach has been more stable this year than iceberg and romaine.

Tomatoes have been able to remain above the price floors for the past 10 weeks. Plum variety tomatoes are up +19 percent over the previous week, and nearly all varieties (grape, cherry, beefsteak, and hothouse tomatoes) are in short supply. Demand is solid thanks to foodservice recovery. Expect markets to remain in flux as growing regions transition.

Strawberries are slightly down over the previous week. Wavering demand is influencing prices and heat damage is affecting the quality of strawberries grown in California. Markets are expected to stay steady.

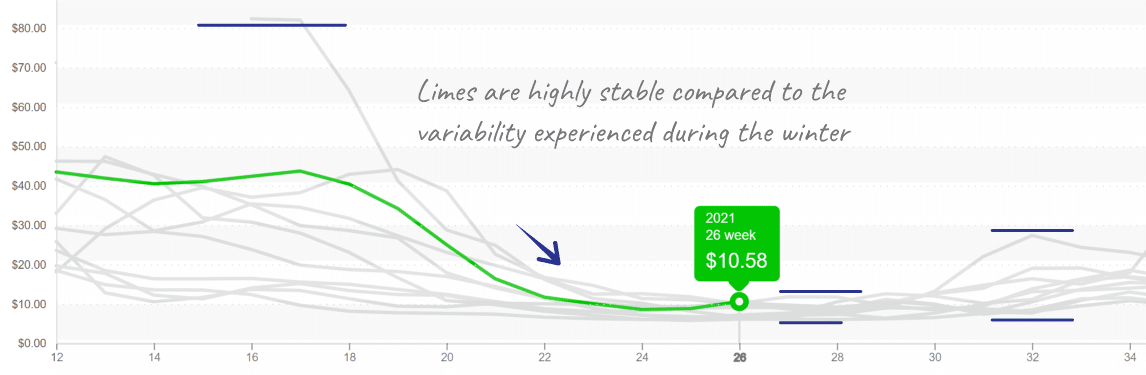

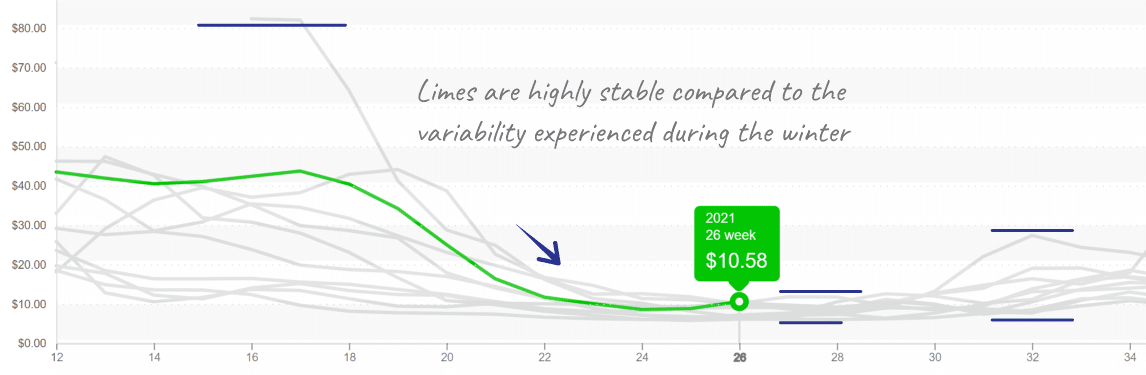

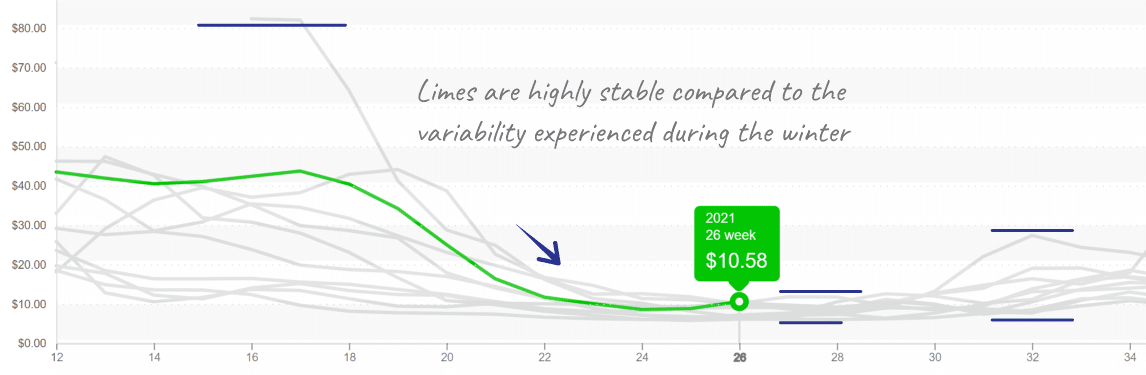

Lemon supply remains limited from California, and imports are increasing. Price volatility has continued, particularly on fancy grade lemons. Limes are finally significantly cheaper than lemons.

Our earlier advice for foodservice to substitute lemons for limes has definitively reversed course. Delivered to a restaurant, limes are now less than half the cost of lemons.

Still under $11, lime prices are at the high end of their (narrow) range for this time of year.

Led by decreases in cherries, and followed by nectarines, the stone fruit category fell -10 percent over the previous week. Excellent supply and quality are expected to keep prices on the retreat for the remainder of the domestic stone fruit season.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Market direction is uncertain. Will demand exceed supply when both are falling?

The market weighs the decline in demand against the challenged supply. While Western crops endure hot temps, Eastern crops are transitioning out of Georgia and are on storm watch next week.

Tropical storm Elsa is making a path for Florida as it heads North toward warm gulf waters. Simultaneously, vegetable harvesting is moving northward from Georgia and spreading out to North Carolina, Tennessee and New Jersey.

Elsa will be a storm to watch as the early path forecasts it moving towards inland growing regions. Dissipating hurricanes can reduce yields and disrupt vegetable harvesting, particularly cucumbers which are vulnerable to wind and rain.

Eastern growers hope that earlier predictions for a mild hurricane season hold true. Despite a promising shift to a neutral ENSO status, Elsa has become the earliest letter “e” storm, surpassing last year’s previous record by 5 days.

In an average hurricane season, the Atlantic’s fifth storm of the season does not occur until August 31st. Unusually early storms can be an omen of a more active hurricane season ahead.

ProduceIQ Index: $1.07/pound, -1.8 percent over prior week

Week #26 ending July 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Cucumber prices are finally off the floor in response to a temporary supply gap. Western growers are in between production, and North Carolina fields are just beginning to harvest. Prices remain uncertain as demand for cucumbers tapers off after the Fourth of July holiday.

After a disappointing winter, cucumber had an opportunity at break-even pricing.

Strong holiday demand for watermelon pulled prices slightly upward. Although watermelon markets are up over the previous week, plentiful supply is keeping prices towards the lower range of historical precedent. In the last ten years, only 2019 fell below this week’s prices of $0.17 per pound.

After a few weeks of gains from the price floor, iceberg and romaine prices dip, -8 percent over the previous week. Spinach is also down. Prices need continued improvement for growers to recover this year. Quality is improving gradually, and growers are still reporting challenges from heat, wind and insects. Markets remain in flux depending on post-holiday demand.

Spinach has been more stable this year than iceberg and romaine.

Tomatoes have been able to remain above the price floors for the past 10 weeks. Plum variety tomatoes are up +19 percent over the previous week, and nearly all varieties (grape, cherry, beefsteak, and hothouse tomatoes) are in short supply. Demand is solid thanks to foodservice recovery. Expect markets to remain in flux as growing regions transition.

Strawberries are slightly down over the previous week. Wavering demand is influencing prices and heat damage is affecting the quality of strawberries grown in California. Markets are expected to stay steady.

Lemon supply remains limited from California, and imports are increasing. Price volatility has continued, particularly on fancy grade lemons. Limes are finally significantly cheaper than lemons.

Our earlier advice for foodservice to substitute lemons for limes has definitively reversed course. Delivered to a restaurant, limes are now less than half the cost of lemons.

Still under $11, lime prices are at the high end of their (narrow) range for this time of year.

Led by decreases in cherries, and followed by nectarines, the stone fruit category fell -10 percent over the previous week. Excellent supply and quality are expected to keep prices on the retreat for the remainder of the domestic stone fruit season.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.