Although overall markets are down this week vs. last, prices hit record highs, $1.10/pound. The previous record, established in 2016, saw markets cap out at $1.03/pound for this week #17.

Demand is solid while supplies are light. The Mother’s Day pull is underway, signifying the end of Florida’s winter season.

The next growing regions to the North (Georgia on the East Coast and transitions from Mexico to California) haven’t reached peak production, creating a wide gap for price inflation. Rain and cool weather are causing the transition to run a bit behind schedule.

ProduceIQ Index: $1.10 /pound, -1.8 percent over prior week

Week #17, ending April 30th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

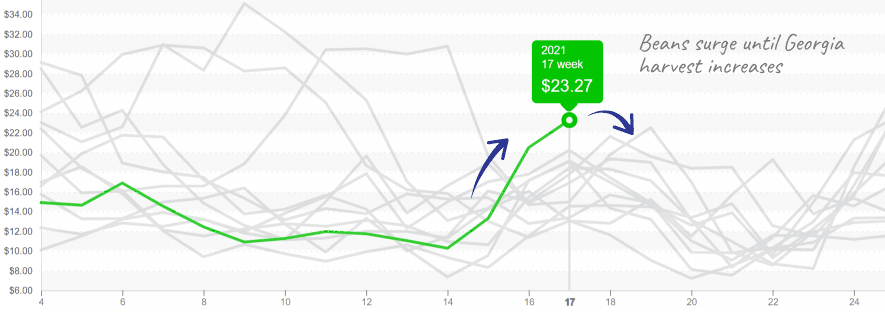

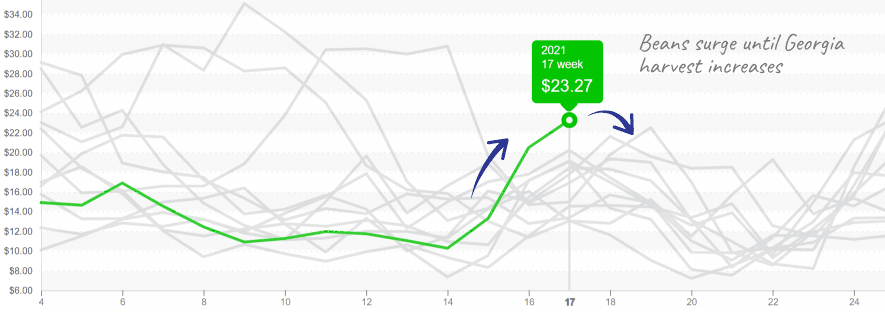

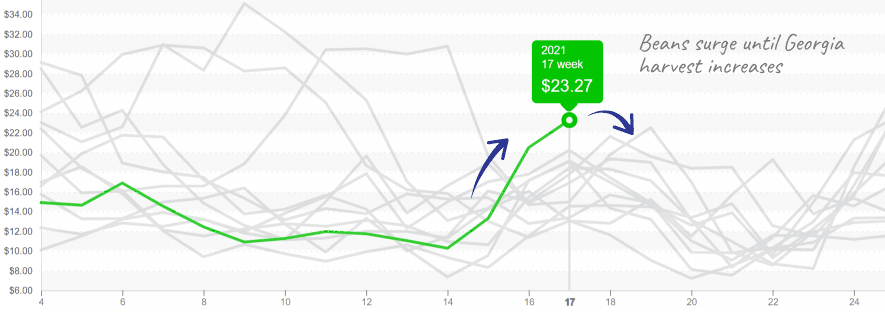

Seasonal movement is affecting prices across the Dry Veg category. Asparagus markets are tight. Green beans jump quickly past $20/box. After a difficult eight weeks, demand finally exceeds supply.

Green beans surpass historical norms before Georgia season fully underway.

Leaving floor prices behind, squash is on its way up. High-flying cucumbers are continuing the journey back towards production costs. Prices are still above the norm but are steadily declining.

Despite being the week’s biggest mover, dry-veg prices are somewhat average. So which category is the real culprit behind this week’s historic prices?

Enter Berries. And apples. Tropical fruit. And, of course, citrus. Essentially, all retail-friendly commodities with high brix.

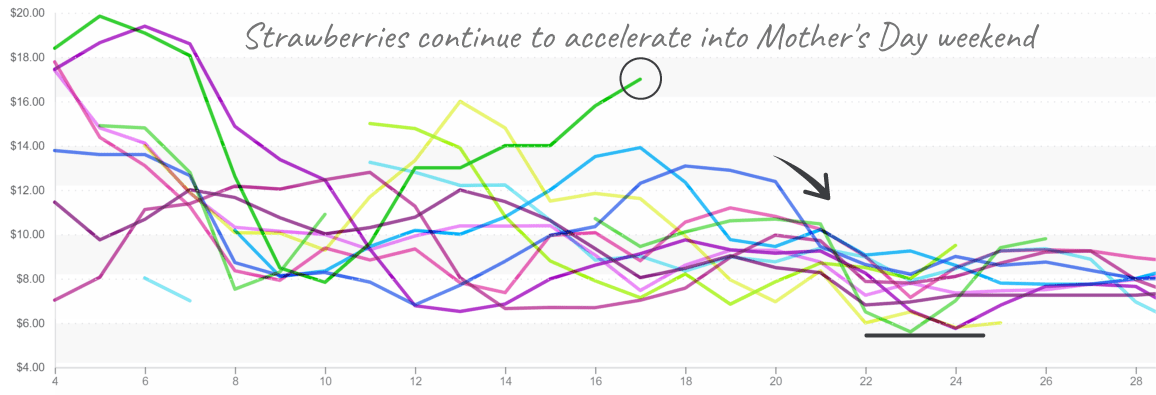

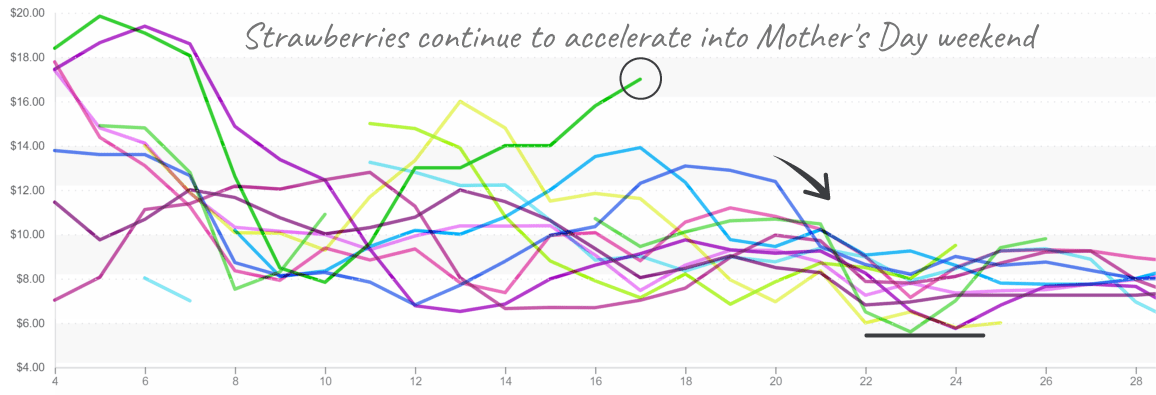

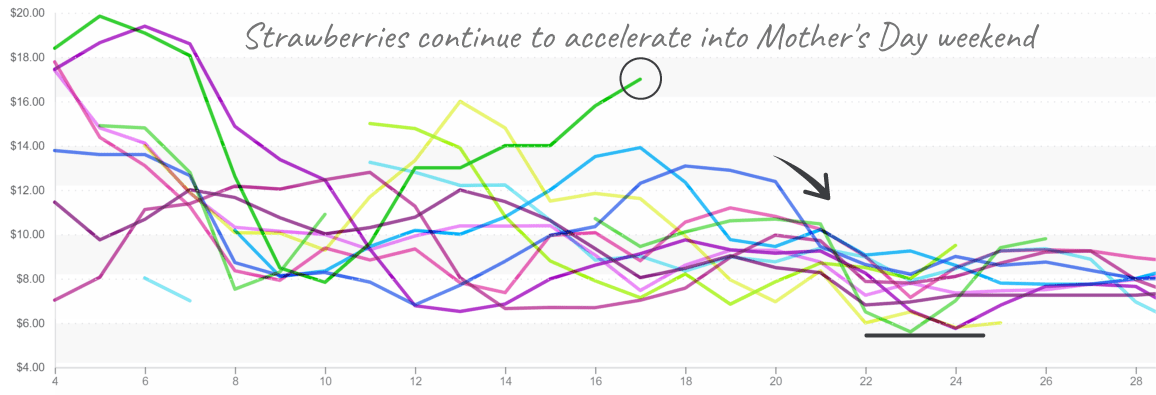

Berries comprise 16 percent of the ProduceIQ Index. The “weight” of each commodity is based on its 5-year average sales, seasonally adjusted. Despite mixed berries falling -18 percent this week, category prices are elevated above historical precedent. As the category leader, strawberries have pushed beyond $2.00 /pound FOB.

Rain, hail, and cold temperatures are keeping sensitive markets on edge and price relief for buyers at bay. Buyers should look for alternatives when they can and continue to wait patiently for mid-May when yields from Georgia and California are expected to pull down inflated prices.

Strawberries continue with strong demand, exceeding supply slowed by cool weather.

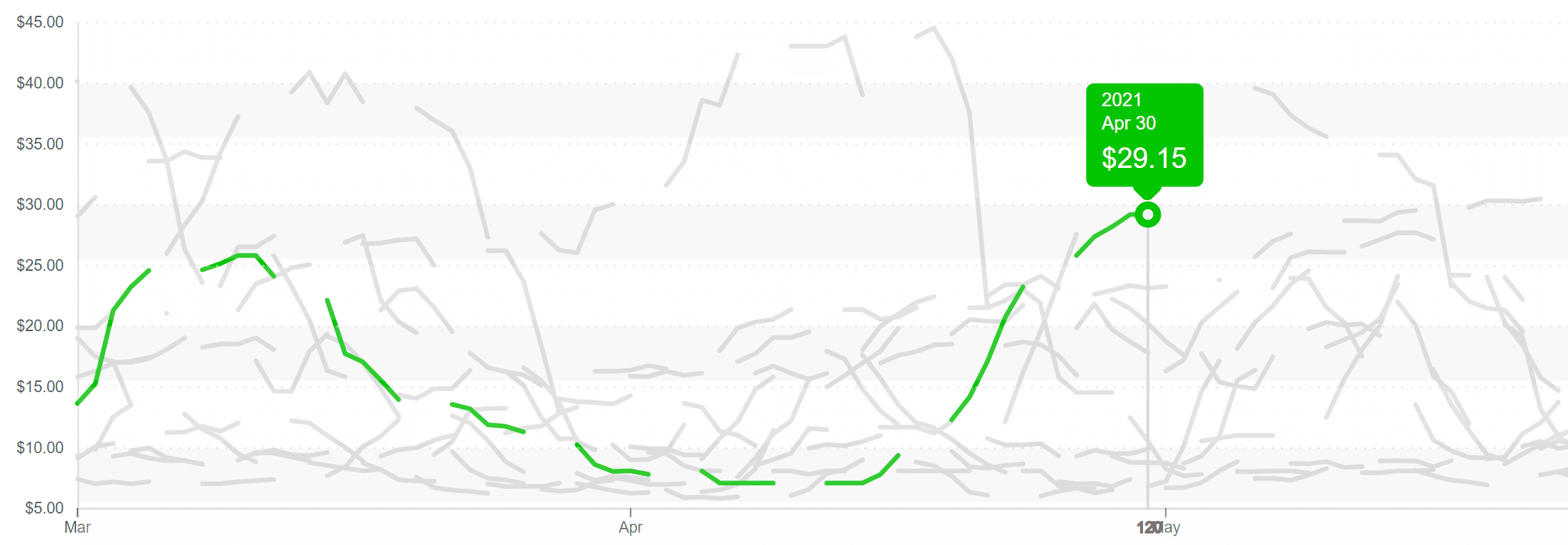

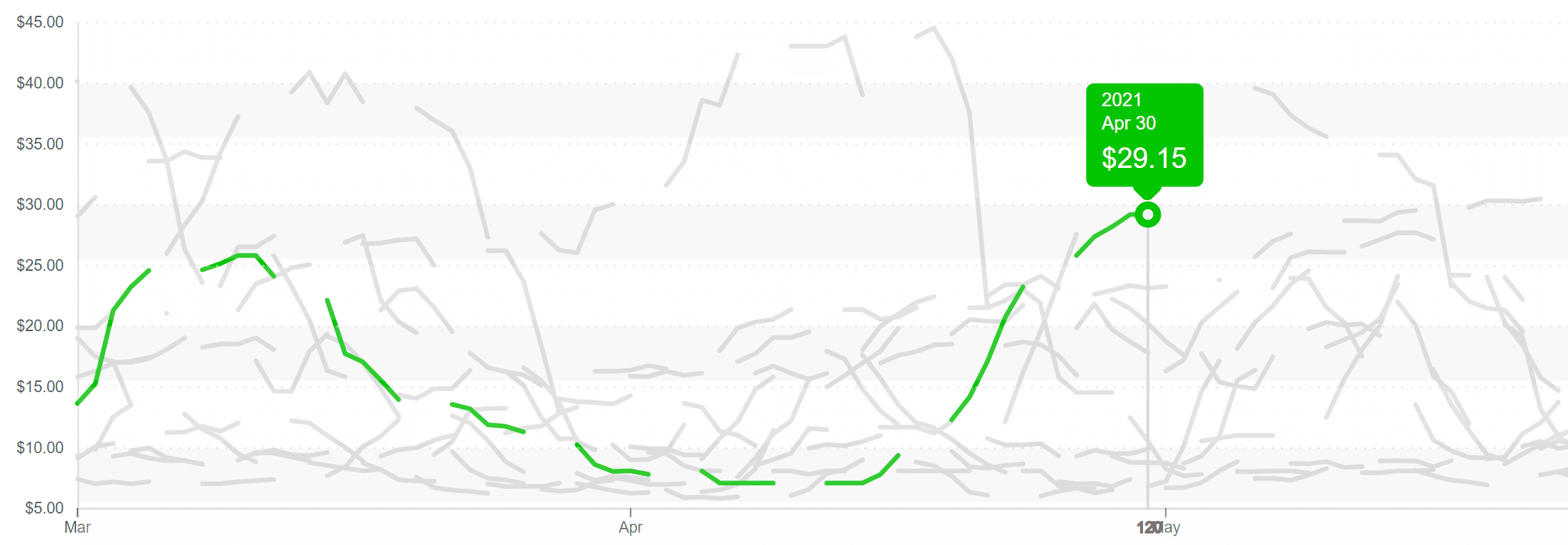

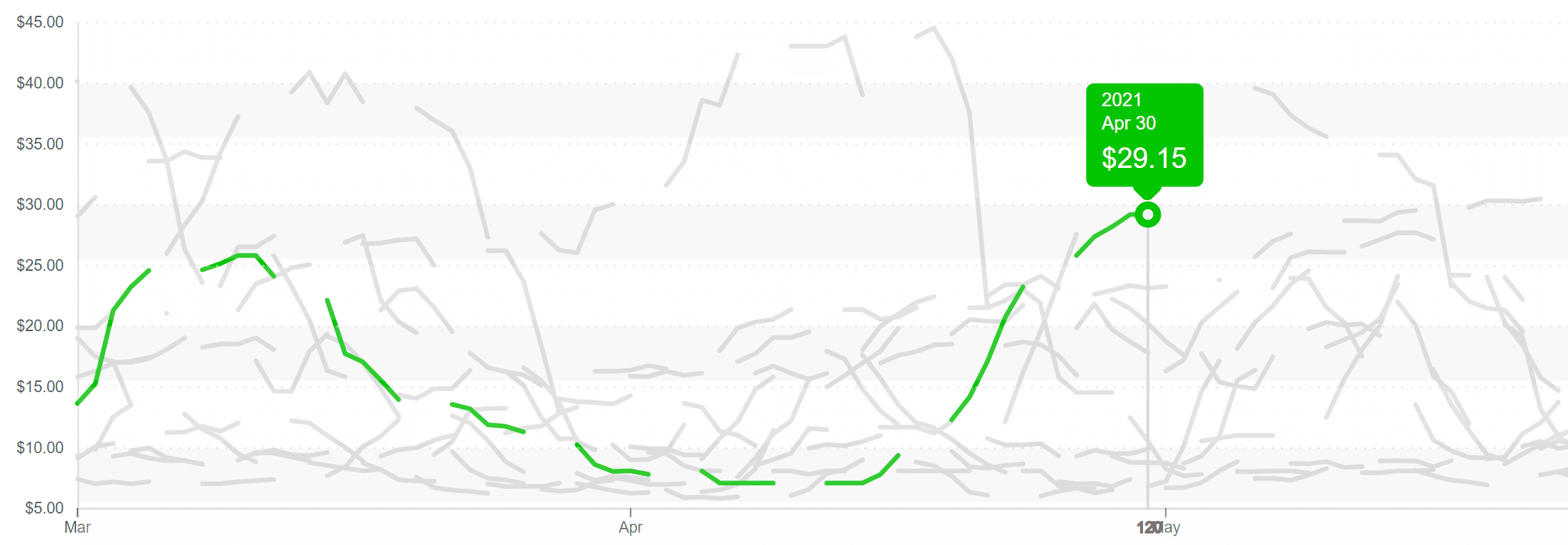

Cooler than usual weather in California is continuing to tighten cauliflower supply. Cauliflower markets are not simply feeling shaky after a brief fainting spell, market conditions are deteriorating into full-on cardiac arrest.

Naturally, buyers and growers are no strangers to price volatility and should recover their stride as more product becomes available with new harvests.

On the other hand, celery, lettuce and leaf are struggling to get off the floor.

From $7/box to $29/box in a matter of two weeks, cauliflower isn’t for the faint of heart. The descent is often quicker.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Although overall markets are down this week vs. last, prices hit record highs, $1.10/pound. The previous record, established in 2016, saw markets cap out at $1.03/pound for this week #17.

Demand is solid while supplies are light. The Mother’s Day pull is underway, signifying the end of Florida’s winter season.

The next growing regions to the North (Georgia on the East Coast and transitions from Mexico to California) haven’t reached peak production, creating a wide gap for price inflation. Rain and cool weather are causing the transition to run a bit behind schedule.

ProduceIQ Index: $1.10 /pound, -1.8 percent over prior week

Week #17, ending April 30th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Seasonal movement is affecting prices across the Dry Veg category. Asparagus markets are tight. Green beans jump quickly past $20/box. After a difficult eight weeks, demand finally exceeds supply.

Green beans surpass historical norms before Georgia season fully underway.

Leaving floor prices behind, squash is on its way up. High-flying cucumbers are continuing the journey back towards production costs. Prices are still above the norm but are steadily declining.

Despite being the week’s biggest mover, dry-veg prices are somewhat average. So which category is the real culprit behind this week’s historic prices?

Enter Berries. And apples. Tropical fruit. And, of course, citrus. Essentially, all retail-friendly commodities with high brix.

Berries comprise 16 percent of the ProduceIQ Index. The “weight” of each commodity is based on its 5-year average sales, seasonally adjusted. Despite mixed berries falling -18 percent this week, category prices are elevated above historical precedent. As the category leader, strawberries have pushed beyond $2.00 /pound FOB.

Rain, hail, and cold temperatures are keeping sensitive markets on edge and price relief for buyers at bay. Buyers should look for alternatives when they can and continue to wait patiently for mid-May when yields from Georgia and California are expected to pull down inflated prices.

Strawberries continue with strong demand, exceeding supply slowed by cool weather.

Cooler than usual weather in California is continuing to tighten cauliflower supply. Cauliflower markets are not simply feeling shaky after a brief fainting spell, market conditions are deteriorating into full-on cardiac arrest.

Naturally, buyers and growers are no strangers to price volatility and should recover their stride as more product becomes available with new harvests.

On the other hand, celery, lettuce and leaf are struggling to get off the floor.

From $7/box to $29/box in a matter of two weeks, cauliflower isn’t for the faint of heart. The descent is often quicker.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.