Canada’s COVID-19 experience has been different than the U.S., and that’s causing the Canadian consumer to act differently.

On the final day of CPMA’s BB #:153602 Fresh Week April 16, David Coletto, CEO and a founding partner of Abacus Data, a market research and strategy firm based in Ottawa and Toronto, said the pandemic isn’t so much fundamentally changing Canadian consumer trends, but it’s accelerating them.

Most of Canada is under a lockdown in April, as COVID-19 cases are rising, and that is causing higher anxiety among consumers, he said.

Because of the restrictions, consumers are shopping more for food in grocery stores and changing the way they interact with food and stores, Coletto said.

Online grocery shopping is the largest retail sector where people are buying more online than before the pandemic, he said.

Canadians are placing more importance on food and on healthy food, especially younger consumers.

He said 50 percent of Millennials say they consider themselves “foodies,” compared to 30 percent of all Canadians, and “foodies are good for fresh produce,” he said.

Additionally, 24 percent of Canadians agree that a plant-based diet is healthier than one that includes animal-based foods, Coletto said, and 30 percent tend to agree.

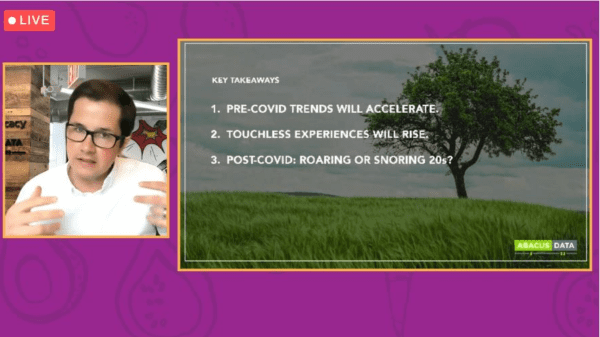

Looking at the future beyond the pandemic, Coletto said there are two schools of thought. One sees a roaring 20s of consumer spending and the other sees a snoring 20s of people more comfortable in their homes.

“COVID risk perception is still very high in Canada,” he said.

His survey found that 72 percent of Canadians say they will most likely continue cooking more often at home than before the pandemic.

“I think foodservice will come back, but it will take a while, and many operations will close,” Coletto said.

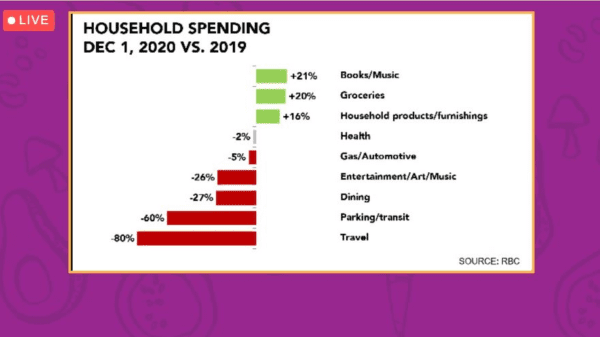

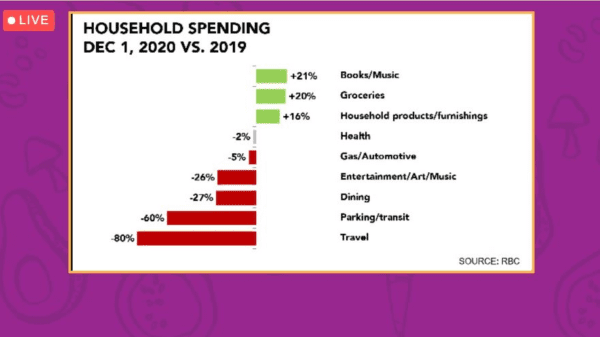

But consumers are saving money like never before. Stats show they’re spending more on things like books, music, groceries and household goods and furnishings than a year ago, while spending is dramatically down on travel, transportation, dining and entertainment.

For Canada to see a roaring 2020s, consumers will have to change considerably from how they’ve been living the past year.

Canada’s COVID-19 experience has been different than the U.S., and that’s causing the Canadian consumer to act differently.

On the final day of CPMA’s BB #:153602 Fresh Week April 16, David Coletto, CEO and a founding partner of Abacus Data, a market research and strategy firm based in Ottawa and Toronto, said the pandemic isn’t so much fundamentally changing Canadian consumer trends, but it’s accelerating them.

Most of Canada is under a lockdown in April, as COVID-19 cases are rising, and that is causing higher anxiety among consumers, he said.

Because of the restrictions, consumers are shopping more for food in grocery stores and changing the way they interact with food and stores, Coletto said.

Online grocery shopping is the largest retail sector where people are buying more online than before the pandemic, he said.

Canadians are placing more importance on food and on healthy food, especially younger consumers.

He said 50 percent of Millennials say they consider themselves “foodies,” compared to 30 percent of all Canadians, and “foodies are good for fresh produce,” he said.

Additionally, 24 percent of Canadians agree that a plant-based diet is healthier than one that includes animal-based foods, Coletto said, and 30 percent tend to agree.

Looking at the future beyond the pandemic, Coletto said there are two schools of thought. One sees a roaring 20s of consumer spending and the other sees a snoring 20s of people more comfortable in their homes.

“COVID risk perception is still very high in Canada,” he said.

His survey found that 72 percent of Canadians say they will most likely continue cooking more often at home than before the pandemic.

“I think foodservice will come back, but it will take a while, and many operations will close,” Coletto said.

But consumers are saving money like never before. Stats show they’re spending more on things like books, music, groceries and household goods and furnishings than a year ago, while spending is dramatically down on travel, transportation, dining and entertainment.

For Canada to see a roaring 2020s, consumers will have to change considerably from how they’ve been living the past year.

Greg Johnson is Director of Media Development for Blue Book Services and enjoys Canadian whisky