SAN FRANCISCO, April 6, 2021 /PRNewswire/ — Instacart, the leading online grocery platform in North America, today released “Beyond the Cart: A Year of Essential Insights,” a new report highlighting how the pandemic has transformed 100 years of grocery habits through the lens of six trends from the past year that are shaping the future of online grocery shopping.

The report combines an in-depth look at data from Instacart along with insights from a new Instacart survey of 2,038 U.S. adults conducted recently online by The Harris Poll.

“More than a year of pandemic living has dramatically reshaped how American households shop for groceries and other household essentials,” said Laurentia Romaniuk, Instacart’s Trends Expert and Senior Product Manager.

“As we analyzed twelve months of data from Instacart, we discovered that the pandemic has driven seismic demographic shifts in who is using online grocery, altered daily and weekly shopping rhythms, set off a wave of customer gratitude for the Instacart shopper community, and more. As the world inches toward normality, it appears that many of the new habits formed in the midst of the pandemic may actually be driving a permanent shift in how consumers shop.”

In the report, Instacart analysts looked to search, purchase and in-app chat data to gauge the national mood and understand how familial relationships, internal clocks, household domestic roles, shopping schedules, and shopping lists are shifting as the world inches toward post-pandemic life. The report explores six notable themes:

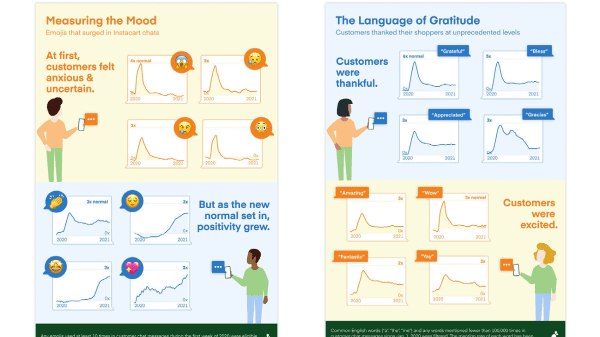

1) HOW WE FELT: MEASURING THE NATIONAL MOOD WITH GROCERY CHAT & EMOJIS

In early spring 2020, consumers grappled with the unknown, and a sense of uncertainty was palpable as customers chatted with Instacart shoppers via in-app and text chat. As customers and shoppers texted about adding last-minute items to orders, how to replace out of stock items, and more, we observed signals for how consumers were feeling:

In March, text chat volume between customers and their Instacart shoppers increased by 50%.

At first, the “scream” emoji experienced the largest upswing in chat usage, ballooning to four times its normal usage.

But as the new normal set in, positivity grew and Instacart saw a 300% upswing in the clapping hands, contented face and starry eyed emojis, a trend that continues today.

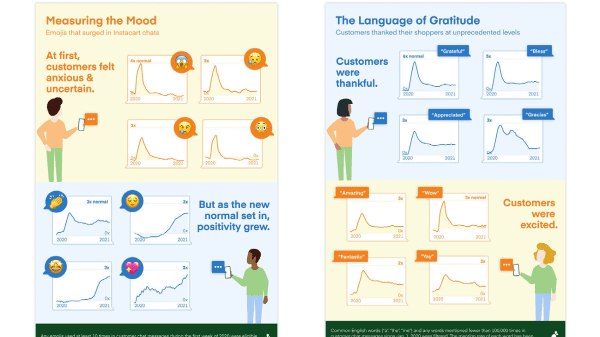

Across the United States, Instacart saw a 13% bump in the use of the phrase “thanks” in customer-shopper chat, with MT, ID, WA, OR, CO, NM, MN, MO and PA expressing thanks the most frequently.

2) WELCOME TO THE PANDEMIC TIME WARP

As the months marched on, homebound consumers began to search online early for seasonal comforts. Also, holiday-related searches in 2020 greatly outpaced 2019 numbers:

According to the Harris Poll survey data, nearly half of Americans (49%) said they had begun planning for the holidays earlier in 2020 than they had in years past.

Year-over-year searches for “Christmas,” “Christmas sprinkles,” and “Christmas decor” grew by 745%, 236%, and 622%, respectively.

Instacart searches for comforting fall favorite “pumpkin spice” started to spike as early as March 16, 2020, a whopping 15 weeks sooner than the seasonal spikes of 2019 and 2018.

3) SHIFTING DOMESTIC NORMS: A SENIOR SURGE & HELP FOR THE HOUSEHOLD CEO

Instacart insights indicate that the profile of the online grocery consumer has changed dramatically in the past year:

According to the Harris Poll survey data, nearly 3 in 4 Americans who were the primary grocery shopper for their household before the COVID-19 pandemic (74%) report that someone in their household has taken on additional grocery shopping responsibilities since the start of the pandemic.

Between the first and fourth quarter of 2020, Instacart saw a 9% increase in the number of seniors using Instacart — the largest jump within any age group.

To-date, nearly 300,000 seniors have learned how to use Instacart with the help of Instacart’s dedicated Senior Support Service.

4) WHEN WE SHOP: MID-WEEK MULTITASKING CHALLENGES THE SUNDAY SHOP

Instacart data indicates that the weekly 90-minute Sunday shop may be loosening its grip on weekend routines:

The share of orders placed on weekdays grew by 8% platform-wide last year.

Instacart orders placed during local working hours (9 a.m. to 5 p.m.) increased by 32% in 2020.

Early 2021 analysis shows us that while some consumers have returned to their weekend ordering habits, a meaningful portion of others are holding onto their new midweek routine.

5) WHAT WE ARE (AND AREN’T) BUYING: THE PANDEMIC PERSONAS WE EMBRACED

As the leading online grocery platform in North America, Instacart has a unique view of the aisles and product categories that customers gravitated towards while they stayed home. Over the past year, Instacart observed four unmissable customer buying personas emerge:

Locked Down & Lovelorn: At the start of the pandemic, Instacart observed a notable plunge across the sexual and reproductive health categories. Sales for many sexual health-related items including pregnancy tests (-9%), ovulation tests (-16%), and condoms (-11%) dipped as lives were thrown into limbo and social distancing rules became the norm.

Springtime Stockpilers: These consumers clipped coupons and bought household essentials like toilet paper, hand sanitizers, Lysol, PineSol, Clorox, and batteries to keep their germ-busting survival stores stocked. Keeping hand sanitizers, hand soap, or disinfectant wipes on hand (51%) tops the list of grocery habits adopted during the COVID-19 pandemic that Americans plan to keep for the long term.

Modern Day Homesteaders: These trend-setting homebodies searched for baking supplies like flour (up 4x) and yeast (up 10x) to feed their sourdough starters. When they weren’t in the kitchen, Homesteaders bought backyard essentials like charcoal (up 4x) and grill fuels (up 2x).

Locked-Down Lushes: these consumers imbibed while stuck indoors. The years fastest growing alcoholic beverage category proved to pre-mixed cocktails—year-over-year sales grew by 127%. Sales for specialty beers and spiked seltzers grew by 96% and 131% respectively year-over-year, while the hard liquor of choice proved to be gin, which grew by 21% year-over-year.

6) POST-PANDEMIC: THE FUTURE OF GROCERY IS FAST

According to the Harris Poll data of those who bought groceries online during the pandemic, 77% indicated they are likely to continue doing so in the future. While consumer shopping habits will continue to evolve post-pandemic, living through more than a year of distanced living, new habits and cultural norms have forever changed how many of us shop. Instacart predicts that the future of online grocery will be defined by several enduring themes:

Speed and convenience: In an Instacart experiment, when presented with a slate of delivery options including 2-hour or less delivery, 5-hour delivery, and other scheduled options throughout the day, an overwhelming 85% of customers opt for delivery in 2-hours or less. In 2020, 95% of small orders were delivered in under two hours and 50% of them were delivered in under one hour.

Added accessibility: Post-pandemic, Instacart anticipates that the profile of the online grocery delivery customer will continue expanding to younger and older customers. Even today, Instacart continues to see a steady rise in seniors coming online via the company’s Senior Support Service, which has been growing by about 1,000 senior customers daily.

A personal touch: Instacart expects to see a sustained boost in shopper-customer chat, now that customers have spent a year communicating directly with their shopper more often. Ongoing, elevated use of phrases and emojis that communicate gratitude suggest customers will retain a deeper sense of appreciation for Instacart shoppers.

Whether customers opt for 2-hours or less delivery, curbside pickup, or periodic trips to the store, the future of online grocery post-pandemic will be about swiftly adapting to meet consumers’ expectations and deepening the role online grocery plays in their weekly routines.

For more on the “Beyond the Cart: A Year of Essential Insights” report including data visualizations and full methodology.

About Instacart

Instacart is the leading online grocery platform in North America. Instacart shoppers offer same-day delivery and pickup services to bring fresh groceries and everyday essentials to busy people and families across the U.S. and Canada. Instacart has partnered with nearly 600 beloved national, regional and local retailers, including unique brand names, to deliver from more than 45,000 stores across more than 5,500 cities in North America. Instacart’s delivery service is available to over 85% of U.S. households and 70% of Canadian households. The company’s cutting-edge enterprise technology also powers the ecommerce platforms of some of the world’s biggest retail players, supporting their white-label websites, applications and delivery solutions. Instacart offers an Instacart Express membership that includes reduced service fees and unlimited free delivery on orders over $35. For more information, visit www.instacart.com. For anyone interested in becoming an Instacart shopper, visit https://shoppers.instacart.com/.

CONTACT: press@instacart.com

SOURCE Instacart

SAN FRANCISCO, April 6, 2021 /PRNewswire/ — Instacart, the leading online grocery platform in North America, today released “Beyond the Cart: A Year of Essential Insights,” a new report highlighting how the pandemic has transformed 100 years of grocery habits through the lens of six trends from the past year that are shaping the future of online grocery shopping.

The report combines an in-depth look at data from Instacart along with insights from a new Instacart survey of 2,038 U.S. adults conducted recently online by The Harris Poll.

“More than a year of pandemic living has dramatically reshaped how American households shop for groceries and other household essentials,” said Laurentia Romaniuk, Instacart’s Trends Expert and Senior Product Manager.

“As we analyzed twelve months of data from Instacart, we discovered that the pandemic has driven seismic demographic shifts in who is using online grocery, altered daily and weekly shopping rhythms, set off a wave of customer gratitude for the Instacart shopper community, and more. As the world inches toward normality, it appears that many of the new habits formed in the midst of the pandemic may actually be driving a permanent shift in how consumers shop.”

In the report, Instacart analysts looked to search, purchase and in-app chat data to gauge the national mood and understand how familial relationships, internal clocks, household domestic roles, shopping schedules, and shopping lists are shifting as the world inches toward post-pandemic life. The report explores six notable themes:

1) HOW WE FELT: MEASURING THE NATIONAL MOOD WITH GROCERY CHAT & EMOJIS

In early spring 2020, consumers grappled with the unknown, and a sense of uncertainty was palpable as customers chatted with Instacart shoppers via in-app and text chat. As customers and shoppers texted about adding last-minute items to orders, how to replace out of stock items, and more, we observed signals for how consumers were feeling:

In March, text chat volume between customers and their Instacart shoppers increased by 50%.

At first, the “scream” emoji experienced the largest upswing in chat usage, ballooning to four times its normal usage.

But as the new normal set in, positivity grew and Instacart saw a 300% upswing in the clapping hands, contented face and starry eyed emojis, a trend that continues today.

Across the United States, Instacart saw a 13% bump in the use of the phrase “thanks” in customer-shopper chat, with MT, ID, WA, OR, CO, NM, MN, MO and PA expressing thanks the most frequently.

2) WELCOME TO THE PANDEMIC TIME WARP

As the months marched on, homebound consumers began to search online early for seasonal comforts. Also, holiday-related searches in 2020 greatly outpaced 2019 numbers:

According to the Harris Poll survey data, nearly half of Americans (49%) said they had begun planning for the holidays earlier in 2020 than they had in years past.

Year-over-year searches for “Christmas,” “Christmas sprinkles,” and “Christmas decor” grew by 745%, 236%, and 622%, respectively.

Instacart searches for comforting fall favorite “pumpkin spice” started to spike as early as March 16, 2020, a whopping 15 weeks sooner than the seasonal spikes of 2019 and 2018.

3) SHIFTING DOMESTIC NORMS: A SENIOR SURGE & HELP FOR THE HOUSEHOLD CEO

Instacart insights indicate that the profile of the online grocery consumer has changed dramatically in the past year:

According to the Harris Poll survey data, nearly 3 in 4 Americans who were the primary grocery shopper for their household before the COVID-19 pandemic (74%) report that someone in their household has taken on additional grocery shopping responsibilities since the start of the pandemic.

Between the first and fourth quarter of 2020, Instacart saw a 9% increase in the number of seniors using Instacart — the largest jump within any age group.

To-date, nearly 300,000 seniors have learned how to use Instacart with the help of Instacart’s dedicated Senior Support Service.

4) WHEN WE SHOP: MID-WEEK MULTITASKING CHALLENGES THE SUNDAY SHOP

Instacart data indicates that the weekly 90-minute Sunday shop may be loosening its grip on weekend routines:

The share of orders placed on weekdays grew by 8% platform-wide last year.

Instacart orders placed during local working hours (9 a.m. to 5 p.m.) increased by 32% in 2020.

Early 2021 analysis shows us that while some consumers have returned to their weekend ordering habits, a meaningful portion of others are holding onto their new midweek routine.

5) WHAT WE ARE (AND AREN’T) BUYING: THE PANDEMIC PERSONAS WE EMBRACED

As the leading online grocery platform in North America, Instacart has a unique view of the aisles and product categories that customers gravitated towards while they stayed home. Over the past year, Instacart observed four unmissable customer buying personas emerge:

Locked Down & Lovelorn: At the start of the pandemic, Instacart observed a notable plunge across the sexual and reproductive health categories. Sales for many sexual health-related items including pregnancy tests (-9%), ovulation tests (-16%), and condoms (-11%) dipped as lives were thrown into limbo and social distancing rules became the norm.

Springtime Stockpilers: These consumers clipped coupons and bought household essentials like toilet paper, hand sanitizers, Lysol, PineSol, Clorox, and batteries to keep their germ-busting survival stores stocked. Keeping hand sanitizers, hand soap, or disinfectant wipes on hand (51%) tops the list of grocery habits adopted during the COVID-19 pandemic that Americans plan to keep for the long term.

Modern Day Homesteaders: These trend-setting homebodies searched for baking supplies like flour (up 4x) and yeast (up 10x) to feed their sourdough starters. When they weren’t in the kitchen, Homesteaders bought backyard essentials like charcoal (up 4x) and grill fuels (up 2x).

Locked-Down Lushes: these consumers imbibed while stuck indoors. The years fastest growing alcoholic beverage category proved to pre-mixed cocktails—year-over-year sales grew by 127%. Sales for specialty beers and spiked seltzers grew by 96% and 131% respectively year-over-year, while the hard liquor of choice proved to be gin, which grew by 21% year-over-year.

6) POST-PANDEMIC: THE FUTURE OF GROCERY IS FAST

According to the Harris Poll data of those who bought groceries online during the pandemic, 77% indicated they are likely to continue doing so in the future. While consumer shopping habits will continue to evolve post-pandemic, living through more than a year of distanced living, new habits and cultural norms have forever changed how many of us shop. Instacart predicts that the future of online grocery will be defined by several enduring themes:

Speed and convenience: In an Instacart experiment, when presented with a slate of delivery options including 2-hour or less delivery, 5-hour delivery, and other scheduled options throughout the day, an overwhelming 85% of customers opt for delivery in 2-hours or less. In 2020, 95% of small orders were delivered in under two hours and 50% of them were delivered in under one hour.

Added accessibility: Post-pandemic, Instacart anticipates that the profile of the online grocery delivery customer will continue expanding to younger and older customers. Even today, Instacart continues to see a steady rise in seniors coming online via the company’s Senior Support Service, which has been growing by about 1,000 senior customers daily.

A personal touch: Instacart expects to see a sustained boost in shopper-customer chat, now that customers have spent a year communicating directly with their shopper more often. Ongoing, elevated use of phrases and emojis that communicate gratitude suggest customers will retain a deeper sense of appreciation for Instacart shoppers.

Whether customers opt for 2-hours or less delivery, curbside pickup, or periodic trips to the store, the future of online grocery post-pandemic will be about swiftly adapting to meet consumers’ expectations and deepening the role online grocery plays in their weekly routines.

For more on the “Beyond the Cart: A Year of Essential Insights” report including data visualizations and full methodology.

About Instacart

Instacart is the leading online grocery platform in North America. Instacart shoppers offer same-day delivery and pickup services to bring fresh groceries and everyday essentials to busy people and families across the U.S. and Canada. Instacart has partnered with nearly 600 beloved national, regional and local retailers, including unique brand names, to deliver from more than 45,000 stores across more than 5,500 cities in North America. Instacart’s delivery service is available to over 85% of U.S. households and 70% of Canadian households. The company’s cutting-edge enterprise technology also powers the ecommerce platforms of some of the world’s biggest retail players, supporting their white-label websites, applications and delivery solutions. Instacart offers an Instacart Express membership that includes reduced service fees and unlimited free delivery on orders over $35. For more information, visit www.instacart.com. For anyone interested in becoming an Instacart shopper, visit https://shoppers.instacart.com/.

CONTACT: press@instacart.com

SOURCE Instacart