The theme for the Southeast Produce Council’s Southern Exposure event this week, “The rise of produce,” captures the current state of produce markets wonderfully.

Prices are anticipating the return of normal demand, increasing for a 4th consecutive week. Overall industry prices are at record highs for this week #13.

Don’t be dismayed if you’re a buyer on the hunt for a deal. Although overall markets are up, there are treasured little eggs to find for everyone’s basket this week. Transitions to new supply are creating promotable pricing on more than one commodity in the ProduceIQ Index.

ProduceIQ Index: $1.09 /pound, +1.9 percent over prior week

Week #13, ending April 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

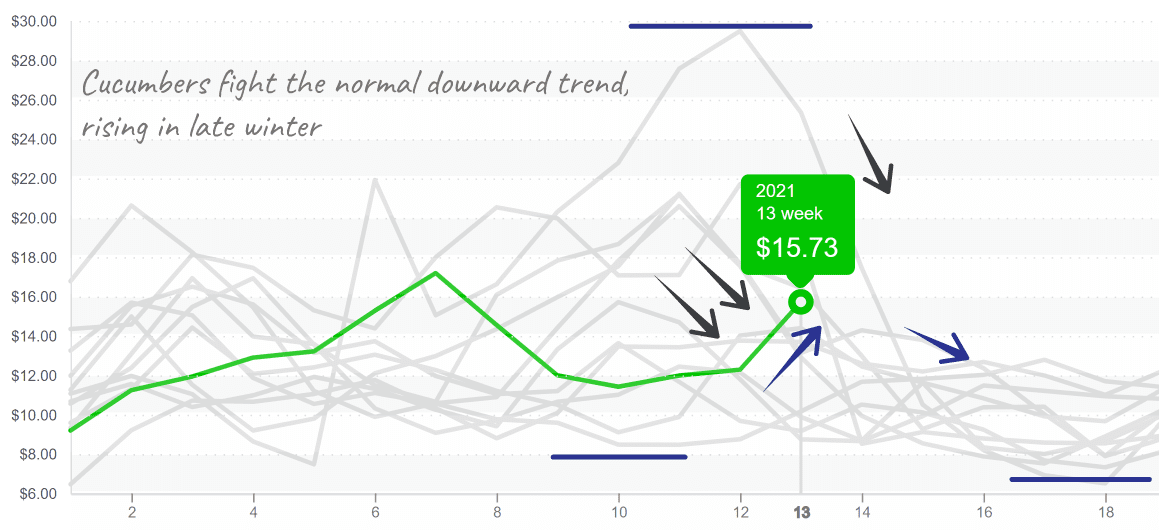

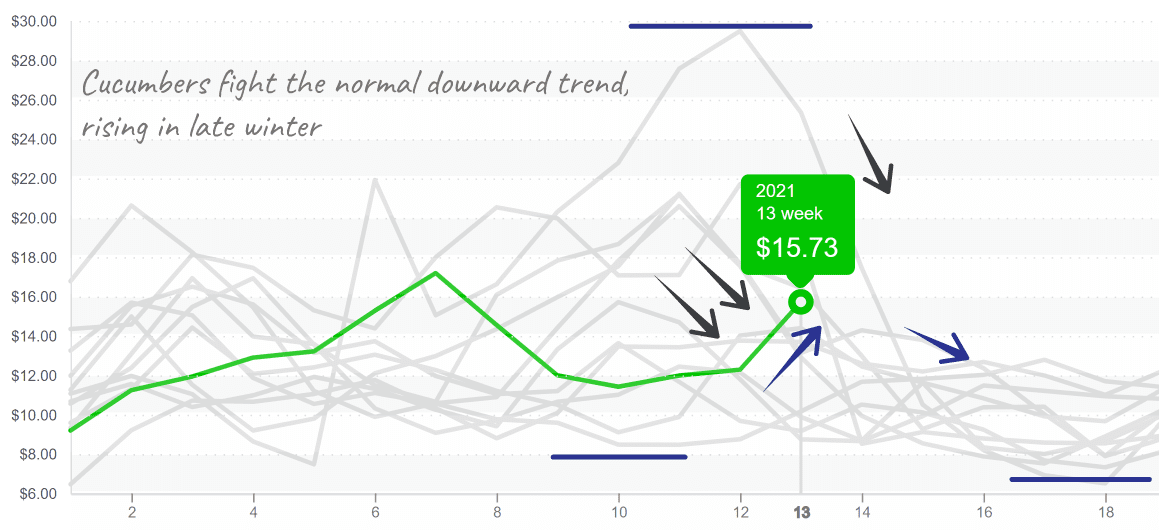

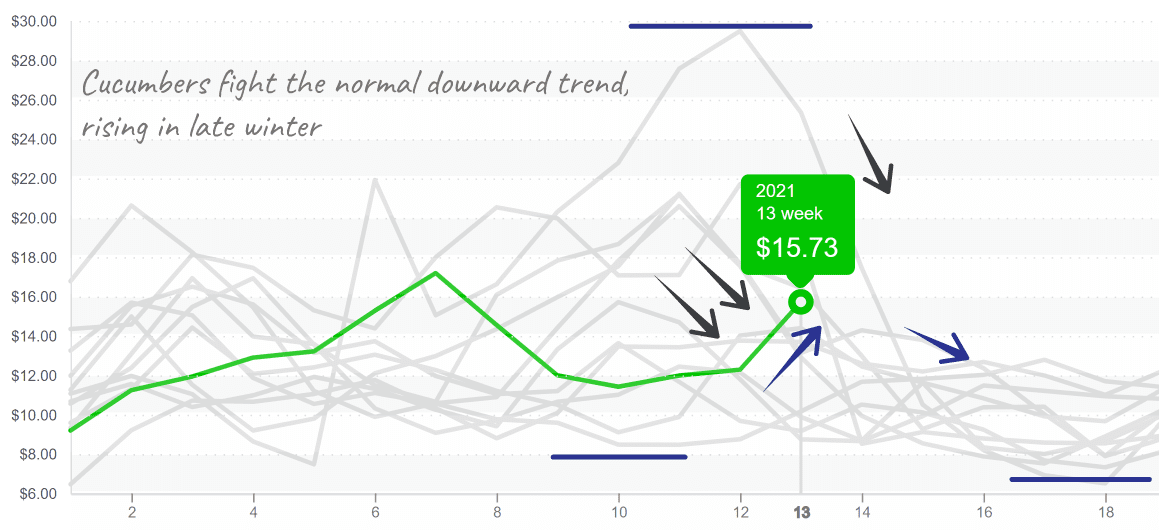

Up 23 percent, cucumbers are gapping in both East and West Coast. In Florida, a few fields finally crown after the East Coast endured declining quality from Honduras. Mid-winter cucumber prices slumped since mid-February.

A short window of decent prices exists before Mexico’s northern region, Sonora, increases volume. Supply movement will accelerate within the next few weeks.

Cucumbers valiantly press for increased pricing during early spring.

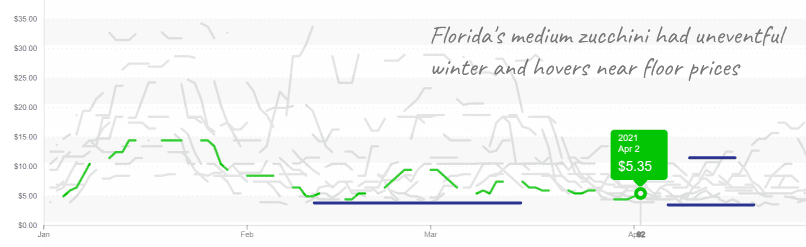

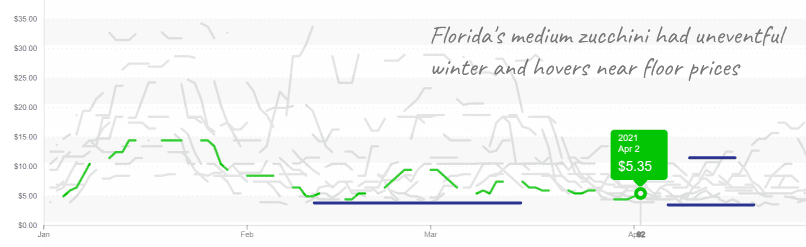

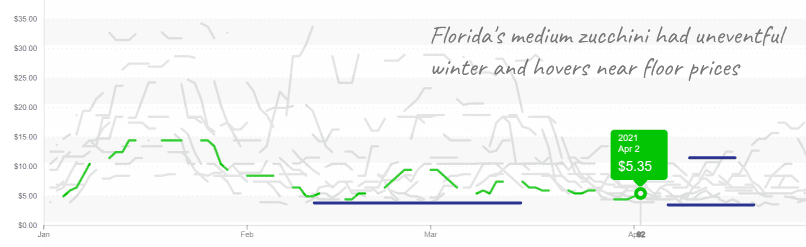

Squash, on the other hand, has an inequity of excess supply, causing prices to fall -21 percent. Quality is good, especially on squash coming out of Florida. Quantities are promotable on both yellow squash and zucchini.

Squash prices remain low for 8 weeks.

Low supply and increasing demand upped the price of strawberries, 10 percent. Mexico and Florida’s growing season is nearly finished, California is the only domestic producer left, leaving supply tight and prices high, over $15/case. Demand, prior to Easter weekend, pushed prices further.

Celery is up slightly, 8 percent. Yuma’s harvest is fizzling out and season is transitioning to the Oxnard/Santa Maria growing region. Quality remains strong and promotable pricing is available on larger volumes.

Lettuce, specifically iceberg, fell –20 percent to under $9/case after a short run at higher prices. Iceberg pricing has been uneventful this winter. Ideal growing conditions are creating ample supply of high-quality lettuce, great news if you are looking for a buy.

Quality remains strong and supply improved, somewhat unexpectedly, on grape tomatoes. Although grape tomato prices fell significantly this week, -39 percent, prices are not unusual for this time of year.

Grape tomatoes descend with historical norms.

Please visit our online marketplace and gain access to our free online tools.

Hope to see you at SEPC’s Southern Exposure. May the produce force be with you!

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

The theme for the Southeast Produce Council’s Southern Exposure event this week, “The rise of produce,” captures the current state of produce markets wonderfully.

Prices are anticipating the return of normal demand, increasing for a 4th consecutive week. Overall industry prices are at record highs for this week #13.

Don’t be dismayed if you’re a buyer on the hunt for a deal. Although overall markets are up, there are treasured little eggs to find for everyone’s basket this week. Transitions to new supply are creating promotable pricing on more than one commodity in the ProduceIQ Index.

ProduceIQ Index: $1.09 /pound, +1.9 percent over prior week

Week #13, ending April 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Up 23 percent, cucumbers are gapping in both East and West Coast. In Florida, a few fields finally crown after the East Coast endured declining quality from Honduras. Mid-winter cucumber prices slumped since mid-February.

A short window of decent prices exists before Mexico’s northern region, Sonora, increases volume. Supply movement will accelerate within the next few weeks.

Cucumbers valiantly press for increased pricing during early spring.

Squash, on the other hand, has an inequity of excess supply, causing prices to fall -21 percent. Quality is good, especially on squash coming out of Florida. Quantities are promotable on both yellow squash and zucchini.

Squash prices remain low for 8 weeks.

Low supply and increasing demand upped the price of strawberries, 10 percent. Mexico and Florida’s growing season is nearly finished, California is the only domestic producer left, leaving supply tight and prices high, over $15/case. Demand, prior to Easter weekend, pushed prices further.

Celery is up slightly, 8 percent. Yuma’s harvest is fizzling out and season is transitioning to the Oxnard/Santa Maria growing region. Quality remains strong and promotable pricing is available on larger volumes.

Lettuce, specifically iceberg, fell –20 percent to under $9/case after a short run at higher prices. Iceberg pricing has been uneventful this winter. Ideal growing conditions are creating ample supply of high-quality lettuce, great news if you are looking for a buy.

Quality remains strong and supply improved, somewhat unexpectedly, on grape tomatoes. Although grape tomato prices fell significantly this week, -39 percent, prices are not unusual for this time of year.

Grape tomatoes descend with historical norms.

Please visit our online marketplace and gain access to our free online tools.

Hope to see you at SEPC’s Southern Exposure. May the produce force be with you!

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.