Overall market prices are lower on most commodities.

Both supply and demand are less than in recent years, causing prices to plateau in the mid-range.

Market prices will strengthen if foodservice in major metropolitan markets recover from restrictions and regain patrons.

ProduceIQ Index: $0.95 /pound, -4.0 percent over prior week

(Week #3, ending January 22nd)

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

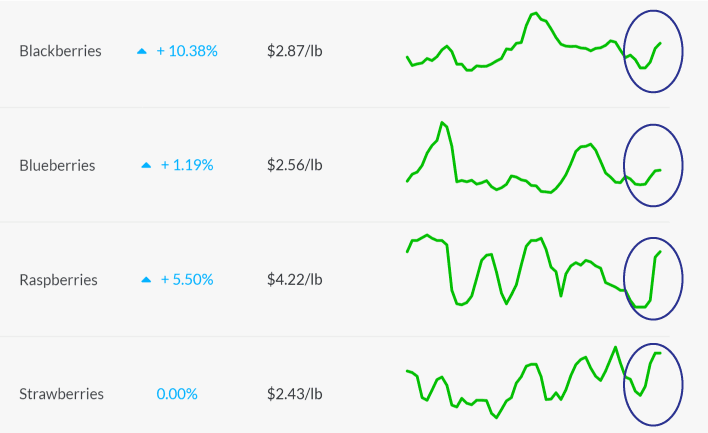

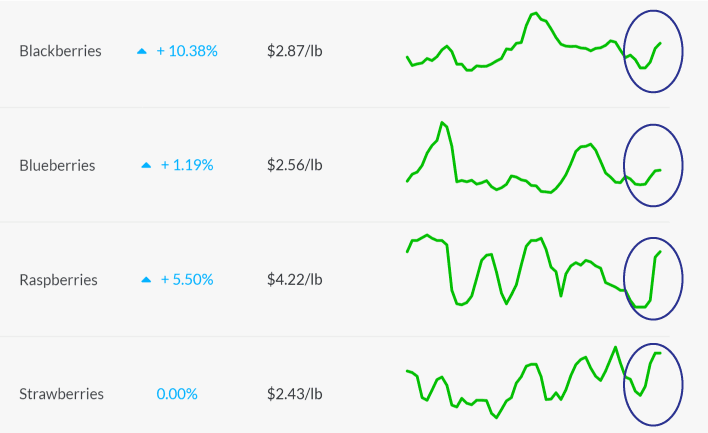

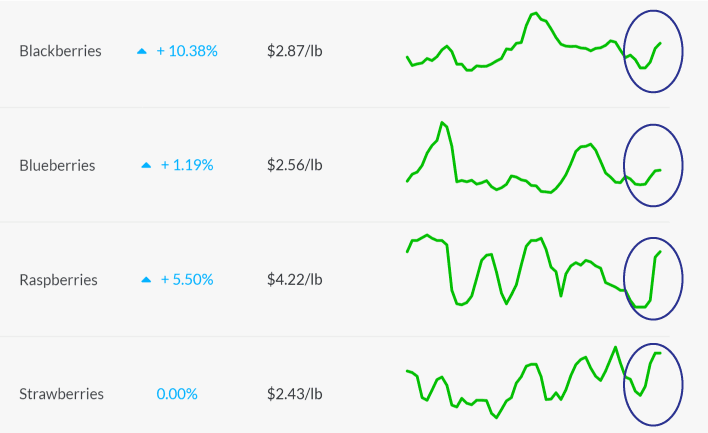

Berries are the primary exception to current industry trends. Although cold weather and labor shortages have impaired supply, retail is driving demand, causing price strength that is now leveling off. Anticipate markets to remain elevated through Valentine’s Day.

Berries enjoying high prices from cold temps. Yields are lower in primary growing regions.

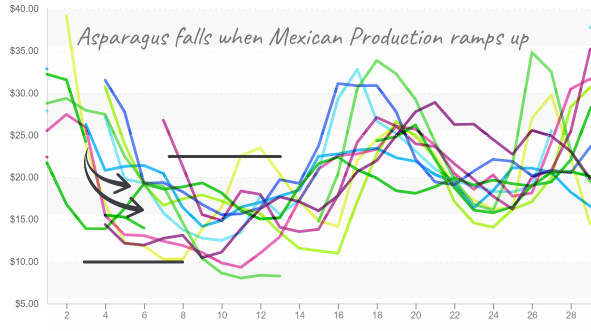

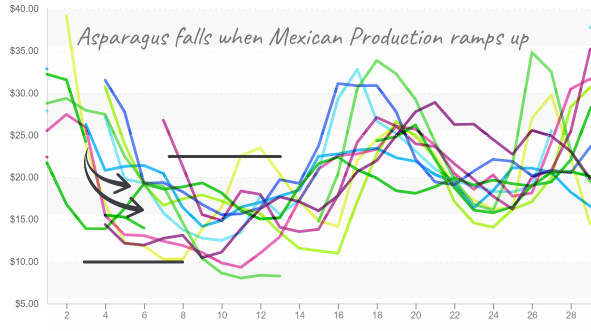

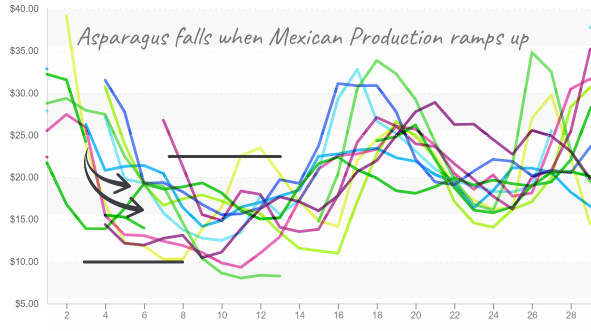

Increased supply from Caborca, Mexico and steady supply from Peru is forcing asparagus to fall quickly, -24 percent from last week. Pricing patterns are directionally predictable this time of year. As expected, prices move inverse to the increased Mexican supply.

Asparagus follows a seasonal pattern of descent.

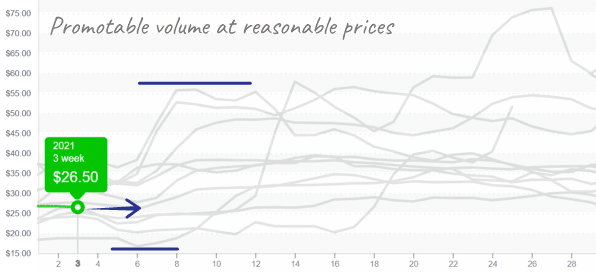

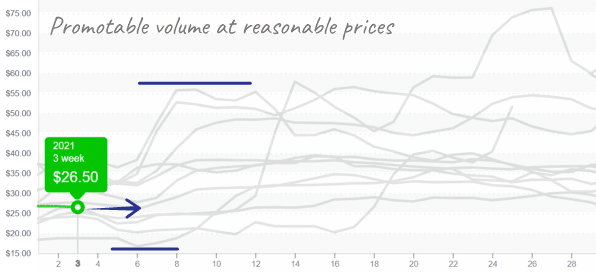

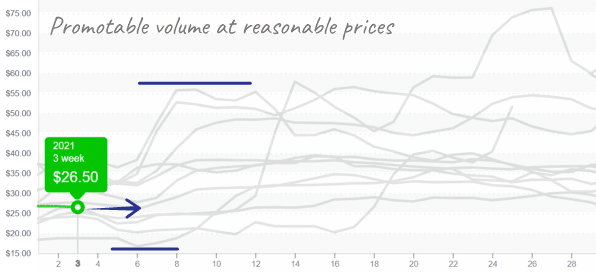

Not every variety of apple is priced for perfection. Relative to its trading range, Fuji is modestly priced and provides reliable volume. Though the overall supply of apples is lower this year, promotion of value-priced varieties is advantageous.

Fuji apple variety stay between the lines with modest pricing.

Melon supply, dominantly from Honduras, is struggling due to late-season hurricanes. Dramatic reductions in yield are causing the limited existing supply to primarily cover contracts. Spot market prices are high and volatile.

Honeydew prices dropped -16 percent as volume form Mexico began crossing into U.S. markets.

Avocado’s low prices are encouraging higher movement leading up to the big game, Super Bowl LV. Rumor has it that Mexican growers are experiencing a bumper crop and will harvest sufficient fruit to promote in the upcoming weeks.

Mexico is prepared to import significant volume of avocados leading to the Super Bowl.

Check out the ProduceIQ Marketplace here. Let us know at mark@produceiq.com if you have any feedback regarding these articles.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Overall market prices are lower on most commodities.

Both supply and demand are less than in recent years, causing prices to plateau in the mid-range.

Market prices will strengthen if foodservice in major metropolitan markets recover from restrictions and regain patrons.

ProduceIQ Index: $0.95 /pound, -4.0 percent over prior week

(Week #3, ending January 22nd)

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Berries are the primary exception to current industry trends. Although cold weather and labor shortages have impaired supply, retail is driving demand, causing price strength that is now leveling off. Anticipate markets to remain elevated through Valentine’s Day.

Berries enjoying high prices from cold temps. Yields are lower in primary growing regions.

Increased supply from Caborca, Mexico and steady supply from Peru is forcing asparagus to fall quickly, -24 percent from last week. Pricing patterns are directionally predictable this time of year. As expected, prices move inverse to the increased Mexican supply.

Asparagus follows a seasonal pattern of descent.

Not every variety of apple is priced for perfection. Relative to its trading range, Fuji is modestly priced and provides reliable volume. Though the overall supply of apples is lower this year, promotion of value-priced varieties is advantageous.

Fuji apple variety stay between the lines with modest pricing.

Melon supply, dominantly from Honduras, is struggling due to late-season hurricanes. Dramatic reductions in yield are causing the limited existing supply to primarily cover contracts. Spot market prices are high and volatile.

Honeydew prices dropped -16 percent as volume form Mexico began crossing into U.S. markets.

Avocado’s low prices are encouraging higher movement leading up to the big game, Super Bowl LV. Rumor has it that Mexican growers are experiencing a bumper crop and will harvest sufficient fruit to promote in the upcoming weeks.

Mexico is prepared to import significant volume of avocados leading to the Super Bowl.

Check out the ProduceIQ Marketplace here. Let us know at mark@produceiq.com if you have any feedback regarding these articles.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.