We’ve seen big gains for produce prices to start 2021.

Customers that didn’t build inventory going into the holidays now need to replenish quickly. In a regular year, produce markets typically fall the first week of January.

On average, the ProduceIQ Index declines -2.8 percent. However, this year hadn’t realized the normal holiday price increases, and so prices this past week rose decisively across multiple categories.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.00 /pound, +6.4 percent over prior week

(Week #1, ending January 8th)

Twenty-nine of the 40 commodities included in the ProduceIQ Index had price increases. Categories with unanimous gains included dry vegetables, lettuce/leaf, tropical fruit, and grapes/berries.

With seven often-divergent commodities, dry vegetables had a heroic week increasing 33 percent. Of course, squash, which led the gains, is coming off historic lows and needs further increases to achieve modest prices relative to production costs.

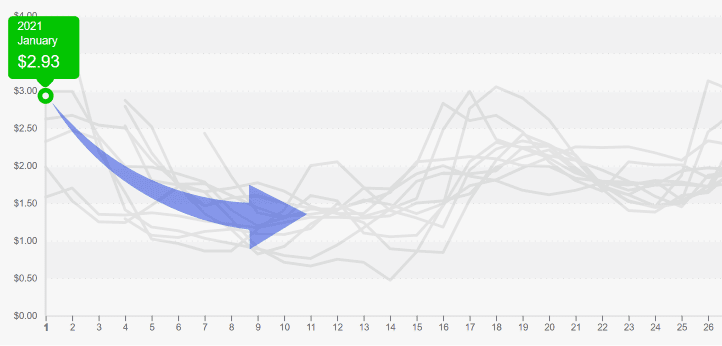

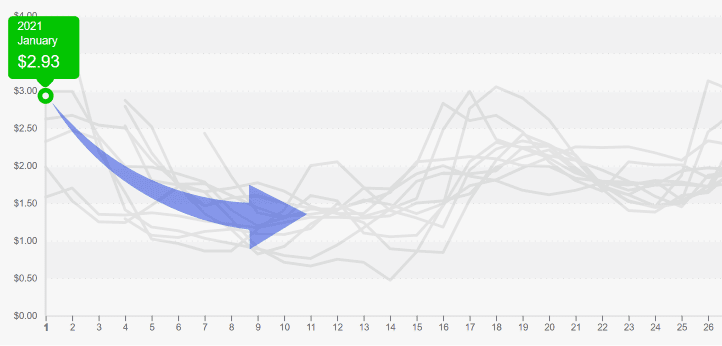

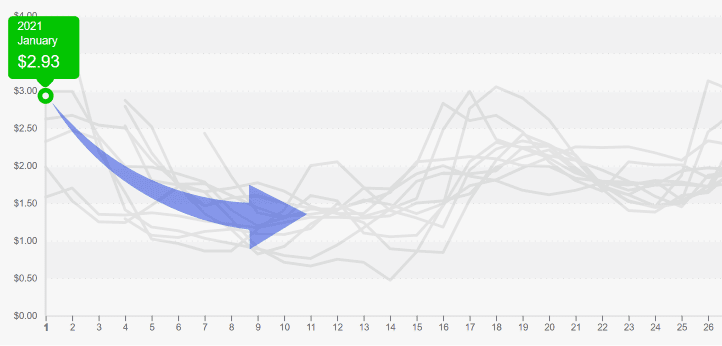

Asparagus more than doubled in two weeks, from $1.40 to $2.93 per pound. Asparagus is relying on Peru until Caborca, Mexico ramps up supply near the end of January. Anticipate prices to hold until Mexican supply increases.

Asparagus enjoying high prices until Mexican production increases in later January.

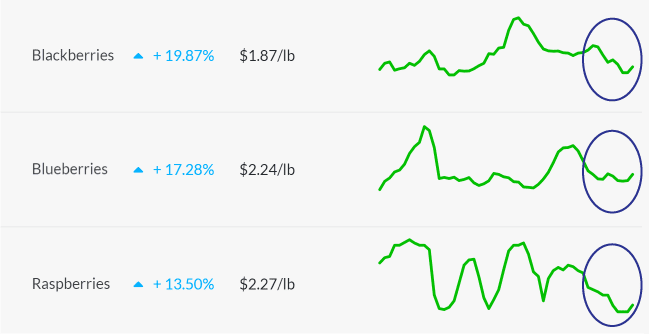

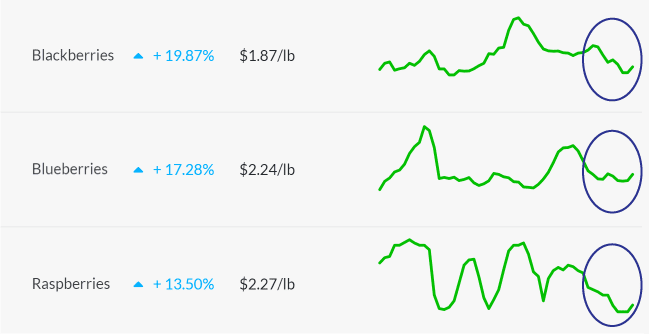

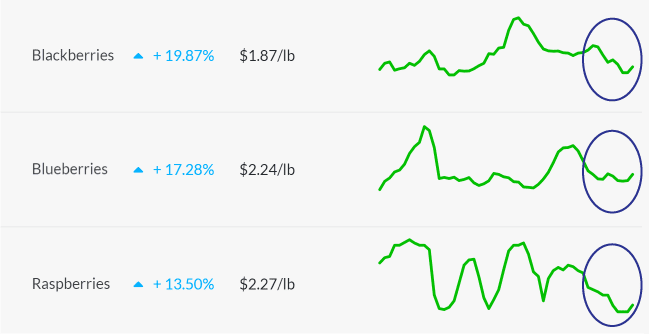

Colder weather in Mexico, California, and Florida is slowing production for all types of berries. The big four (strawberries, blackberries, blueberries and raspberries) realized price gains from 13 to 40 percent.

Strawberries led the category, increasing to $2.15/pound, and is expected to have an active market through January. The other three “bush berries” are all bounding off their trading floor prices.

All bush berries bounced off floor level prices and are trending up with the slowdown in Mexican supply.

Tomatoes are this year’s outlier. After enjoying high prices through the holiday, they are following the normal post-New Year drop in price. Though Florida is feeling cold, which should keep supply low enough for the generally high markets to hold until Mexico is in full production.

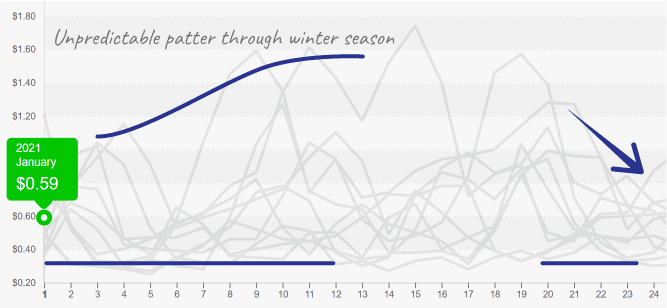

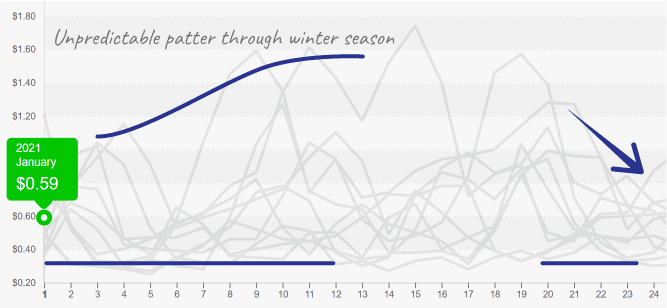

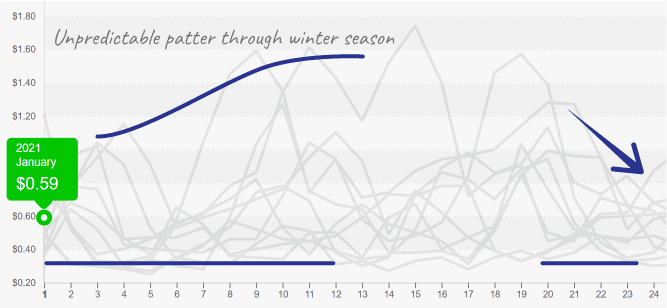

Cauliflower supplies increased in Yuma, dropping prices -42 percent, moving closer to historical norms. In reality, cauliflower prices through winter have no normal. Prices have ranged from $0.30 to $1.60 per pound for this time of year with no clear pattern until the end of May.

For an additional channel to market and procure your produce, check out the ProduceIQ Marketplace here. We seek feedback regarding these articles and any produce topic at mark@produceiq.com.

Cheers to a healthy produce industry in the new year!

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

We’ve seen big gains for produce prices to start 2021.

Customers that didn’t build inventory going into the holidays now need to replenish quickly. In a regular year, produce markets typically fall the first week of January.

On average, the ProduceIQ Index declines -2.8 percent. However, this year hadn’t realized the normal holiday price increases, and so prices this past week rose decisively across multiple categories.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.00 /pound, +6.4 percent over prior week

(Week #1, ending January 8th)

Twenty-nine of the 40 commodities included in the ProduceIQ Index had price increases. Categories with unanimous gains included dry vegetables, lettuce/leaf, tropical fruit, and grapes/berries.

With seven often-divergent commodities, dry vegetables had a heroic week increasing 33 percent. Of course, squash, which led the gains, is coming off historic lows and needs further increases to achieve modest prices relative to production costs.

Asparagus more than doubled in two weeks, from $1.40 to $2.93 per pound. Asparagus is relying on Peru until Caborca, Mexico ramps up supply near the end of January. Anticipate prices to hold until Mexican supply increases.

Asparagus enjoying high prices until Mexican production increases in later January.

Colder weather in Mexico, California, and Florida is slowing production for all types of berries. The big four (strawberries, blackberries, blueberries and raspberries) realized price gains from 13 to 40 percent.

Strawberries led the category, increasing to $2.15/pound, and is expected to have an active market through January. The other three “bush berries” are all bounding off their trading floor prices.

All bush berries bounced off floor level prices and are trending up with the slowdown in Mexican supply.

Tomatoes are this year’s outlier. After enjoying high prices through the holiday, they are following the normal post-New Year drop in price. Though Florida is feeling cold, which should keep supply low enough for the generally high markets to hold until Mexico is in full production.

Cauliflower supplies increased in Yuma, dropping prices -42 percent, moving closer to historical norms. In reality, cauliflower prices through winter have no normal. Prices have ranged from $0.30 to $1.60 per pound for this time of year with no clear pattern until the end of May.

For an additional channel to market and procure your produce, check out the ProduceIQ Marketplace here. We seek feedback regarding these articles and any produce topic at mark@produceiq.com.

Cheers to a healthy produce industry in the new year!

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

produceiq.com

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.