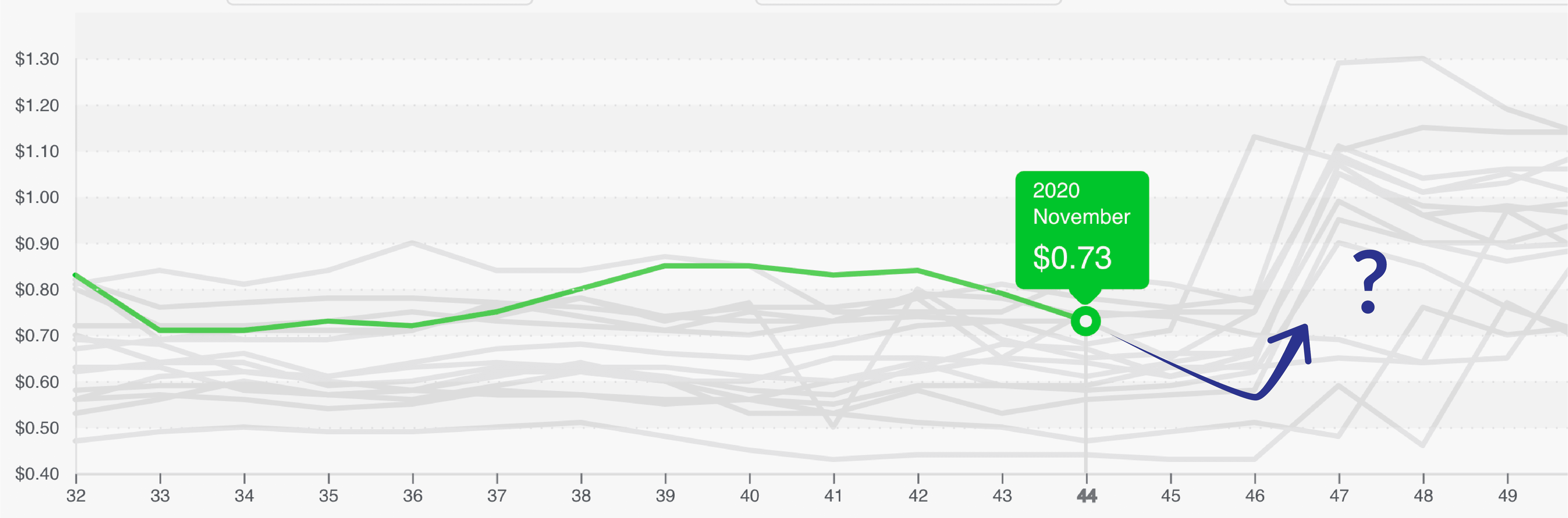

Predictably, industry prices fell further.

The downward trend will likely continue this week as demand remains low. We have a bit more time before the Thanksgiving pull typically impacts demand.

The annual price climb begins about November 10th and is reflected in prices by week 47. By category, Tomatoes, Melons and Lettuce each fell -13 to -20 percent.

Blue Book has teamed with ProduceIQ to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

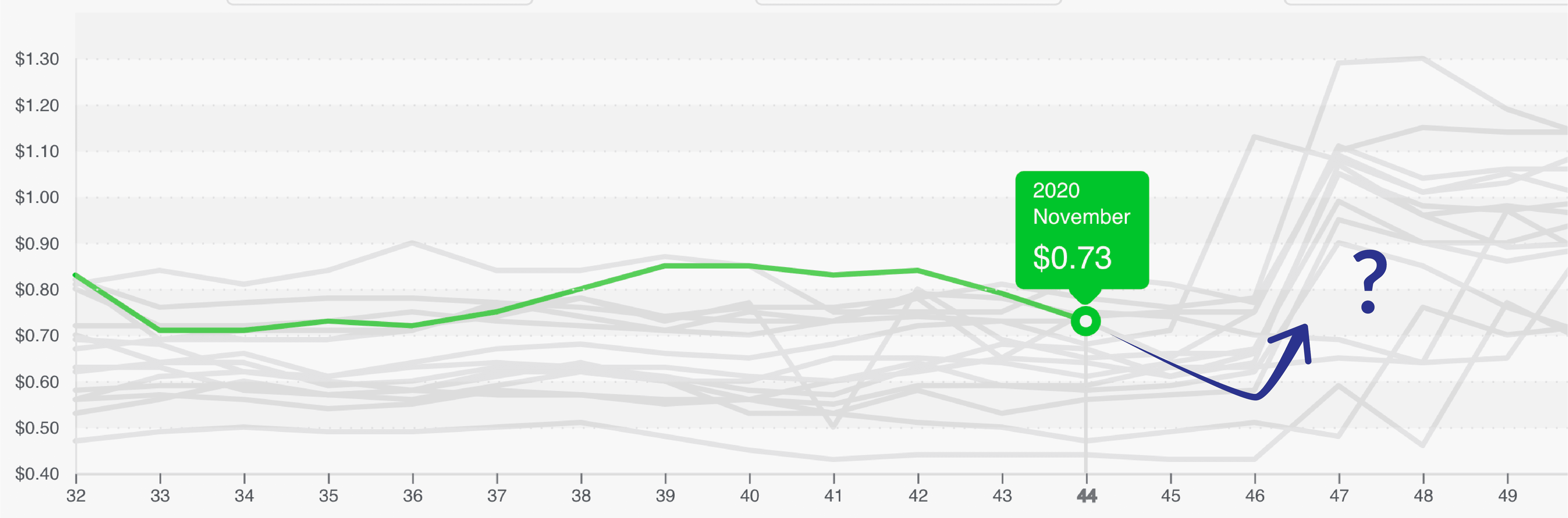

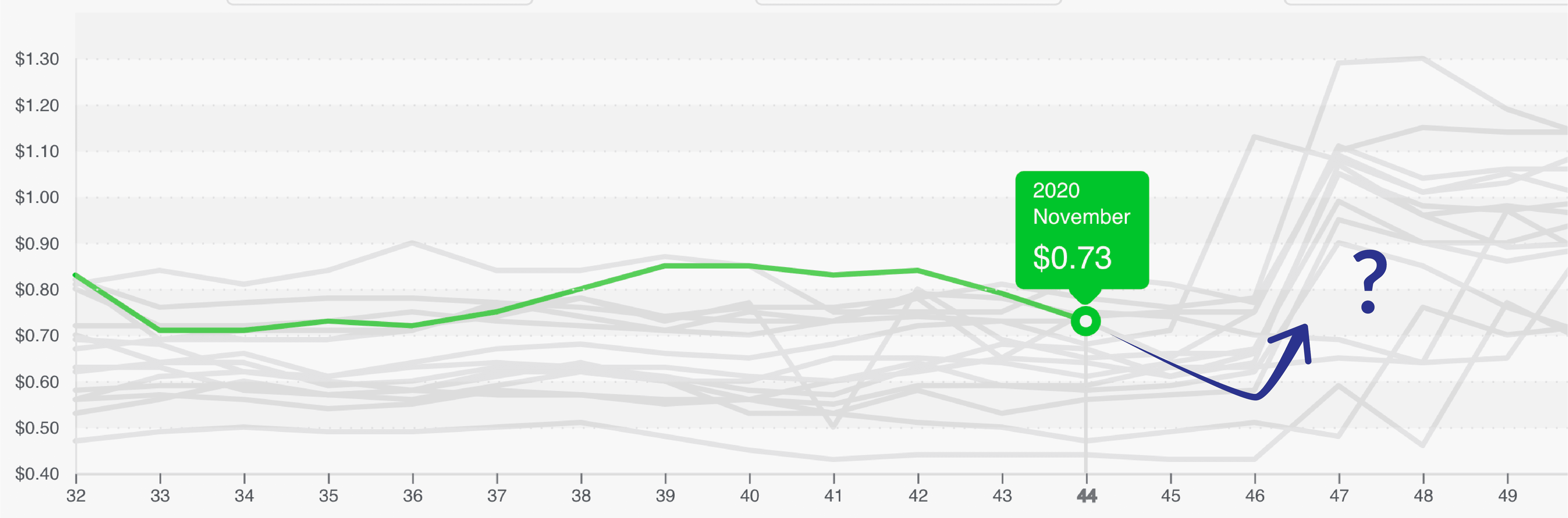

ProduceIQ Index: $0.73 /pound, -7.6 percent over prior week

(Week #44, ending October 30th)

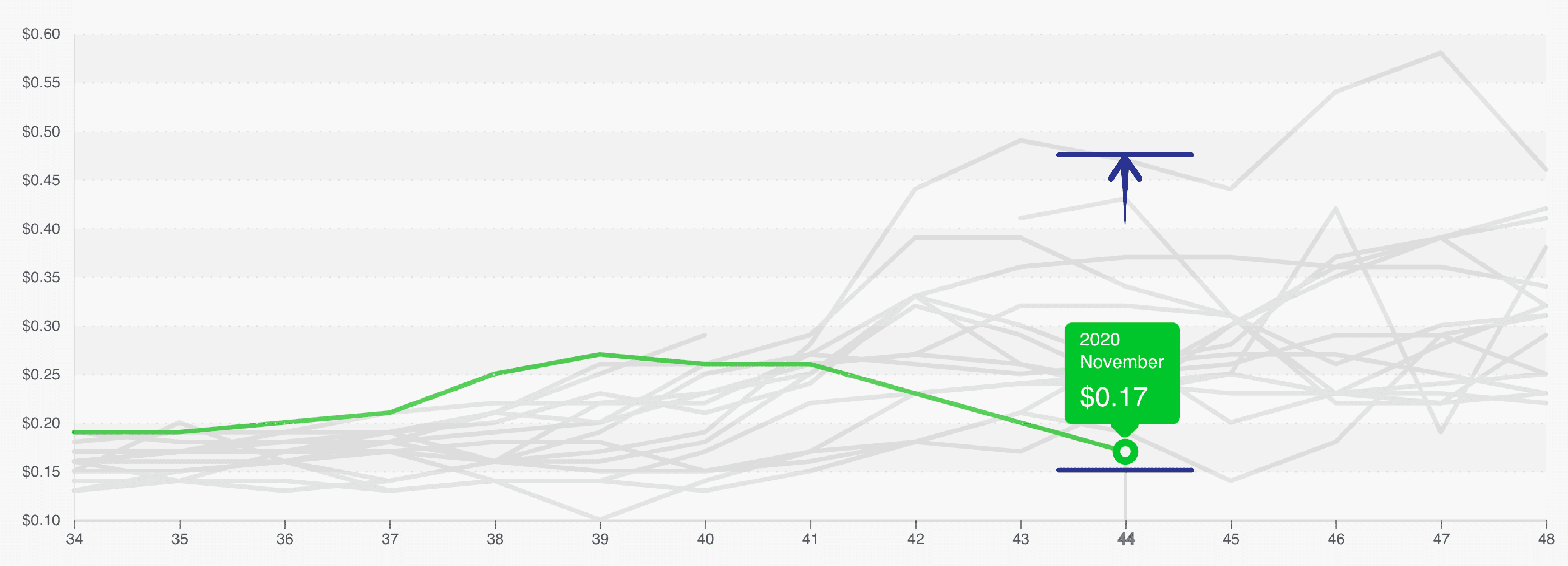

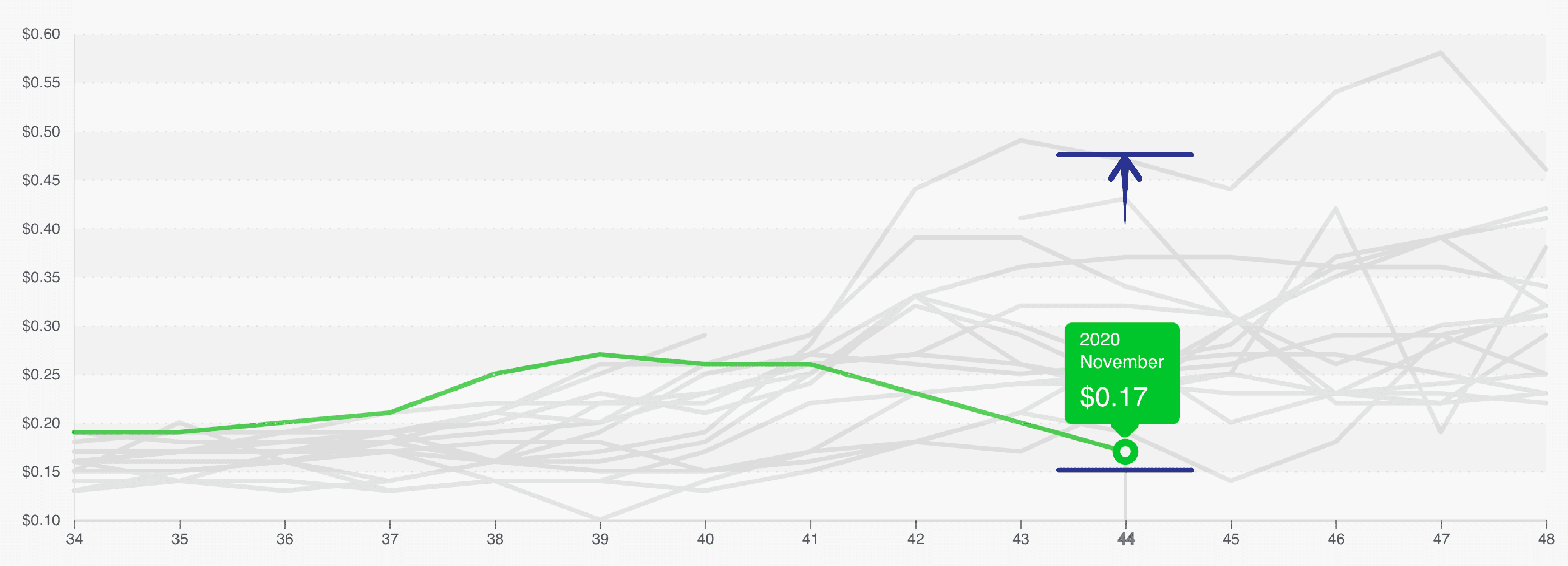

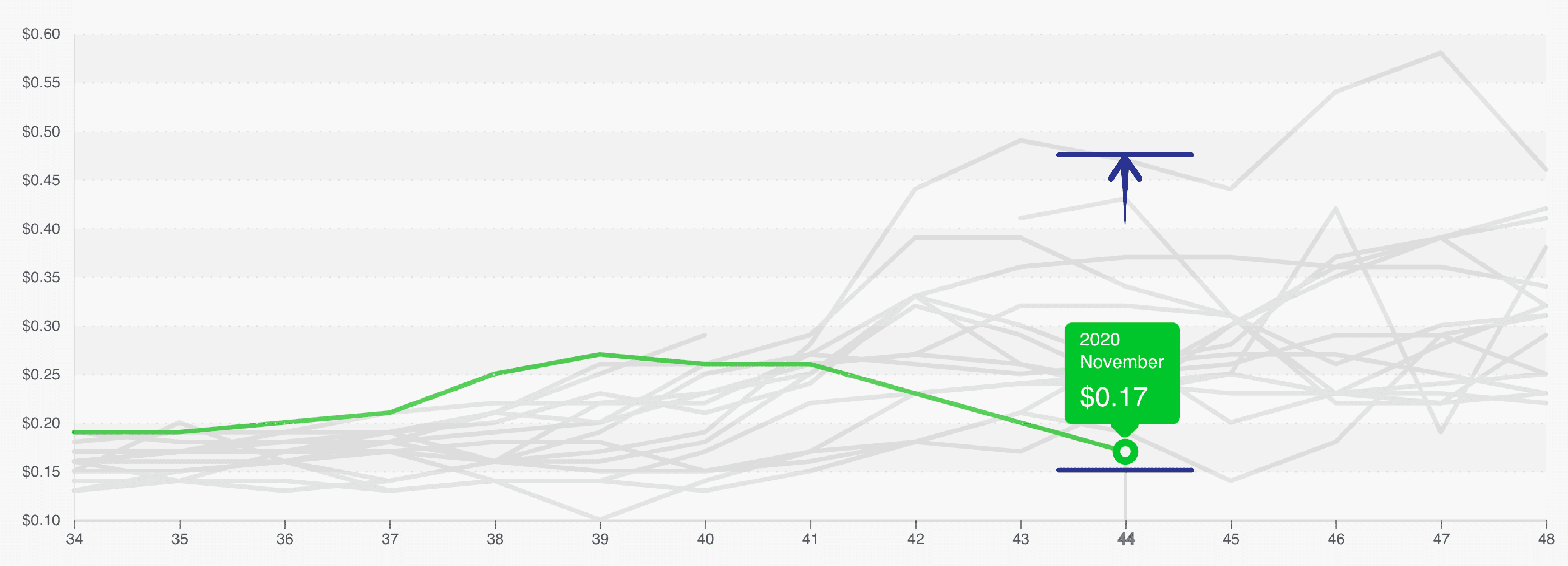

Although Tomatoes and Lettuce began their descents at historically high prices, Melons are simply cheap, priced at their lowest seasonal level of $0.17 /pound.

Honeydew, Cantaloupes and Watermelons are all promotable even though summer has ended. Quality is good and volume of supply is sufficient, causing some prices to be lower than production costs.

November will experience a regional transition to increased imports from Mexico, Guatemala, in addition to Florida.

Tomatoes, particularly Grape Tomatoes, took their plunge as Mexico and Florida increased volume.

Round Tomatoes remain elevated in pricing, $0.91 /pound (greater than $20/case), though they’re expected to normalize as Mexico increases production. Mexico is picking a little early (green, or light color) to meet the high-priced markets.

Green Beans fell off a cliff, -62 percent to $0.40 /pound. South Georgia increased in production, and the West, including Coachella Valley and Northern Mexico, also starting to improve.

So, any winners? Oddly, Lemons are up +17.5 percent to $0.94/pound, yet accounts are mixed with many reporting a supply-exceeds-demand situation.

Expect prices to drop as the District 3 Desert California growing region increases production. Limes on the other hand are down to $0.24 /pound.

The divergence from Lemons is caused by an uncorrelated supply; whereas, the demand for Lemons and Limes is correlated. Limes have steadily continued in quality and volume of supply. Restaurants that are paying attention will push more substitutions to Limes.

Melon category is at the lowest end of its 15-year range for this time of year.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Predictably, industry prices fell further.

The downward trend will likely continue this week as demand remains low. We have a bit more time before the Thanksgiving pull typically impacts demand.

The annual price climb begins about November 10th and is reflected in prices by week 47. By category, Tomatoes, Melons and Lettuce each fell -13 to -20 percent.

Blue Book has teamed with ProduceIQ to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $0.73 /pound, -7.6 percent over prior week

(Week #44, ending October 30th)

Although Tomatoes and Lettuce began their descents at historically high prices, Melons are simply cheap, priced at their lowest seasonal level of $0.17 /pound.

Honeydew, Cantaloupes and Watermelons are all promotable even though summer has ended. Quality is good and volume of supply is sufficient, causing some prices to be lower than production costs.

November will experience a regional transition to increased imports from Mexico, Guatemala, in addition to Florida.

Tomatoes, particularly Grape Tomatoes, took their plunge as Mexico and Florida increased volume.

Round Tomatoes remain elevated in pricing, $0.91 /pound (greater than $20/case), though they’re expected to normalize as Mexico increases production. Mexico is picking a little early (green, or light color) to meet the high-priced markets.

Green Beans fell off a cliff, -62 percent to $0.40 /pound. South Georgia increased in production, and the West, including Coachella Valley and Northern Mexico, also starting to improve.

So, any winners? Oddly, Lemons are up +17.5 percent to $0.94/pound, yet accounts are mixed with many reporting a supply-exceeds-demand situation.

Expect prices to drop as the District 3 Desert California growing region increases production. Limes on the other hand are down to $0.24 /pound.

The divergence from Lemons is caused by an uncorrelated supply; whereas, the demand for Lemons and Limes is correlated. Limes have steadily continued in quality and volume of supply. Restaurants that are paying attention will push more substitutions to Limes.

Melon category is at the lowest end of its 15-year range for this time of year.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.