Though prices dipped slightly from last week, industry prices remain the highest seen for this week No. 41 over the last 15 years. Demand is steady, while supply on most commodities will remain tenuous throughout October.

Interestingly, last week, fresh produce sales surpassed the 2019 weekly sales level for the first time since the pandemic began to impact the produce markets (week No. 13).

ProduceIQ Index: $0.83 /pound, -2.3 percent over prior week

Blue Book has teamed with ProduceIQ to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Sales recovered its pre-COVID-19 footing due to high prices, despite being down -4.9 percent in volume movement. Weekly sales are 10.8 percent higher over 2019, an estimate based on ProduceIQ’s top 40 commodities, which represent $705 million in sales for the week.

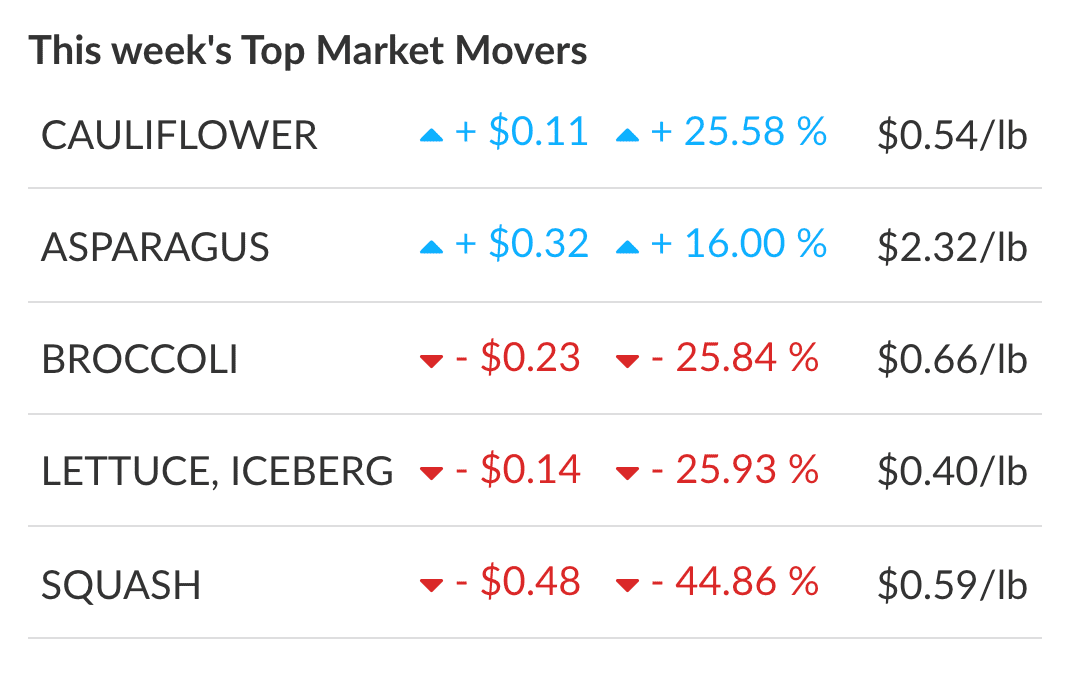

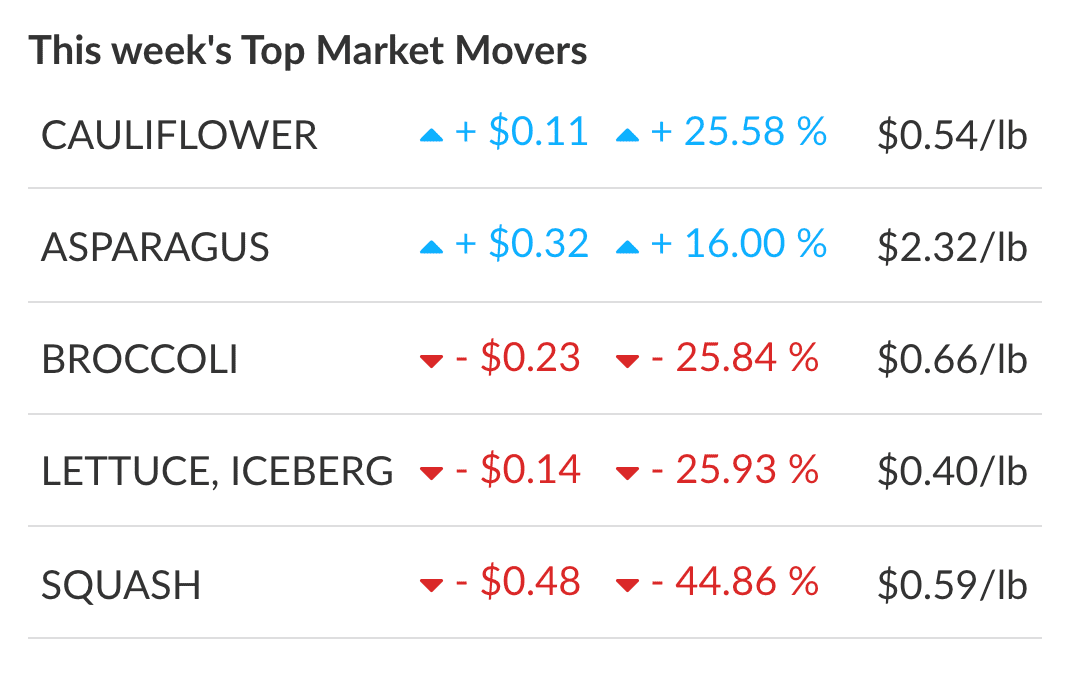

Apparently, Broccoli and Cauliflower are not correlated. Cauliflower rose 26 percent while Broccoli fell 26 percent. Though Broccoli yields have improved, the diverging prices seem dramatic.

Why? Feel free to message your thoughts, and we’ll share any insights next week.

Iceberg continued its steep descent, falling 26 percent, as demand has eased during extreme supply challenges.

Quality is fair, and yields are low due to heat-induced diseases for Romaine as well. However, there is greater demand for Romaine. Demand for Romaine is forcing prices to continue climbing, +13 percent to $0.96 /pound.

Grapes are a buy and remain steady in California. At $0.91/pound, they are easily promotable and offer good value for the consumer.

Potatoes are experiencing the classic produce story of a plentiful and quality supply causing prices to fall. Despite help from the USDA’s food box program on consumer sizes, foodservice demand remains down from prior year.

Potato growers are currently working through the annual fall transition, finishing the prior year’s storage crop and harvesting and storing the new crop.

Squash prices crashed as we foreshadowed last week. New growing regions began in both the East, South Georgia, and in the West, Hermosillo Mexico. Expect markets to continue to fall in price and trade within the range on our price graph below.

Squash prices obeyed the forecast and fell -45 percent from their peak.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Though prices dipped slightly from last week, industry prices remain the highest seen for this week No. 41 over the last 15 years. Demand is steady, while supply on most commodities will remain tenuous throughout October.

Interestingly, last week, fresh produce sales surpassed the 2019 weekly sales level for the first time since the pandemic began to impact the produce markets (week No. 13).

ProduceIQ Index: $0.83 /pound, -2.3 percent over prior week

Blue Book has teamed with ProduceIQ to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Sales recovered its pre-COVID-19 footing due to high prices, despite being down -4.9 percent in volume movement. Weekly sales are 10.8 percent higher over 2019, an estimate based on ProduceIQ’s top 40 commodities, which represent $705 million in sales for the week.

Apparently, Broccoli and Cauliflower are not correlated. Cauliflower rose 26 percent while Broccoli fell 26 percent. Though Broccoli yields have improved, the diverging prices seem dramatic.

Why? Feel free to message your thoughts, and we’ll share any insights next week.

Iceberg continued its steep descent, falling 26 percent, as demand has eased during extreme supply challenges.

Quality is fair, and yields are low due to heat-induced diseases for Romaine as well. However, there is greater demand for Romaine. Demand for Romaine is forcing prices to continue climbing, +13 percent to $0.96 /pound.

Grapes are a buy and remain steady in California. At $0.91/pound, they are easily promotable and offer good value for the consumer.

Potatoes are experiencing the classic produce story of a plentiful and quality supply causing prices to fall. Despite help from the USDA’s food box program on consumer sizes, foodservice demand remains down from prior year.

Potato growers are currently working through the annual fall transition, finishing the prior year’s storage crop and harvesting and storing the new crop.

Squash prices crashed as we foreshadowed last week. New growing regions began in both the East, South Georgia, and in the West, Hermosillo Mexico. Expect markets to continue to fall in price and trade within the range on our price graph below.

Squash prices obeyed the forecast and fell -45 percent from their peak.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.

Mark Campbell was introduced to the fresh produce industry as a lender for Farm Credit. After earning his MBA from Columbia Business School, he spent seven years as CFO for J&J Family of Farms and later served as CFO advisor to several produce growers, shippers and distributors. In this role, Mark saw the impediments that prevent produce growers and buyers to trade with greater access and efficiency. This led him to cofound ProduceIQ.