Consumer demand for cucumbers remains high as evidenced by the significant volume growth this year compared to prior years.

F.O.B. prices tend to be fairly volatile, ranging from $5 to $20 per case from Michigan in July. Both the Michigan growing region for the Eastern U.S. and the Baja California, Mexico, area for the Western U.S. are seeing some supply slowdowns, which could tip the market upwards for the next few weeks.

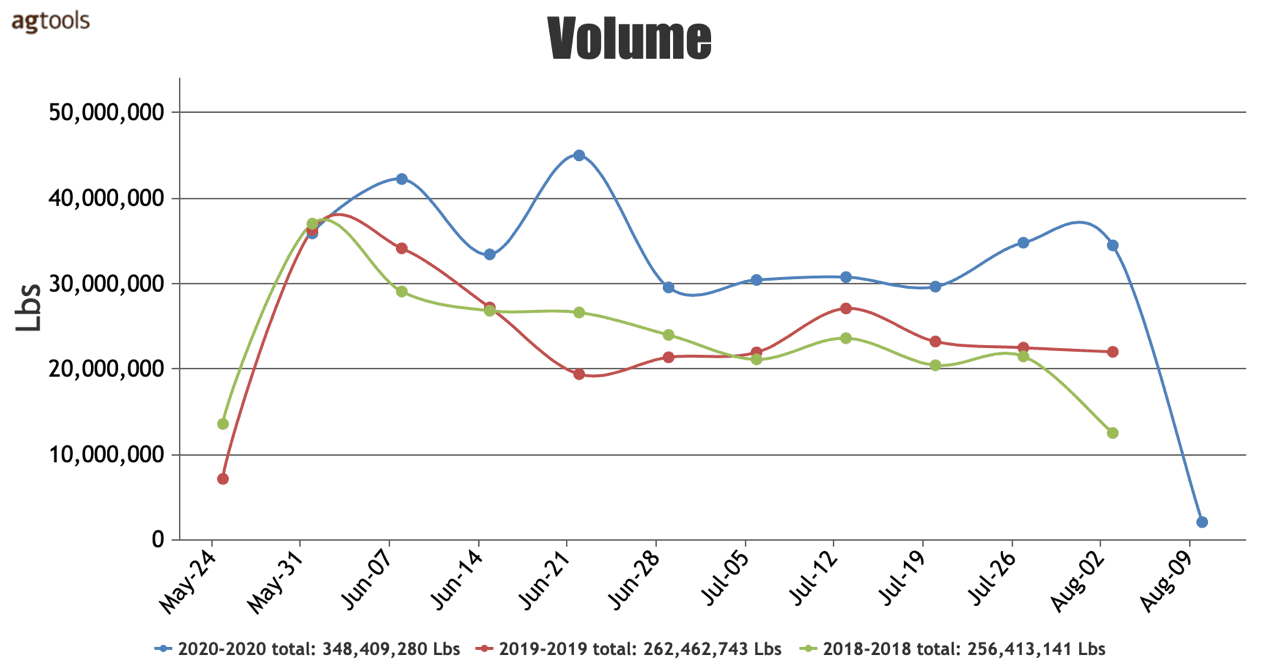

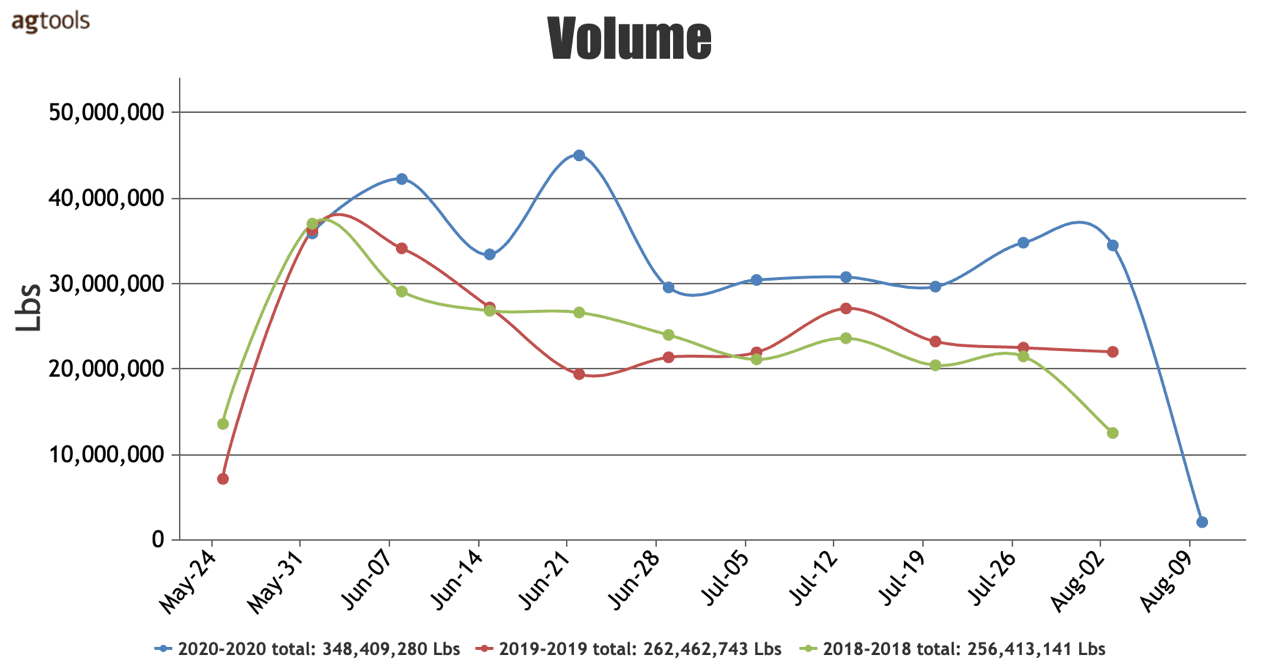

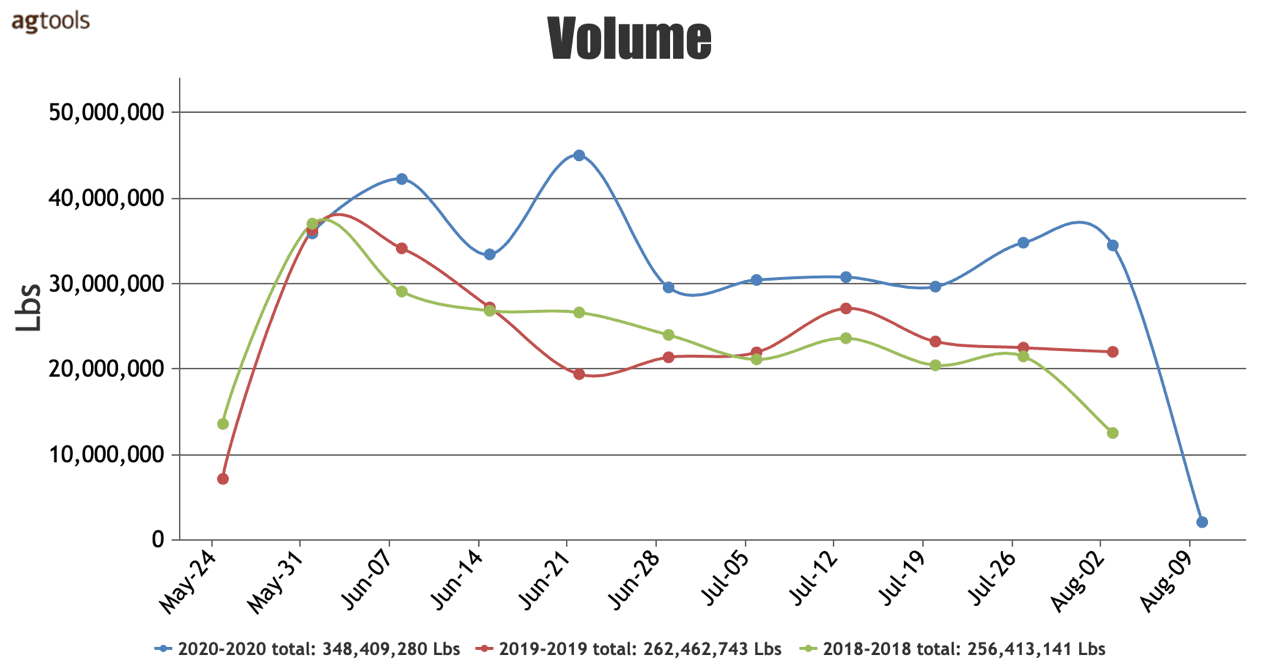

VOLUME TOTAL, CUCUMBERS CONVENTIONAL FROM JUNE 1ST THROUGH AUGUST 10TH

A comparison of 2020 volume with 2019 and 2018, for the period between June and August 10, 2020, shows increases of 33 percent and 36 percent respectively, said Paola Ochoa, Program Manager for Agtools Inc. BB #:355102

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

Demand for this commodity is steadily moving upwards as evidence by consecutive years of significant growth.

F.O.B. PRICE IN MICHIGAN CUCUMBERS CONVENTIONAL SIZE MEDIUM FROM JUNE 1ST THROUGH JULY 31TH

The price of cucumbers has been very volatile, going from $5 to $20 with many rises and falls, Ochoa said. The constant fluctuation pattern also occurred in previous years. For instance, in 2019 the range of prices was even higher, from a low of $4 to a high of $23.

F.O.B. PRICE IN MEXICO CROSSINGS THROUGH TEXAS CUCUMBERS CONVENTIONAL SIZE MEDIUM FROM JUNE 1ST THROUGH JULY 31TH

When analyzing the price of Mexican cucumbers on the border with McAllen, TX, we find similar patterns of variations although less dramatic than those for Michigan, Ochoa said.

This year’s prices have remained between $8 and $16. Prices for Mexico product have, on average, decreased yearly. This is evident for July as seen in the above graph, where 2020 prices were lower than those for 2019 which in turn were lower than those during 2018.

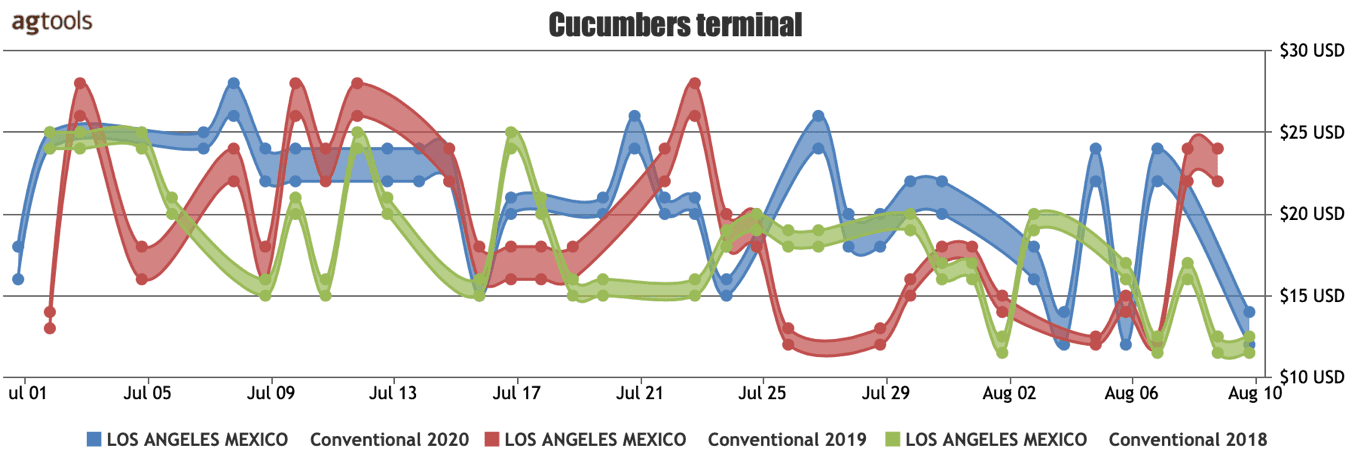

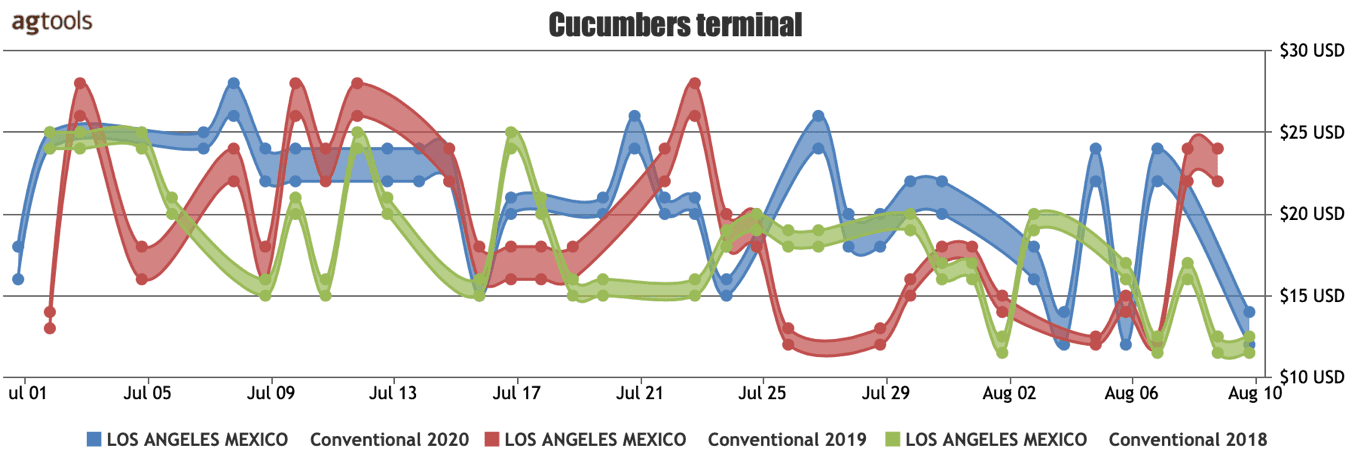

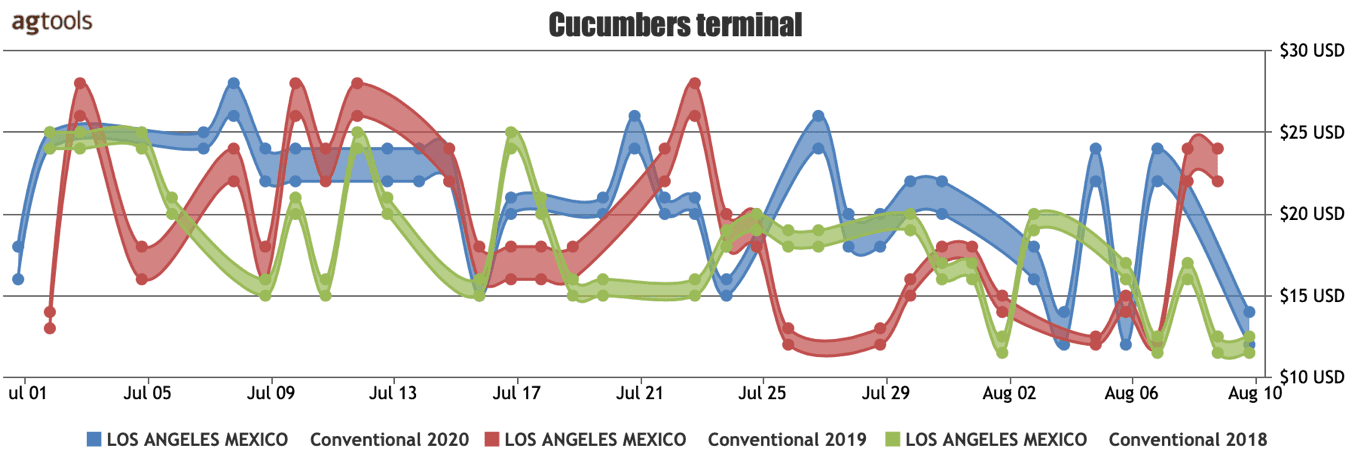

NEW YORK TERMINAL PRICE FOR CONVENTIONAL CUCUMBERS SIZE MEDIUM FROM MEXICO VS CALIFORNIA JULY 1ST THROUGH AUGUST 10TH

When analyzing the cucumber market in New York we can see that like the F.O.B. in Michigan this has been very volatile and when analyzing the last seven years we see that this volatility is very common in this period of time, every year, she said.

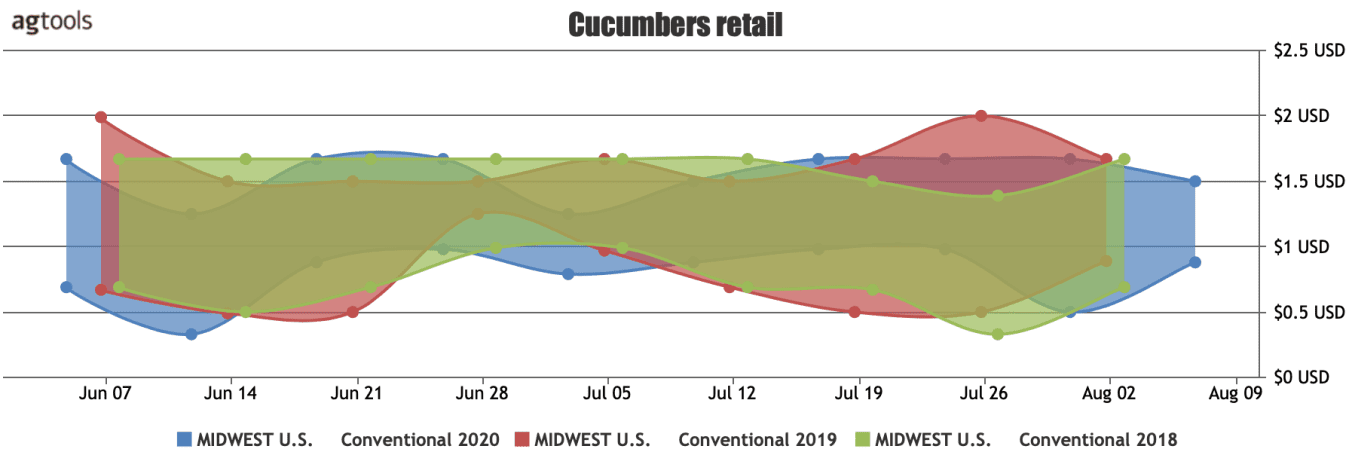

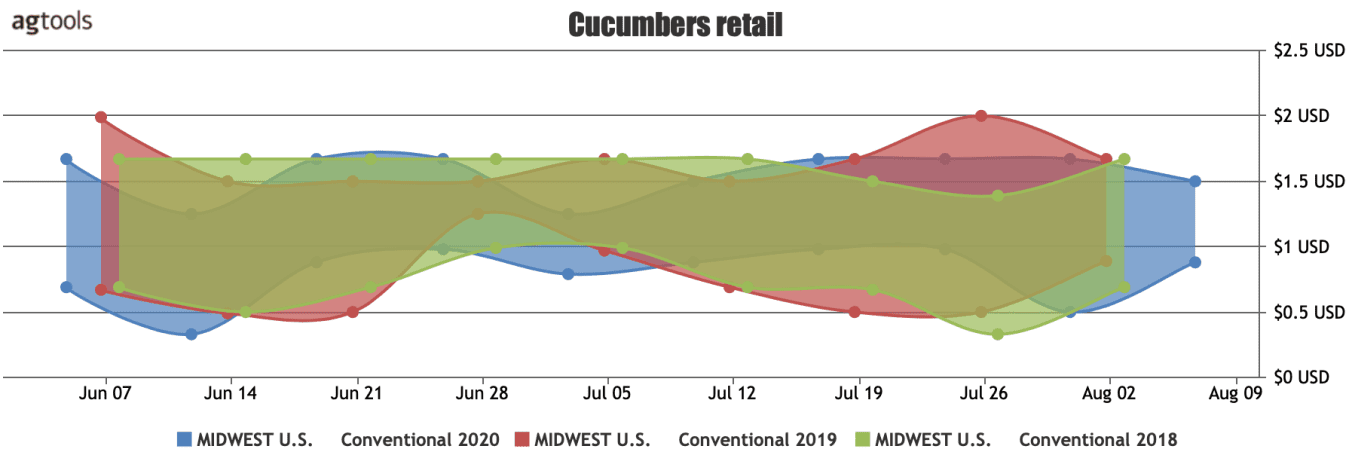

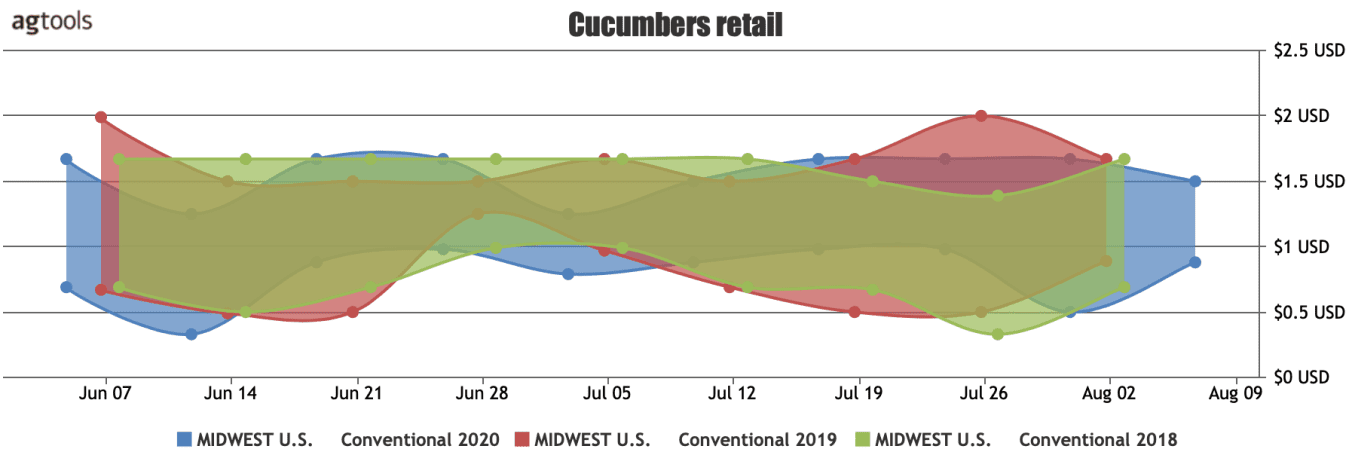

MIDWEST RETAIL PRICE FOR CONVENTIONAL CUCUMBERS FROM JUNE 1ST THROUGH JULY 31TH

When we review the retail price in Midwest we can see that unlike the F.O.B. price and the terminal market price, the price paid by the consumer is very stable and has been for the last 3 years, Ochoa said.

The consumer has not been affected by the price fluctuations and continues to increase the consumption of cucumbers at a steady pace.

2020 YTD Cucumbers

Together, Mexico and Canada account for 83 percent of the U.S. consumption of cucumbers, with Mexico the largest producer with 71 percent of total U.S. volume.

The regions of Honduras, Florida, Michigan and Georgia are the next group of producers into the U.S. in terms of volume. These six supplying regions are responsible for almost the entire U.S. volume.

Consumer demand for cucumbers remains high as evidenced by the significant volume growth this year compared to prior years.

F.O.B. prices tend to be fairly volatile, ranging from $5 to $20 per case from Michigan in July. Both the Michigan growing region for the Eastern U.S. and the Baja California, Mexico, area for the Western U.S. are seeing some supply slowdowns, which could tip the market upwards for the next few weeks.

VOLUME TOTAL, CUCUMBERS CONVENTIONAL FROM JUNE 1ST THROUGH AUGUST 10TH

A comparison of 2020 volume with 2019 and 2018, for the period between June and August 10, 2020, shows increases of 33 percent and 36 percent respectively, said Paola Ochoa, Program Manager for Agtools Inc. BB #:355102

Blue Book has teamed with Agtools Inc., the data analytic service for the produce industry, to look at a handful of crops and how they’re adjusting in the market during the pandemic.

Demand for this commodity is steadily moving upwards as evidence by consecutive years of significant growth.

F.O.B. PRICE IN MICHIGAN CUCUMBERS CONVENTIONAL SIZE MEDIUM FROM JUNE 1ST THROUGH JULY 31TH

The price of cucumbers has been very volatile, going from $5 to $20 with many rises and falls, Ochoa said. The constant fluctuation pattern also occurred in previous years. For instance, in 2019 the range of prices was even higher, from a low of $4 to a high of $23.

F.O.B. PRICE IN MEXICO CROSSINGS THROUGH TEXAS CUCUMBERS CONVENTIONAL SIZE MEDIUM FROM JUNE 1ST THROUGH JULY 31TH

When analyzing the price of Mexican cucumbers on the border with McAllen, TX, we find similar patterns of variations although less dramatic than those for Michigan, Ochoa said.

This year’s prices have remained between $8 and $16. Prices for Mexico product have, on average, decreased yearly. This is evident for July as seen in the above graph, where 2020 prices were lower than those for 2019 which in turn were lower than those during 2018.

NEW YORK TERMINAL PRICE FOR CONVENTIONAL CUCUMBERS SIZE MEDIUM FROM MEXICO VS CALIFORNIA JULY 1ST THROUGH AUGUST 10TH

When analyzing the cucumber market in New York we can see that like the F.O.B. in Michigan this has been very volatile and when analyzing the last seven years we see that this volatility is very common in this period of time, every year, she said.

MIDWEST RETAIL PRICE FOR CONVENTIONAL CUCUMBERS FROM JUNE 1ST THROUGH JULY 31TH

When we review the retail price in Midwest we can see that unlike the F.O.B. price and the terminal market price, the price paid by the consumer is very stable and has been for the last 3 years, Ochoa said.

The consumer has not been affected by the price fluctuations and continues to increase the consumption of cucumbers at a steady pace.

2020 YTD Cucumbers

Together, Mexico and Canada account for 83 percent of the U.S. consumption of cucumbers, with Mexico the largest producer with 71 percent of total U.S. volume.

The regions of Honduras, Florida, Michigan and Georgia are the next group of producers into the U.S. in terms of volume. These six supplying regions are responsible for almost the entire U.S. volume.

Greg Johnson is Director of Media Development for Blue Book Services