Produce sales rose along with consumer anxiety levels. IRI found that 58% of consumers were extremely concerned about COVID-19 the week of March 22, up from 38% the prior week. This resulted in produce continuing to move at unprecedented volumes regardless of where they are sold in the store:

• Fresh produce increased 29.7%

• Frozen, +111.4%

• Shelf-stable, +158.1%

Source: IRI, Total US, MULO, week ending March 22, 2020

“During these unprecedented times, everyone is coming together to help produce move from where it is to where it needs to go,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “Matching distributors’ abilities with retailer needs, running at double the normal volume, rerouting product from foodservice to retail, consumer-direct solutions, new partnerships like small bakeries selling produce items and donations to food banks, this industry is doing it all to meet the consumer demand for produce.”

Fresh Produce

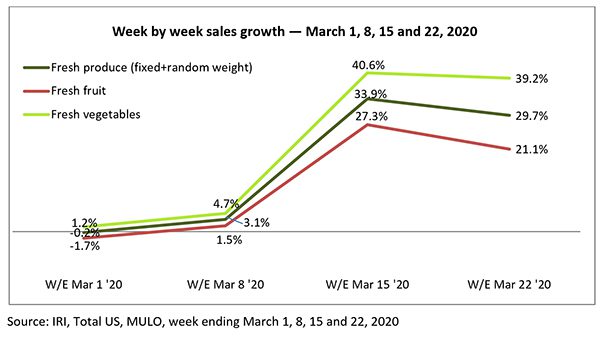

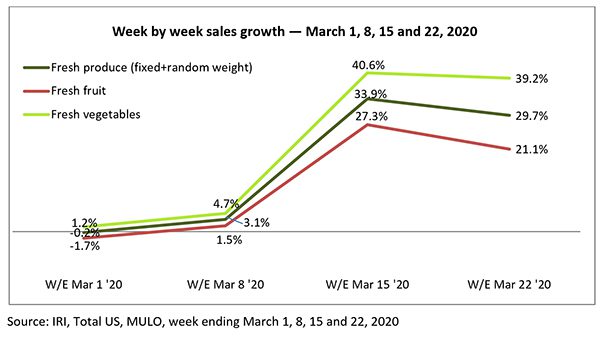

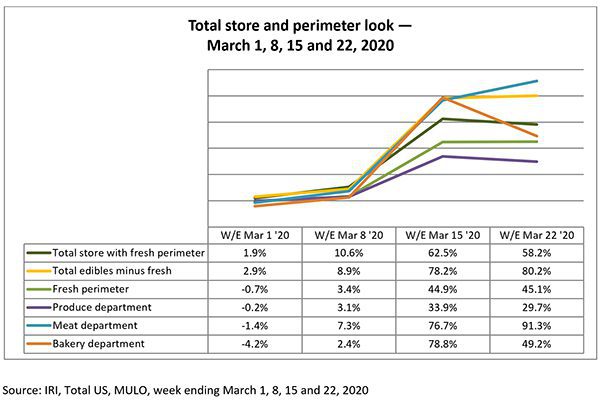

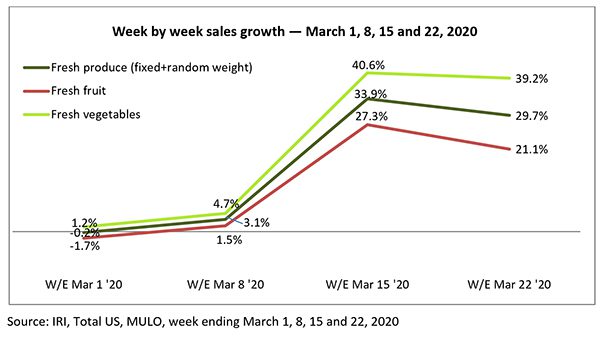

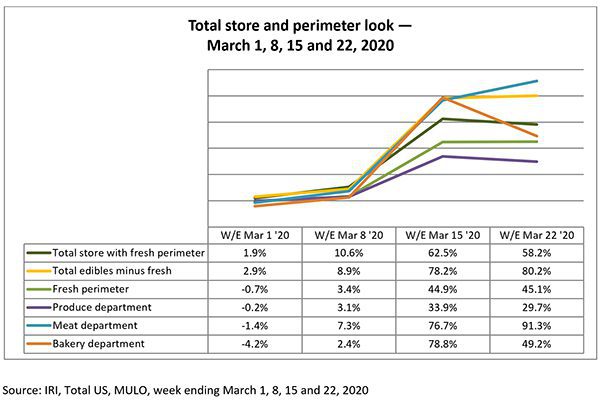

The inflection point in shopping behavior was the week of March 1, when non-edibles started to gear up, but fresh produce sales gains were still much in line with trends seen in 2019 — ranging from -1.7% (fresh fruit) to +1.2% (fresh vegetables). Produce sales started to rise the subsequent week, at +3.1%, followed by a 33.9% increase the week ending March 15. For the week ending March 22, IRI showed vegetables up 39.2% —adding $227 million versus the comparable week in 2019. Fruits gained 21.1% over the week of March 22, which translated into an additional $116 million. “Our warehouse got wiped out after the first big wave of panic buying,” said Mike Kamphaus, President and CEO of Peirone Produce. “While the huge sales took the headlines, the positive attitude of our retail customers and our vendor partners is really the most impressive back story. They employed lots of creative solutions to get product back into our supply chain and out to our customers in record time. I would also call out the efforts of my warehouse workforce, many of which worked double shifts and our drivers who ran lots of extra routes to keep our retail customers in business. Forty years of being in business and I am still awed by the resilience and resourcefulness of our people!”

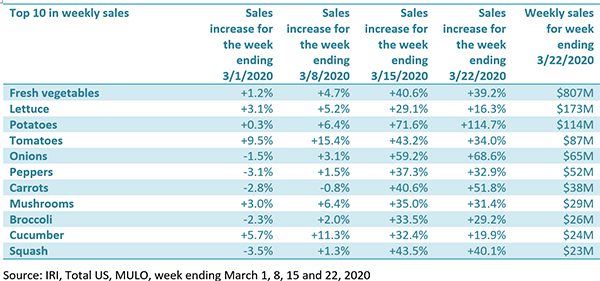

Sales increases extended across fresh produce items. In absolute dollars, the biggest fresh produce winners for the week of March 22 were once more potatoes that gained $61 million, or +114.7% over the comparable week in 2019.

“The surge in potato sales these past few weeks has far surpassed even the level we see during the end-of-year holidays,” said the Produce Director for a large retailer in the Northeast. Berries were second, with a gain of $28 million, or 23.5%. Onions closed out the top three, with gains of $27 million, up 68.6%. Others that gained big were lettuce, apples, tomatoes, tangerines, bananas, oranges and carrots. Several retailers remarked that items with longer shelf life as well as packaged items moved faster, perhaps due to consumer safety perceptions. “Consumers often touch, pinch and smell fresh produce items before selecting the ones they want,” Watson said. “Along with our retail partners, we advise shoppers to wash their hands before and after store visits, minimize touching produce items and to wash/clean fresh produce properly once home. With proper handling, there should be no concerns about eating fresh produce.”

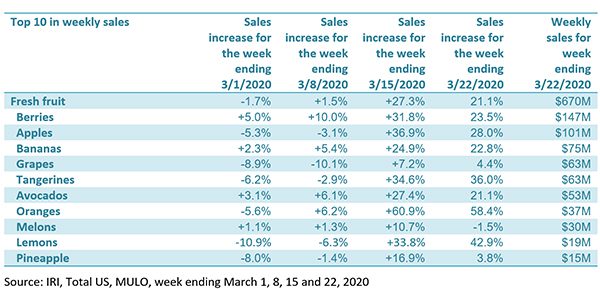

Fresh Fruit

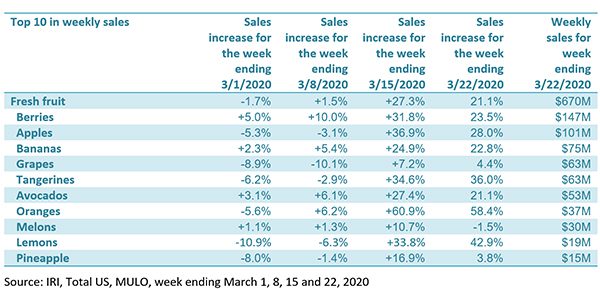

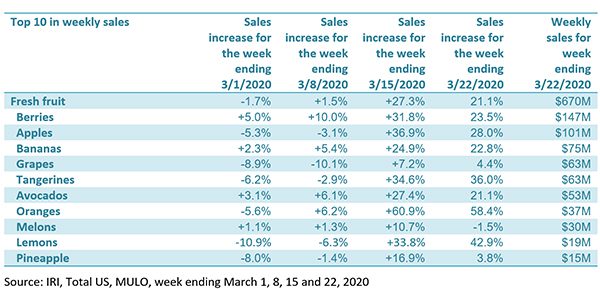

Fresh fruit sales saw a slightly bigger uptick during the week of March 22 than the week prior — no doubt to address the many more at-home consumption occasions, from more -home breakfasts, lunches and dinners to snacking and smoothies. On the fruit side, berries generated 22% of fruit sales, yet grew 23.5%. Similarly, apples generated more than 15% of all fruit sales and grew 28%.

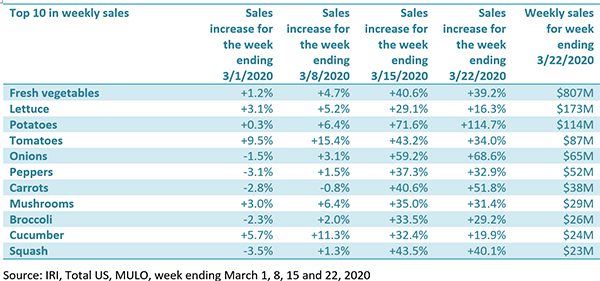

Fresh vegetables

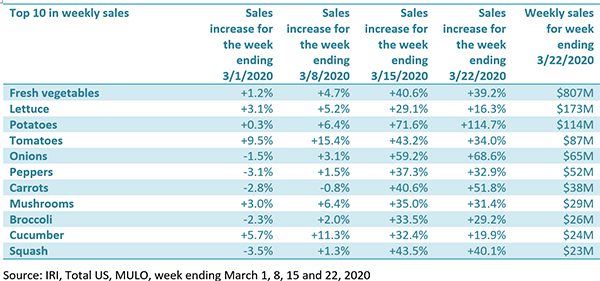

On the fresh vegetable side, shoppers are stocking up on items with longer shelf life, in particular. Beyond potatoes, other impressive growth categories were onions, carrots and squash.

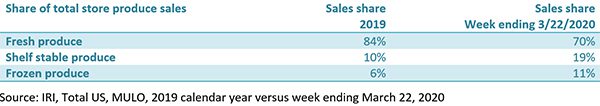

Fresh Versus Frozen and Shelf-Stable

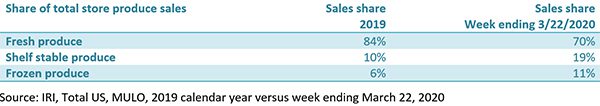

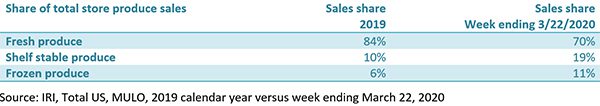

Consumers continued to split their produce dollar three ways during the week of March 22. Fresh produce generates the bulk of total produce sales during regular times and it still does today,” said Jonna Parker, Team Lead, Fresh for IRI. “The size of the pie is one of the reasons why fresh produce growth percentages are lower than that of frozen and shelf-stable. However, consumers remained in a stock-up mindset the week of March 22 and that drove high interest in frozen and shelf-stable fruit and vegetables. The share of total cross-store produce sales for shelf-stable, for instance, is up from 10% during 2019 to 19% during the week ending March 22, 2020.”

Canned vegetables once more saw the highest percentage gains, at 207.9%, followed by frozen vegetables and frozen fruit.

In part, these spikes can be attributed to the combination of panic buying and freezer stocking. “We are finding that among consumers who stocking up, the top goal is having a two-week supply,” said Parker. However, the sales surges address the increased everyday need as well. The increase in home-cooked meals is a given with mandated restaurant/restaurant seating area closures around the country. IRI found that for the week of March 22, 56% of consumers ate more meals at home versus at/from a restaurant. But also consider the fact that universities and schools are closed, which means many students moved back home. In Florida, for instance, 350,000 students live on campus. Consider their added three meals per day plus snacks at home — that is one million more meals consumed at home per day, for Florida students alone. Next, consider the people working from home and all the elementary and high school students being at home. That means many more breakfast, snack and lunch occasions that moved to at-home. Also consider the fact that all sports and evening activities have been cancelled, so no more “scramble dinners” to be out the door in 10 minutes, but time to create an actual home-cooked dinner. “We found that among households with kids, 69% have kids staying home from school or daycares versus 38% the week prior and 47% are doing fewer activities and sports,” said Parker. And lastly, consumers are looking to boost their nutritional intake and build their immune systems and from their buying patterns, it certainly appears produce matters during times of crisis. These are all drivers of increased everyday demand of the grocery channel versus foodservice.

Perimeter performance

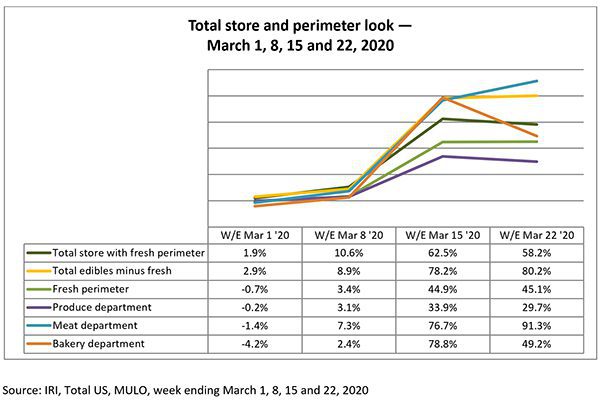

Boosted by an increase of 91.3% in meat, the total perimeter increased 45.1%. Center store edibles increased 80.2%.

Floral

Whereas fresh produce is seeing big increases over the comparable week in 2019, floral is struggling amid COVID-19.

It is important to remember that the produce sales surges at retail are only possible thanks to the heroic work of the entire grocery and produce supply chains, from farm to retailer #produce . #SupermarketSuperHeroes 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA.

Produce sales rose along with consumer anxiety levels. IRI found that 58% of consumers were extremely concerned about COVID-19 the week of March 22, up from 38% the prior week. This resulted in produce continuing to move at unprecedented volumes regardless of where they are sold in the store:

• Fresh produce increased 29.7%

• Frozen, +111.4%

• Shelf-stable, +158.1%

Source: IRI, Total US, MULO, week ending March 22, 2020

“During these unprecedented times, everyone is coming together to help produce move from where it is to where it needs to go,” said Joe Watson, VP of Membership and Engagement for the Produce Marketing Association (PMA). “Matching distributors’ abilities with retailer needs, running at double the normal volume, rerouting product from foodservice to retail, consumer-direct solutions, new partnerships like small bakeries selling produce items and donations to food banks, this industry is doing it all to meet the consumer demand for produce.”

Fresh Produce

The inflection point in shopping behavior was the week of March 1, when non-edibles started to gear up, but fresh produce sales gains were still much in line with trends seen in 2019 — ranging from -1.7% (fresh fruit) to +1.2% (fresh vegetables). Produce sales started to rise the subsequent week, at +3.1%, followed by a 33.9% increase the week ending March 15. For the week ending March 22, IRI showed vegetables up 39.2% —adding $227 million versus the comparable week in 2019. Fruits gained 21.1% over the week of March 22, which translated into an additional $116 million. “Our warehouse got wiped out after the first big wave of panic buying,” said Mike Kamphaus, President and CEO of Peirone Produce. “While the huge sales took the headlines, the positive attitude of our retail customers and our vendor partners is really the most impressive back story. They employed lots of creative solutions to get product back into our supply chain and out to our customers in record time. I would also call out the efforts of my warehouse workforce, many of which worked double shifts and our drivers who ran lots of extra routes to keep our retail customers in business. Forty years of being in business and I am still awed by the resilience and resourcefulness of our people!”

Sales increases extended across fresh produce items. In absolute dollars, the biggest fresh produce winners for the week of March 22 were once more potatoes that gained $61 million, or +114.7% over the comparable week in 2019.

“The surge in potato sales these past few weeks has far surpassed even the level we see during the end-of-year holidays,” said the Produce Director for a large retailer in the Northeast. Berries were second, with a gain of $28 million, or 23.5%. Onions closed out the top three, with gains of $27 million, up 68.6%. Others that gained big were lettuce, apples, tomatoes, tangerines, bananas, oranges and carrots. Several retailers remarked that items with longer shelf life as well as packaged items moved faster, perhaps due to consumer safety perceptions. “Consumers often touch, pinch and smell fresh produce items before selecting the ones they want,” Watson said. “Along with our retail partners, we advise shoppers to wash their hands before and after store visits, minimize touching produce items and to wash/clean fresh produce properly once home. With proper handling, there should be no concerns about eating fresh produce.”

Fresh Fruit

Fresh fruit sales saw a slightly bigger uptick during the week of March 22 than the week prior — no doubt to address the many more at-home consumption occasions, from more -home breakfasts, lunches and dinners to snacking and smoothies. On the fruit side, berries generated 22% of fruit sales, yet grew 23.5%. Similarly, apples generated more than 15% of all fruit sales and grew 28%.

Fresh vegetables

On the fresh vegetable side, shoppers are stocking up on items with longer shelf life, in particular. Beyond potatoes, other impressive growth categories were onions, carrots and squash.

Fresh Versus Frozen and Shelf-Stable

Consumers continued to split their produce dollar three ways during the week of March 22. Fresh produce generates the bulk of total produce sales during regular times and it still does today,” said Jonna Parker, Team Lead, Fresh for IRI. “The size of the pie is one of the reasons why fresh produce growth percentages are lower than that of frozen and shelf-stable. However, consumers remained in a stock-up mindset the week of March 22 and that drove high interest in frozen and shelf-stable fruit and vegetables. The share of total cross-store produce sales for shelf-stable, for instance, is up from 10% during 2019 to 19% during the week ending March 22, 2020.”

Canned vegetables once more saw the highest percentage gains, at 207.9%, followed by frozen vegetables and frozen fruit.

In part, these spikes can be attributed to the combination of panic buying and freezer stocking. “We are finding that among consumers who stocking up, the top goal is having a two-week supply,” said Parker. However, the sales surges address the increased everyday need as well. The increase in home-cooked meals is a given with mandated restaurant/restaurant seating area closures around the country. IRI found that for the week of March 22, 56% of consumers ate more meals at home versus at/from a restaurant. But also consider the fact that universities and schools are closed, which means many students moved back home. In Florida, for instance, 350,000 students live on campus. Consider their added three meals per day plus snacks at home — that is one million more meals consumed at home per day, for Florida students alone. Next, consider the people working from home and all the elementary and high school students being at home. That means many more breakfast, snack and lunch occasions that moved to at-home. Also consider the fact that all sports and evening activities have been cancelled, so no more “scramble dinners” to be out the door in 10 minutes, but time to create an actual home-cooked dinner. “We found that among households with kids, 69% have kids staying home from school or daycares versus 38% the week prior and 47% are doing fewer activities and sports,” said Parker. And lastly, consumers are looking to boost their nutritional intake and build their immune systems and from their buying patterns, it certainly appears produce matters during times of crisis. These are all drivers of increased everyday demand of the grocery channel versus foodservice.

Perimeter performance

Boosted by an increase of 91.3% in meat, the total perimeter increased 45.1%. Center store edibles increased 80.2%.

Floral

Whereas fresh produce is seeing big increases over the comparable week in 2019, floral is struggling amid COVID-19.

It is important to remember that the produce sales surges at retail are only possible thanks to the heroic work of the entire grocery and produce supply chains, from farm to retailer #produce . #SupermarketSuperHeroes 210 Analytics and IRI will continue to provide weekly updates as sales trends develop, made possible by PMA.

Anne-Marie Roerink is the principal of 210 Analytics, a Lakeland, FL-based research firm focused on grocery and consumer behaviors. She is the author of the Power of Produce, the Power of Meat, and the Power of Deli, among other retail-focused research reports.