In case you avoided the internet all weekend, the tropics are ablaze with activity. Storms on the West and East coast are disrupting the flow of goods.

As a result, supply challenges are forcing the ProduceIQ Index to reach record levels. Average prices are +14 percent higher than the next highest year for week #34.

Although Tropical Storm Hilary caused significant damage for some Southern California citizens, most Golden State growers managed to avoid the worst. Still, because so many growing areas throughout the West Coast did receive abnormally heavy rain for August, there is genuine concern about increasing pest, disease, and weed pressure for in-season commodities.

In other hurricane news, Tropical Storm Idalia is forecasted to barrel into Florida as a major hurricane early this week. Rain and wind from the major storm will likely impact growers throughout Central/North Florida, Georgia, and South Carolina. Bell peppers, tomatoes, sweet corn, and cucumbers are just a few of the most vulnerable commodities.

ProduceIQ Index: $1.23/pound, up +2.5 percent over prior week

Week #34, ending August 25th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

The fact that peak California grape production and peak Atlantic Hurricane Season happen simultaneously hasn’t been a problem until now. Last week, when Hurricane Hilary made landfall in Southern California as a tropical storm, Kern County, responsible for most domestic grape production in August, received record rain.

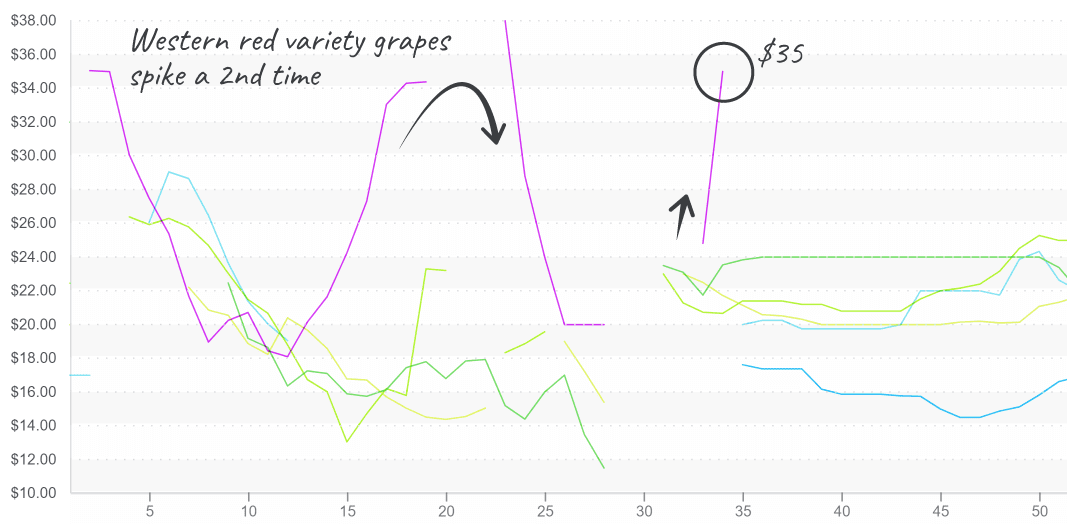

1.21 inches of rain fell in Bakersfield, surpassing August’s previous record of 1.18 inches set in 1983. As a result, average prices are up +44 percent over the last week to $33.

It’s still too early to say how long the adverse effects of Hilary will hold sway over market prices, but growers estimate losses in the 25 percent range and up. Much depends on the weather and the grape grower’s ability to fight excess moisture with fungicide and drying agents effectively. Bakersfield’s forecast this week is to be dry and in the mid-90s (www.produceiq.com/weather).

Table grapes are having a roller-coaster year, red varieties spiking from $24 to $35 in a week.

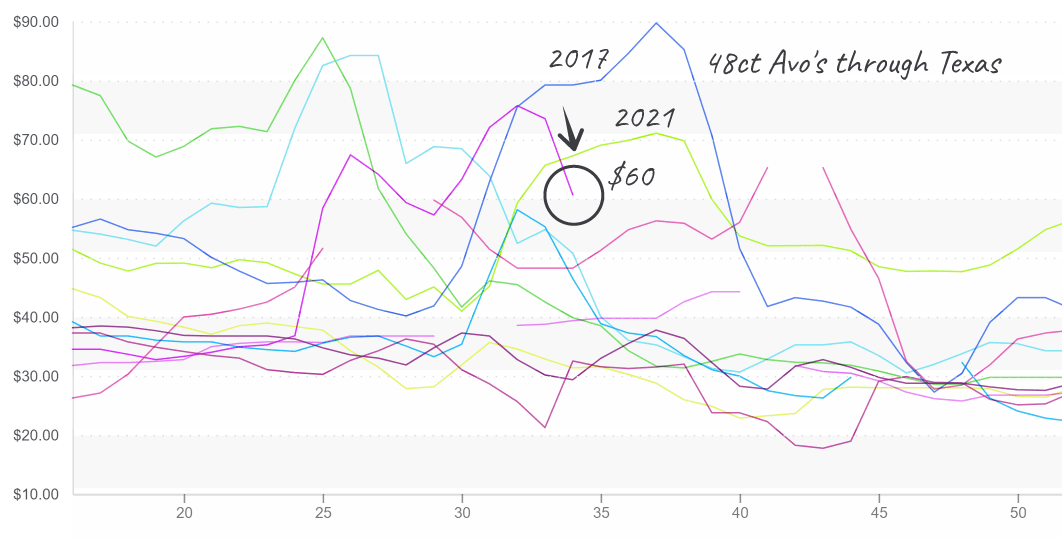

Declining Hass avocado prices balance out significant increases from commodities hit by Hilary. Brought on by deflating demand, average avocado prices are down -10 percent over the previous week. In the balance between 48-count and 60-count, the larger fruit still commands a significant premium, $17, which is lower than the season’s $25 spread. If you can use smaller fruit, big savings remain.

Because California growers are 90 percent finished with their season (and comprise a fraction of the overall supply), Hilary won’t greatly affect avocado prices. However, Mexico’s supply hasn’t improved meaningfully, especially on larger-sized fruit. Prices are forecasted to decline over the next few weeks as Mexican supply increases.

Hass Avocado prices begin to decline, slightly narrowing the big spread between 48 and 60-count

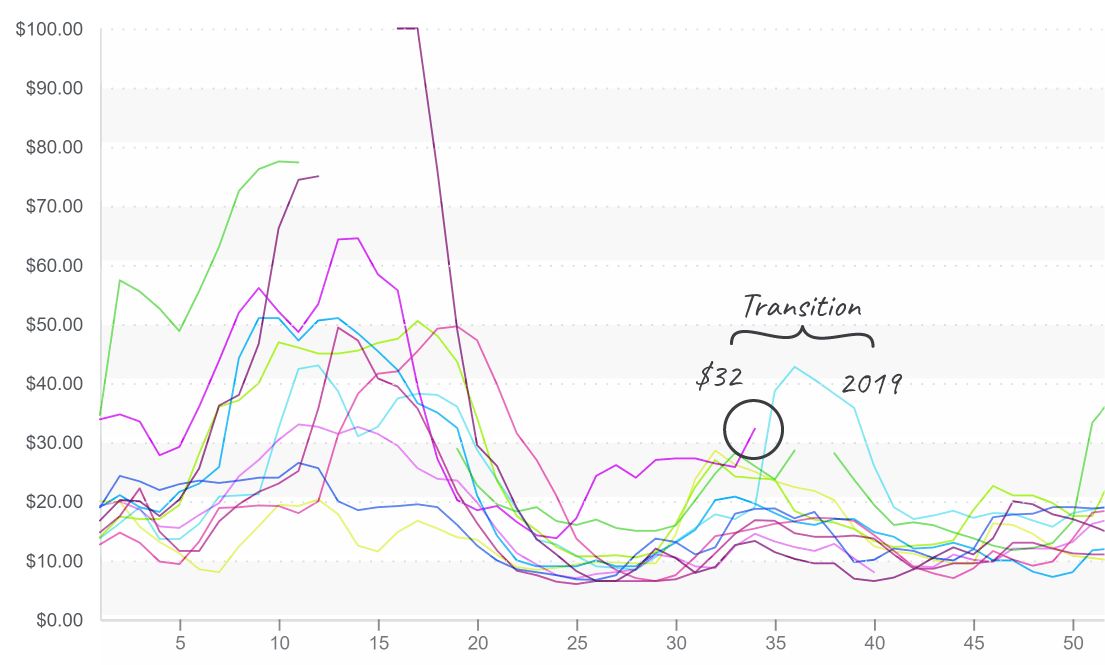

Lime prices are up +25 percent over the previous week. Rain in Veracruz, Mexico, and decreased crossings into Texas due to Tropical Storm Harold and Hurricane Hilary are causing quality issues and reducing supply. At $32 for 175 count, prices are at a ten-year high. More rain is forecasted this week, so future supplies depend greatly on surprise…the weather.

Lime prices start high during this year’s 2nd season of volatility.

High heat in Baja California, Mexico, had already put green onion prices on the ledge. Hurricane Hilary just nudged them over the edge.

Because growers anticipated the storm’s arrival, they were able to pick more product; however, wet fields and general recovery have halted picking the last few days. Buyers will likely feel the effects of Hilary on green onion prices more over the next few weeks as buyers tally losses and the existing supply is depleted.

Please visit Stores to learn more about our qualified group of suppliers and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.