September 19, 2022 TORONTO–(BUSINESS WIRE)–The top reason shoppers choose to use grocery pickup is because of lower service fees, closely followed by customers not wanting to wait at home for a delivery order according to new grocery customer research from Mercatus, fielded August 25 – 27, 2022.

Half of grocery customers would opt for next day or longer if it meant paying an even lower Pickup fee. Customer preference for Pickup’s lower fees is consistent across all age groups, while not wanting to wait around for a delivery resonated most strongly with customers in the 30-44 age group.

“We know that many grocery customers consciously opt to use Pickup and avoid using Delivery because of all the explicit and additional costs,” said Mark Fairhurst, VP Marketing at Mercatus. “It turns out that by giving customers a choice about the cost they’re willing to pay to use Pickup, retailers also gain the opportunity to lower the cost-to-serve aspects of online shopping for both themselves and their customers.”

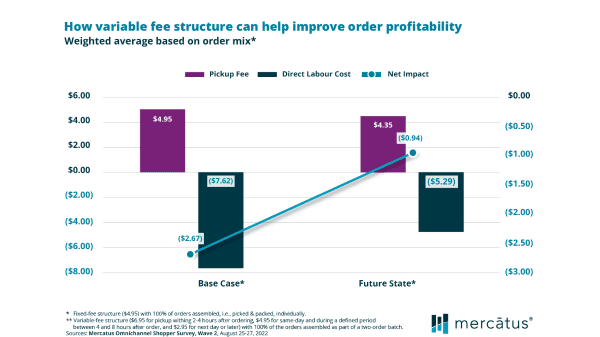

Specifically, this latest Mercatus research suggests that grocery retailers can improve order profitability by implementing a variable service fee structure that offers customers more control over the extra costs.

“Since time is money, a structure that flexes fees based on when someone picks up an order benefits both customers and retailers,” said David Bishop of Brick Meets Click, who conducted the research for Mercatus. “The findings highlight that paying less is more important than receiving the order as fast as possible. The tradeoff that the customer makes means the retailer can realize significant labor savings by batching out more orders together during the assembly stage.”

The Mercatus research also revealed that 60% of U.S. households used Pickup during the past 12 months, and over 80% of those (i.e., 49% of the total households) experienced what it’s like to use either Walmart or Target’s service.

More than 70% of Pickup customers received their most recent order while remaining in the vehicle. Nearly 50% used the retailer’s app to let the store know that they had arrived in the designated pickup location; however, app usage by Grocery customers trailed Mass by 20 percentage points for this purpose.

This is important, because mobile app usage during the check-in stage also drove a 67% stronger net promoter score (NPS) compared to methods that were not as quick or easy to use. While on average customers perceived their wait time lasted between 5 and 6 minutes, the level of satisfaction, measured by NPS, dropped consistently and significantly the longer customers waited to receive their order, ranging from 81% for under a 2-minute wait to -38% for over 10 minutes.

“When it comes to Pickup, linking order staging readiness with geolocation notifications triggered automatically by the retailer’s branded mobile app is an effective way to streamline the Pickup experience into a faster, hassle-free experience,” explained Sylvain Perrier, president and CEO, Mercatus. “Shorter wait times at Pickup can have a dramatic effect on customer perception and brand affinity and will go a long way to encouraging repeat customer behavior.”

This research and the related report are the second in a three-part series. The Omnichannel Shopper Behavior Report (OSBR) 2022 – Volume 2 explores other areas of importance for regional grocers, including methods used to notify the store of the customer’s arrival, the likelihood that Pickup customers will shop in-store on the same trip, and future intent to use a Pickup service during the next year. The OSBR Volume 3 will focus on the ordering stage of the online shopping experience and is to be released later this fall.

For information about how to access the research, go to mercatus.com.

About this shopper research

The custom shopper research from Mercatus was conducted by Brick Meets Click via an online survey on August 25 – 27, 2022 with 1,828 U.S. adults, 18 years and older, who participated in the household’s grocery shopping. The sample was weighted to match current population measures related to age and Census region based on the 2020 American Community Survey from the U.S. Census Bureau. The margin of error for the top-line results was +/- 2.6% at the 95% confidence level.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in customer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets and others.

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise and fact-based analysis to the challenge of finding new routes to success.

Contacts

Media Inquiries

Mark Fairhurst, VP Marketing

Mercatus

media@mercatus.com