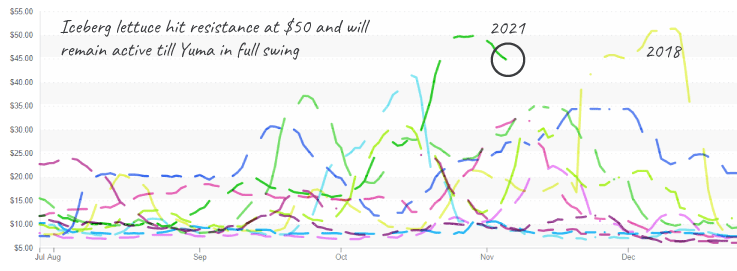

Lettuce markets are in abysmal shape after a series of unfortunate events damaged domestic and Mexican supply.

Yuma, AZ, is running a little late, and growers are eager to make the transition southward. Many Western price lists are now ‘call’ lists, as saleable inventory is scarce.

Impatiens Necrotic Spot Virus (INSV) wreaked havoc on Salinas lettuce fields in 2020, and this year is no better. When combined with other common soil-borne pathogens, the insect-transmitted virus can leave entire fields unmarketable.

According to an article published by Vegetable Growers News, damage from INSV caused at least $50 million in losses throughout 2020 for lettuce growers. In addition, cases of the highly contagious virus are now being spotted in other domestic lettuce growing regions in Arizona and greater California (Imperial Valley).

These photos compare an INSV-impacted iceberg field to a healthy romaine stand near Yuma last season.

Salinas’ lettuce growing season is winding down, and domestic production is picking up in Santa Maria, Huron and Yuma. However, domestic markets will remain tight in response to increasing demand and weak supply for at least three weeks.

In Mexico, heavy rain is causing ongoing quality issues. Overall, romaine and iceberg quality are mixed depending on the growing region.

At $50/case, Iceberg lettuce is barely shy of making USDA price record set in 2018.

ProduceIQ Index: $1.07/pound, -2.7 percent over prior week

Week #44, ending November 5th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Broccoli and cauliflower supply is starting to improve in a small way thanks to increased production out of Santa Maria and Salinas Valley. Broccoli is down -17 percent over the previous week, and cauliflower fell -34 percent.

Still, quality is an enduring issue, with fields becoming unmarketable due to quality issues, such as pin-rot and cat-eye. Expect prices to decline further as domestic supply increases and quality issues decrease.

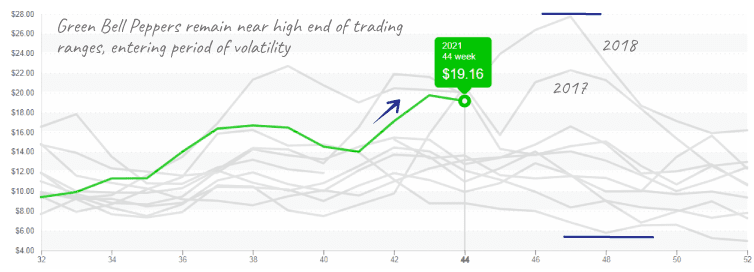

In the East, strong demand and weak supply are keeping green bell pepper markets tight. Georgia’s production of green bells is waning, and Florida has yet to begin in a significant way. Prices are reportedly down -4 percent over the previous week, but at a ten-year high, such a minor decrease is in no way an indicator of increasing supply.

Western bell markets aren’t faring much better. In California, green bell production is in transition, and colored pepper supply is gapping. Coachella production is insufficient to overwhelm demand, and Nogales should begin crossings later this month and through early December.

Bell Pepper supply is low, waiting on Nogales to start with volume.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.