When the pandemic supply chain crunches hit in mid-March 2020, the produce industry braced itself for SKU rationalization.

Were specialties going to suffer? What about premium apples, or the plethora of tomatoes now featured in an abundant category?

During the Produce Marketing Association’s “Retail with the Experts: Outlook on 2021” panel discussion on Feb. 26, retailers gave perspective on what caused the reduction in SKUs, and what to expect in 2021.

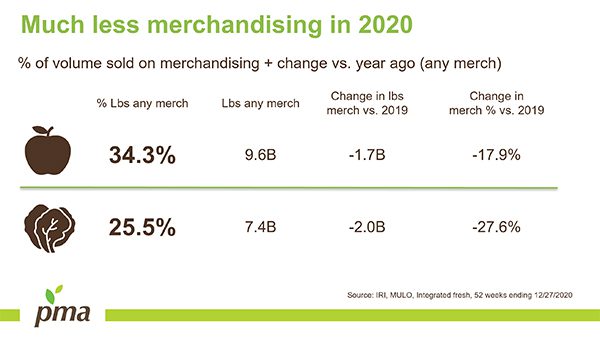

Anne-Marie Roerink, president of 210 Analytics, presented IRI data showing a drastic decrease in items sold on merchandising.

“When I was typing these numbers, I had the number 44 percent in my mind, and that’s what it’s been for years,” she said. “So when I started typing 34 percent for fruit and 25 percent for vegetables, I thought this is insane.”

The volume of vegetables sold on promotion in 2020 was down 28 percent, and fruit was down 18 percent. That’s a major challenge for the produce department, which sees a large percentage of sales on impulse, said PMA’s Joe Watson.

“Since fresh produce largely is successful on those merchandising and impulse sales, and certainly promotion…how do we gain that back,” Watson asked.

Shawn Perry, vice president of produce and floral for Albertsons, Boise, ID, said the reduction in SKU count wasn’t a permanent change.

“It wasn’t really a SKU (rationalization),” he said. “It was a temporary suspension, and we had to do it to get produce through the door.”

Albertsons, like many retailers, had to get creative to get stocks in the height of pandemic supply chain challenges, like get alternative sources, foodservice distributors, healthcare products.

“Even after we were able to get back in business, our items came back to 100 percent within the first 90 days,” he said.

SKUs are constantly evaluated, with some general guidelines, he said.

“I coach my divisions for every 100 stores, if you’re selling less than 25 cases a week on a fresh item, does it move to a specialty order guide, should it just be discontinued, or replaced with some new innovations,” he said.

SKUs have jumped from about 500 to around 1000.

“We’ve doubled our SKU count, but we haven’t doubled our labor,” he said. “Our productivity expectations are a lot higher today than they were 20 years ago, so we have to continually be challenging ourselves on assortment optimization.”

Some items are really performing well in the pandemic era, he said.

“There’s been a lot of new habits that have been created with all the cooking at home,” he said. “You know, you look at the herb category, specialty produce, the flavor potatoes – all double-digit growth outpacing produce by over double what they’ve done.”