A snapshot look at the data explains how the fresh avocado market in the U.S. remains strained under pressure to deliver enough volume for the consumer demand, but prices have come down in the last month.

Ag Tools, an Irvine, CA-based technology company that tracks real-time data for growers and buyers of more than 500 fresh fruits, vegetables, herbs and nuts, has given permission to Blue Book Services to analyze and reference their data over the next several weeks. We plan to provide snapshots of data for various fruits and vegetables.

F.o.b. prices have softened a little from a month ago, when Mexican 2-layer cartons of hass were $80-90 for most sizes. On July 19, prices were $65-72 for 32-36s; $62-69 on 40s; $58-66 on 48s; $50-58 on 60s; $45-54 on 70s and $28-36 on 84s.

Likewise, California hass prices are a little lower than a month ago, when prices were $70-80 per 2-layer carton on most sizes. Ag Tools reports July 19 prices are $62-72 for sizes 32-40; $60-70 for 48s; $55-66 for 60s; $54-64 for 70s; and $30-40 for 84s.

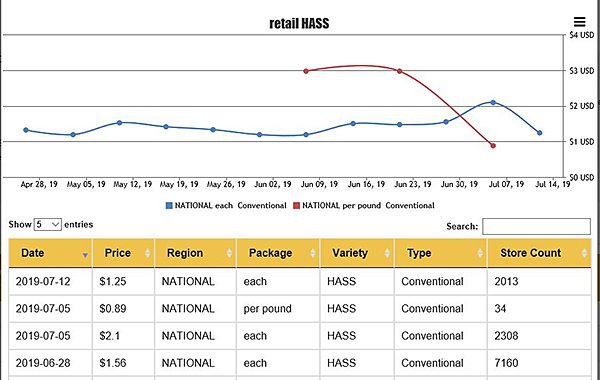

Retail prices peaked around Independence Day at above $2 per pound nation-wide, but it’s since dropped to $1.25 each by July 12. Retail hass avocado prices have remained above $1 each for the last three months.

Year to date through July 19, Mexico has shipped 1.148 billion pounds of avocados to the U.S., 4.01 million more than 2018, accounting for 80.2 percent of avocados in the U.S. market. California has shipped 152.03 million pounds, 112.7 million less than last year, accounting for 10.6 percent of the market. Peru has shipped 78.5 million pounds, up 46 million pounds from last year, making up 5.5 percent of the market, and the Dominican Republic has shipped 33.8 million pounds, down 1.7 million pounds from last year.