Spring transition looms over produce prices. The ProduceIQ index is up +6 percent over the previous week, in line with historical pricing trends for week #11.

Warming temperatures necessitate a shift in sourcing, as production slows in old regions and picks up in new ones. This period of supply volatility is expected to push prices higher over the coming weeks—though with a bit of luck, some markets may find stability sooner rather than later.

Over the weekend, a powerful storm swept across the U.S., bringing severe weather and wildfires. Rain and snow battered California, while hail and tornadoes struck the South. Strong winds fueled uncontrollable wildfires in Oklahoma, and in Texas, gusts reaching 85 mph overturned semi-trucks.

These extreme conditions disrupted transportation and left key growing fields in California and the Southeast windburned and waterlogged. As a result, prices for commodities such as strawberries, raspberries, and lettuces are expected to see minor impacts.

ProduceIQ Index: $1.17/pound, + up 6.4 percent over prior week

Week #11, ending March 14th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

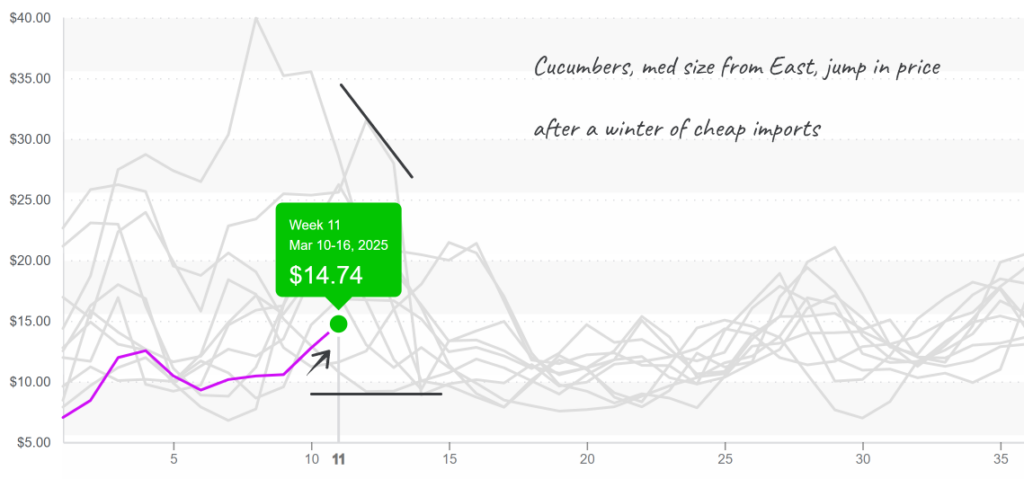

After a winter of abundant imports, cucumber markets are now tightening—perhaps a reminder that the “luck of the Irish” doesn’t always extend to produce pricing. Cucumber prices are up +35 percent over the previous week. Low supply in the West due to a regional transition in Mexico is fueling price increases. Large price fluctuations aren’t uncommon for March, volatility in cucumber markets is normal in week #11 as fickle Spring weather destabilizes supply.

Averaging $16, slicing cucumber prices are above average and may increase over the next two weeks before declining. The price of other varieties, such as Persian and long seedless cucumbers, have been trending above average for a few weeks and may surge as well over the next few weeks.

Cucumber prices begin to rise after a winter of abundant supply of imports

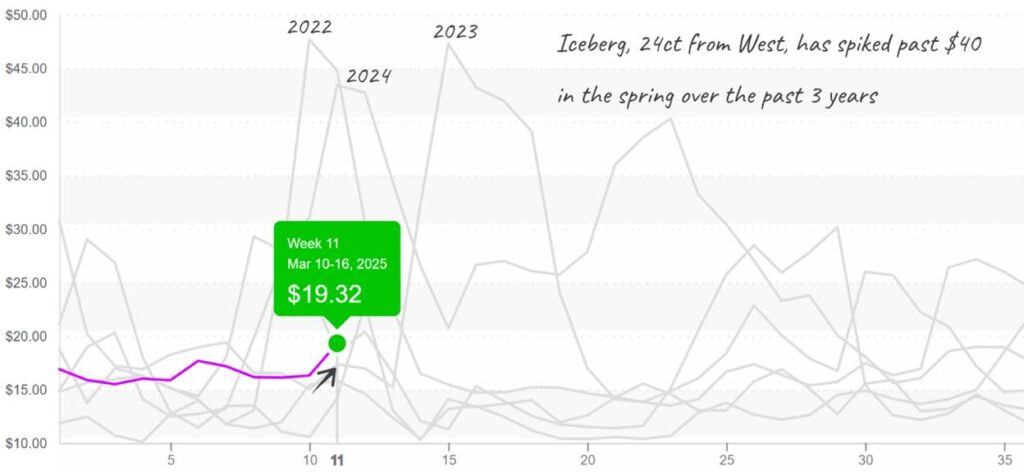

Infamous spring volatility is grasping at lettuce markets. Romaine and iceberg supply is down over the previous week as capricious Mother Nature prompts the annual transition from Yuma, AZ, to Salinas, CA. Fortunately for buyers, average prices remain well below typical levels for week #11, leaving room for further price movement.

Iceberg, 24ct from West, increases to $19.

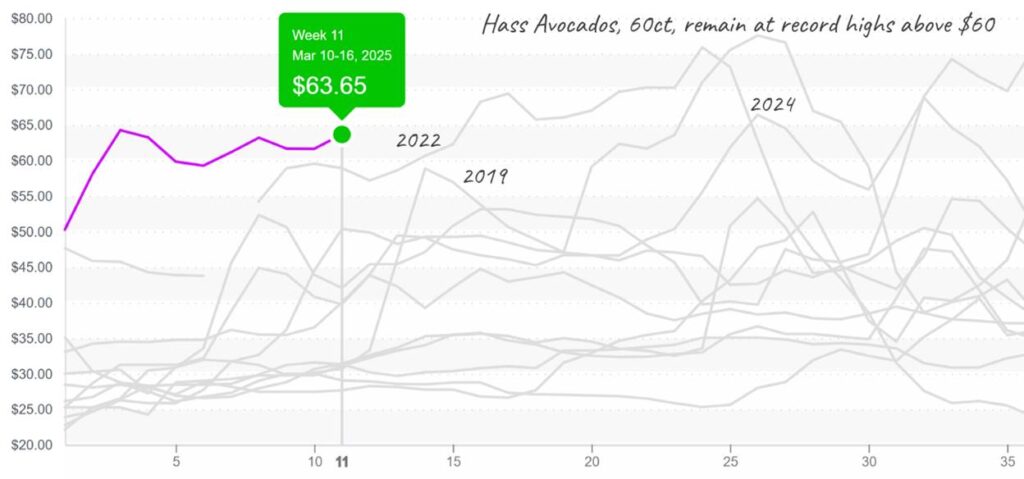

Hass avocado prices stubbornly refuse to yield. At $66, average Hass prices are at a 10-year high by a significant margin.

Mexican avocado exports are historically low for week #11 and prices will likely continue to rise, or at least stay the same, as Mexican production withers. For budget-conscious buyers, smaller-sized avocados (60-count and smaller) offer slightly lower pricing.

60ct Hass Avocados are slightly lower priced, yet remain above $60 for most of 2025.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.