The Thanksgiving pull has arrived, and produce markets have more than a few things to be grateful for.

Tropical Storm Sara may have left parts of Guatemala, Honduras, Belize, and Mexico last week with infrastructure damage and crop losses from substantial rain.

Still, at least the storm will not become a threat to weather-worn Florida as initially forecasted. However, the ripple effects of past hurricanes and poor growing conditions across regions continue to pressure several key crops.

ProduceIQ Index: $1.21/pound, up +0.8 percentover prior week

Week #46, ending November 15th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

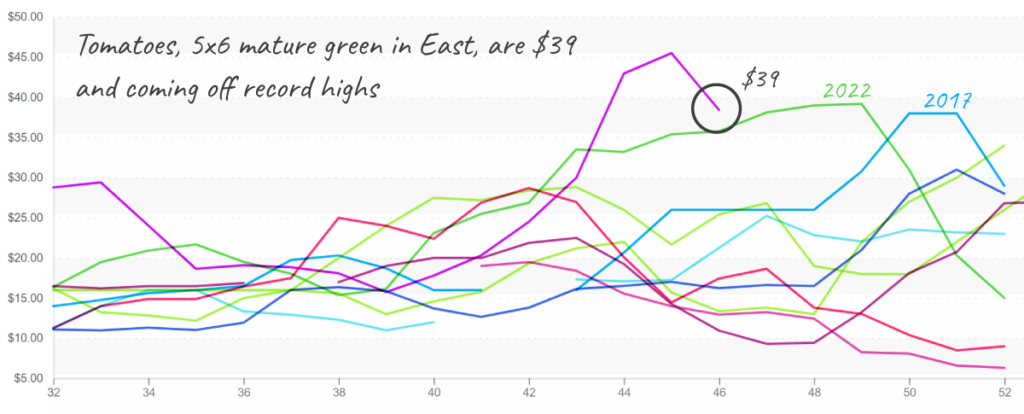

Tomatoes grabbed headlines this week when Chinese scientists announced they’d ended the quest for the perfectly sweet round-type tomato. The news is somewhat of a tease for supply-hungry tomato markets. This CRISPR-created variety of tomatoes won’t be ready for consumers for five years.

Average roma and round-type tomato prices are still on the higher end of the historical spectrum. Elevated prices persist due to crop loss from Hurricanes Milton and Helene in the East and weak Mexican supply. Expect elevated markets through the holiday season.

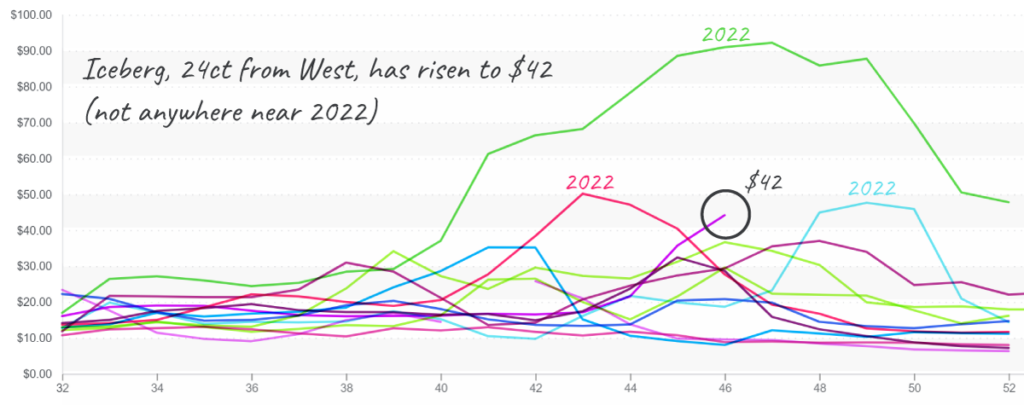

Iceberg and romaine lettuce prices climb as the sun sets on production in the Salinas Valley, and Yuma slowly comes to life. Last week’s cold front will reduce insect pressure on remaining suppliers in the Salinas Valley but will likely curb yields in Yuma. Prices for both commodities are forecasted to remain elevated through the first week of December.

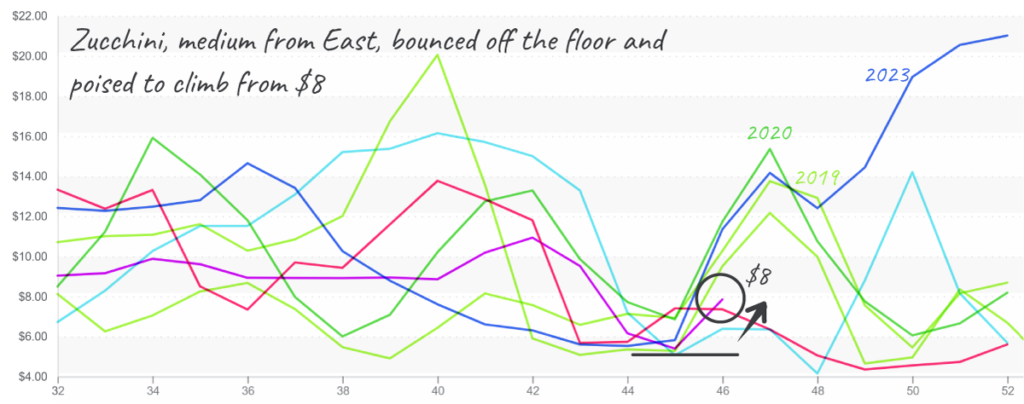

In line with previous Thanksgiving pull trends, average squash prices are up significantly over the previous week as the holiday rapidly approaches. Unlike previous years, damage from back-to-back hurricanes in the Southeast and poor growing conditions in Mexico are strangling supply. Expect tight supply and escalated markets over the next few weeks.

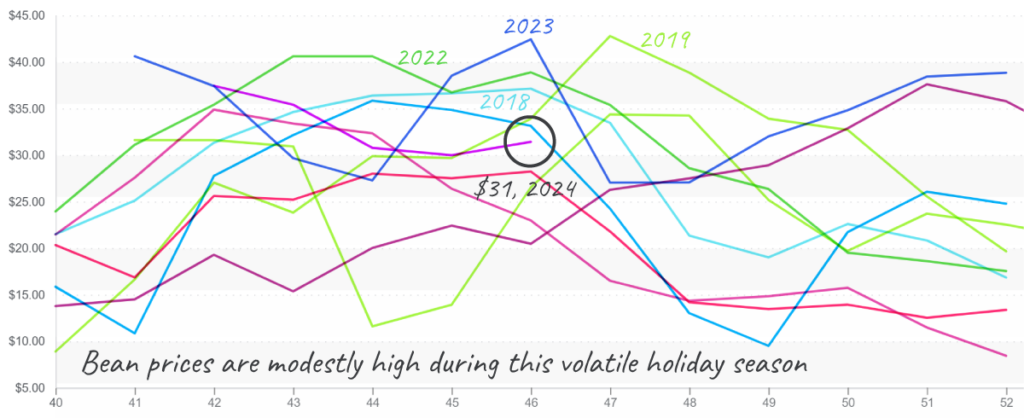

Despite ominous predictions about the state of bean supply this Thanksgiving, average prices are only moderately high for week #46. Bean Markets are up +5 percent over the previous week. Cooler demand combined with strong Western supply won’t entirely cover the gap in supply left by devastated bean growers in Georgia and Florida, but it may keep prices surprisingly normal.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.