This is the monthly GuestXM restaurant report from Black Box Intelligence March 2024:

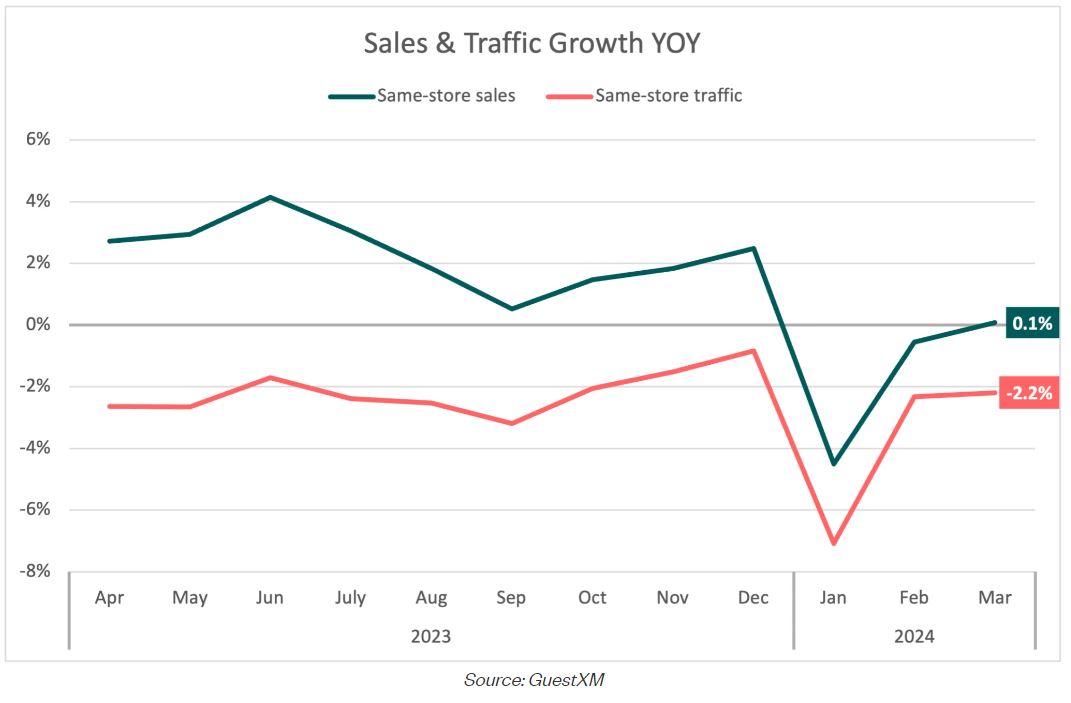

There is little doubt that restaurant sales growth has slowed down this year. March’s year-over-year (YoY) same-store sales growth was 0.1%. The good news is that this was the first month of this year the industry has been able to post positive sales growth.

In fact, March’s YoY sales growth was 0.6 percentage points greater than February’s YoY growth rate and 4.6 percentage points greater than January’s.

However, given that January and February were likely negatively impacted by the weather, optimism resulting from March’s results should be moderated. Furthermore, excluding the first two months of 2024, March was the weakest month for same-store sales growth in restaurants in the last three years.

Same-store traffic growth in March was -2.2%, which represented a very small 0.1 percentage point acceleration in this growth rate since February. Excluding the first two months of 2024, the last time the industry experienced worse YoY traffic growth was in the July through September period of 2023. But while traffic growth has softened compared to where it was during the last three months of 2023, the decline in sales growth has been even larger.

The reason is the rapid deceleration in average check growth, which increased by just 2.5% YoY in March, compared to a much higher average of 3.6% for the months in Q4 of last year. Pre-pandemic, average check growth in the 3% to 4% range was normal, which means this year we will be very likely experiencing relatively low check growth driven by conservative menu price increases, more reliance on value offerings from restaurants, and guests lowering their spending by managing their orders.

This is especially important given the inverse relationship that exists between traffic and check growth. As economic conditions soften through Q3 of this year, which seems to be the consensus from economists, lower-than-normal check growth will help prevent restaurant traffic from plummeting.

Quick Service Remains the Top-Performing Segment

Part of that effort from consumers to manage their spending comes in the form of trading down to less expensive options when dining out or ordering from restaurants. And the quick-service segment is in a prime spot to benefit from those trade-downs. The data suggests this may be in fact what is happening, with this segment remaining at the top based on same-store sales growth for the last nine months.

Fast casual, the other segment classified under limited-service restaurants, is also performing better than most, but this is most obvious when looking at traffic growth. This segment has had relatively low check growth, which means it has enjoyed a smaller lift in sales growth than quick service. But their number of transactions suggests they may also be benefiting from some of those trade-downs among consumers. Fast casual’s same-store traffic growth was the highest for the industry in the period between November and February and came in second place from August to October.

Over the past four years, inflation has gone up 21%—an increase not seen in decades. Restaurants have had no choice but to raise prices. And raise prices again. And again. And again.

This rampant check growth has made sales statistics noisy and, therefore, a less reliable gauge of a brand’s overall health. A restaurant may see great sales growth merely because it took on so much check. But as consumers grow more price-conscious, this short-term victory may be pyrrhic. Consequently, for many brands in this post-pandemic economy, traffic growth has become the primary measure of success.

The Best vs. the Rest in Traffic Growth

How does a restaurant achieve great traffic growth? Rather than speculating, we should consider what actual customers are saying. Connecting restaurant units between Black Box Financial Intelligence and Black Box Guest Intelligence allows us to compare the reviews of those restaurants with the best traffic relative to their local peers with the rest of the field.

Not surprisingly, restaurant units with the best traffic growth had better food, service, and value net sentiment scores (net sentiment is the difference between the percentage positive and percentage negative for each category).

Service scores mattered much more in full service than limited service. Full-service restaurants with the best traffic had 5% better net sentiment than the rest. In limited service, the differential was only 1 point. Digging in a little more, full-service restaurants with the best traffic had 7% higher attentiveness, 6% higher experience, and 5% higher speed scores.

When it comes to food, full-service customers cared a lot about quality, and limited-service customers wanted the food’s temperature to be right. However, portion mattered more than any other food subcategory in both restaurant categories. Units with higher traffic had 8 points higher portion scores for full service and a massive 34-point difference in limited service.

Value Meals

The narrative continues when we look at value net sentiment scores. Value scores were a bigger separator than both food and service. Restaurant units with great traffic averaged 7 points higher value net sentiment scores in full service and 11 points higher in limited service.

In this inflationary environment, value has become a key metric. Detailed in our April 2023 blog post, the brands that saw the most improvement in their value net sentiment scores over the past four years had 1.5 times better sales growth and an enormous 8 times better traffic.

It is crucial to realize, however, that check growth and value are not perfectly associated. In fact, in Q3 2023, half of all the brands above the median in value net sentiment were also over the median in check growth YoY. Price is only one aspect of the value score.

Restaurants with the best value scores outperformed their peers in guest sentiment related to portion (which was found to be the biggest differentiator), service, quality, speed, and cleanliness.

Value doesn’t mean “Is the price high or low?” but rather “Was my food and experience worth the price?” So as brands struggle to give customers the price they want, they should focus on delivering the other parts of the value equation.