It might just be the ample amount of time I spent listening to fire and brimstone Southern Baptist preachers, but between the persistent media buzz about the total eclipse and the 17-year cicada emergence just days away in the Southeast and Midwest, Week #14 is feeling spattered with a bit of apocalyptic verve.

So, to kick off this week’s newsletter and combat the doomsday energy, here are a few commodities having a perfectly average, nothing-out-the-ordinary week.

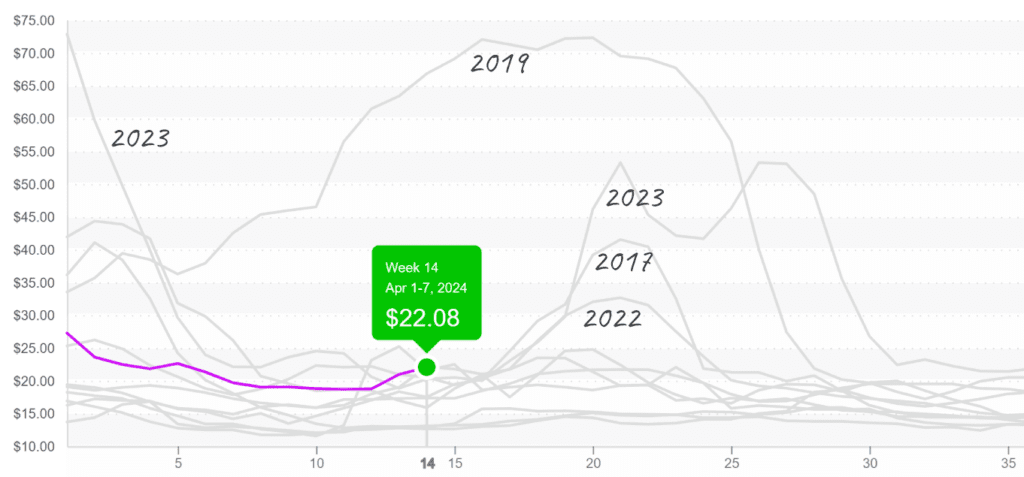

Avocados are near average for week #14. Markets are feeling a little pressure due to strong demand for larger-sized fruit, but nothing unprecedented for this time of year.

Celery season in Yuma, AZ, has ended, and week #14 prices are average compared to the last 10 years of USDA data. Demand is strong, and supplies are adequate.

ProduceIQ Index: $1.31/pound, up +2.34 percent over prior week

Week #14, ending April 6th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Celery (Western, 18ct) prices are $22, which is within the normal range given inflation. Seasonal volatility begins in 4-6 weeks.

Strong squash supply on both coasts is holding prices a bit lower than the average, but no records are in danger of being broken yet.

We can’t justify writing a newsletter without any “newsworthy” content. So, in the words of woke millennials everywhere, trigger warning: the rest of this newsletter may provoke feelings of panic for those who have a strong aversion to disasters of biblical proportions, such as drought and/or floods.

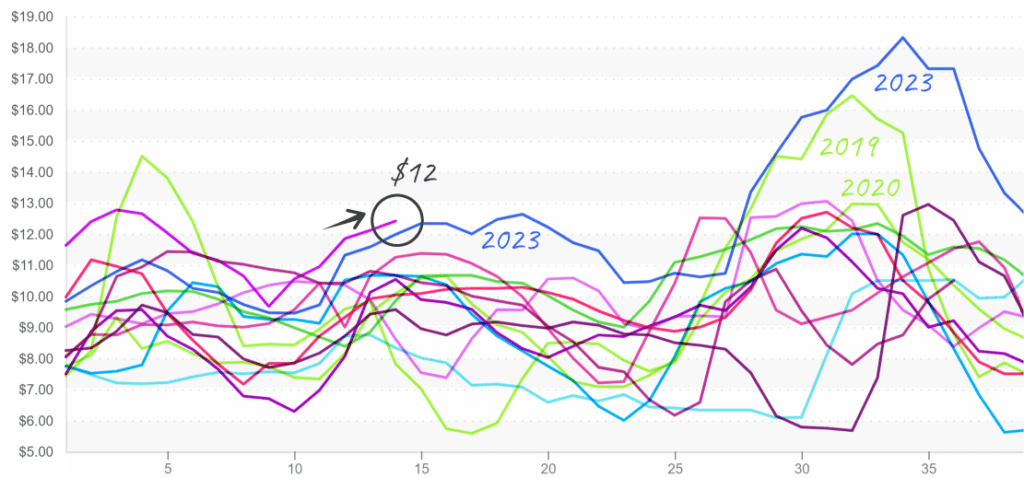

At $12, stratospheric pineapple prices continue to plague buyers. Since 2023, pineapple markets have defined a new normal as less-than-ideal growing conditions hamper growers’ efforts to increase yields in Costa Rica, the U.S. market’s leading supplier.

El Niño is exacerbating drought conditions in the country. Watersheds were not replenished in 2024’s wet season, and this year’s dry season is exceptionally arid. In addition, the same vessel delays impacting grape markets also affect pineapple supply.

Larger-sized fruit, 5/6/7, are extremely short but can be substituted for smaller fruit. The dry season is ending, and hopefully, the forecasted shift to La Niña over the summer will bring much-needed relief to the country’s water supply.

Pineapple (East Coast, 7ct) prices pass $12, maintaining record highs for week 14.

Strawberry prices are up +30 percent over the previous week. Inundated by rain and wind, growers in California are working to increase yields. In the East, Florida is nearly finished. As growers in Northern California ramp up production over the next few weeks, supply should increase and prices ease.

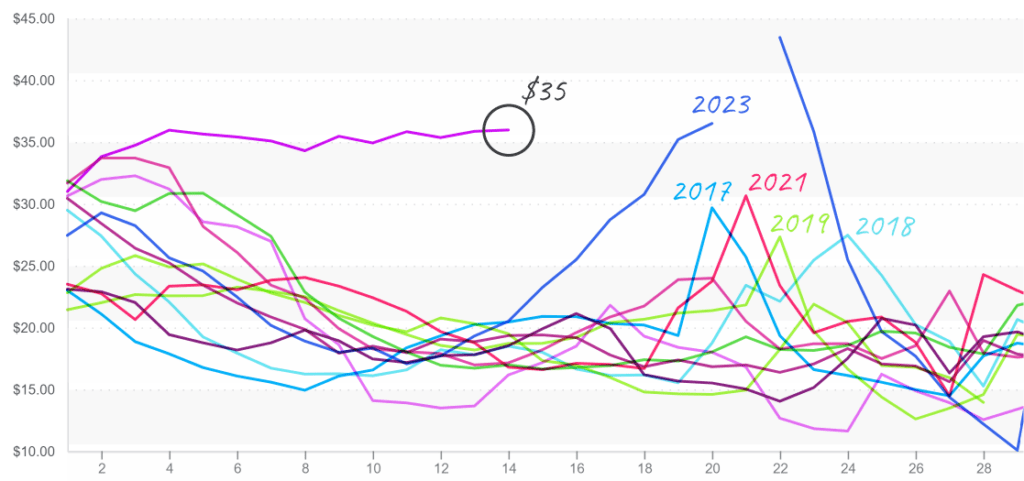

Record-breaking grape prices inch higher. Inconsistent vessel arrival won’t allow prices to come down despite improving supply. Fortunately for buyers, hope is on the horizon, with Mexican growers starting in May.

Table Grapes (red varieties) remain level at record prices of $35. Time of seasonal volatility approaches over the next 6-8 weeks.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.