California has turned into a real-life snow globe. Up to ten feet of snow is expected in parts of the Sierras. Although the late winter storm will impact logistics throughout the state for a few days, the snowpack and rain will only benefit the industry in the dry season. Skiers are happy, too. Before the snowstorm, snowpack was only 66 percent of normal.

Meteorologists have altered the temperature outlook for March slightly. No longer is the Southeast expected to experience a cooler-than-average spring. Now, cooler-than-average weather is in the forecast for the West, and significantly higher-than-average temperatures are forecasted for the rest of the country.

This means fruit growers throughout the Midwest and East will be on their toes. Early spring can leave fruit trees especially vulnerable to damage when an inevitable cold spring snap startles fruit trees in full bloom.

Another concern for fruit tree growers in the Eastern half of the U.S. is reduced cold hours. February saw some of the highest average temperatures on record in states outside the extreme Southeast. As a result, yields may be lower and fruit less sweet.

ProduceIQ Index: $1.18/pound, down -5.6 percent over prior week

Week #9, ending March 1st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Citrus production in North America is transitioning northward. Average citrus prices are at a ten-year high due to long-awaited but disease-breeding rain on the West Coast and strong demand. Down -11 percent over the previous week, average citrus prices are declining slightly due to an increase in volume from Mexican growers. However, the reprieve is forecasted to be short-lived.

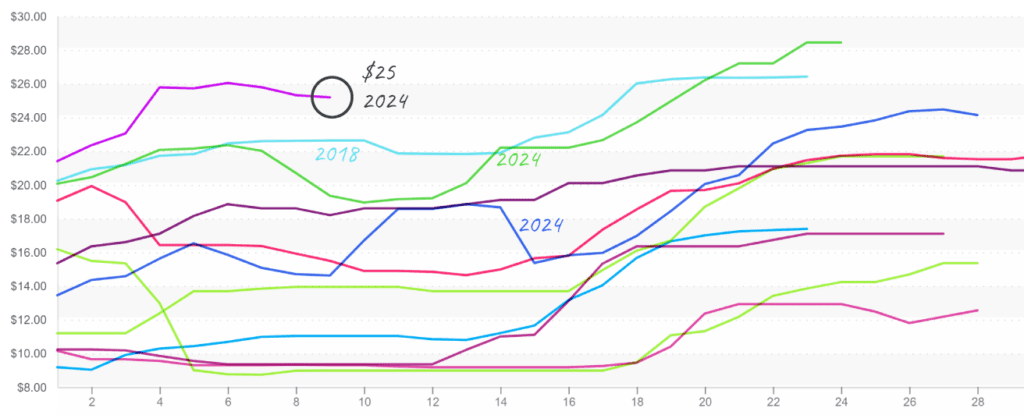

Navel Oranges (138ct) from the West softened around $25, remaining at historical highs.

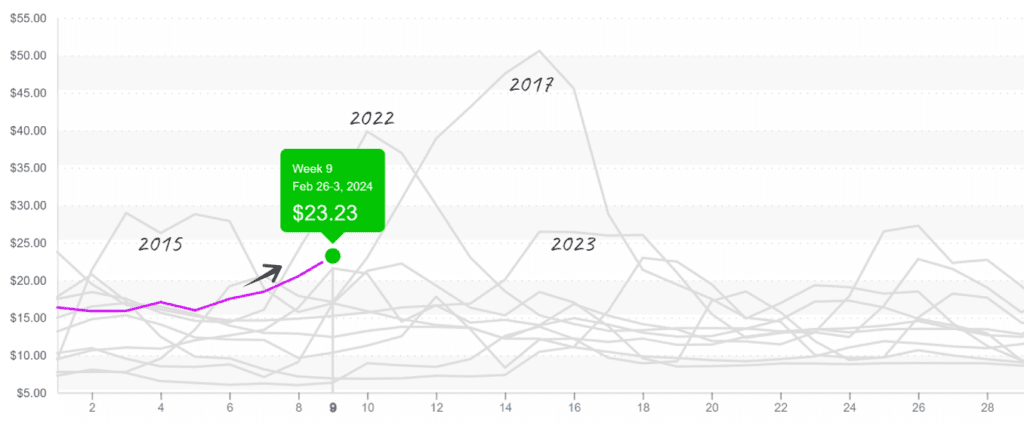

At $23, Romaine lettuce prices clinch the second-highest slot for week #9 in the last ten years. Rain has left product vulnerable to quality issues such as mildew and peel. Last week, reported yields from Western growers were low, but nothing unheard of for this time of year. If the weather cooperates, prices should follow iceberg’s lead and soften this week.

Romaine (24ct) is on a steady rise and enters a time of seasonal volatility.

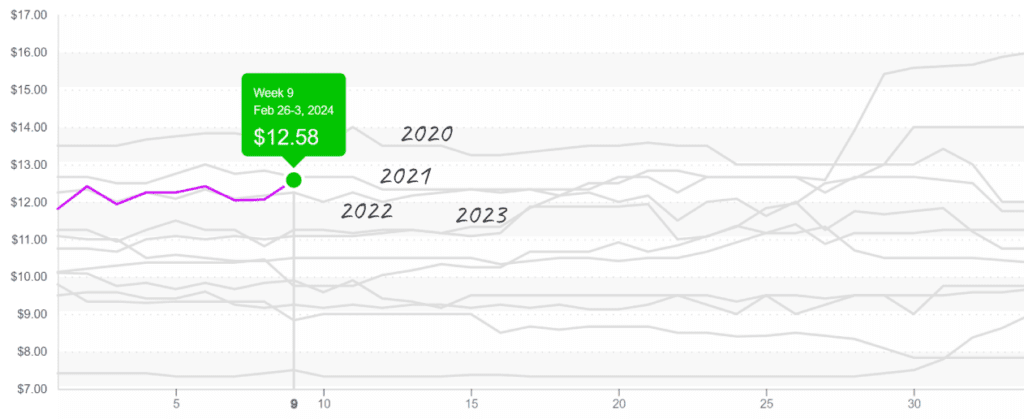

Sweet potato prices are relatively stable and mostly avoid the headlines. But we can’t ignore this undervalued staple. Swelling production costs in North Carolina are decreasing incentives for growers to plant more acres. As a result, yields have consistently decreased over the last two years, and f.o.b. shipping point inflation is also evident.

Easter is the next significant bout of holiday pull for sweet potato markets. Thus, prices will likely climb throughout March to keep up with rising demand.

Sweet potato prices in the East are hovering between $12 -13, not the most volatile commodity in our industry.

At $26, raspberry prices defy historical trends for week #9. Good news for buyers: record-high prices aren’t forecasted to last very long. Mexican export volume is down considerably but is projected to ramp up quickly over the next few weeks.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.