This is the monthly GuestXM restaurant report from Black Box Intelligence:

January offered little clarity in terms of the current health of the restaurant industry from a year-over-year growth perspective. Several factors added noise into the data, contributing to results that were much more negative than expected, painting a bleak and inaccurate picture for the industry.

The biggest factor was the weather. Large areas of the country experienced unusually cold weather fronts or rainfall during January, negatively impacting restaurant sales and traffic.

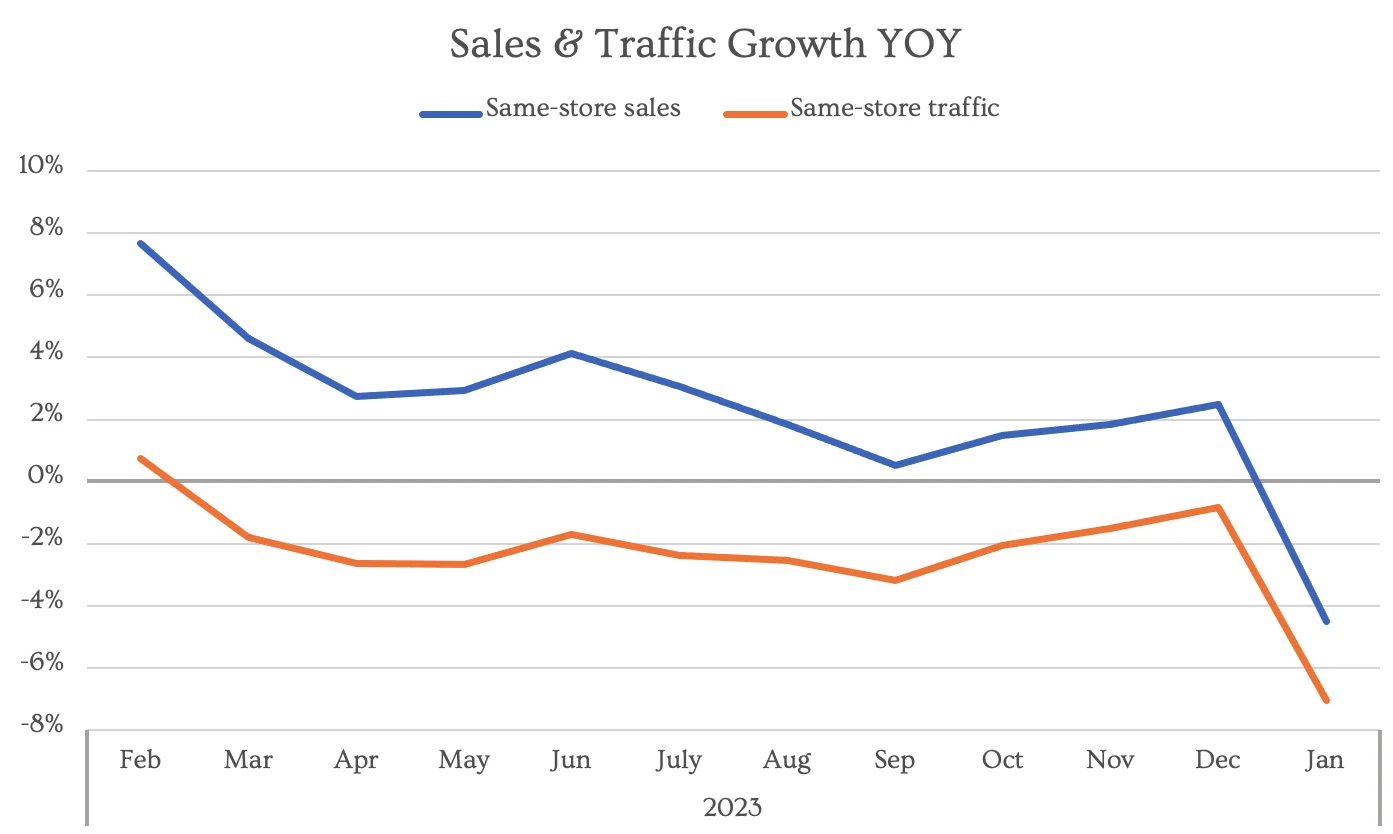

Same-store sales growth was -4.5% for the industry in January, which represented a sharp drop of 7.0 percentage points compared to the previous month’s performance. This was the weakest month based on sales growth since February of 2021. Traffic also experienced a significant year-over-year slowdown during the month. Same-store traffic growth was -7.1%, representing a 6.2 percentage point fall compared to December.

However, it is important to note that December saw the completely opposite effect, with restaurant sales and traffic growth year-over-year being lifted by unusually mild weather during the month. But averaging the performance for the two months still results in relatively soft performance for the industry.

Same-store sales growth for December of 2023 and January of 2024 averaged -1.0%, while same-store traffic growth averaged -4.0%. For context sales growth averaged +1.3% during the period between September and November of 2023, while the average for traffic growth was -2.3% during that same period.

Average guest check growth year-over-year reached +3.0% in January, which is the seventh straight month of deceleration in this metric and represents the weakest check growth in more than three years. An expected decrease in check growth this year is set to hamper sales momentum, further aggravated by an ongoing decline in year-over-year traffic. Consumer spending could taper off as pandemic stimulus aid wanes, with credit card balances climbing amidst a rise in delinquencies, hinting at financial strains among consumers.

Limited-Service Restaurants Continue to Perform Better

All industry sectors faced declines in same-store traffic in January, with year-over-year traffic growth rates deteriorating from December. While most segments experienced a consistent slowdown in traffic growth, fine dining witnessed a double-digit decline compared to the previous month. This trend suggests that experience-driven dining establishments were particularly impacted by severe weather conditions.

Limited-service restaurants, specifically quick service and fast casual establishments, once again stood out as the top performers in terms of traffic growth. These segments have consistently led in traffic growth for the past three months. It is anticipated that consumers will persist in adjusting their spending habits amidst increasing economic strains by shifting away from full-service restaurants – especially family and casual dining options – and allocating more of their budget to limited-service establishments.

Restaurants in Regions Hit Hardest by Abnormal Cold Weather Experience Decreased Performance

During January, every region across the country experienced a noticeable decrease in year-over-year traffic growth. The areas least accustomed to harsh cold weather faced particularly challenging conditions due to the unusually severe weather patterns. Specifically, the Southwest, Mountain Plains, Southeast, and Texas reported the most significant declines in same-store traffic growth.

Conversely, regions blessed with milder temperatures, like New England and California, demonstrated more resilience and performed relatively better during this period of comparison.