From kayaking in one of the driest places on earth, Death Valley National Park, to 70-degree highs in places like Omaha, NE, and Chicago, weather is the most exciting thing to discuss. We should probably change the title of this article to Weekly Weather Highlights.

Spring is arriving early across parts of the United States. Areas below the Mason-Dixon Line are already reporting Spring foliage. How will the unprecedented heat affect long-term forecasts for the fresh produce industry?

Well, since you asked, the warmer-than-usual weather paints a frightening picture of what could be ahead for 2024’s hurricane season. Growers of summer crops may be tempted to plant early this year.

The El Niño weather phenomenon is fading, and La Niña is forecasted to begin again sometime this summer. Growers and buyers across the U.S., but especially in the South, will have to be prepared for a very active season and the related market volatility.

ProduceIQ Index: $1.25/pound, down -3.9 percent over prior week

Week #8, ending February 23rd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

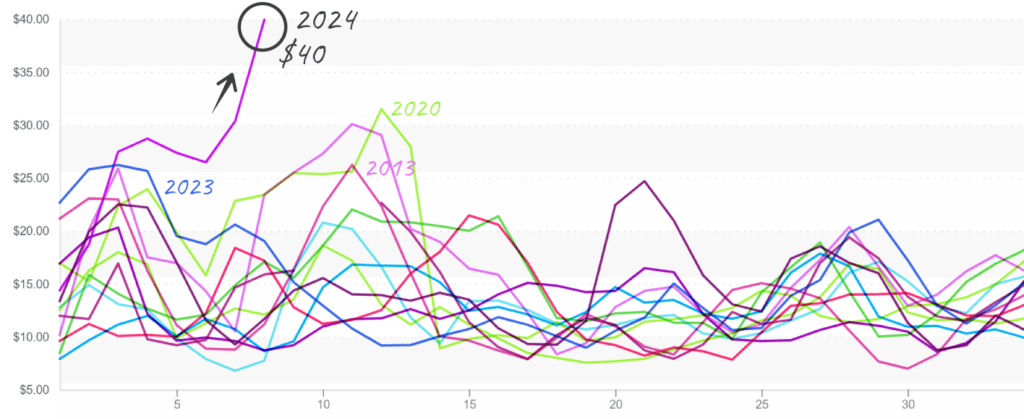

At $40, average cucumber prices in the East are seizing an unprecedented high. Supply is light on both coasts, and demand is strong. Like last year’s week eight supply situation, Mexican volume and East Coast imports from Honduras are significantly below the norm. With Florida’s producers still two weeks out, the sky is the limit for cucumber prices.

Cucumber prices rocket to new levels during a gap after mid-winter production.

The sun may finally shine in the western growing regions, but lettuce markets are still visibly downtrodden after the last two weeks of heavy rain. Obviously, defects such as epidermal peel, blistering, and discoloration are common in lettuce commodities such as romaine and iceberg.

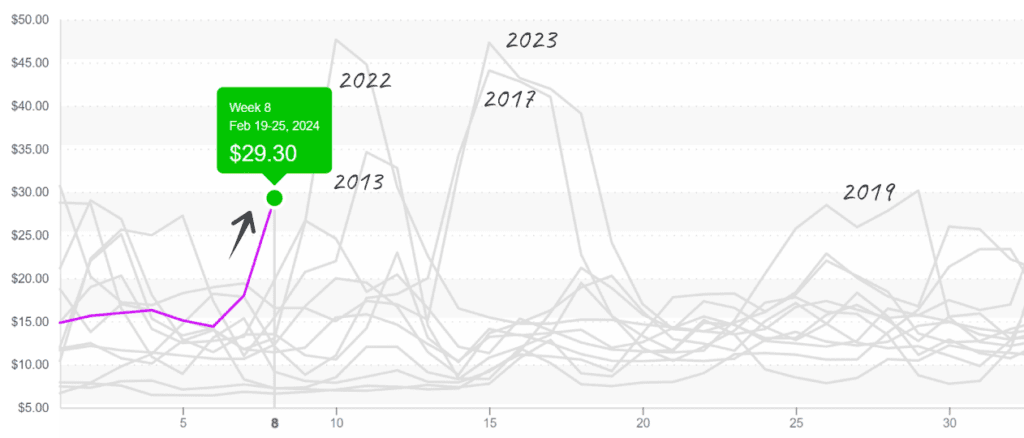

Iceberg prices are up +62 percent over the previous week to a ten-year high, and romaine is up +22 percent. However, supply and prices should quickly recover with more favorable forecasted growing conditions.

Iceberg (24ct wrapped) prices from the West surpass $29, spiking earlier than normal Spring volatility.

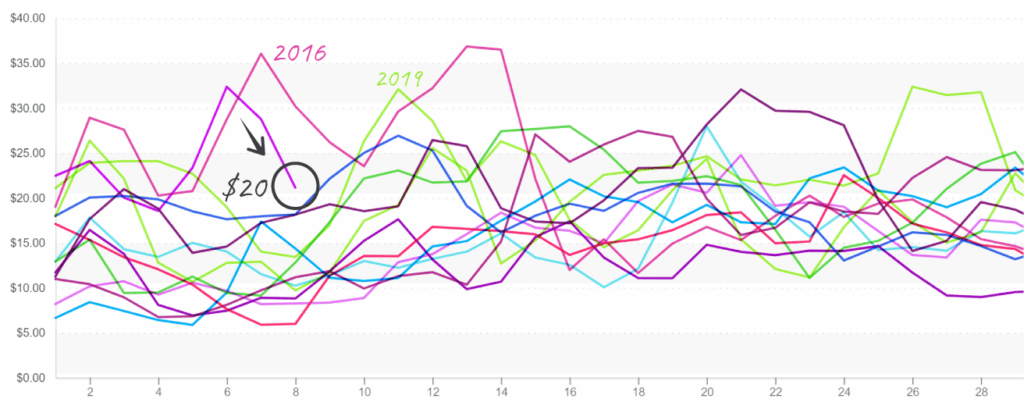

Speaking of recovery. Bell pepper markets have practically joined AA. Surprisingly, supply for green or colored bells hasn’t improved noticeably, but demand has cooled to the point of dropping average prices -27 percent over the previous week. Going forward, expect supply to increase steadily as growing conditions improve in the East and West.

Bell Pepper (XL) prices in the East descend to $20 after Florida warms up.

Average tomato prices are up +22 percent over the previous week due to supply shortages for round and Roma varieties. Historically low yields from growers in Florida and Mexico are vaulting tomato prices to a ten-year high for week #8. However, prices for grape and cherry varieties are trending downward due to increasing supply.

Despite lighter than average Eastern supply, sweet corn prices are finally declining. At $31, markets barely hold a ten-year high for week eight. Barring any major weather events, increasing supply from growers in the West should continue to bring prices down over the next few weeks.

Please visit our website to discover how our online tools can save time and expand your reach. [hyperlink:

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.