California can’t shake the gray. The deluge and flood risk should lighten up by Tuesday, but there is a high chance of isolated showers continuing through Wednesday. Later in the week, that same system of storms is forecasted to bring more rainy and wintery weather to the East Coast.

How will the last few weeks of wet weather impact the state’s snowpack and reservoir levels? Data shows that the snowpack is still lagging behind the average, but with more moisture in the long-term forecasts, levels will likely catch up in March.

ProduceIQ Index: $1.30/pound, down -1.5 percent over prior week

Week #7, ending February 16th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

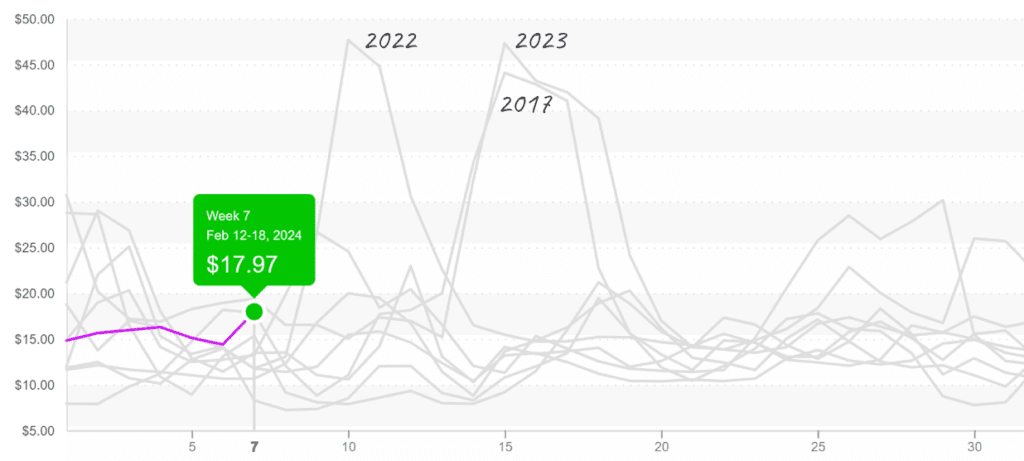

As a result of heavy rain and cooler temperatures in the West, lettuce markets are experiencing some quality issues. Yields are down for iceberg, romaine, and tender leaf commodities.

Prices are on the rise. Iceberg is up +26 percent over the previous week, and romaine +9 percent. Quality issues such as rot, blistering, yellowing, and epidermal peel are heavily reported. Expect prices to escalate this week as growers endure another round of rain.

Iceberg (24ct film-wrapped) prices reach $18 and enter a period of seasonal volatility.

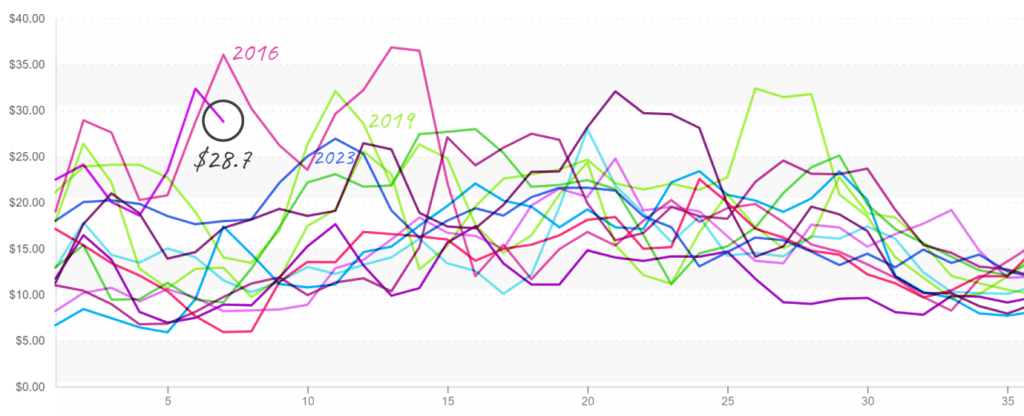

Despite challenging growing conditions, bell pepper prices are down over the previous week. Increasing green bell supply is alleviating pressure for overextended markets. However, colored bells are still extremely tight.

Week #7 yields from Florida are down 30 percent over the previous year but aren’t entirely at fault. Floridians are shivering through their own rainy and cold weather. Yields from both Florida and Mexican growers are noticeably below the historical precedent. Supply should slowly improve over the next few weeks.

Green bell peppers (XL) fall below $30, the highest price since 2016

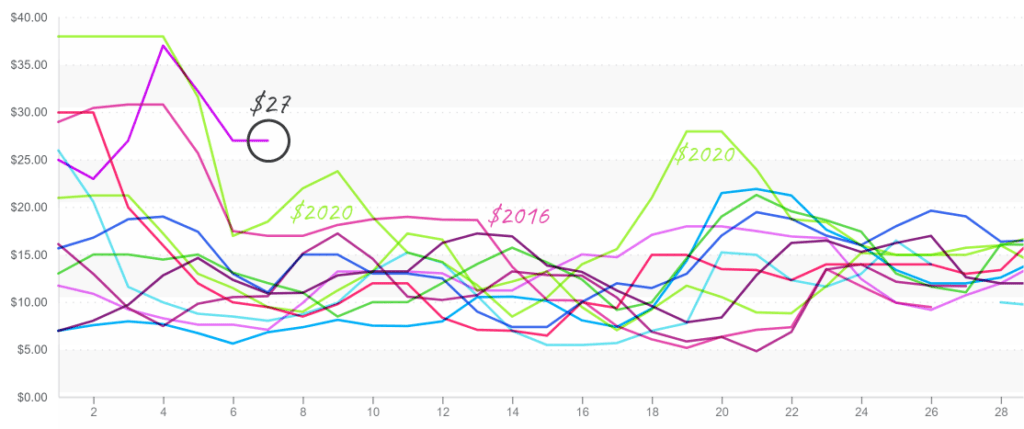

Rain in Mexico and lower-than-average temperatures in Florida are suppressing round tomato yields. At $23, round tomato prices are at a ten-year high. Prices seem on track to replicate and maybe surpass 2020’s historic February prices.

Tomato prices (5×6, 25lb from East Coast) are at record highs, $27

No, you aren’t seeing things, those cherries are on sale at your local retailer. The second-largest Chile export season on record has pushed prices to a ten-year low. Enjoy this rare opportunity for promotion on an out-of-season commodity.

Please visit our website to discover how our online tools can save time and expand your reach.

ProduceIQ is an online toolset designed to improve the produce trading process for buyers and suppliers. We save you time, expand your opportunities, and provide valuable information to increase your profits.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.