Active tropics are still plaguing fresh produce supply chains. Hurricane Lidia made landfall as a powerful Category 4 Hurricane off the Southwestern Coast of Mexico last week and was closely followed by Tropical Storm Max.

Lidia hit landfall in Jalisco and Max further south, both to the west of the avocado region of Michoacan. Although the storms avoided directly impacting active growing/harvesting regions, rain, and wind battered growing regions in Central Mexico. Approximately 4-8 inches of rain fell in Southern portions of Sinaloa.

There is another area of interest in the Atlantic Ocean. The tropical disturbance is forecasted to develop into a named storm this week. However, forecasters predict a cold front will keep the storm off the mainland.

ProduceIQ Index: $1.08/pound, down -13.0 percent over prior week

Week #41, ending October 13th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Significant decreases in the mixed berries category are finally leveling out index prices. Raspberries, blueberries, and strawberries are down notably in price over the previous week. However, blackberries remain high. The supply of strawberries and raspberries is slowly increasing from Mexico and will steadily bring down prices over the next few weeks.

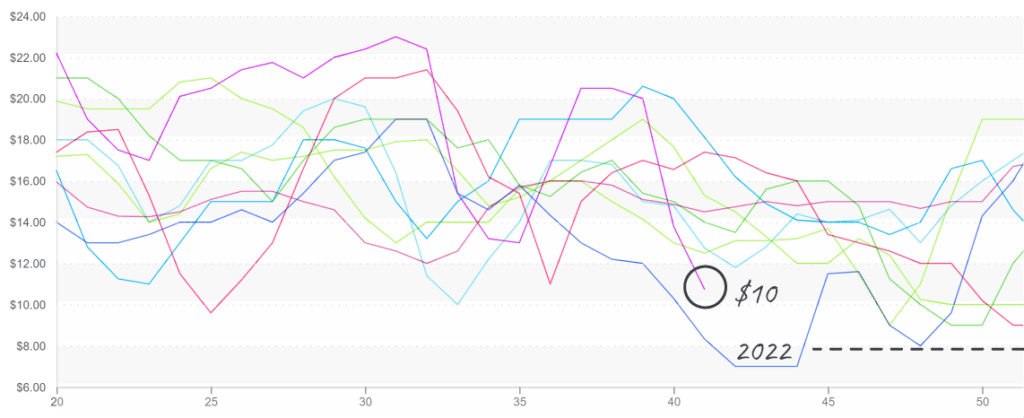

Raspberries need promotion; prices fall to $10 and may test last year’s historic lows.

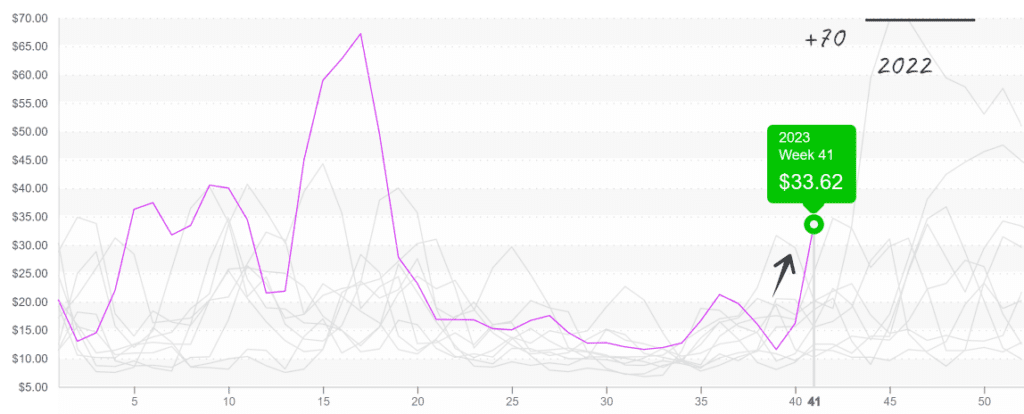

Inclement weather in California is negatively impacting cauliflower supply. Prices doubled to $34, a ten-year high. Unseasonably warm temperatures are causing quality issues and decreasing yields, and the reported volume from the Salinas/Watsonville area is around 50 percent of the norm for week #41.

Cauliflower prices skyrocket, yet not close to the heights reached a year ago.

The extreme overnight heat will likely impact the yields of other heat-sensitive commodities such as broccoli, cabbage, and brussels sprouts grown in the region. Fortunately for buyers, cooler temperatures aren’t too far off and should bring some reprieve to a waning supply.

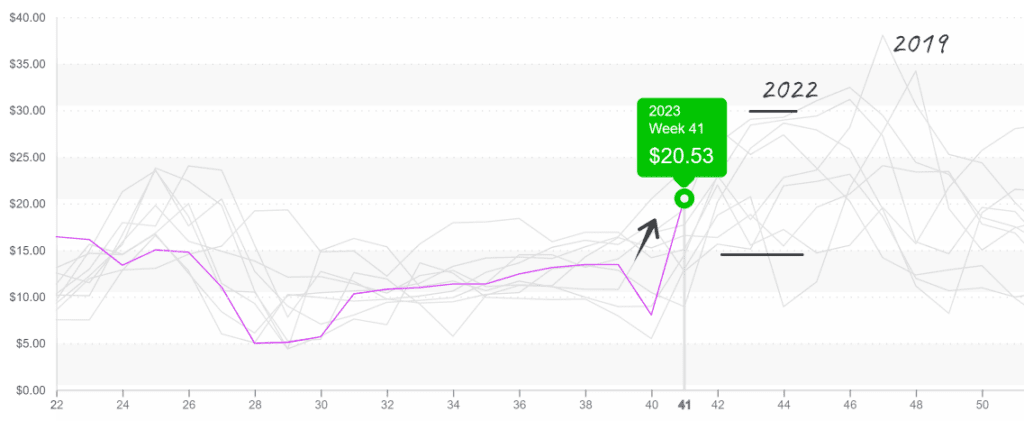

Seemingly overnight, green bean prices doubled in response to an unexpected gap in supply. Growers in the Eastern/Midwestern U.S. are finished, and Florida and Georgia have yet to pick up production. Georgia usually takes on the production mantle around week #40; however, the grower’s efforts have been hampered by hurricane Idalia’s damage to green bean fields.

With no relief anticipated until November, prices will likely explode over the next few weeks. In the meantime, look to suppliers in Central America and Florida to fill in the gaps in supply.

Green bean prices climb fast before volatile time of year, leading to the Thanksgiving pull.

Please visit Stores to learn more about our qualified group of suppliers and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance