First Quarter Highlights

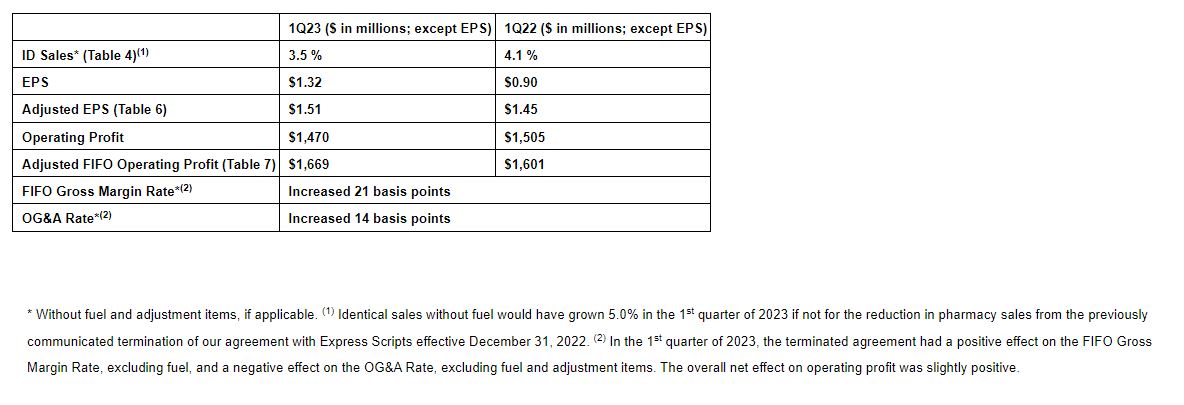

- Identical Sales without fuel increased 3.5% with underlying growth of 5.0% (1)

- Operating Profit of $1,470 million; Adjusted FIFO Operating Profit of $1,669 million

- EPS of $1.32; Adjusted EPS of $1.51

- Achieved strong Adjusted Free Cash Flow leading to a record low net total debt to adjusted EBITDA ratio

- Executed its go-to-market strategy to deliver value for customers

- Grew digital sales 15%

- Increased customer households and trips

CINCINNATI, June 15, 2023 /PRNewswire/ — The Kroger Co. BB #:100073 today reported its first quarter 2023 results, reaffirmed 2023 guidance for identical sales without fuel and adjusted EPS and updated investors on how Leading with Fresh and Accelerating with Digital continues to position Kroger for long-term sustainable growth.

Comments from Chairman and CEO Rodney McMullen

“Kroger achieved solid first quarter results guided by the execution of our Leading with Fresh and Accelerating with Digital strategy.

As more customers are feeling the effects of inflation and economic uncertainty, we are growing customer households by providing fresher products at affordable prices with personalized rewards. Our amazing associates are bringing this strategy to life every day by delivering a full, fresh and friendly shopping experience with zero compromise on quality, selection and convenience.

Looking forward, Kroger’s go-to-market strategy positions us well in a wide range of economic environments to continue to deliver for our customers, invest in our associates and achieve sustainable and attractive returns for shareholders.”

First Quarter Financial Results

Total company sales were $45.2 billion in the first quarter, compared to $44.6 billion for the same period last year. Excluding fuel, sales increased 3.5% compared to the same period last year.

Gross margin was 22.3% of sales for the first quarter. The FIFO gross margin rate, excluding fuel, increased 21 basis points compared to the same period last year. This increase in rate was achieved while also investing in price to maintain a competitive price position and deliver greater value for our customers. The improvement in the FIFO gross margin rate, excluding fuel, was primarily attributable to Our Brands performance, sourcing benefits, lower supply chain costs and the effect of our terminated agreement with Express Scripts, partially offset by higher shrink and increased promotional price investments.

The LIFO charge for the quarter was $99 million, compared to a LIFO charge of $93 million for the same period last year.

The Operating, General & Administrative rate increased 14 basis points, excluding fuel and adjustment items, compared to the same period last year. The increase in OG&A rate was driven by planned investments in associates and the effect of our terminated agreement with Express Scripts, partially offset by sales leverage and continued execution of cost savings initiatives.

Capital Allocation Strategy

Kroger expects to continue to generate strong free cash flow and remains committed to investing in the business to drive long-term sustainable net earnings growth, as well as maintaining its current investment grade debt rating. The Company expects to continue to pay its quarterly dividend and expects this to increase over time, subject to board approval. Kroger has paused its share repurchase program to prioritize de-leveraging following the proposed merger with Albertsons.

Kroger’s net total debt to adjusted EBITDA ratio is 1.34, compared to 1.68 a year ago (Table 5). The company’s net total debt to adjusted EBITDA ratio target range is 2.30 to 2.50.

Comments from CFO Gary Millerchip

“Kroger’s first quarter results demonstrate the durability of our business model in a more challenged operating environment.

The investments we have made over recent years to deliver for our customers and strengthen our value creation flywheel give us the confidence to reaffirm our full-year identical sales without fuel and adjusted net earnings per diluted share guidance. We delivered strong Adjusted Free Cash Flow in the quarter and as a result of improvements in working capital, we are raising our guidance to a range of $2.5 to $2.7 billion for the fiscal year 2023.

Kroger remains committed to delivering attractive and sustainable total shareholder returns for our investors.”

First Quarter 2023 Highlights

Leading with Fresh

Accelerated Fresh Produce Initiative with a total of 1,738 stores now certified, driving higher identical sales without fuel in certified stores

Increased Alternative Farming offerings to 1,094 stores connecting more communities to locally sourced fresh products

Expanded on-demand floral and sushi delivery to the Uber Eats marketplace

Accelerating with Digital

Increased delivery sales by 30% over last year driven by our delivery solutions including Kroger Boost and Customer

Fulfillment Centers

Announced connected TV collaboration between Disney and Kroger Precision Marketing

Increased digitally engaged households by 13% over last year

Associate Experience

Awarded the 2023 Gold Bell Seal for Workplace Mental Health by Mental Health for America

Featured on the 2023 Axios Harris Poll 100, an annual ranking of the most visible and trusted companies in America

Recognized as one of Newsweek’s “America’s Most Trustworthy Companies” for 2023, marking the second consecutive year

Live Our Purpose

Received 2023 SEAL Business Sustainability Award for Zero Hunger | Zero Waste

Attained milestone of more than one million pieces of Our Brands flexible plastic product packaging recycled

Launched new Kroger + USO mobile food kitchens to support military families

About Kroger

At The Kroger Co. (NYSE: KR), we are dedicated to our Purpose: to Feed the Human Spirit™. We are, across our family of companies nearly half a million associates who serve over eleven million customers daily through a seamless digital shopping experience and retail food stores under a variety of banner names, serving America through food inspiration and uplift, and creating #ZeroHungerZeroWaste communities by 2025. To learn more about us, visit our newsroom and investor relations site.