Happy Tuesday! We hope you avoided the worst of Memorial Day travel traffic, ate a fantastic barbecue, and took some time to remember and honor those who have given their lives for our country.

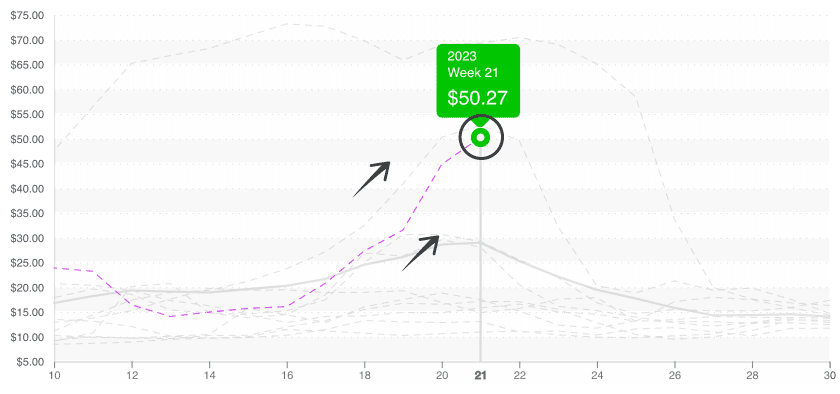

If it weren’t for the beginning of cherry season, overall market prices would likely show a slight dip due to a well-earned post-holiday demand hangover. But this year, sky-high cherry prices, coupled with increases in the price of other heavily weighted commodities, are taking average prices from a near-record low to a record high.

Domestic cherry season is making a flashier entrance than a WWE superstar. Although initial projections show the Pacific Northwest as being one of the best seen in the last few years, USDA just clocked its first summer price at a glitzy $55.

Due to cooler-than-average weather in growing regions, production is a couple of weeks behind schedule but will pick up quickly over the next two weeks. The front end of the Pacific Northwest cherry season should see opportunities for promotion due to ample volume. However, growers report that volume may get slightly sparse (post the 4th of July) due to a “flash bloom” experienced this Spring.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.39/pound, up +40.4 percent over prior week

Week #21, ending May 26th

At $50, celery prices are nearing records that buyers might’ve preferred left unchallenged. Declining production in Oxnard, CA, coupled with minor quality issues, pushed prices up another +15 percent over the previous week. Growers in Salinas are still reportedly two to three weeks out from being able to provide meaningful relief to overextended markets.

Short supply pushes celery prices to the brink.

For the 7th week, white-hot grape markets continue to astound us. In what will surely be known as “The Great Grape Shortage of 2023,” prices have soared into the unknown, setting records that will hopefully never be surpassed.

However bleak and empty the present may be for grape supply, hope is always close behind. Seedless greens and reds are forecasted to begin out of Nogales, AZ, next week. Of course, it will take some time before demand no longer exceeds supply, but at least grapes will be available.

Transition in the Southeast and West is slicing tomato supply pretty thin. At $14 and $15, plum and cherry-type tomatoes are at a ten-year high for week #21, but despite short supply, other varieties are just above or even below the average.

Expect a strained supply until North Florida and Georgia come online in two to three weeks.

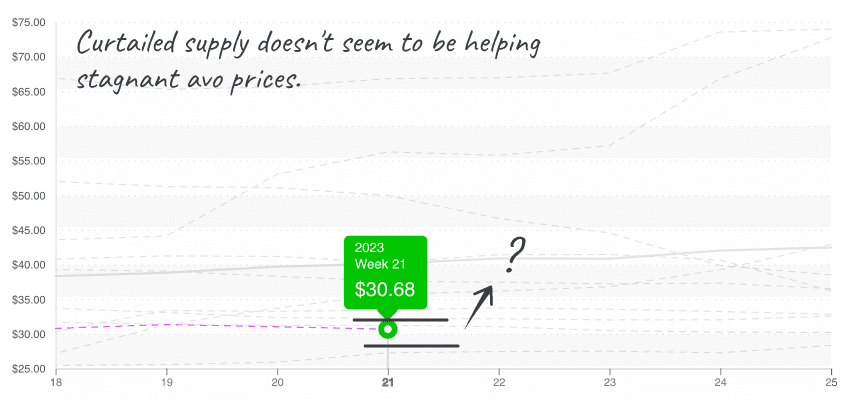

At $31, avocado prices are at their lowest week #21 prices in the last ten years. Mexican growers and other Latin American growers are holding back supply in an attempt to raise prices from the dead, but thus far, their efforts aren’t pushing the needle noticeably.

Beware, this blissful period of endless avocado promotion may end soon as growers transition to the loca crop.

Low prices can’t last forever. Promote while you can!

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.