The report, U.S. Potato Outlook 2023/24: After a Record-breaking Year, What Is in Store for US Potatoes? summarizes that U.S. potato production declined for the fourth consecutive year, and this season’s crop is the smallest since 2010.

The report from RaboResearch author, Almuhanad Melhim, Analyst – Fruits, Vegetables, & Tree Nuts, highlights the potato is extra precious during a period of inflation, when consumer purchasing power is eroded.

Key highlights:

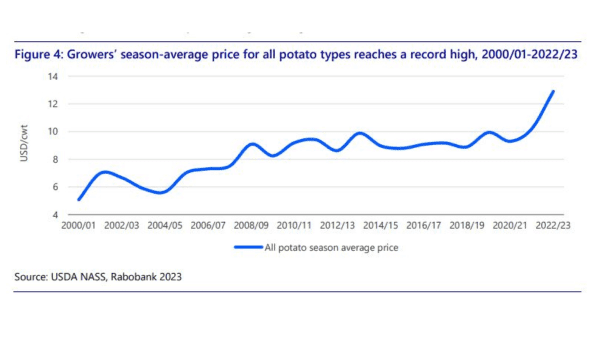

• Potato prices surged to their highest levels, accordingly.

• Strong demand for frozen potatoes also contributed to the high price environment. Strong open market prices and strong demand for frozen potatoes are typically sufficient reasons to raise contract prices, particularly since heightened demand for processing potatoes has gone unmet for two years running and fryers were able to pass on costs to consumers without a loss in sales.

• Competitive open market and higher contract potato prices, an improved water outlook, and crop rotation pressures are expected to increase potato planted area by 2 percent YOY and lead to a 7 percent drop in price in the 2023/24 marketing year. Growers, through their cooperatives and associations, are in a good position this year to negotiate better contract prices with processors.

• Fryers, who had to rely on imports and sourcing raw inventories from other regions with better supply situations, have strong economic incentives to increase contract prices and improve contract terms, given strong demand for finished products. Although consumers will pay higher prices for fresh potatoes, French fries, and other frozen potato products, they are not expected to reduce their potato consumption.