The U.S. has a nearly 90 percent chance of seeing El Nino weather trends persist this summer. So what does that mean for fresh produce? In general, this means the South can expect cooler and wetter than average weather (welcome news for non-snowbird Florida residents), and the North can expect dryer and warmer than average weather.

Forecasters are projecting that this summer may be the coolest summer since 2017, primarily due to temperatures forecasted to run below average throughout June.

ProduceIQ Index: $0.99/pound, up -2.9 percent over prior week

Week #20, ending May 19th

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

At $0.99, the ProduceIQ Index price average is the lowest week #20 has been since 2018. Interestingly, IntraFish reported on Friday that fresh seafood retail sales dollars are on a steady two-year decline exceeding -12 percent. The data indicates that shoppers of fresh food cannot afford inflationary prices and are making economic decisions to forego the more expensive fresh food.

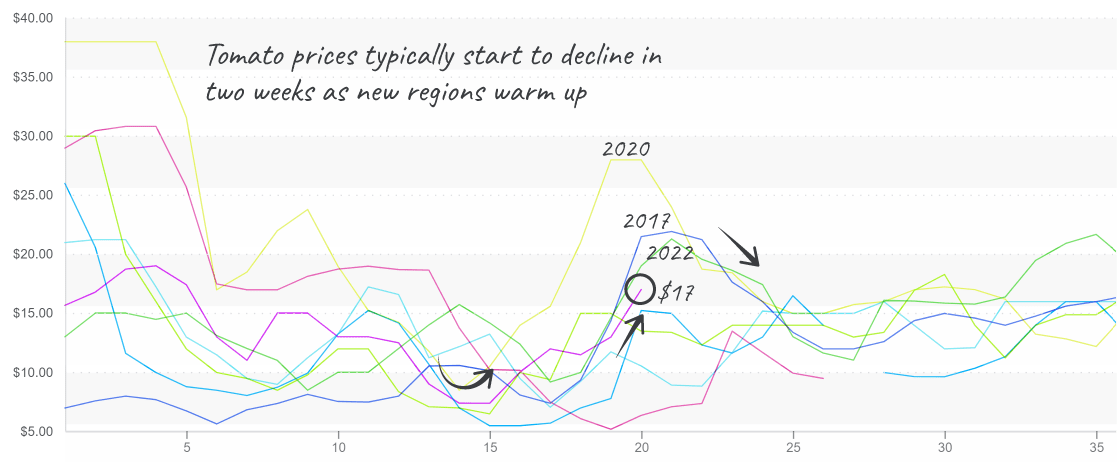

Tomato-growing regions in Florida have yet to get the message about El Nino’s cooling weather trends. As a result, tomato prices in the East and West are surging upward. Unfortunately, in Florida, unseasonable heat is causing tomato plants to reach maturity (and decline) quicker than usual.

ProduceIQ will be launching a new weather tool in the coming weeks so that you can stay alert to the forecast. In Mexico, the supply decline follows typical waning patterns for late Spring.

Average tomato prices are up +37 percent over the previous week. Cherry and plum-type tomato prices are significantly above the average for week #20. Grape and round-type tomatoes are up considerably over the previous week, but prices remain on the lower end of the historical price spectrum.

Some light volatility should be expected over the next few weeks as markets splinter across the U.S. and more local options come online. Grainger County, TN, is warming up, as is the tomato harvest from their greenhouses.

Tomatoes, 25lb mature green (5×6), are in transitional pricing and may continue higher.

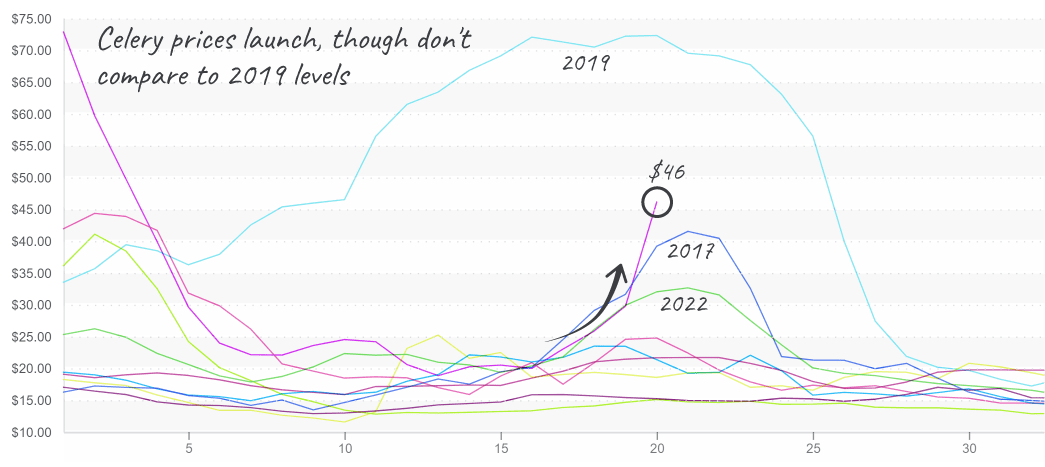

Celery markets are on the rise. Prices typically spike between week #18 and week #22 as production wanes in Oxnard, California, and moves to the Salinas Valley. This year, Oxnard celery production is fading much more quickly than usual, forming a small gap in production.

At $46, celery prices are at their third highest in the last ten years. Because Salinas is still two weeks out from their official start date, expect prices to soar even higher before they find some relief.

Celery, 18ct, prices are dramatically increasing… hold on

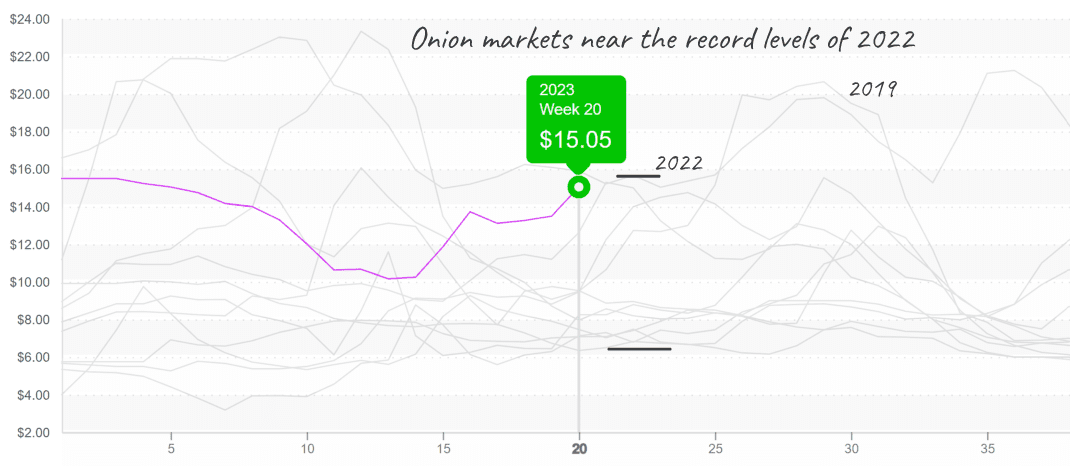

Heavy rain in Southern Texas is ending The Lone Star State’s onion season. Prices are up +9 percent over the previous week and are poised to climb higher due to strong demand and moderate supply. California came in late with smaller sizing. Expect prices to increase over the next few weeks as growers work to match consumer demand. Generally, summer supply is forecast to be light this year.

At $15, Yellow Onions (50lb jumbo) are returning to tempt record highs this summer.

Ideal growing conditions are amping of California strawberry supply and softening prices. As a result, markets are down -22 percent over the previous week and will likely fall further as the Salinas/Watsonville areas ramp up their summer season production.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.