Lots of insane weather in Florida and throughout the Southeast this past week. Heavy rain, golf ball-sized hail, severe wind, and even a few tornadoes in Palm Beach County caused damage to the homes, cars, and the remaining crops of producers in the state.

Fortunately, Florida production is moving quickly to Georgia, and reported losses caused by the severe weather are relatively minor. Overall industry-wide produce prices are down due to increasing production in the West, transitions into new spring crops, and lighter demand.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.12/pound, down -7.4 percent over prior week

Week #17, ending April 28th

Mother’s Day is still a few weeks out. The holiday tends to be one of the biggest of the year for foodservice. That’s because the last thing any wise spouse should ever do on that sacred day is make a big mess in the kitchen. Commodities such as strawberries, broccoli, and cucumbers are experiencing dramatic price reductions as growing regions fill production gaps.

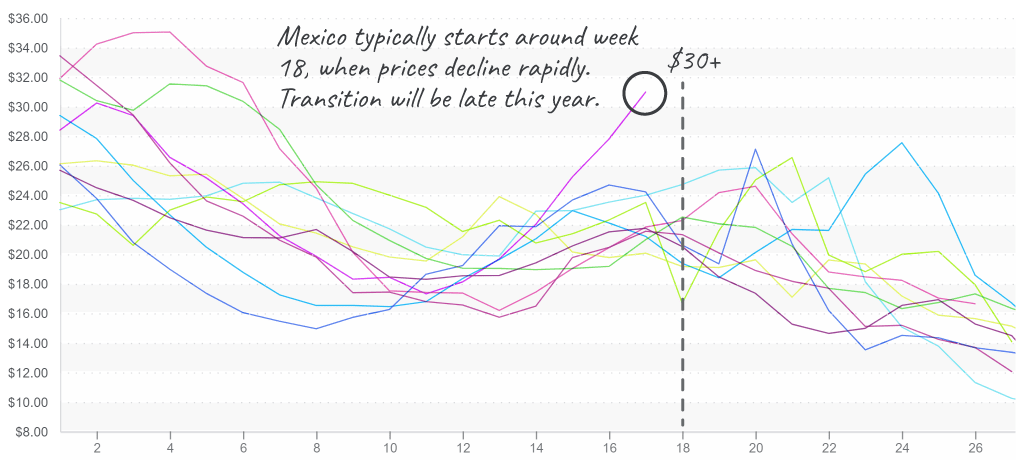

Undeterred by Chilean growers’ valiant attempts to salvage what is left of their export season, green and red grapes are at a ten-year high by a significant margin. At an average of $31, week #17 prices could be confused with week #1, when volume tends to be near its lowest.

In addition, Mexican grape production is at least ten days behind schedule. Grapes are trying to warm up after cool temps in the early season. The result is a significant gap in production between South and Central American grape growers. With California production still about a month away, prices will swell as markets wait patiently for Mexican growers to catch up.

Table Grapes will have a big gap this year as Mexico is starting late, and Chile is already struggling with low yield.

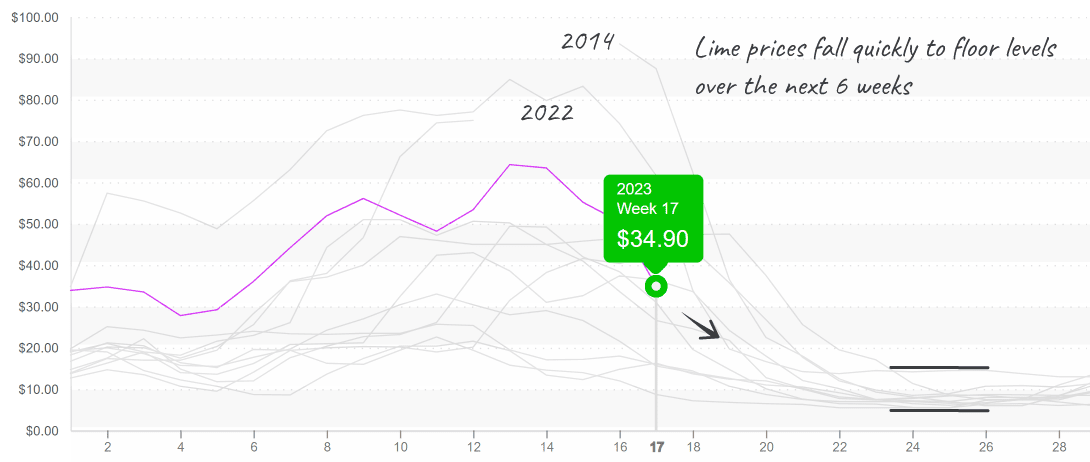

Since our most recent reference point is 2022, 2023’s lime season has felt tame despite prices being some of the highest on record. But good news for buyers, as this week’s lime prices are down -30 percent thanks to the strong availability of smaller fruit in the new crop.

Expect demand to tick up slightly this week as passionate Cinco De Mayo celebrators across the U.S. reach for their favorite Mexican alcoholic beverage, preferably served with a side of guac.

Lime (200 count) prices descending quickly from the low $60s to the $30s and then further to the teens.

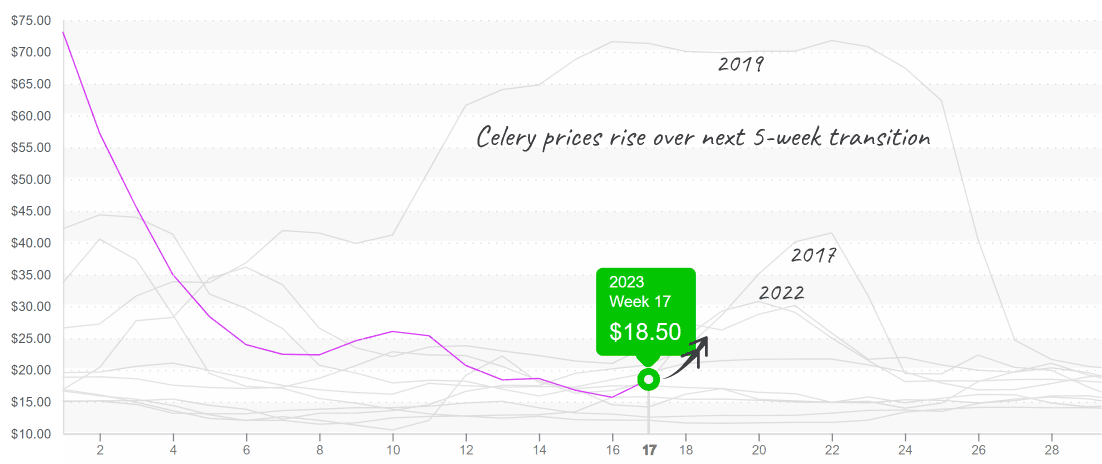

Celery markets are heating up. Prices are up +66 percent over the prior week due to decreasing Western supply (and a low starting point). Prices usually spike between week #17 and week #25 as growers transition out of the Arizona desert and into Oxnard and Santa Maria, CA. Some quality issues, such as pith and seeder, are also being reported.

Expect prices to increase over the next few weeks as production volumes fluctuate and Spring growing regions transition quickly.

Celery prices climb to $18 and have a substantial runway to reach higher levels over the following weeks.

Due to heavy Florida and southeast rains, the Roma and round tomato supply are in danger. Volatility, especially in the East, is forecasted as unseasonably wet weather trends persist. Cherry and grape markets are finding some stability thanks to increasing Western supply.

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.