With the first quarter of 2023 behind us, Placer.ai dove into offline traffic data to understand how the ongoing economic headwinds are impacting the retail landscape.

Tough Start to 2023

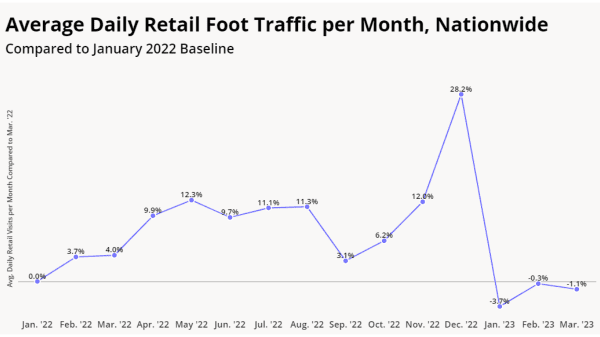

Although inflation rates have been making headlines since early 2022, rising prices did not have an oversized impact on last year’s retail traffic. With the exception of a challenging September 2022, retail visits mostly increased steadily following the Omicron lows of the beginning of the year before peaking over last year’s holiday season.

But more recent retail traffic data seems to indicate that the economic headwinds are beginning to take a larger toll on consumer demand. According to the U.S. Department of Commerce, month-over-month adjusted retail sales dipped in March, and foot traffic data shows that monthly retail visits in Q1 2023 were consistently below the January 2022 baseline. Perhaps the higher interest rates – rather than the ongoing inflation – are finally beginning to impact U.S. consumer spending.

Regional Variations

Comparing retail traffic in March 2023 to March 2022 and 2019 on a state level reveals that, while the visit dip is a nationwide phenomenon, some states have been more impacted than others. Nationwide, March 2023 retail traffic fell 5.0% year-over-year (YoY) but in the five best-performing states, the YoY retail visit gap was smaller than 2.2%, and in the five worst-performing states, the YoY retail visit gap exceeded 7.4%.

The data also shows that seven of the 10 best performing states – Massachusetts, Rhode Island, Pennsylvania, New Jersey, Connecticut, New York, and Vermont – were in the northeast.

When comparing retail foot traffic to pre-pandemic levels, the regional differences were even more pronounced. Retail traffic was down 8.1% in March 2023 relative to March 2019, but the top five performing states all had Yo4Y visit gaps smaller than 2.1%, while the five worst performing states had visit gaps larger than 10.3%. When looking at the Yo4Y traffic data, four of the 10 best performing states on a Yo4Y were in the northeast – Connecticut, New Hampshire, Maine, and Vermont.

Pockets of Optimism

Even as overall retail visits fell, several retail and retail service categories succeeded in growing their traffic in the first three months of 2023.

Fast Food & QSR and Discount & Dollar Stores likely benefited from consumers’ value-orientation, while Fitness and Beauty & Spa maintained their impressive post-pandemic growth. And Theaters & Music Venues continued their post-COVID recovery trajectory, with early 2023 consistently up relative to early 2022.

What lies ahead in 2023?

The next couple of months may continue to pose a challenge to the recently recovered offline retail space – but there are already some bright spots on the horizon. Even though consumer spending fell in March, consumer confidence improved. And the many consumers (43% according to some estimates) still delaying making larger purchases may lead to a particularly strong Memorial Day, as pent-up demand drives shoppers back to stores.

For more data-driven retail insights, visit placer.ai/blog.