Latest results reinforce that today’s retail realities will likely continue to challenge Grocers

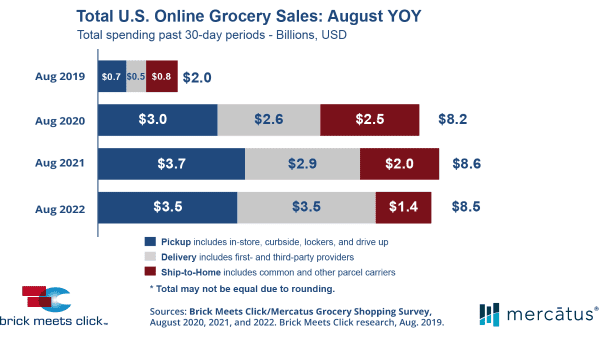

Barrington, Ill. – September 13, 2022 – Total U.S. online grocery sales slipped by less than 1% versus last year to $8.5 billion in August according to the Brick Meets Click/Mercatus Grocery Shopping Survey fielded Aug 29-30, 2022.

Despite this small year-over-year dip, ongoing shopper research conducted by Brick Meets Click over the last four years shows how eGrocery sales have remained at significantly elevated levels following the dramatic surge experienced at the onset of the pandemic.

Since overall online grocery sales quadrupled to $8.2 billion in August 2020 from pre-COVID levels, they have stabilized at even higher levels, finishing at $8.6 billion for August 2021 and $8.5 billion for August 2022. Shifts in the way households shop online for groceries, however, have changed the competitive landscape.

While the three segments (Pickup, Delivery and Ship-to-Home) have each grown since pre-COVID, the share of sales has migrated away from Ship-to-Home, with Delivery consistently growing year over year and Pickup also growing but ceding a small share in August 2022 versus 2021.

“The COVID pandemic motivated trial of Delivery and Pickup services at a scale that no one could have predicted,” said David Bishop, partner at Brick Meets Click. “And, as the pandemic evolves, it’s increasingly clear that many households find online grocery shopping an acceptable option to complement their new in-store shopping behaviors.”

During August 2022, over 68 million households went online to buy at least one grocery order via Delivery, Pickup, or Ship-to-Home. Although the total base of monthly active users (MAUs) for August 2022 is down by just over 1% versus 2021, it’s still up 23% from 2020 and 116% compared to 2019.

As the base of MAUs has grown, the demand for specific receiving methods has continued to shift from pre-COVID behaviors. The share of MAUs engaged with Ship-to-Home dropped from 58% in 2019 to 44% in 2022. Over the same time period, Delivery’s share of MAUs climbed from 25% to 44%, and Pickup expanded from 32% to 54%.

The rate of order frequency among MAUs also shows that online grocery shopping has become a more frequent occurrence in shoppers’ lives, although the year-over-year trends since pre-COVID are slightly different.

Between August 2019 and August 2020, the average number of orders received by a MAU jumped by 40%, from 2.0 to 2.8; since then, it has gradually declined to 2.7 in August 2021 and 2.6 in August 2022. “This downward trend in order frequency is largely the result of a growing MAU base that is still influenced to some degree by concerns about catching the virus,” explained Bishop.

Weekly grocery spending for August 2022 does show signs of inflationary pressures versus the prior year; however, that’s in part due to where customers are shopping as well as the size of the average order. Overall grocery spending in August was up 14% compared to a year ago as households reported spending just over $200 during the most recent 7-day period.

For the month, both the Mass and Dollar formats reported larger user bases while Grocery remained relatively flat. Most significantly, Mass experienced a 7% gain in MAUs, effectively serving 45% of the overall base of MAUs, up from 42% in August 2021.

Dollar, which has a significantly smaller MAU base, reported a gain of over 70% versus 2021. At the same time, the composite average order value (AOV) for the Delivery and Pickup segments climbed 10% versus the prior year to $87 during August, while Ship-to-Home’s AOV plummeted 20% to $40 during the same period.

An important leading indicator, the likelihood that an online grocery shopper will use the same service again within the next month, has remained extremely stable during 2022, finishing August at 63%. This is three points higher compared to 2021, although it still trails the two earlier years by almost 10 points. And, while the overall year-over-year view is positive, Grocery continued to lag Mass on this metric by nearly 10 points for August.

The wide and persistent gap in repeat intent between Grocery and Mass is especially concerning because cross-shopping between the two formats remained elevated at 29% in August, three points higher than last year and 11 and 14 points higher compared to 2020 and 2019 respectively. This suggests that Grocery operators need to focus on closing this gap by improving various aspects of the online shopping experience, ranging from how orders are placed to when they are received.

“The strategies that Mass retailers use are difficult for most Grocery retailers to imitate for various reasons,” said Sylvain Perrier, president and CEO, Mercatus. “Price inflation plays to their competitive advantage, but only up to a point as online shopping still is about convenience. Conventional grocers should emphasize the cost savings and convenience of their pickup services. At the same time, consider implementing a variable service fee structure that offers customers more control over the extra costs and grocers better ways to lower costs through operational efficiencies.”

For information about access to the research and monthly eShopper/eMarket report, go to brickmeetsclick.com.

About this consumer research

The Brick Meets Click/Mercatus Grocery Shopping Survey is an ongoing independent research initiative created and conducted by Brick Meets Click and sponsored by Mercatus. Brick Meets Click conducted the survey on August 29-30, 2022, with 1,755 adults, 18 years and older, who participated in the household’s grocery shopping.

The three receiving methods for online grocery orders are defined as follows:

• Delivery includes orders received from a first- or third-party provider like Instacart, Shipt or the retailer’s own employees.

• Pickup includes orders that are received by customers either inside or outside a store or at a designated location/locker.

• Ship-to-Home includes orders that are received via common or contract carriers like FedEx, UPS, USPS, etc.

Results were adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. Responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older, according to the U.S. Census Bureau. Brick Meets Click used a similar methodology for each of the surveys conducted in 2022 – July 29-30 (n=1,690), June 29-30 (n=1,743), May 28-29 (n=1,802), Apr. 28-29 (n=1,746), Mar. 28-29 (n=1,681), Feb. 26-27 (n=1,790), and Jan. 29-30 (n=1,793); in 2021 – Dec. 29-30 (n = 1,836), Nov. 29-30 (n=1,785), Oct. 29-30 (n=1,751), Sept. 28-29 (n=1,728), Aug. 29-30 (n=1,806), July 29-30 (n=1,892), June 27-28 (n=1,789), May 28-30 (n=1,872), Apr. 26-28 (n=1,941), Mar. 26-28 (n=1,811), Feb. 26-28 (n= 1,812), and Jan. 28-31 (n=1,776); in 2020 – Nov. 11-14 (n=2,067), Aug. 24-26 (n=1,817), Jun. 24-25 (n=1,781), May 20-22 (n=1,724), Apr. 22-24 (n= 1,651), and Mar. 23-25 (n=1,601); and in 2019 – Aug. 22-24 (n = 2,485).

About Brick Meets Click

Brick Meets Click is an analytics and strategic insight firm that connects today’s grocery business with tomorrow’s needs. Our clear thinking and practical solutions help clients make their strategies and customer offers more compelling and relevant in the changing U.S. grocery market. We bring deep industry expertise, knowledge of what’s coming next, and fact-based analysis to the challenge of finding new routes to success.

About Mercatus

Mercatus helps leading grocers get back in charge of their eCommerce experience, empowering them to deliver exceptional retailer-branded, end-to-end online shopping, from store to door. Our expansive network of more than 50 integration partners allows grocers to work with their partners of choice, on their terms. Together, we enable clients to create authentic digital shopping experiences with solutions to drive shopper engagement, grow share of wallet and achieve profitability, while quickly adapting to changes in consumer behavior. The Mercatus Digital Commerce platform is used by leading North American retailers, including Weis Markets, Save Mart brands, Brookshire’s Grocery Company, Kowalski’s Markets, WinCo Foods, Smart & Final, Stater Bros. Markets and others.

Media Inquiries

David Bishop, Partner, Brick Meets Click

847-722-2732, david.bishop@brickmeetsclick.com

www.brickmeetsclick.com