It’s only the first week of September, but it seems as though our social media feeds are already turning orange and every Pinterest recipe tastes like pumpkin spice.

Last week, a 60-year-old Nebraskan man paddled 38 miles in an 846-pound pumpkin fondly named the SS Berta; talk about fall spirit!

Although it seems consumers are eager to exchange their watermelons for pumpkins, mother nature has no intention of cooperating just yet. Record heat in the West and heavy rain in the South spoiled plenty of Labor Day celebrations over the weekend.

In addition to thwarting barbeques, worsening wildfire concerns, and straining electrical grids, inclement weather is affecting produce growers across the U.S.

Temperatures in Salinas Valley reached 96 degrees on Labor Day, affecting broccoli, lettuce, leaf, and strawberry growers. Heat and scattered rain will likely make the transition back to Georgia challenging in the Southeast.

ProduceIQ Index: $0.99 /pound, -1 percent over prior week

Week #35, ending September 2nd

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

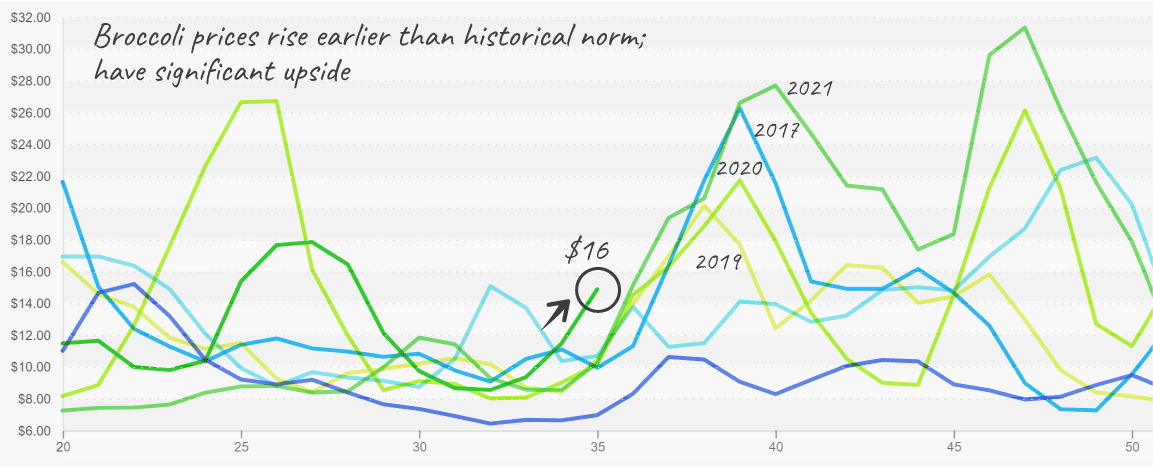

The Labor Day heat wave on the West Coast is tightening broccoli and cauliflower supply. Most of our broccoli and cauliflower come from Salinas and Santa Maria this time of year. Both growing regions are expected to “cool” down into the mid-80s this week. Heat-related quality issues, such as pest pressure and pin rot, are fueling the dramatic price increases we’ve seen over the last couple of weeks.

This week, prices maintain that trend with gusto. Broccoli prices are up +26 percent and cauliflower +19 percent over the previous week. Broccoli and cauliflower markets will likely see continued price increases as Mexican growers wind down production.

Broccoli prices pass $16 on their way to higher levels; last year, prices went to $28 by week 40

Lime prices are gaining downward momentum, -6 percent over the previous week. The transition to the new crop in Mexico is nearly complete, and supply is leveling off. However, there are reports of quality issues due to rain, heat, and high humidity. Higher-grade fruit naturally demands higher prices, while there are many deals on lower-grade fruit at very affordable prices.

Rain in Mexico and on the East Coast is shrinking cucumber supply across the country. Unfortunately, growers in Ohio and Michigan received more rain over the weekend. As a result, markets are forecasted to remain elevated over the weekend but should improve marginally in the next few weeks. Georgia’s fall crop isn’t far away.

Cucumber prices from Mexico are significantly higher than domestic, local-grown product

Table grape prices are at a ten-year high. Although grape supply is seemingly plentiful, extreme heat shortens shelf life and stunts sugar accumulation in the berries. Hopefully, quality and prices will improve over the next few weeks as Kern County gets into the swing of fall production.

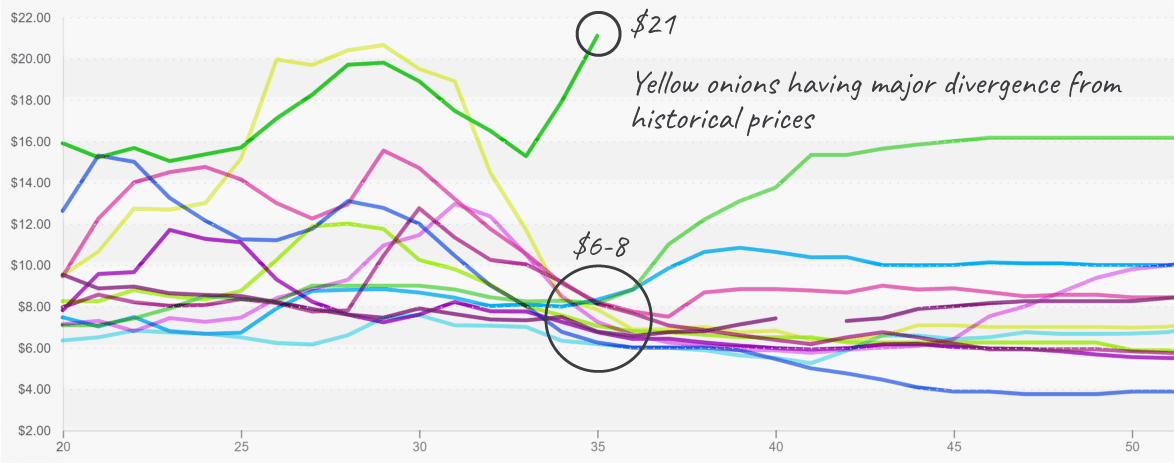

Dry onion prices are more than inching upwards due to a temporary gap in yellow supply. Many storages are empty and waiting for current harvesting. The Pacific Northwest is bearing the brunt of production as California’s supply rapidly decreased over the last couple of weeks. However, Idaho is ramping up, and supplies should improve post-Labor Day celebrations.

Yellow onion prices (50lb sack) are close to 3x historical averages for this time of harvest

Please visit Stores to learn more about our qualified group of suppliers, and our online marketplace, here.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.