CHICAGO – Numerator, a data and tech company serving the market research space, has released new Inflation Insights providing an omnichannel, omnicategory view of rising prices and the impact on consumer behavior.

The report quantifies how prices paid by consumers have changed across categories (Grocery, Health & Beauty, Baby, Household Goods, Pet) and channels (Online, Mass, Food, Dollar, Club). A survey of more than 14,000 panelists layers in consumer expectations related to rising prices.

Key findings include:

• Grocery sees the highest price increases across tracked categories. The average price consumers paid for a single grocery item was up 7.1% in October vs. year ago and up 11.6% vs. 2019.

o Grocery is followed by Healthy & Beauty (+5.7%), Baby (+4.0%), Household Goods (+3.7%), and Pet (+1.5%).

• Grocery price increases are concentrated in Mass, Food, and Dollar channels. Price increases were most significant in Mass (+8.0%), Food (+7.7%) and Dollar (+7.7%) channels, compared to Club (+4.9%) and Online (+3.8%).

A Numerator Inflation Survey of more than 14,000 consumers revealed the following key insights:

• Nearly 9 in 10 consumers plan to change their buying behavior if prices continue to rise. 11% of respondents claim that they will not make any adjustments to their shopping habits.

• 1 in 5 consumers (20%) plan to switch to cheaper brands, and 17% plan to shop at different retailers.

• 1 in 10 (10%) will stop buying certain products due to inflation.

• Nearly 1 in 5 (17%) will wait to buy on promotion or with coupons.

• Many consumers will make cutbacks by switching package size or buying less frequently. 8% plan to buy in bulk, 7% plan to buy smaller package sizes, and 10% will buy less often.

Expected inflation impact varies by category:

• Care Commodities are the least vulnerable to customer attrition due to inflation. On average, 1 in 5 consumers (21%) say their buying behaviors for Health & Beauty, Pet Food, and Baby & Toddler products will not change if prices rise, and only 2% say they would stop buying.

• Gifts & Durable Goods are the most vulnerable to behavioral shifts due to inflation, especially during the holiday season. On average, 14% of Toys, Apparel, Electronics, and Home & Garden shoppers say they will stop buying the category if prices continue to rise.

• Everyday Indulgences like Alcohol, Beverages, and Snacks & Candy are moderately vulnerable. More than 1 in 5 Alcohol buyers (21%) say they will continue to purchase despite rising prices, but 10% would stop buying. Among consumable categories, Snacks & Candy has the highest percentage of buyers (12%) saying they would stop purchasing altogether.

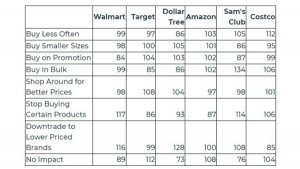

Expected inflation impact also varies among top retailers (Walmart, Target, Amazon, Costco, Sam’s Club, Dollar Tree):

• Target, Amazon and Costco shoppers are the most likely to say they will not change their buying behavior in response to rising prices (Index 112, 108, 104, respectively, vs. all shoppers).

• Dollar Tree, Sam’s Club, and Walmart shoppers are the least likely to keep shopping normally as they see prices rise (Index 73, 76, 89, respectively).

• Target and Dollar Tree shoppers indicate the highest likelihood of shopping around for better prices (Index 108, 104, respectively).

• Walmart and Sam’s Club buyers are the least likely to respond with promotion-seeking behaviors (Index 84, 87, respectively).

• Sam’s Club shoppers are significantly more likely than Costco shoppers to say they will respond by buying more in bulk (Index 134 vs 106).

Expected Behavioral Change with Rising Prices, by Retailer (Index vs All Shoppers)

How would rising prices impact the majority of your purchases?  Source: Numerator Inflation Survey, Numerator Insights

Source: Numerator Inflation Survey, Numerator Insights

Methodology: Numerator’s Premium Inflation Survey was fielded 9/17/21 – 9/25/21 and includes responses from 14,287 shoppers who made purchases in select categories, and covers their general inflation attitudes as well as how they expect rising prices to impact their category shopping behavior.

About Numerator

About Numerator

Numerator is a data and tech company bringing speed and scale to market research. Headquartered in Chicago, IL, Numerator has more than 2,400 employees worldwide. The company blends proprietary data with advanced technology to create unique insights for the market research industry that has been slow to change. The majority of Fortune 100 companies are Numerator clients.