Twenty months into the pandemic, fresh produce retailing remains in flux. Continually changing consumer consumption and buying patterns, high inflation and severe supply chain disruption and constraints have yet to create a new and lasting balance of supply and demand. IRI, 210 Analytics and the Produce Marketing Association (PMA) have teamed up since March 2020 to document the ever-changing marketplace and its impact on fresh produce sales.

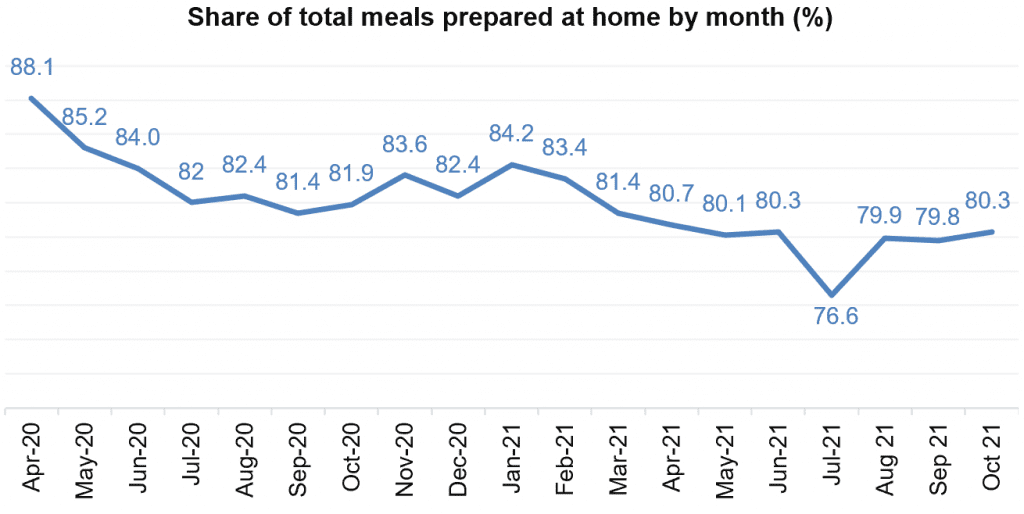

Meals continued to be home-centric in October. “According to the October IRI primary shopper survey, the share of meals prepared at home is back to late spring, early summer levels,” said Jonna Parker, Team Lead Fresh with IRI. “There are many drivers for the reversal, from the uptick in COVID case counts to rapidly rising inflation. While retail inflation is the highest in many decades, the cost for eating out rose even faster. Restaurant inflation typically results in more at-home meal preparation and it is likely we will see an enhanced reaction as many people were reminded of the potential savings and other benefits of home cooking over the past 20 months.”

Other changes also point to a reversal in the normalization of shopping and consumption patterns. During the height of the pandemic, as many as 20% of trips were online. This dropped to a low of 11% in July. In October, the online share of trips increased to 15%. Yet online shopping remains a complementary trip for most consumers. “Only 4% of survey respondents believe they will buy all their groceries online in the next month,” said Parker. “This compares to 21% who will only buy some or a little online. This underscores the importance of a strong omnichannel strategy to optimize the share of total dollars, particularly in fresh.”

Year-to-Date Sales

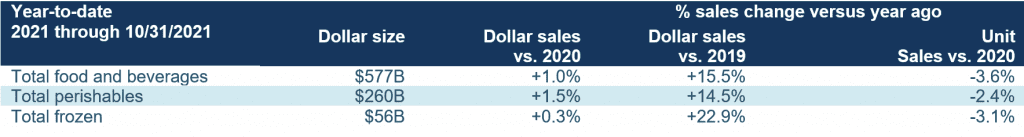

The first 10 months of the year brought $577 billion in food and beverage sales — now up 1.0% over 2020 and 15.5% over the 2019 pre-pandemic normal. However, inflation played a significant role with year-on-year units still down 3.6%. Perishables, including produce, seafood, meat, bakery and deli, had the highest year-over-year growth during the first 10 months of 2021, at +1.5%. Frozen foods had the highest increase versus the pre-pandemic normal of 2019, at +22.9%.

Food Inflation

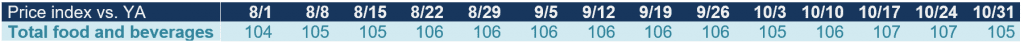

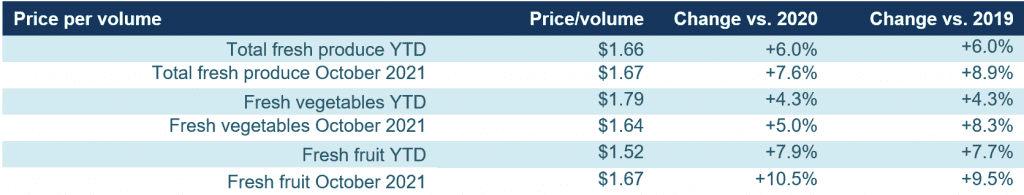

The consumer price index increased 6.2% in October, the largest year-over-year increase in 30 years, according to the Labor Department. Food prices jumped 0.9% for the month and 5.4% for the year. IRI-measured price per volume also shows that prices continued to rise over and above their elevated 2020 levels for food and beverages.

Fresh produce prices are also higher than last year. Year-to-date, prices for total fresh produce are about 6% higher than they were last year. Inflation for fruit is above average, at +7.9% year-to-date through October 31st. Fruit prices during October 2021 were 10.5% higher than in October 2020. “I certainly remember other times of high inflation for produce but the level of national media attention to the food supply chain supply challenges has shoppers ever so aware today,” said Joe Watson, VP of Membership and Engagement for PMA. “The inflationary pressure is causing more careful meal and product decisions for many American families. This means more than ever it is important to make the case for the healthfulness of fresh produce in the diet by highlighting nutrients, tying them back to health benefit and leveraging the overall health halo of fresh fruit and vegetables. Flash sales when inventory allows and continuing to drive eyes with the circular front page are ways to keep fresh produce top-of-mind for consumers.”

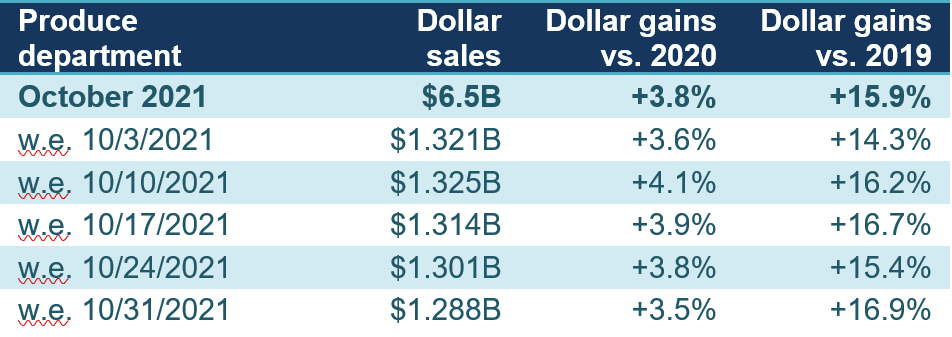

Week-by-Week Sales Fresh Produce

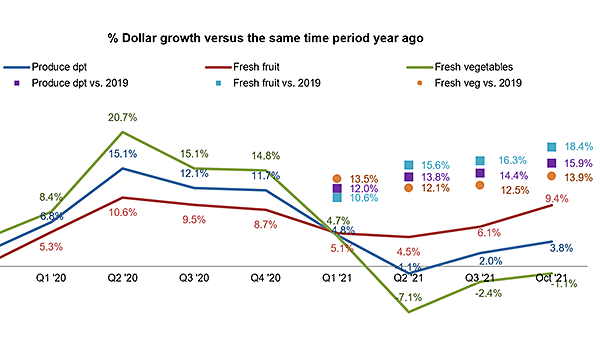

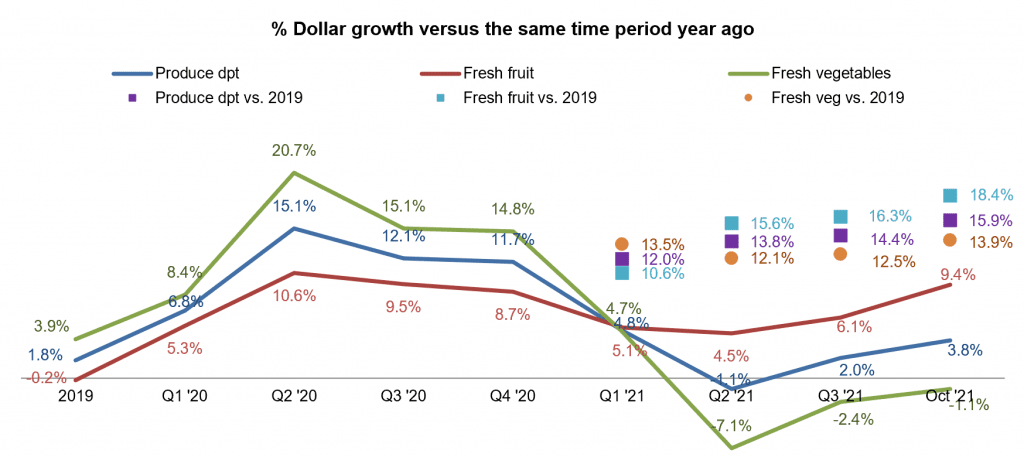

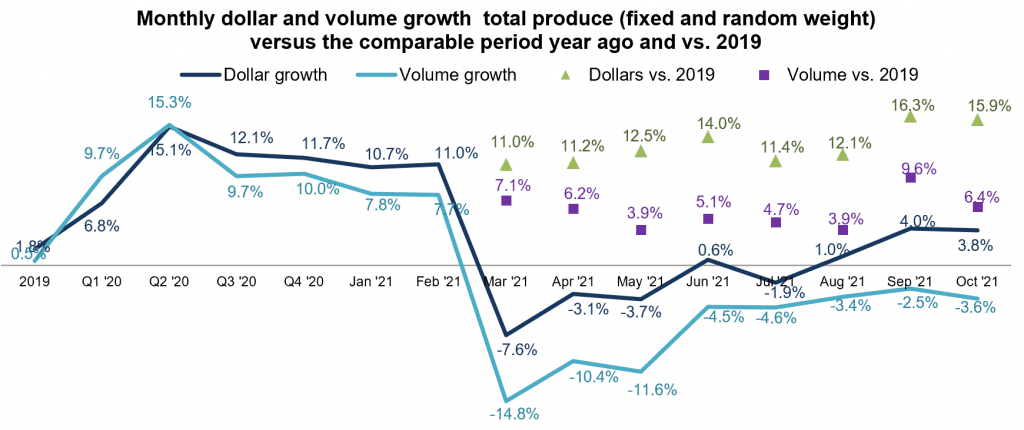

Fresh produce sales were very consistent with October levels around $1.3 billion each week. Despite the high consumer demand in 2020, sales exceeded last year’s levels and remained about 16% ahead of the 2019 pre-pandemic normal.

“As more meals moved back to the home, October delivered the strongest year-on-year results we have seen since having to go up against the pandemic sales peaks in March,” said Watson. “Granted, inflation played a role and volume is off by 3.6% year-on-year. But that means we still moved 6.4% more pounds through the system in October 2021 compared to October 2019.”

When comparing the last five quarters to 2019 dollar sales, a very consistent patterns emerges. Dollar sales trend between 12% and 16% ahead of the pre-pandemic normal. “It is also important to keep in mind that the supply chain challenges are leaving items in low- or out-of-stock positions at retailers across the country,” added Watson. “While some categories are more affected than others, we cannot sell what we do not have, which without a doubt is impacting the dollars and volume numbers. Taking in-stock positions into account, produce department sales are holding their own.”

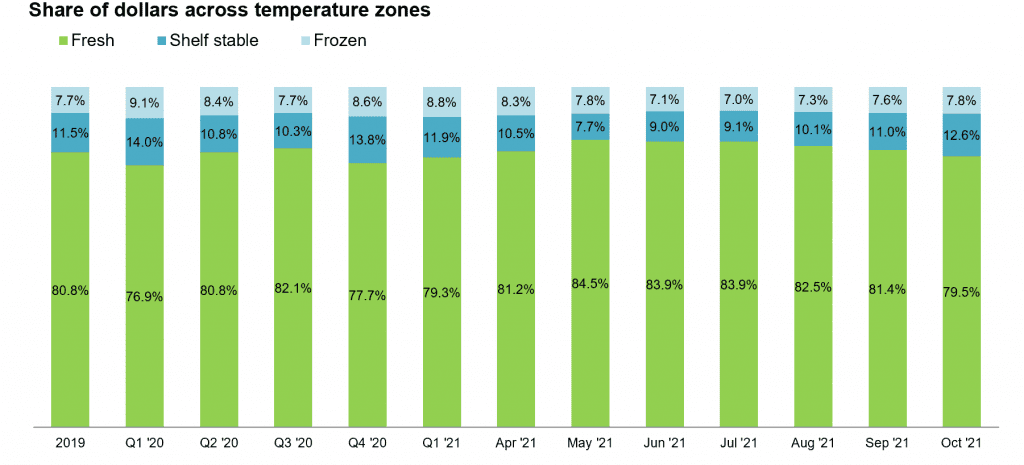

Fresh Share

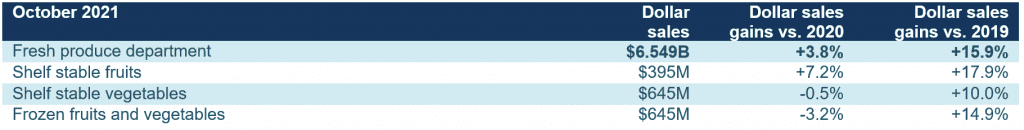

While fresh sales are strong, it does appear that the produce department is not capturing all of the demand that returned to retail in recent months. “The share of fresh fruit and vegetable dollars across the store reached a high in May 2021 and has dropped slightly ever since,” said Watson. “At the onset of the pandemic, the fresh share dropped as low as 76.9% in the first quarter of 2020. October was the first month this year that fresh produce dropped below the 80%-mark. While inflationary pressures are different across fresh, frozen and canned, demand for items with longer shelf life seems to have returned.”

In frozen, fruit represented 20% of October sales. Frozen fruit sales increased 1.0% year-on-year whereas frozen vegetables declined 6.7%. In canned, fruit also outperformed vegetables. Fruit sales increased 7.2% in October 2021 versus year ago compared with -0.5% for shelf-stable vegetables. All areas are still benefiting from robust demand versus the 2019 pre-pandemic normal.

Fresh Produce Dollars versus Volume

Volume sales came within 2.5 points of last year’s level in September. In October, volume fell further behind, at -3.6%. Pound sales are still 6.4% ahead of the pre-pandemic normal.

Comparing October fruit pound sales versus the pre-pandemic 2019 normal is particularly impressive. Free and clear of the effect of inflation, it shows that U.S. retailers sold 8.1% more pounds of fruit versus 5.1% more pounds of vegetables in October 2021 than the same month in 2019. While volume is down year-over-year, it shows that the home-centric meal consumption is still driving robust demand for produce at retail.

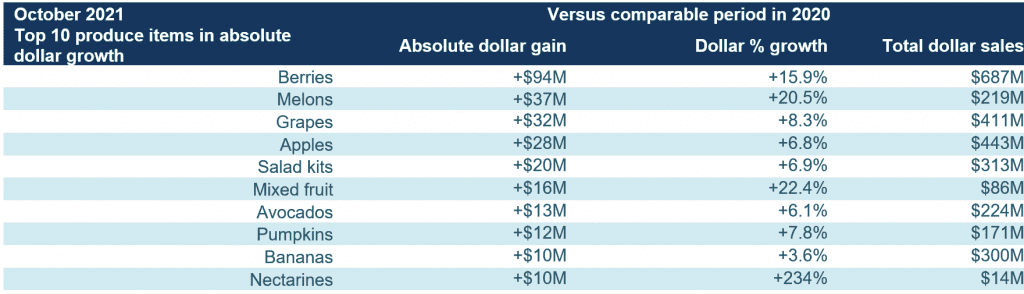

Fresh Fruit Sales in October

“On the fruit side, we continue to see the top 10 players in terms of absolute dollar sales change with the season,” said Parker. “Berries are not only the biggest seller, with October sales of $687 million, but also one of the fastest growers, at +15.9%. That is not a combination we see very often and it underscores the absolute dominance of berries in the marketplace. At the same time, apples and grapes are having very strong month as well — each bigger than the top seller in vegetables, being tomatoes.”

Others with above average growth are melons, mixed fruit and pineapples. The only top 10 seller that did not manage to grow dollars year-on-year were mandarins.

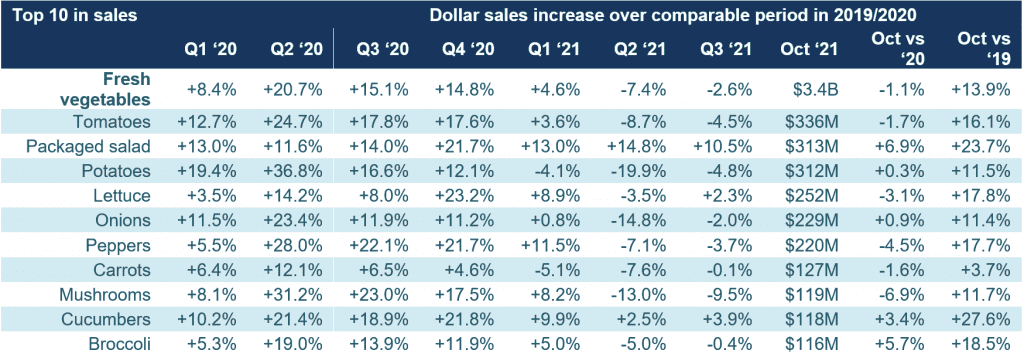

Fresh Vegetables Sales in October

“Vegetables’ performance was more mixed than fruit,” said Watson. “Several areas trailed the October 2020 performance, including tomatoes, lettuce, peppers, carrots and mushrooms. In several cases, it may not be lack of demand but rather the 2020 sales spikes along with today’s supply chain situation that is driving the small declines. The top growth driver this month was packaged salad, with a dollar sales increase of 6.9% despite an incredibly strong 2020.”

Absolute Dollar Gains

“The top 10 in absolute dollar gains showed both small and large categories are important for department growth,” said Parker. “It is always interesting to keep an eye on some of the smaller sellers that manage to gain in a big way. It is often these highly seasonal items or unexpected delights that drives incremental, unplanned dollars.”

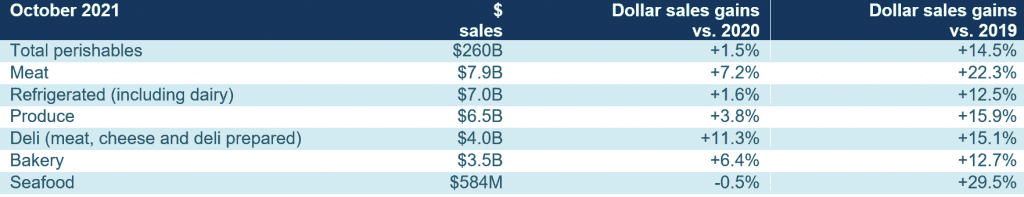

Perishables Performance

A look across fresh foods departments for the five October weeks shows perimeter strength. All departments, with the exception of seafood, gained year-over-year, with the highest increases going to deli and meat. Seafood is significantly smaller than the other fresh departments and deli sales overtook bakery sales this month, with October sales of $4.0 billion.

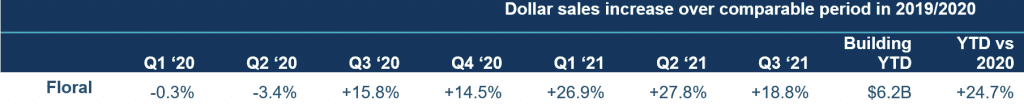

Floral

Floral dollar sales grew by 24.7% over the first 10 months of 2021 compared with the same period in 2020. Sales now exceed $6.2 billion for the year but gains did start to slow down a little, though still in the high teens. Whereas growth was upwards of +25% in the first and second quarters of the year, sales advanced a lower +18.8% in the third quarter.

What’s Next?

The IRI primary shopper survey points to some more normalcy for the Thanksgiving celebrations compared with last year. The survey did find a sizeable share of consumers with plans to shop early.

- More people are planning on celebrating Thanksgiving this year, with 60% saying it will be the usual way as they celebrated before COVID-19.

- 36% hosting or attending a party with guests beyond their own household and 25% preparing a special meal for just their own household.

- In addition to or in lieu of Thanksgiving dinner, 8% are also doing a “Friendsgiving” meal with friends.

- Only 9% are not planning on a special celebration this year.

- The average party size is also expected to be bigger this year, at an average of seven to eight people.

- 22% expect to spend more on Thanksgiving dinner than they did last year, in part because of inflation and in part because of a larger party size.

- 36% also plan to start shopping earlier. This has been a trend all throughout the pandemic, making the week before the holiday the biggest week for most departments rather than the holiday week itself.

The next report, covering November and the Thanksgiving holiday, will be released in mid-December. We encourage you to contact Joe Watson, PMA’s Vice President of Membership and Engagement, at jwatson@pma.com with any questions or concerns. Please recognize the continued dedication of the entire grocery and produce supply chains, from farm to retailer. #produce #joyoffresh #SupermarketSuperHeroes.

Date ranges:

2019: 52 weeks ending 12/28/2019

Q1 2020: 13 weeks ending 3/29/2020

Q2 2020: 13 weeks ending 6/28/2020

Q3 2020: 13 weeks ending 9/27/2020

Q4 2020: 13 weeks ending 12/27/2020

Q1 2021: 13 weeks ending 3/28/2021

Q2 2021: 13 weeks ending 6/27/2021

Q3 2021: 13 weeks ending 9/26/2021

October 2021: 5 weeks ending 10/31/2021