You may have things to be thankful for this year, but fresh produce buyers are struggling to count their blessings. Limited supply, marginal quality and high prices are plaguing all aspects of the fresh produce industry.

Of course, the average grower needs price increases to compensate for reduced yields and rising production costs. Combined with the typical Thanksgiving holiday pull, the fresh produce industry is seeing record prices across staple commodities like potatoes, onions and lettuce.

Consumers are in for a rude awakening. Labor shortages, poor weather, and spiraling truck costs add fuel to an inflation fire already roaring with gusto. As economists debate the nuances of transitory versus persistent inflation, you should simply expect higher prices.

In response, Walmart, determined to defeat supply chain challenges, and willing to shock a few unsuspecting Arkansas drivers, is launching more autonomous trucks.

Of the 3.5 million truck drivers in the U.S., only 300,000 to 500,000 are ‘long haul,” which is where the most impactful driver shortage exists. With difficult working conditions, high turnover and an aging workforce (48-year-old average), it’s wise to stay in front of this systemic problem. Truck shortages are expected to worsen further during the holiday season.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.04/pound, -2.8 percent over prior week

Week #45, ending November 12th

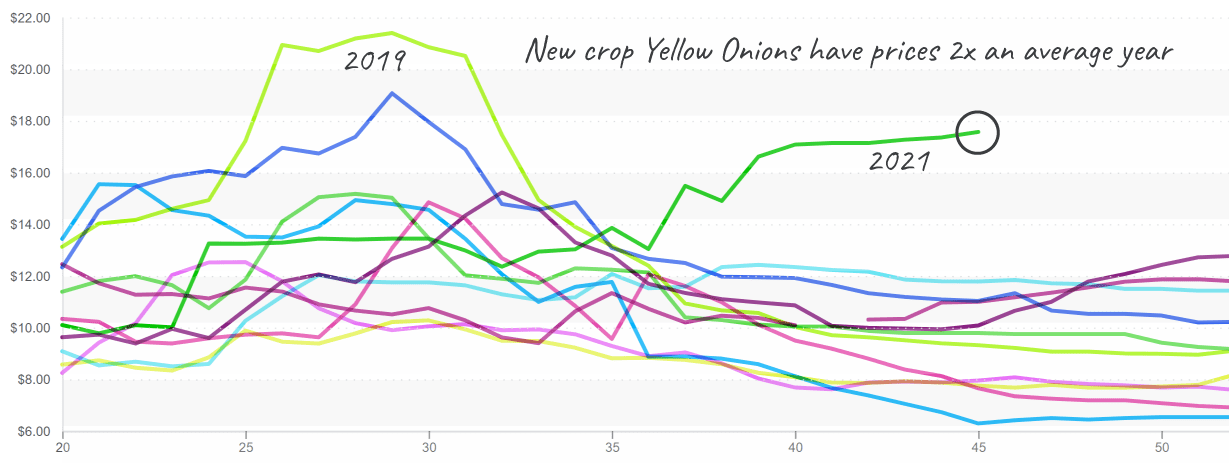

Dry onions continue to soar into unprecedented territory. This year’s week #45 dry onion prices far surpass any record set in the last ten years.

Reports from the Pacific Northwest’s fall harvest typically calm market nerves through the end of the year; however, poor yields and an already depleted supply is sending onion prices into unchartered territory.

Throughout the summer, dry and hot weather set onion fields up for small sizes and a difficult harvest. Growers battled harsh growing conditions, weeds, and labor shortages. This combination of worst-possible circumstances has resulted in what some growers report as their most challenging harvest in three decades.

Yellow onions exceed $17, double the norm, on large sizes. Medium item size is moderately high at $10 per 50 lbs.

If you’re a real Floridian and Thanksgiving Key Lime Pie is tantamount to your love for air-conditioning and flip-flops, we recommend purchasing your limes sooner than later. The citrus is up +38 percent over the previous week and is expected to continue climbing. Mexican production of limes is declining but will pick back up in a few weeks.

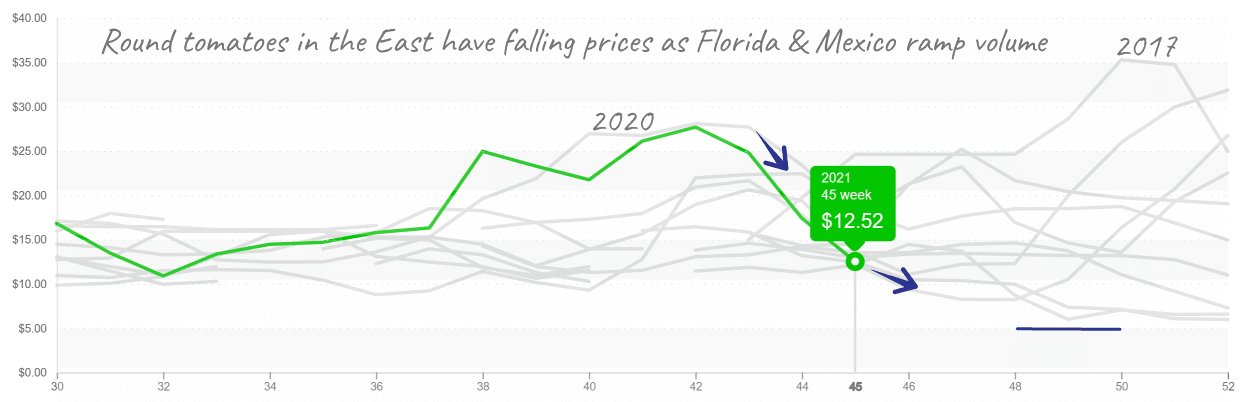

Here’s something for buyers to be thankful for, tomato markets are finally stabilizing. Thanks to an increase in production from Florida and Mexico, overall tomato prices are down another -20 percent over the previous week. Roma supply is still lagging a bit behind demand, but grape, cherry and rounds are seeing significant improvements.

Eastern round mature-green tomatoes dive as Florida volume starts.

Nogales crossings for peppers and other chilis are expected to increase in the next 7-10 days; watch for falling prices as increased supply coincides with the lull in demand near Thanksgiving Day.

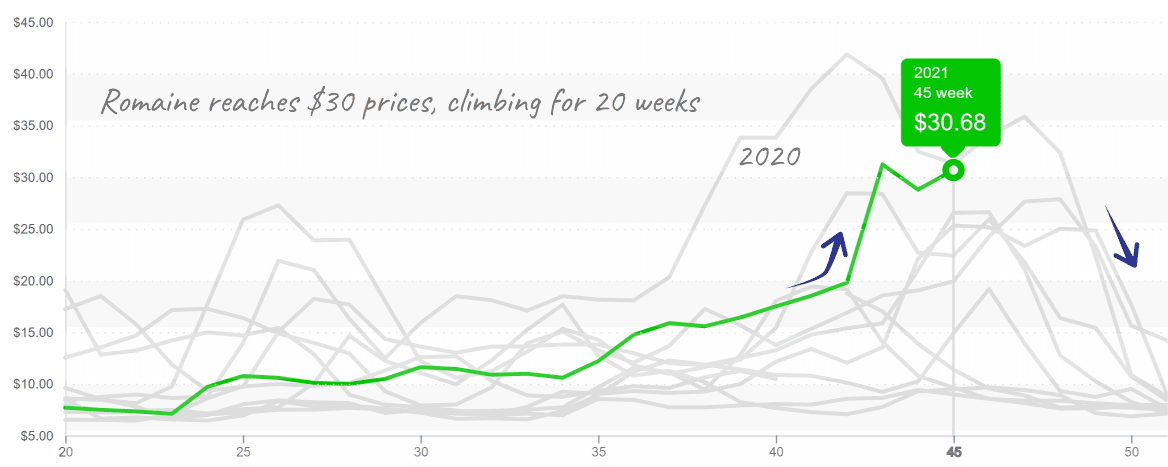

Lettuce harvest shortages continue to create active markets. Even after iceberg prices peaked spectacularly two weeks ago and have now settled, lettuce prices remain at a ten-year high.

Romaine lettuce may be slightly less pricey than its ‘cool friend,’ but don’t think it’s anything close to a cheap date. Prices are up +7 percent over the previous week and are expected to stay elevated throughout November. Poor quality coming out of Salinas and Arizona’s delayed production are contributing to supply problems plaguing the industry.

Romaine lettuce prices plateau before inevitable fall when Yuma commences.

This week’s not-so-subtle message, watch your wallet this holiday season.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

ProduceIQ Index

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.