Veggies seeking sunshine on their vacation southward are sorely disappointed. Rain in Mexico is a challenge to quality and a smooth transition.

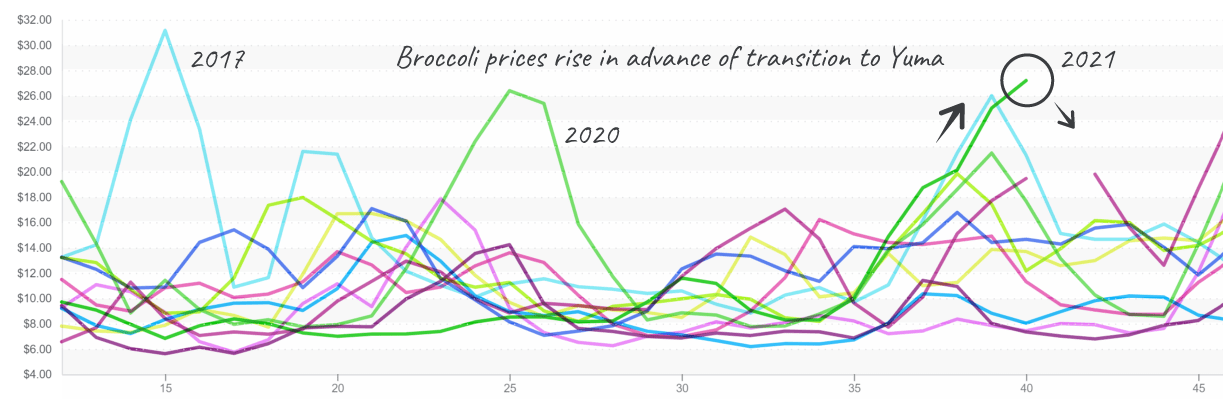

Broccoli and cauliflower prices diverge slightly this week. However, the divergence is only temporary; the prices of both commodities will increase throughout the month.

Broccoli seems to be plagued with rotten luck this fall. Extreme heat is damaging an already weak California broccoli supply.

And in addition, Mexican yields are struggling due to abnormally wet weather. Prices surpassed $27, reaching record highs for this time of year. Even so, not all hope is lost. Yuma’s season is on the horizon and will provide some much-needed relief for exacerbated buyers.

Broccoli volatility surpasses the wild ride of 2017.

At a ten-year high for week #40, Cauliflower is slightly down over the previous week. Quality remains fair despite facing similar conditions as broccoli. Still, cauliflower supply is tight. The transition to Arizona and extreme heat will keep markets active for a while longer.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $1.07/pound, -7.8 percent over prior week

Week #40, ending October 8th

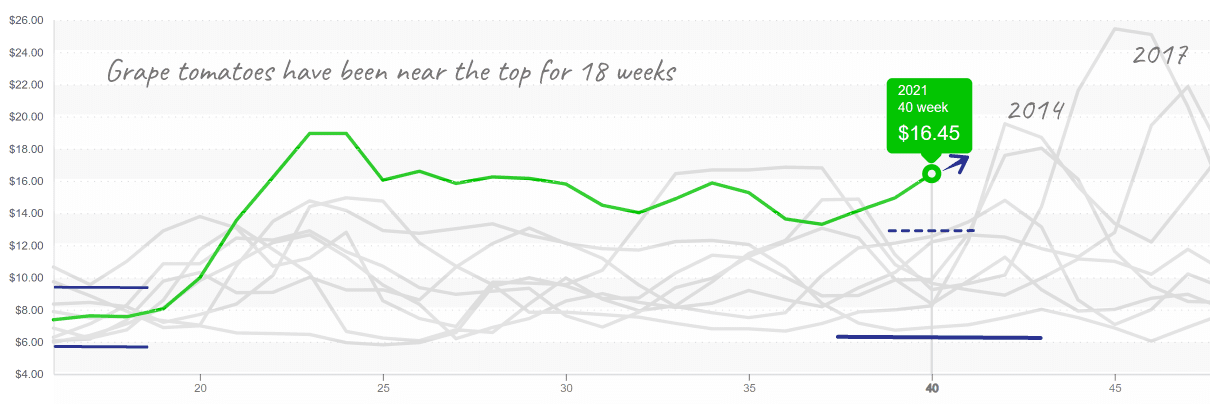

Per last week’s forecast, tomato markets are up again. If you missed it, here’s the gist: Tomato markets are hot; supply is low due to scorching heat in the West and transitioning growing regions in the East. All varieties are short, and prices exceed previous week #40 records. Expect supply to remain slim for a few more weeks as Georgia and Florida slowly ramp up production.

Grape tomato prices, exceeding $16 for 12 1-pint clamshells, have been high most of the year

Although shipment of Peruvian blueberries is still obstructed due to U.S. port labor shortages, prices are down -34 percent over the previous week. Blueberry prices typically peak close to week #40 and descend after Mexican blueberries enter the market.

Mexico is only just beginning its blueberry season, but the market is already taking cues as prices drop significantly over the previous week. Expect supply to increase by the end of the month as Mexico picks up production.

Blueberries ignore supply challenges; prices fall as Mexico ramps.

Avocado markets are finally stabilizing after an extended period of short supply. Now that Peru’s season is nearly finished and California is done, the market is reliant on Mexico’s new crop to meet demand. Expect prices to remain stable as Mexican growers adjust their harvest to account for market saturation.

Increasing demand for iceberg is pushing up averages in the Lettuce and Leaf Category. Iceberg prices are up +25 percent over the previous week.

Increases are following typical trends for this time of year. Supply will remain mixed depending on the supplier. Anticipate some light quality issues including insects and low weight.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.