New study highlights the consumer take on supply chain innovation and technology addressing the biggest trends in fresh produce marketing and merchandising.

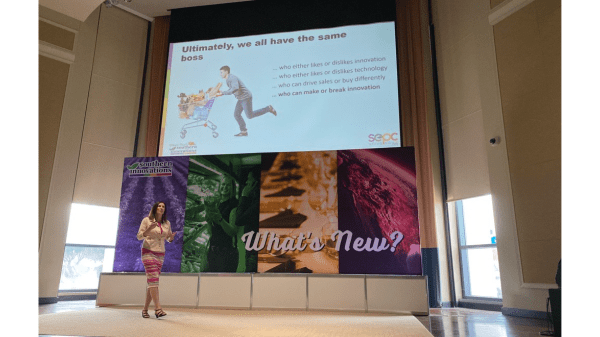

September 10, 2021 Savannah, Georgia — Today, the Southeast Produce Council (SEPC) BB #:191194 in conjunction with 210 Analytics released What’s New: The Consumer Take on Produce Innovation and Technology 2021 in one of two educational sessions at its fall show, Southern Innovations.

“Southern Innovations has always been focused on the latest and greatest in fresh produce retailing and foodservice,” says David Sherrod, President and CEO of SEPC.

“This year, we wanted to highlight innovations throughout the supply chain from farm to menu through the eyes of the consumer. After all, it is the shopper who drives change in produce purchases and consumption. Together with 210 Analytics, we conducted in-depth consumer research to understand sentiments about anything from farm-direct sales to drones and self-checkout to air fryers. Having a solid understanding of where consumers weigh in will help the fresh produce industry with vital innovation and technology decisions in months and years to come.”

There are four areas of focus for the Southern Innovations show; for the planet, at the farm, in the store and on the menu. Exhibitors are encouraged to highlight innovations in each of these areas and presentations will take place throughout the exhibit hours.

“When comparing the consumer input on innovation we have seen throughout the supply chain to sales growth trends it is clear that fresh produce sales patterns are closely interwoven with technology and innovation,” says Anne-Marie Roerink, President of 210 Analytics.

“Technology has enabled easier engagement and better communication with consumers who are increasingly looking for the how, what, where and why behind the produce they buy. At the same time, product innovation is driving operational efficiencies, labor solutions and sales gains for the category.”

The study is commissioned by the SEPC and conducted by 210 Analytics based on a consumer sample of 1,500 shoppers fielded in mid-August 2021. For more information about the Southeast Produce Council’s programs, events, and how to get involved, visit www.seproducecouncil.com. 210 Analytics is a marketing research company with a specialty in food retailing.

For more information, contact Anne-Marie Roerink at aroerink@210analytics.com.

For questions or additional information:

SEPC — Anna Burch: anna@seproducecouncil.com

210 Analytics — Anne-Marie Roerink: aroerink@210analytics.com

What’s New: The Consumer Take on Produce Innovation and Technology 2021

Top findings for each of the four sections of the research are as follows.

For the Planet

1. Quality and freshness dominate the fresh produce purchase but the influence of sustainability is rapidly growing.

Today’s average and high-spending consumers emphasize quality and freshness (53%) over sustainability (17%) when deciding what fresh fruits/vegetables to buy. Tomorrow’s shoppers, Gen Z and Millennials, near equally emphasize sustainability (26%) and quality/freshness (33%) — signaling that a brand’s or a retailers’ sustainability story can become a purchase decision tie breaker.

2. Sustainability commitments matter, but consumers are not hearing enough about it.

When buying a produce brand, picking a store or choosing a restaurant, commitments to limiting food waste, packaging waste, fair pay, diversity and inclusion and giving back to the community matter to 5-6 in 10 shoppers. However, aside from community activities, few consumers have heard about initiatives by produce brands, grocery stores or restaurants in these areas. This points to a big opportunity in better consumer-focused communications about the many initiatives and commitments made throughout the fresh produce supply chain.

3. Consumers have a wide definition of sustainability to include planet, people and community.

Transparency is the currency of trust and consumers want to know about the where, the who and the how. Interest levels are highly elevated among frequent buyers and younger consumers. The package label is the preferred learning platform, followed by websites, social media and in-store signage — providing a wide range of communication vehicles that can work in tandem to create a powerful body of evidence.

At the Farm

4. New varieties drive category engagement and grow sales, with 83% of consumers liking to see new varieties.

Fresh produce is a mature category but innovation in convenience, new flavors and sizes is driving new engagement, social media buzz and sales growth. In most categories, a few mature powerhouses solidify the bulk of sales, but new varieties are driving high gains — underscoring the importance of assortment innovation.

5. More than half of consumers have bought farm-direct produce with online subscriptions making inroads.

From farmers’ markets and produce stands to online produce orders with pickup or delivery, 53% of consumers have bypassed traditional retail channels to buy fresh produce thus far this year. One-third have bought farm-direct produce online with delivery (23%) or pickup (12%) with highest participation among Gen Z (47%) and Millennials (46%) versus just 10% among Boomers. Of online orders, 54% are subscription based.

6. Consumers understand little about the advantages of various growing methods; technology can help.

Assuming cost and taste are the same, 43% of consumers have no growing method preference, 20% outright prefer hydroponic/indoor and 37% outdoor/traditional growing. Many consumers want to learn more and virtual field (41%) and greenhouse (49%) visits are of interest. Retailers are using in-store growing to educate about hydroponic advantages and the entire supply chain has an opportunity to highlight the story behind the product.

In the Store

7. In-store trips dominate with produce in a key role for store selection and store performance.

While grocery e-commerce grew leaps and bounds over the past 18 months, 87% of grocery purchase trips are in-store (IRI). Produce, along with meat, has long been the key department driving store choice. Produce is the second-largest perimeter department, adding $70B in annual sales with year-to-date 2021 growth of 1.0% over the 2020 sales spikes. Winning with produce, means winning for the entire store.

8. Inflation is driving more promotional research among shoppers with the app becoming the 2nd most used vehicle.

Nearly nine in 10 consumers (86%) look for sales specials when buying fresh produce. Now 23% points ahead of the paper circular, 54% look for promotional signage in-store that increasingly uses digital screens. But grocery apps are the biggest change, now the second most popular way to check specials — pointing to a need to update trade spending and marketing dollars accordingly.

9. Thumbs up for personalized content, including customized sales promotions and recommendations.

Online retailers are known for using AI, past purchase data and substitution behavior to make effective product recommendations. Consumers like that idea for fresh produce as well: 68% favor personalized sales promotions and 63% would enjoy product suggestions in the app or online. In-store, product placement and suggestive selling drive impulse, don’t miss out online!

10. Consumers have high expectations for label content, from nutrition and origin information to meal inspiration.

Fixed weight, packaged produce now represents 62% of sales (IRI) and drove all gains in the first half of 2021. That means a prominent and growing role for the label. Five in 10 shoppers want to see nutrition information and four in 10 like information on origin, taste/texture, growing practices and preparation/storage tips. The QR code is a growing gateway to extend label content into various digital platforms, including videos and recipes.

11. Many consumers are less than thrilled about ringing up fresh produce in self-check lanes.

Roughly half of Americans skip self-checkout altogether or are annoyed when ringing up fresh fruits and vegetables in self-checkout lanes. Irritation is highest among younger shoppers who, perhaps related, far over index for fixed weight purchases. The growth in online sales, more organic and value-added produce, more self-checkout and frictionless stores will likely continue to drive fixed weight’s share of the business.

12. Package waste and produce waste are widespread concerns that shoppers expect retailers to address.

Seven in 10 consumers are concerned about package waste and six in 10 worry about the produce they toss out at home in addition to items tossed out in the supply chain. They are interested in package solutions and shelf-life technology — emphasizing solutions that safely prevent or limit food waste.

13. E-commerce remains a growth opportunity for fresh produce, with consistent quality being key to repurchase.

More shoppers have bought groceries online this year (66%) and more are doing so weekly (11%), but not everyone is willing to purchase fresh produce online (81% of online buyers are). Produce is a leader among fresh categories but half of online shoppers pick and choose the items they are or are not comfortable to buy online. Figuring out how to transfer in-store confidence to an online world will be key to future growth.

On the Menu

14. Routine is out, inspiration from friends, family and digital sources is in.

Only 53% of meals these days are dishes shoppers tend to know how to cook and routinely make. Instead, they are finding inspiration everywhere, from family and friends (42%) to recipe websites (35%) and the latest arrival, TikTok (16%). Half of shoppers are intrigued in being able to add items from a recipe onto a grocery list or shopping cart and are obsessed with food videos and taste challenges.

15. The face of cooking is changing with air fryers being the most powerful of the new appliances.

Americans invested billions in new grills and smokers along with the most basic of cooking appliances. Of newer appliances, air fryers have made the biggest inroads and are used the most often, leading to appliance-forward recipe searches and product innovations.

16. Technology is front and center in retail foodservice and restaurants, but don’t forget the power of people.

From ghost kitchens and QR codes replacing menus to online ordering, the integration of consumer-facing innovation is rapidly growing. But the generational differences in acceptance are astounding. For instance, 88% of Boomers prefer ordering grocery deli prepared from a person versus 22% of Gen Z. In contrast, 54% of Gen Z want to use their own phone versus 7% of Boomers. Gaps are similar for fast-food and fast casual restaurants.