Northerners have one less excuse for not moving to Florida, as it seems the Northeast isn’t immune to the occasional hurricane either.

While growing regions in the West have battled ferocious heat and drought throughout the summer, it’s the East Coast’s turn to navigate the challenges that come with turbulent weather.

Tropical Storm Henri made landfall off the coast of Rhode Island, a day after Hurricane Grace slammed into Mexico. Heavy rains from Henri will most likely affect growers in New York, New Jersey and may cause a temporary shift in demand from foodservice towards retail in the Northeast.

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

ProduceIQ Index: $0.95 /pound, -1.0 percent over prior week

Week #33, ending August 20th

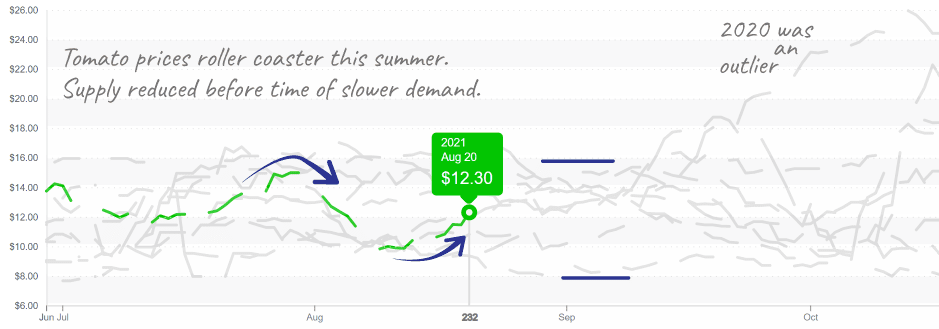

Tomatoes, up +11 percent over the previous week, are once again in short supply and have “upside potential.” Rain from Tropical Storm Henri will further soak crops already drenched by Tropical Depression Fred. Tomatoes are particularly vulnerable to overwatering as too much rain causes the fruit to pop, crack or rot.

Tomatoes have struggled to stay off floor pricing and may increase further depending on storm impacts.

Hurricane Grace, a Category 3 storm made landfall in Central Mexico on Saturday, August 21. Rain and wind from the storm will affect commodities grown throughout central Mexico, mostly limes and avocados this time of year.

Although Grace dissipated upon hitting the Eastern Coast of Mexico, rain from the storm is expected to cause flash floods and mudslides in central Mexico, disrupting transport throughout the region.

Avocados are up slightly up over the previous week, +4 percent. However, prices fall in line with historical trends for mid-August. Buyers are reporting a demand-exceeds-supply situation, particularly on sizes 40ct and up.

Prices should continue to increase as Labor Day demand depletes a limited supply. Beware, Avocado prices may rise more than usual due to logistical challenges brought on by Hurricane Grace.

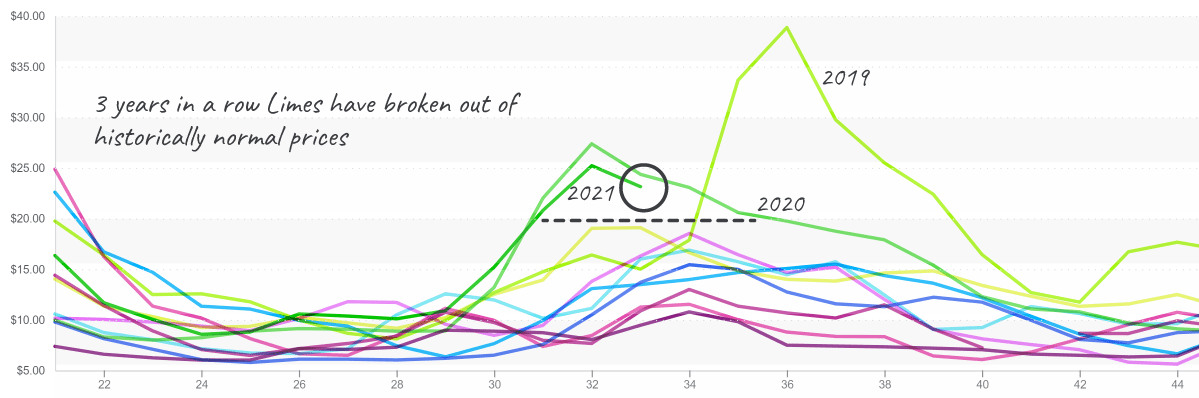

2020 and 2021 are two of the most expensive years on record for Limes. The citric is down -9 percent, but prices are still high when compared with the past ten years of USDA data. Thanks to new crop, limes should continue their descent throughout the next few weeks. Of course, that depends on how rain from Hurricane Grace affects central Mexican growing regions.

Limes exceed $20/case once again during August.

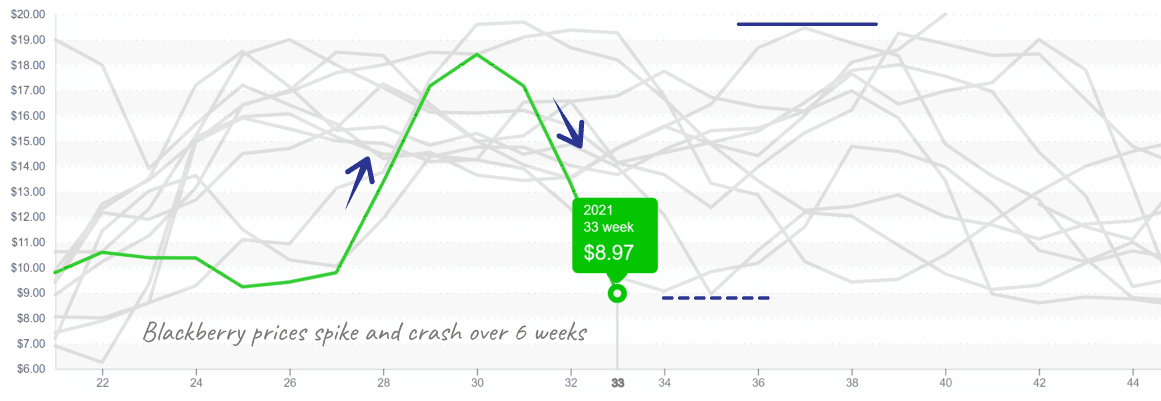

With strong California production and multiple growing regions online, blackberry prices are at a ten-year low. Blackberries and raspberries are enjoying plentiful supply. We’re glad to see BOGO-promoted blackberries at our local grocer.

Slightly down from last week’s prices, strawberries are still at a six-year high. Supply is tight, caused by waning production and labor challenges in Salinas/Watsonville. However, volume is expected to improve throughout the next few weeks as production ramps up in Santa Maria.

In comparison to the rest of the berry category, blueberry prices are high. Growing regions are in transition, moving from the Pacific Northwest to Peru. Supply is expected to increase in the next few weeks.

Prices fall to a new 10-year low for Blackberries.

Cauliflower fell -17 percent over the previous week on slacking demand. Current prices are in line with historical trends. Good supply and quality product are coming out of both California (Santa Maria/Salinas) and Mexico.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.