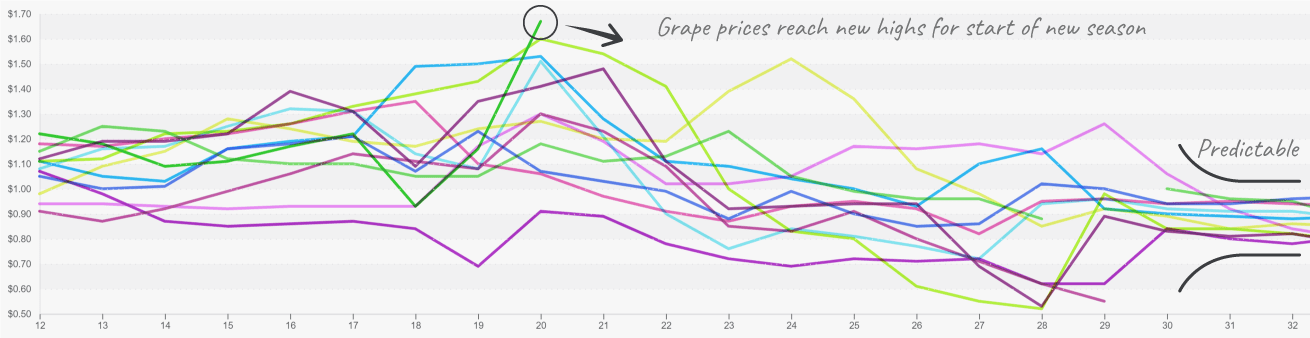

Grape volume falters slightly in the Coachella Valley. In response, prices hurdled upwards, +44 percent.

In the summer months, the U.S. becomes largely dependent on growers in the Southwest region to meet demand for grapes.

However, competitive growing regions and prolonged droughts have forced growers to decrease acreage in the Coachella Valley. Acreage has declined from 18,000 to only 5,000 acres over past 25 years. The result is a widening supply gap between the Southern and Northern hemispheres.

Persistent drought conditions, brought on by La Niña, has depleted water supplies in the Southwest.

According to NOAA’s 2020 Annual Report on The State of The Climate, records for dryness and heat occurred across Southwestern states in 2020. In May, the NOAA marked the end of La Niña trends and the beginning of a neutral period.

“La Niña conditions have ended and NOAA forecasters estimate about a 67% chance that neutral conditions will continue through the summer.”

Grape prices remain volatile during the fast and furious spring season. Prices expected to remain high on lower supply.

Climate scientists are not yet in agreement on whether La Niña will return in the fall or if the tropical Pacific will favor El Niño conditions.

El Niño conditions, although unlikely, would not only provide much needed rain for grape growers in the Southwest, but would provide respite for Southeastern growers affected by last year’s extended hurricane season.

While La Niña left grape growers hot and dry, it spared peach farmers in the Southeast. Peaches require at least 650 “chill” hours to have a consistent bloom.

For the past five years, growers have struggled against warm winters brought on by La Niña. A slight shift in the jet stream allowed cooler weather to spill further South than forecasters initially predicted.

ProduceIQ Index: $1.20 /pound, -2.4 percent over prior week

Week #20 ending May 21st

Blue Book has teamed with ProduceIQ BB #:368175 to bring the ProduceIQ Index to its readers. The index provides a produce industry price benchmark using 40 top commodities to provide data for decision making.

Over 1,000 estimated ‘chill’ hours saved Peach growers from what was expected to be a bust season.

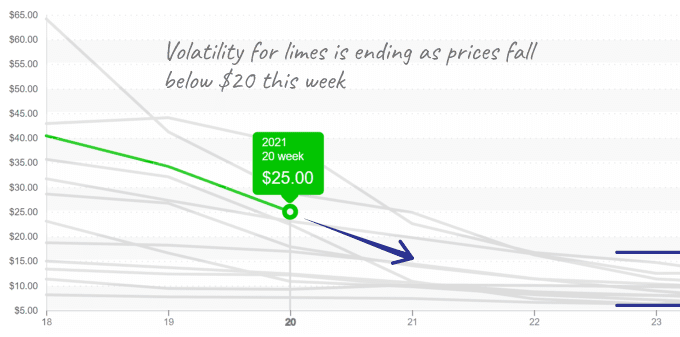

At least some Mexican growers are getting much-needed hydration. Rains are bringing relief to lime buyers, which have endured an expensive winter. Prices fell from the mid-$30s to less than $20 this week. Its descent is following historical trends as the summer season approaches.

Limes falling into place with historical prices that range from $8 to 16 by week 23.

Mixed berry prices are sinking further. Consumers looking to score inexpensive berries for Memorial Day are in luck, prices may have come down just enough to make a festive celebratory dessert. Retailers are encouraged to promote generously.

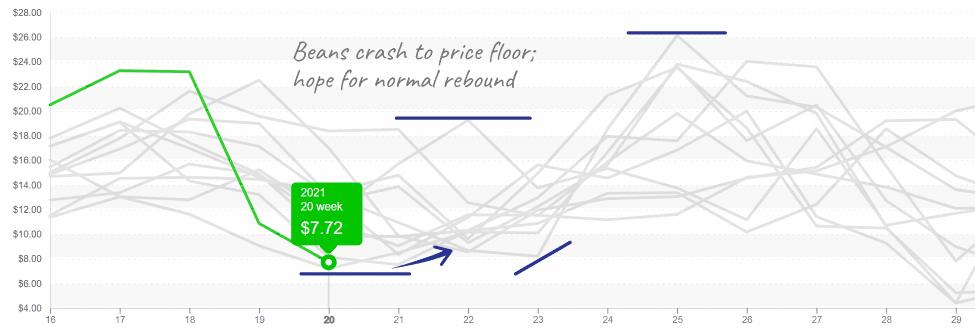

After spending some time in the clouds during April, bean prices nosedived. Within three weeks, beans lost over half their value.

This week’s historic prices just edged out 2016, the previous record holder, by one cent, falling to $0.30 per lb. The Florida crop is plentiful, and demand is low. With Georgia’s harvest just around the corner, beans are a buy.

Beans fall significantly under the cost of production.

Please visit our online marketplace here and enjoy free access to our market tools which created the graphs above.

The ProduceIQ Index is the fresh produce industry’s only shipping point price index. It represents the industry-wide price per pound at the location of packing for domestic produce, and at the port of U.S. entry for imported produce.

ProduceIQ uses 40 top commodities to represent the industry. The Index weights each commodity dynamically, by season, as a function of the weekly 5-year rolling average Sales. Sales are calculated using the USDA’s Agricultural Marketing Service for movement and price data. The Index serves as a fair benchmark for industry price performance.