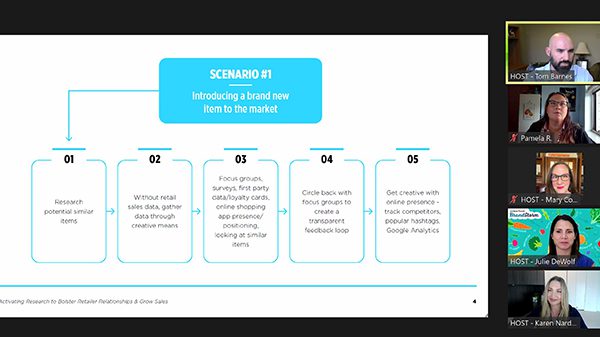

Getting a new product on the shelf can be one of the most challenging things for a marketer, but it helps to have research to back it up.

“Any supplier who can provide that type of information, analyze it and provide additional support to go with it is certainly a more valuable supplier than those who cannot,” said Karen Nardozza, CEO of Moxxy Marketing, during a United Fresh BrandStorm session.

Data takes you beyond the sales pitch “fluff,” Nardozza said, and brings retail partners added value about their own customers and other products in their categories.

Research is the foot in the door, but it can also be a determining factor in a buyer’s decision to give a new product a chance, said Julie DeWolf, director of retail marketing for Sunkist Growers.

“We have tried and tried several times to get retailers to take items that we knew were starting to sell well,” she said. “And until we got a chance to sit down with them and prove to them that this was the right decision. They were very reluctant to do it.”

Sales strategies and marketing strategies differ when it comes to using research, so it’s important to share between them.

“If we’re not talking to each other, then we lose the full story,” said Tom Barnes, CEO of Category Partners.

A sales staff may be more focused on closing a deal, DeWolf.

“We (marketers) tend to have a little bit more time to give it the thought it deserves and turn the data from just numbers into a story,” she said.

Focus groups are a valuable tool for product research, and the COVID-19 pandemic may have changed that strategy – for the better.

“We were able to pivot and work with online focus groups where we shipped the product to the people’s homes, and then we’re able to get on a Zoom call with them touching and feeling the product and giving us all of that feedback and moderating of over Zoom,” Barnes said. “And to be honest, in a lot of ways it worked better.”

Online focus groups gave marketing agencies a chance to quell “group think,” and other issues that arise with in-person focus groups. The format also was more flexible for target audiences, who often don’t have the time to take off work for focus groups.